How Can Someone Steal My Tax Refund

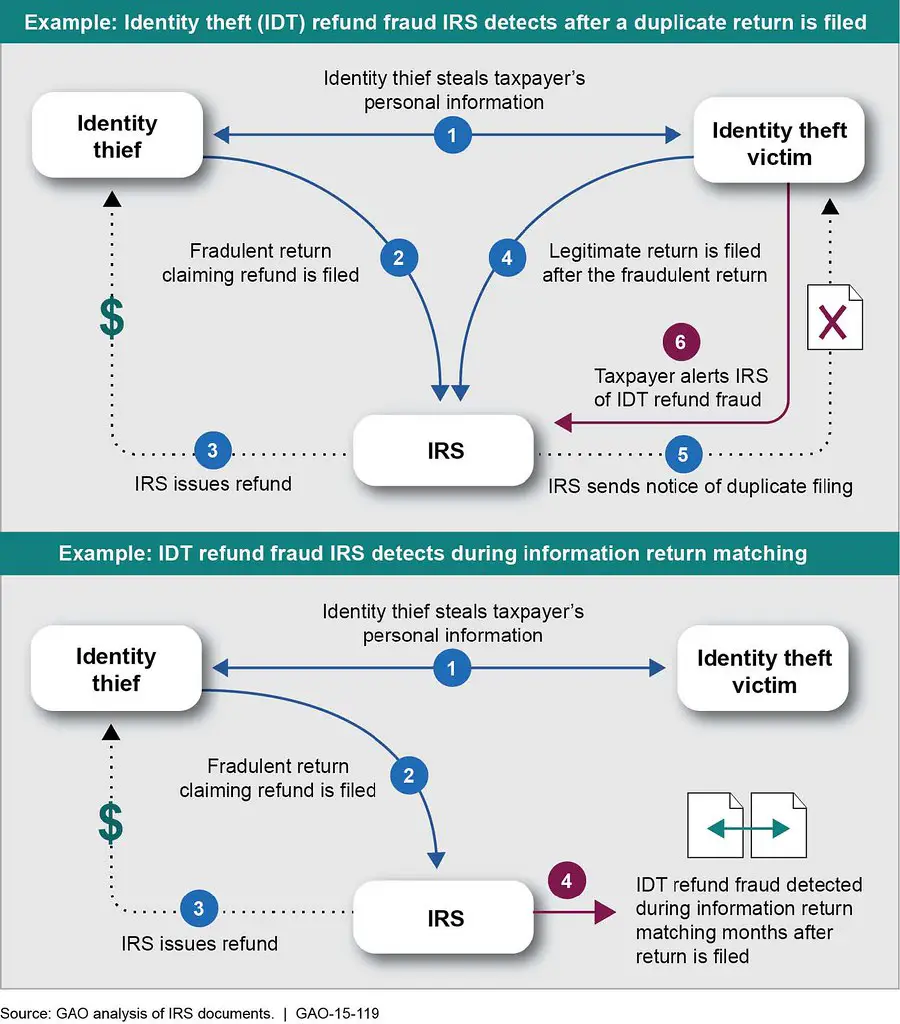

Armed with little more than your name, birthdate and Social Security number, a crook can file a fraudulent tax return and collect a refund. Then, when you go to file your legitimate return, the IRS blocks you because its records show your return has already been filed.

Prevent Tax Id Theft With An Identification Protection Id

Identification Protection PINs are six-digit numbers issued to taxpayers by the IRS to prevent tax ID theft. If youve experienced tax ID theft in the past, the IRS will automatically issue you an IP PIN. You can also voluntarily request one. After the IRS issues your IP PIN, you will use it to file your return. This will help the IRS confirm your identity so no one can file a return using your personal information to fraudulently collect a refund. Learn more about the IP PIN and how you can apply.

What Are Some Red Flags Of Small Business Identity Theft In Terms Of Taxes

Business filers should be alert for signs of tax identity theft throughout the year, not just during tax season. Here are some small business identity theft warning signs:

- The IRS rejects an e-filed return or extension due to a duplicated Federal Tax Identification Number .

- You dont get expected mailings from the IRS.

- You receive an unexpected tax transcript.

- You receive an IRS notice that doesnt relate to your business or has a fake employee name.

