When Are Taxes Due

For most taxpayers, the main income tax return deadline for 2020 tax returns is May 17, 2021 aka IRS Tax Day 2021. The deadline has been pushed from April 15 this year, but this does not change things for state taxes deadlines for those typically also fall on April 15, but you should check with your state to confirm.

The deadlines differ for individuals versus businesses, and it depends in part on whether you use a calendar year or a fiscal year. If youve already missed a deadline, file and pay your taxes as soon as possible to stop additional interest and penalties from accruing.

Does The New Deadline Apply To All Taxes

No. This applies to all individual tax filers, and it does not include trusts, estates, corporations and other noncorporate tax filers. Quarterly estimated taxes for individuals are still due April 15, 2021, too.

Theres a good chance the new deadline applies to your state taxes. As of April 2021, most states have either followed the IRS lead and delayed their tax deadlines until May 17, or have extended their deadline further. But each state is different. Here is an updated list of how each state has approached its 2021 tax deadlines in response to the coronavirus.

You May Like: Who Can I Call About My Tax Refund

Tax Deadlines: October To December

- : Deadline for employees who earned more than $20 in tip income in September to report this income to their employers.

- : Final extended deadline to file individual and corporate tax returns for the year 2021 using Form 1040 and Form 1120.

- :Deadline for eligible taxpayers who earned $73,000 or less in adjusted gross income for tax year 2021 to use Free File to prepare and file their returns.

- :Deadline for employees who earned more than $20 in tip income in October to report this income to their employers.

- :Deadline for employees who earned more than $20 in tip income in November to report this income to their employers.

- : Deadline for corporations that need to file the fourth installment of estimated income tax for 2022.

Also Check: How Far Can You Go Back To File Taxes

Notice On The Status Of The City Of Detroit Individual Income Tax Return Deadline

Date: March 25, 2021

Taxpayers have recently contacted the Department with questions regarding whether the April 15, 2021 deadline for the City of Detroit individual income tax will be automatically extended consistent with similar extensions granted at the federal and state levels. This notice explains the status of the April 15, 2021 due date for City of Detroit individual income tax returns due for tax year 2020.

Short Answer: The City Income Tax deadline of April 15 for Detroit was not automatically extended with the extensions granted at the State and Federal levels. There has been legislation introduced that would also extend the 2020 City Income Tax deadline, however, this legislation has not yet been passed into law. To read the proposed legislation, please see House Bill 4569.

Status of the City of Detroit Filing Deadline

Although the Department administers the city income tax for the City of Detroit, the City Income Tax Act prevents extension relief from being provided in the same manner as provided for the state income tax. In particular, while the Act permits a discretionary waiver of penalty, it does not permit a similar waiver of interest. Therefore, for purposes of administratively providing an extension until May 17, 2021 to file city individual income tax returns, the Department can waive penalty for returns filed after April 15, 2021, but cannot waive interest.

What If You Miss A Deadline

You’ll probably be hit with a financial penalty, such as an extra interest charge, if you don’t submit a tax return and make any payment that is due by its appropriate deadline. There are two main penalties you may face:

- Failure-to-file penalty:This penalty for 1040 returns is 5% of the tax due per month as of tax year 2021, up to a cap of 25% overall, with additional fees piling up after 60 days.

- Failure-to-paypenalty: This penalty is 0.5% for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

If both are penalties are applied, the failure-to-file penalty will be reduced by the failure-to-pay penalty amount for that month. If you are on a payment plan, the failure-to-pay penalty is reduced to 0.25% per month during that payment plan schedule. If you don’t pay the taxes you owe within 10 days of receiving a notice from the IRS that says the agency intends to levy, then the failure-to-pay penalty is 1% per month.

You May Like: How To Get California State Tax Id Number

Reasons To File Your Return Before The Tax Deadline

While its tempting to celebrate the news of the 2021 tax deadline extension, there are a lot of compelling reasons to file your return well in advance of the new May 17 deadline.

Here is a list of reasons to consider filing your taxes sooner rather than later

- Some taxes are still due on April 15

While the federal taxes deadline may have shifted to May 17, the date for estimated quarterly tax payments remains April 15. This may or may not affect you, depending on what state you live in.

