Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

Tax Credits For Education Expenses

Two types of tax credits, the Lifetime Learning Credit and the American Opportunity Tax Credit, provide tax benefits for qualified educational expenses for postsecondary education. The rules for these credits differ. The IRS provides a comparison chart online. It also provides an extensive list of FAQs to help you determine which credit to claim.

How Can I Get My Tax Refund Fast

If you are looking for ways to get your income tax refund fast, there are a few things you can do. One option is to use TurboTax.

Turbotax tax preparation software allows you to file your taxes online. This means that you can get your refund in as little as ten days.

Another way to get your refund fast is to file your taxes early. The sooner you file, the sooner the IRS will process your return and send you your refund.

Finally, if you are due a large refund, consider having it direct deposited into your bank account. This way, you will have access to the funds immediately upon receiving your refund.

Also Check: How To Deduct Mileage On Taxes

Average Tax Refund By Income

There’s a clear correlation between income and tax refund amounts. Filers who have higher incomes get more back. This average tax return by income chart will give you the details:

Americans who earn $200,000 and over experience a much higher tax return than those who earn less because high earners generally have more cash withheld from their income over the course of the year.

For a more detailed look at the average tax refund across income levels, see the table below.

A more detailed breakdown reveals that tax refund amounts and incomes are related but anomalies exist.

Filers with no adjusted gross income posted an average tax refund of $2,132, which is more than or close to the average returns for most income bands up to those who earn $200,00 or more. Filers with no AGI or negative AGI aren’t necessarily earning no income. It’s more likely that they’re taking advantage of tax deductions.

Another departure — Americans that made $15,000 to $19,999 had a higher average refund than every subsequent group up to those making $200,000 or more. This isn’t a one-year quirk. Earners in the $15,000 to $19,999 band had a higher average tax return than every group up to those making $50,000 to $75,000 every tax year dating back to 2012. Even in years prior to 2012, those making between $15,000 and $24,999 tended to have higher or similar refund amounts to those making up to $74,999.

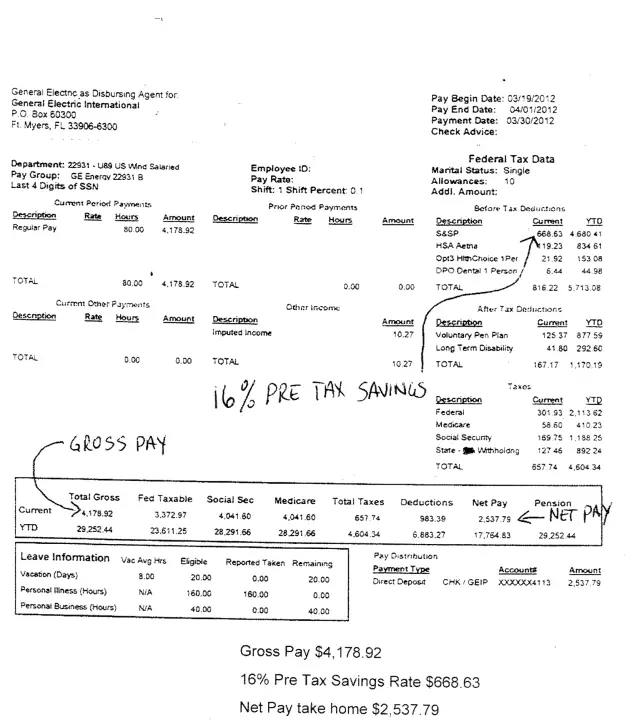

What Taxes Will I Pay In The Us

You will pay three to four taxes1. Federal Tax – usually at 10% for temporary workers2. State Tax – varies between 1 – 13% depending on what state you worked in3. Local Tax – A city/county tax4. FICA tax social security and Medicare contributionsAs a temporary worker in the US, youre not meant to be charged FICA. If youve been charged it, you are most likely due a refund.

Don’t Miss: How To File S Corp Taxes

What Forms Do I Need To File My Tax Return And Apply For A Tax Refund

You will need to provide either a 1. Final Cumulative Pay slip OR W2 Form/1042-S form2. Your social security number/ITIN numberSometimes we can use your final cumulative pay slip to begin your application process however some states only accept a W2/1040-S form. You will receive this form at the end of the tax year.

Tax Refunds: When Will I Get My Tax Refund

By: Jack Caporal |Updated Nov. 18, 2022

Image source: Getty Images

Filing taxes isn’t anyone’s idea of a good time, but a tax refund is a light at the end of the tunnel. Considering the Internal Revenue Service refunded $293 billion in income tax in 2021, plenty of filers get a sizable return.

How long does it take to receive your tax refund? What’s the average tax refund amount? And do certain characteristics, such as income or marital status, influence tax refund amounts?

To find out, we analyzed the most recent IRS data on tax refunds. In the sections that follow, you’ll learn exactly which filers get the biggest refunds.