- You get an IRS notice about a defunct, closed, or dormant business after all account balances have been paid.

- Your return is accepted as an amended return, but you havent filed a return yet.

Also Check: How Much Is New Jersey Sales Tax

The How And Why Of Tax Identity Theft

HomeHelp CenterThe How and Why of Tax Identity Theft

Identity theft is not one single type of crime. There are many different ways a criminal can use your information, such as applying for government benefits, getting a job under your Social Security number, receiving medical care or prescription drugs in your name, and of course, the financial aspects. But stealing from your bank account or signing up for a new credit card in your name are just scraping the surface when it comes to the harm identity theft can cause.

Tax identity theft occurs when someone uses your compromised information to file a tax return in your name. They fudge the numbers, enter an unrelated refund dispersal option like a prepaid debit card, and make off with your money before you ever know that anything has gone wrong.

How do they get their hands on your data in the first place? There are many ways, including:

- Unsecured and public Wi-Fi hotspots

- Social Security number that is lost, stolen or compromised

Of course, its just as easy for a criminal to purchase your previously stolen information online, then use it to file a fraudulent return.

How can you know if someone has filed a return with your stolen information? Again, you may find out in different ways, but one common way is for the IRS to inform you.

For more questions and answers about tax identity theft, read our tips here.

How Can Tax Identity Theft Occur

Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. Thieves invent phony wages or other income, submit the information electronically, and receive the fraudulent refund via mail or direct deposit.

What is the phone number for the IRS identity theft?

- The IRS also advises that, if you believe you may become a victim of identity theft, you should call the Identity Protection Specialized Unit , toll-free at 1-800-908-4490.

Don’t Miss: Do I Need To File Income Tax Return

Warning Signs Of Tax Identity Theft

Awareness is a key piece in a good identity theft prevention strategy. When you can identify suspicious activity and threats early on, it is easier to take action and limit the damage. Here are nine warning signs of tax identity theft:

- Multiple filings

- Large personal expense claims

If you receive an unfamiliar notice like this from the IRS, there is a chance that a scammer has stolen your personal information. The thieves could have used your identity to file a fraudulent return.

IN THE NEWS: On April 1, 2021, Julio Polanco Suarez earned a six-year prison sentence for tax refund fraud. He had to pay almost $1.1 million in restitution after he was caught using stolen personal information to submit wrongful tax returns. Suarez ran the scam from 2009 to 2016 â almost seven full years of fraudulent tax submissions. Source: IRS:CI Annual Report 2021

Signs That Youve Been A Victim Of Tax Id Theft

According to the IRS Taxpayer Guide To ID Theft, there are 8 likely scenarios that might indicate your identity has been compromised:

Recommended Reading: How Much Percent Does Tax Take Out

How Can Tax Identity Theft Happen

Tax-related identity theft occurs when someone uses your stolen personal information, including your Social Security number, to file a tax return claiming a fraudulent refund. If you suspect you are a victim of identity theft, continue to pay your taxes and file your tax return, even if you must file a paper return.

Why Taxpayer Fraud Happens

Tax identity fraud typically occurs when taxpayers do not have secure financial information. However, this may not be the only cause. Knowing why tax identity fraud happens can help you take steps to avoid it.

You should always protect your Social Security number and/or tax identification number with the utmost care. Keep a very close eye on paperwork that may contain your personal identification information and avoid sharing this information more than absolutely necessary. In addition, try not to carry Social Security cards in your purse or wallet, which can be easy targets for thieves.

Recommended Reading: How Does The Federal Solar Tax Credit Work

Contact The Social Security Fraud Hotline

When you submit a fraud report through the Social Security fraud hotline, the Office of Inspector General will review and investigate the alleged fraud.

Hereâs how:

- Contact the OIG fraud hotline at 1-800-269-0271.You can also submit a fraud report to the OIG via their online submission portal.

- Indicate that your SSN was stolen and might be at risk. Provide as much information as possible, including your reports from the police and FTC.

- Remember that federal regulations prevent law enforcement agencies, including the OIG, from sharing information about investigations.

Submit An Identity Theft Affidavit

If you discover that you are a victim of tax identity fraud, you should complete an Identity Theft Affidavit. Also known as Form 14039, this document is the official method for alerting the IRS to potential tax identity theft.