For the last tax year, most states adjusted the estimated quarterly tax payment date to match the new federal tax deadline, so try to stay in the loop in your state.

- You could qualify for a stimulus payment

Theres a chance that by filing your taxes sooner rather than later, you could qualify for the most recent stimulus payment.

The latest stimulus payment is calculated according to your 2020, so if you noticed a decrease in income that year, you should file your taxes as soon as possible to give yourself a chance of receiving the payment sooner.

- You will have more time to make sure you filed correctly

One of the main reasons to do anything early is to give yourself more time.

If you have more time, you are more likely to notice any mistakes and provide any additional information if necessary. You give yourself the luxury of speaking with your tax consultant about any deductions you may be eligible for and anything else you might have missed out.

- You could receive a refund faster

Individual Income Tax Forms 2021 Tax Filing Season

To learn more about OTR’s response to the COVID-19 pandemic, please .***

| Form # | |

|---|---|

| Individual Income Tax Forms and Instructions for Single and Joint Filers with No Dependents and All Other Filers | On or before May 17, 2021.If the due date for filing a return falls on a Saturday, Sunday or legal holiday, the return is due the next business day. |

| US Bank ReliaCard Pre-Acquisition Disclosure | N/A |

Also Check: How To Get The Most Out Of Tax Return

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Do You Have To File Taxes To Get A Stimulus Check 2021

The answer is yes, and no. If you cant file your 2020 tax return by 17 May, you can ask for an automatic tax filing extension to buy time until 15 October. This will give you more time but delay any payment that you could receive. Regardless, you will have to file to get any stimulus money that might be due to you.

You May Like: When Can You Withdraw From 401k Tax Free

When Are Estimated Taxes Due In 2022

Those who pay estimated taxes have a slightly different filing schedule than everyone else. People who pay quarterly estimated taxes include the self-employed, as well as those who work similar entrepreneurial or independent contractor jobs. If your paycheck doesnt have income taxes taken out before the money gets to you, then this requirement applies to you.

Estimated taxes are due quarterly and must be submitted with Form 1040-ES. Heres when those payments are due:

- First-quarter payments: April 18, 2022

- Second-quarter payments: June 15, 2022

- Third-quarter payments: Sept. 15, 2022

- Fourth-quarter payments: Jan. 17, 2023

Note: Like Tax Day, quarterly tax payments are due on April 18 this year. But because Jan. 15, 2023, is a Sunday, and Monday, Jan. 16 is Martin Luther King Jr. Day , the deadline to pay estimated taxes on the self-employment income you earn in the fourth quarter of 2022 has been pushed to Jan. 17, 2023.

This is the standard schedule to follow, provided nothing interferes.

If youre an employee who earns tips, youre required to report all your monthly tip earnings to your employer by the 10th of the following month. Your employer is responsible for sending those numbers to the IRS, as well as for adjusting how much money comes out of your paycheck to satisfy your tip withholding.

Tax Day For Individuals Extended To May 1: Treasury Irs Extend Filing And Payment Deadline

IR-2021-59, March 17, 2021

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig. “Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.”

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed. This postponement applies to individual taxpayers, including individuals who pay self-employment tax. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Individual taxpayers will automatically avoid interest and penalties on the taxes paid by May 17.

Also Check: How To File Shopify Sales Tax

Irs Postpones 2021 Tax Deadline From April 15 To May 17

For the 2021 tax year, the IRS has postponed the regular April 15th deadline to May 17th to give Americans more time to prepare and file during the ongoing Coronavirus pandemic.

The extension also gives taxpayers the chance to incorporate changes from the American Rescue Plan Act, which was passed in the middle of tax season. This year, its especially important for expats to get their US taxes done correctly because its the only way to reclaim stimulus checks that you were eligible for but didnt receive.

This extension is automatic. You do not need to file any additional forms or call the IRS to request it.

Despite the date change, the IRS is still urging Americans to file as soon as they are able. In particular, if youre owed a refund or youre entitled to stimulus payments, you should file electronically with direct deposit to get these funds as quickly as possible.

The IRS has not issued any statements regarding the June 15, 2021 tax filling deadline for Americans living abroad. If you intended to file by this deadline, you should still make plans to complete your return by this dateor sooner if possible.