Jump To

Recommended Reading: How Is Capital Gains Tax Calculated On Sale Of Property

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

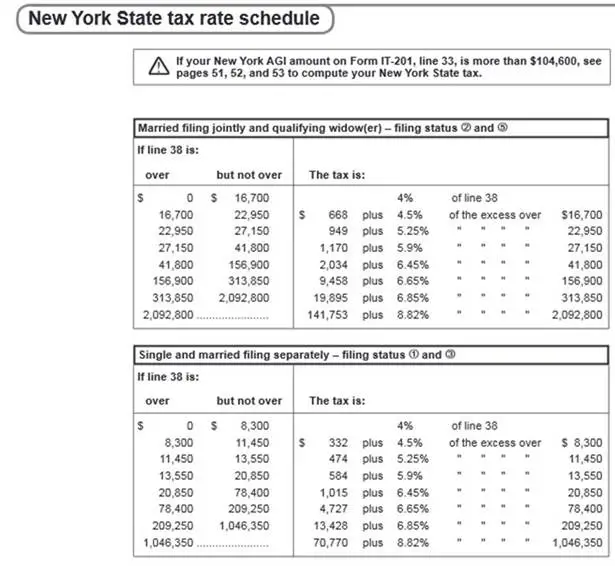

More About Tax Brackets

What Is My Tax Bracket?

The federal income tax system is progressive, which means different tax rates apply to different portions of your total income. Tax bracket refers to the highest tax rate charged on your income.

What Are Tax Tables?

Tax tables like the one above, help you understand the amount of tax you owe based on your filing status, income, and deductions and credits.

Tax brackets only apply to your taxable income. Your deductions and taxable income may drop you into a lower tax bracket or potentially a higher one.

Taxable Income vs. Nontaxable Income

Income comes in various forms, including wages, salaries, interest, tips and commissions. Nontaxable income wont be taxed, whether or not it is entered on your tax return.

You May Like: When Do You Pay Quarterly Taxes

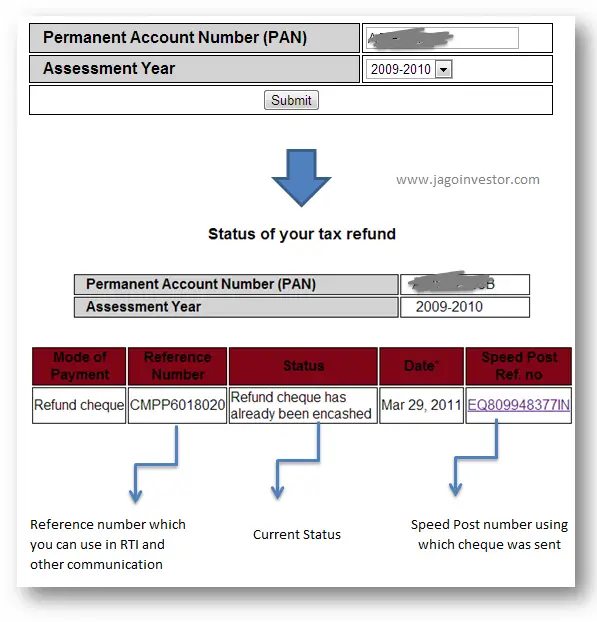

Faqs: How To Check Your Income Tax Refund Status And More

Where is my tax refund?

Nine out of 10 tax refunds are issued within 21 days, according to the IRS.

The IRS “Where’s My Refund?” tool provides information on your tax refund status. To access that information, you’ll need your Social Security number, filing status, and refund amount, which can be copied from your tax return. It can take 24 hours after you file an electronic return to access a status update and up to four weeks if you file your refund on paper.

Many states offer similar tools to track state tax refunds. Most states estimate issue refunds within eight weeks.

Can I file for an extension on my taxes?

The IRS provides a six-month tax-filing extension if you need one however you must request an extension prior to the tax deadline. The extension applies only to filing your taxes — if you owe money, you still need to pay by the original due date regardless of an extension.

What’s the best tax refund software?

Check out The Ascent’s recommendations for the best tax software. We’ve also recommended the best free tax software. These services help taxpayers navigate the filing process and seek out deductions and credits so filers get the largest return possible.

When It Comes To Us Tax Refunds Its Safe To Say We Know What Were Doing

When it comes to US tax refunds, its safe to say we know what were doing.We take our responsibilities as a US tax agent very seriously and are 100% committed to filing compliant tax returns that meet all requirements of the US tax office. We carefully review all our customers US tax returns before sending them to the IRS to make sure they fully comply with US tax law. We will also check if you are entitled to avail of any tax deductions or are affected by any tax treaties. Weve been filing US tax returns since 1996 and our US tax team has 70 years experience collectively. When you apply for your US tax refund with us, youre in good hands.

Read Also: Where Is My Arkansas State Tax Refund

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

How To Maximize Your Tax Refund

There are several ways you can get a bigger refund on your taxes this year. Here are just a few of the best ways to maximize your refund.

Top 5 Tips to Get Your Maximum Tax Refund

Figuring out how to maximize your refund can involve some pretty in-depth knowledge. If the process seems a bit overwhelming, talking to a CPA or tax professional can help make sure you dont miss anything.