Fill out each section to the best of your knowledge, as the more data you provide, the easier it is to protect your accounts. Form 14039 has mail-in and fax submission instructions, and you must often include any compromised tax documents.

You will also receive an official confirmation by mail when the IRS has received your form. An accepted Identity Theft Affidavit starts an investigation by the IRS’s Identity Theft Victim Assistance organization. They will work with you to resolve your case, with standard resolution times between 120 and 260 days.

Recommended Reading: Why Do We Have To File Taxes

When Should You Freeze Or Lock Your Ssn

When you know someone untrustworthy has obtained your Social Security information, one of the most effective safeguards is to put an SSN lock in place. Here are some situations in which you should consider locking your SSN:

- You notice early signs of identity theft. For example, you might notice changes to your credit score, unexpected bills, contact from the IRS, or change-of-address confirmation letters.

- Strange inquiries or loans on your credit report. If your credit report has unfamiliar charges and applications for credit, this is a big red flag. You may be the victim of identity theft and should freeze your SSN immediately.

- Someone took out benefits in your name. Social Security benefit claims that you donât recognize may be a sign that scammers are using your SSN.

- A scammer filed a tax return in your name. Fraudulent tax return filings in your name mean someone has stolen your PII. You need to be on guard against other forms of identity fraud.

Is Tax Identity Theft Common

Tax identity theft is generally less common than other types of identity theft and fraud, such as someone stealing and using your credit card account or opening a new credit account using your identity.

Tax identity theft has also decreased in prevalence over the past few years. In part, this is due to a joint effort by the IRS, state tax agencies, private tax preparation companies, tax professionals, payroll processors and financial institutions. Together, they formed a Security Summit in 2015 to fight refund fraudwhich is often perpetrated by organized crime syndicates.

From 2015 to 2019, there was an 80% decline in the number of taxpayers who filed IRS identity theft affidavitsa form you attach to your tax return if you’re the victim of tax identity theft. For context, the IRS processed 155,611,000 returns from individual taxpayers in 2019, as of December 27 of that year.

In addition to responding to taxpayers who report being victims of identity theft, the IRS actively identifies suspicious returns. It then reaches out to taxpayers to confirm their information before continuing to process the return. In 2019, the IRS says it stopped 443,000 confirmed fraudulent returns from being processed.

Employment or tax-related fraud did see an increase in 2020, according to the FTC, but the number of fraud reports remains below 2016 levels. Several other types of fraud also saw increases from 2019 to 2020, with the increase in government benefit fraud especially dramatic.

You May Like: Can I File Taxes At 17

What To Do If Someone Steals Your Tax Refund

If someone uses your Social Security number to file for a tax refund before you do, youll usually find out when you file your return with the IRS.

If you file by mail, the IRS will mail you a letter explaining that they received more than one return in your name. Follow the instructions in the letter.

If you try to submit your tax return online or through a tax preparer, the IRS will reject your tax return as a duplicate filing. If this happens, go to IdentityTheft.gov and report it. IdentityTheft.gov will create your

- FTC Identity Theft Report

Report Identity Theft To Other Organizations

In addition to federal government agencies, you should also report the theft to other organizations, such as:

- Long-term care ombudsman – Report cases of identity theft that resulted from a stay in a nursing home or long-term care facility.

- Financial Institutions – Contact the fraud department at your bank, credit card issuers and any other places where you have accounts.

- Retailers and Other Companies – Report the crime to companies where the identity thief opened credit accounts or even applied for jobs.

- State Consumer Protection Offices or Attorney General – Your state may offer resources to help you contact creditors, dispute errors and other helpful resources.

You may need to get new personal records or identification cards if your identity was stolen. Learn how to replace your vital identification documents, after identity theft.

Also Check: Am I Paying Too Much Tax

Claim Your My Social Security Profile

my Social Security, via the SSA website, is a secure online portal to manage your Social Security benefits. You can use your my Social Security profile to check and protect your Social Security benefits against fraudsters in real time.

Hereâs how:

- Go to the my Social Security portal, follow the instructions, and register your account.

- Log in to your secure profile, and check for changes to your SSA benefits.

- Report any suspicious activity to the SSA online, or by calling 1-800-772-1213.