In addition, quarterly estimated payments are still due on April 15, 2021.

What’s The Fastest Way To File My Tax Return

The fastest and most accurate way to file your tax return is to file electronically.

E-filing your tax return with the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Read Also: When Do We Get Our Taxes Back 2021

How Is A Businesss Payroll Expense Determined

Payroll expense means compensation paid in Seattle to employees. Compensation has the same meaning for purposes of the payroll expense tax as it does for the Washington State Family and Medical Leave program. Compensation includes all payments for personal services, including commissions and bonuses and the cash value of all earnings paid in any medium other than cash.

Read Also: How Many Years Do You Need To Keep Tax Returns

Federal Income Tax Withholding Social Security And Medicare Tax Deposits

For taxes reported on Forms 941, 943, 944, or 945, there are two deposit schedules: monthly and semi-weekly. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use. The deposit schedule you must use is based on the total tax liability you reported on forms previously during the specified lookback period. The lookback period is different based on the form type. See the instructions for the form itself or Publication 15 for more information about the lookback period and how to determine which type of depositor you are.

Recommended Reading: How Much Would I Pay In Taxes Calculator

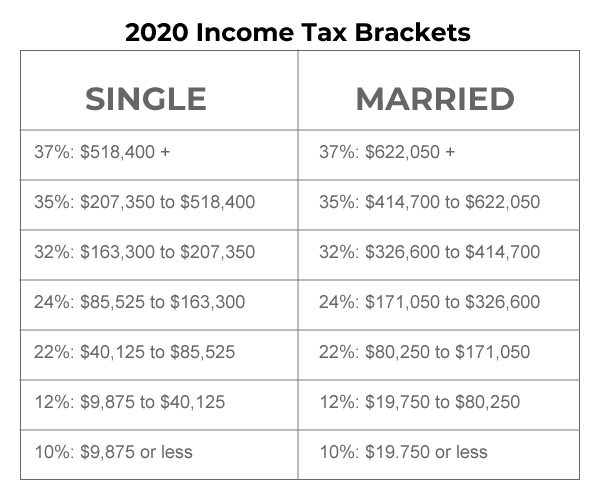

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Volunteer Income Tax Assistance

The IRS’s Volunteer Income Tax Assistance program offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. While the majority of these sites are only open through the end of the filing season, taxpayers can use the VITA Site Locator tool to see if there’s a community-based site staffed by IRS-trained and certified volunteers still open near them.

Read Also: When Will The Irs Start Accepting 2021 Tax Returns

How To File Your Tax Return Electronically

You might want to e-file your late return if you haven’t missed that deadline as well. Many taxpayers can e-file at IRS Free File if their AGIs were under $73,000 in 2021. Some other rules can apply as well, imposed by the individual software providers that participate in the Free File Alliance.

The IRS will accept e-filed returns until November. It will announce the exact November cutoff date sometime in October 2022.

Under The Income Tax Laws If An Individual Has Not Filed Income Tax Return For Fy 2021

income tax returnbelated ITRrevised ITRWhat is the process of filing belated ITR?What is the process of filing revised ITR?What if you do not file a belated ITR for FY 2021-22 by December 31, 2022?

Dont miss out on ET Prime stories! Get your daily dose of business updates on WhatsApp.

-

Torrent Investments is the highest bidder for Anil Ambani-owned Reliance Capital, having offered 8,640 crore for the debt-laden financier at an auction held on Wednesday.

Read More News on

Recommended Reading: How Much Is Tax In The Us

Important Due Dates For Filing Your 2021 Tax Return And Making Payments

The Balance / Catherine Song

Tax filing season can be stressful, but if you plan ahead, the process can be much more seamless.

Generally, April 15 is the official deadline for filing your federal income tax return each year, but that date isn’t carved in stone. The deadline moves to the next business day when April 15 falls on a Saturday, a Sunday, or a legal holiday, and other national events can shift it as well. For example. the tax filing deadline in 2022 is April 18 .

The Internal Revenue Service typically begins processing tax returns in late January of each year, but you can start filing as soon as you have all of the necessary paperwork together. In this guide, you’ll learn all of the important dates to know in 2022 in order to ensure a smooth and easy tax filing process.