Also Check: What Is The Tax In Tennessee

How Long It Takes To Get Your Tax Refund

Nine out of 10 tax refunds are issued within 21 days, according to the IRS.

Twenty-four hours after filing your refund online, you can access the IRS Where’s My Refund tool to get daily updates on your tax refund status. Paper filers have to wait six months or more before the tool becomes available.

The tool shows progress in three phases:

Once your refund is approved, you will be given a date to expect your refund on by the IRS.

Those who file their tax return online and sign up for direct deposit get their tax refund fastest, per the IRS.

Most states estimate that state tax refunds are issued within 10 weeks of processing.

How Can I Estimate How Much My Tax Refund Will Be

The tax refund calculator takes into account your income, deductions, and credits to give you an estimate of your refund. The process is pretty simple.

If you are getting a refund, its best to file your taxes early in the year. If youre like most Americans, you wait until the last minute to prepare your federal income taxes. Filing your taxes early has its benefits.

The IRS issues refunds on a first-come, first-served basis, so the sooner you file, the sooner youll get your money. And if youre expecting one, why not get it as soon as possible?

Don’t Miss: What Does Garnish Tax Levy Mean

How Much Will It Cost

For US Federal tax returns we charge $60 + handling feeAdd in a State tax return for $30 + handling feeFor a state tax return on its own we charge $50 + handling fee.If you are due a small refund from the US that does not cover our minimum fee, Taxback.com offers a reduced fee to allow you to meet your US tax filing obligations and file your tax return. Your Account Manager can discuss the fees with you in more detail if you have any questions.

How Do I Claim A Refund If I Leave The Uk Part Way Through The Tax Year

If you are not a Self Assessment taxpayer, and are leaving the UK to live abroad permanently or are going to work abroad full-time for at least one full tax year, you might be able to claim a refund in respect of your pre-departure employment income. This is because you will probably have unused personal allowances . You can claim this refund by completing form P85 Leaving the UK getting your tax right to HMRC. You can find the form on GOV.UK.

If you are leaving the UK temporarily, then see the guidance in our What if I work abroad temporarily? section.

You May Like: When Can I Do My Taxes 2021

How Much Money Do You Get Back In Taxes For Buying A House

Key takeaways:

- You can get money back after buying a house through deductions on your mortgage interest, property taxes, and mortgage insurance.

- Tax credits on things like energy efficiency improvements can also garner you higher returns.

- Your tax breaks for buying a house can depend on the local programs and options in your area, as well as your willingness to look for them!

How To Get The Most Money Back On Your Tax Return

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

Most taxpayers either hope to pay as little income tax as is legally possible or try to receive the most money back as a refund after filing their income tax return. Come tax season, though, if you haven’t researched how to minimize your income taxes, you may end up paying more than the Internal Revenue Service requires.

To reduce your taxable income or receive a larger refund, it’s important to consider if you’re eligible for tax deductions and tax credits and whether you should itemize when you file your income tax return. We look at each of these ways to reduce your tax bill in detail below.

Don’t Miss: Do I Pay Taxes On Cryptocurrency Gains

Will I Get A 2022 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could result in a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use our tax refund calculator to find out if you can expect a refund for 2022 .

How Much Will I Get Back In Taxes In 2022

So how much are YOU going to get back in taxes in 2022? Well, the average tax refund is about $2,781 . So expect around three grand for your tax refund.

But average doesnt mean guaranteed. Theres nothing worse than planning for a refund and getting nothing. Or worse, OWING money. Thats why I want to break that number down, show you how that refund is calculated, and tell you something that a LOT of people get wrong about your tax refund.

Have you implemented the tactics in my book and are ready for whats next? If so, what I invest in, who I work with, how I protect myself, and what I buy and how these changed as I got more advanced.

You May Like: How To Get Edd Tax Form

Find Out More About Tax Refunds

Finding out more about why you could be owed a tax refund can really pay off. Because there are a number of different reasons that can result in a tax refund being due its always best to discover which could apply to you for as far back as the last four tax years. You can then make an informed decision about what applies to you and avoid missing out on any entitlements you are eligible to.

If none of the options available apply to you currently they may in the future which means at least you know what can be done and when to make a claim.

Property Tax Or Real Estate Tax Deductions

The amount you pay in property taxes to your state and local governments are also deductible. These amounts differ depending on where your house is located. Keep meticulous records if you paid property taxes directly, or be on the lookout for the 1098 form if you paid through an escrow account.

Property taxes can be a huge expense to you, but your state or local government might offer a tax break to help alleviate the cost and encourage homeownership.

Also Check: Can You Refile Your Taxes From Previous Years

What Is My Filing Status

It depends the filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow. If you support a child or relative, they may qualify as your dependent. There are different requirements for qualifying children and qualifying relatives, but both types of dependents must be a U.S. citizen, U.S. national, or U.S. resident alien. You must be the only taxpayer claiming them, and they must be filing single or married filing separately if they’re required to file their own return. For more, see Who Can I Claim as a Dependent?