Request A Replacement Social Security Card

If your Social Security card was stolen, you’ll need a replacement. This step ensures that youâve notified the SSA about the theft, and that you’ll have a paper trail to assist an investigation.

Hereâs how:

- Log in to your my Social Security account, and complete the online Social Security card replacement form. You should receive your new card within 10 to 14 business days.

- Apply for a replacement card in person or by mail if you do not have a my Social Securityaccount.

- Gather documentation to prove your age, citizenship, and identity .

Read Also: When Is Tax Refund 2021

Learn About Tax Id Theft And How To Avoid It

Tax ID theft occurs when someone uses your Social Security number to file taxes and claim a tax refund. You may not know that your tax ID has been stolen until you:

- E-file your tax return and find that another return has already been filed using your Social Security number, or

- The Internal Revenue Service sends a 5071C letter to the address on the federal tax return indicating that tax ID theft has occurred.

Find out what steps you can take after receiving a 5071C letter and how you can avoid or report tax ID scams.

What Can Scammers Do With Your Stolen Ssn

- Take out new lines of credit. Many banks don’t require stringent identity confirmation measures for customers to open new lines of credit you often only need to provide an SSN, name, and address. Scammers can use your stolen PII to obtain new accounts, loans, or credit cards in your name.

- File fraudulent tax returns. Scammers can use your SSN to file a false tax return and collect your tax refunds. Most victims only find out theyâve been defrauded in a tax refund scam after they try to submit their legitimate tax returns.

- Commit Medicare fraud. A fraudster can use your SSN to access medical tests, prescription drugs, and medical care that isn’t covered by health insurance. Check to see if youâve been a victim of medical identity theft.

- Claim other benefits tied to your SSN. With your stolen SSN, scammers can file claims for unemployment, Veterans Affairs benefits, and even disability compensation. This could stick you with a record for fraudulently using state or federal benefits â impacting your tax obligations and leaving you open to investigation for government fraud.

- Give you a criminal record. A scammer can use your SSN to fabricate identity documents, like a driverâs license or passport. Criminals can use these fraudulent documents, including your stolen SSN, to identify themselves if they are arrested for a crime.

ð¯ Pro tip:

Don’t Miss: Who Is Exempt From Filing Taxes

Keep Your Identity Safe

If you use an online application to do your taxes, you can now log in with your username, password and a third personal item like a phone number. Using all 3 will keep your identity and data safer.

Tax-related identity theft occurs when someone uses your stolen personal information, including your Social Security number, to file a tax return claiming a fraudulent refund.

If you suspect you are a victim of identity theft, continue to pay your taxes and file your tax return, even if you must file a paper return.

Id Theft Through A Tax Professional

This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems. This route gives them access to much more information than just one single person, making it a much larger tax-related fraud scheme. For tax-preparing software and systems, a fraudster could potentially just break into an individuals account from a weak password.

You May Like: How Do I Check If I Owe Maryland State Taxes

Alert All Companies Where Your Ssn Was Used Fraudulently

Contacting companies at which scammers used your SSN can stop them from doing further damage to your finances and credit.

Hereâs how:

- Contact any affected businesses to tell them that your SSN was stolen and that criminals are fraudulently using it to open credit accounts and make purchases.

- Submit a copy of your FTC report and police report as evidence of fraud. This official documentation should make it easier to get refunds from vendors.

- Close any fraudulent online accounts in your name with e-commerce stores, and instruct the businesses to stop all activities related to your PII.

The Road Ahead: Rebuilding Your Credit And Finances

The IRS says it typically takes 120 days or less to address cases of identity theft, but due to “extenuating circumstances” caused by the COVID-19 pandemic, the IRS’s identity theft inventories have increased dramatically. It’s taking them 260 days on average to resolve identity theft cases.

This doesn’t even include the time and resources needed to address other consequences of identity theft, such as unauthorized loans, credit cards, and purchases. Depending on how deep the theft goes and how available your personal information was, the financial ramifications can often last months or even years.

The important thing to do is to remain vigilant. This means:

In some cases, you may want to involve a lawyer — especially if your investments, retirement accounts, mortgage, or other major financial products have been affected. They can help you traverse the legal issues that crop up with creditors, lenders, and financial institutions along the way.

Recommended Reading: How To File An Extension Online For Taxes