Which Are The Highest Find Out Here

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

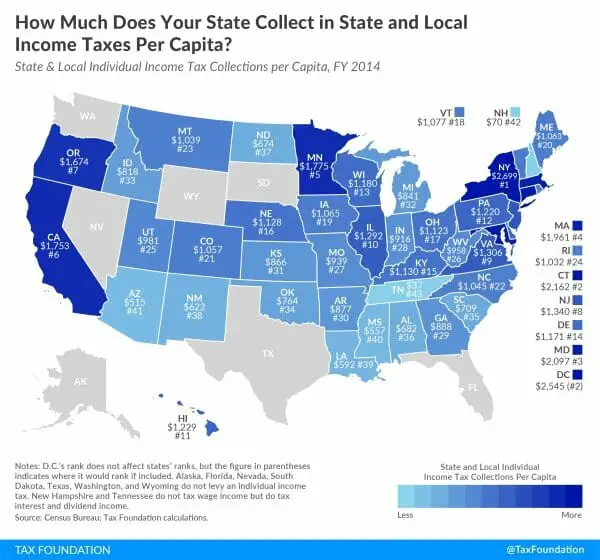

One of the biggest tax bills that most people pay is the federal income tax calculated on the Internal Revenue Service Form 1040 in April of each calendar year. Three other major taxes come from your state or locality: state income taxes, sales taxes, and property taxes. The way that each type of tax is calculated is complicated factors such as your income level, marital status, and county of residence affect your tax rates.

Simple, apples-to-apples comparisons of how much total tax youll pay living in one state versus another are impossible. And since you pay state income tax on the money you earn, sales tax on the money you spend, and property tax on the value of any real estate you might own, you cant simply add up the average rates in each state and rank them from lowest to highest.

However, if youre trying to choose where to live or to locate your businessand taxes are a factor in your decisionthen the tables below can give you a big picture to use as the starting point for more research on how taxes in each state would impact your unique financial situation.

Can I Get A Sales Tax Credit For My Trade

In many states, you can get a sales tax credit based on the value of your trade-in. Depending on the amount of your appraisal, you may be able to get more money trading to the dealership than selling your car on your own.

Weâve created a calculator that will tell you the tax credit amount and help you determine whether itâs better to trade-in to the dealership or to sell your car privately.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

Also Check: When Do We Get Tax Returns 2022

Which State Has The Lowest Sales Tax

Sales tax is one of the top sources of revenue for most of US states. It is a direct tax imposed by the state government on purchased goods and services. The rate of sales tax paid is calculated as a percentage of the sales price. As of 2015, 45 US states charge sales tax. States may exempt certain goods such as prescriptions drugs and some food items from sales tax. In fact, out of all the states, only Illinois charges sales tax on prescription drugs. The rate of sales tax differ from state to state. Also, the rate of sales tax may differ from county to county within a state since the local government allows for local taxes.

You May Like: Are Gifts To 529 Plans Tax Deductible

What Purchases Are Taxed

Most of these states with low sales tax rates exempt food items and many other necessary purchases as well, such as prescription drugs and clothing. But some states have separate, higher taxes for certain purchases like tobacco, alcoholic beverages, and gasoline.

Starting 2020, New Hampshire will get you if you purchase tobacco products therea pack of 20 cigarettes will cost you an extra $1.78, and a pack of 25 cigarettes has a tax rate of $2.23 per package.

You can take heart if you live in Wyoming, however. The state had the lowest excise tax on beer in the country at just $0.02 per gallon as of 2022.

What Are The Income Tax

Right now, the nine states that donât collect personal income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Alaska

Alaska doesnât have a state sales tax or income tax. Instead, it relies on property taxes for roughly 50% of its state and local tax revenue, according to a 2020 report by taxfoundation.org. Itâs also the state with the sixth-highest cost of living, according to a 2022 report by the Missouri Economic Research and Information Center , in part because of the high cost of goods and services, such as groceries and utilities.

Florida

Florida relies on property taxes and state taxes for much of its revenue, but the rates of those taxes is about average compared to the rest of the country. Despite being a popular retirement haven, Floridaâs cost of living is slightly above average, with groceries, housing and utilities representing the highest costs of living.

Nevada

Nevada has a state and local sales tax of 8.23%, the 13th-highest in the nation. High housing costs also contribute to its higher-than-average cost of living index, according to MERIC.

New Hampshire

Property taxes account for roughly 64% of New Hampshireâs state and local tax revenue, which makes sense considering it has the third-highest property tax rate in the country. Its cost-of-living index is also high, making it the 15th most expensive state to live in.

South Dakota

Tennessee

Texas

Washington

Wyoming

Also Check: How Much Is My Salary After Tax

What Are Property Taxes

Property taxes, or real estate taxes, are paid by a real estate owner to county or local tax authorities. The amount is based on the assessed value of your home and vary depending on your states property tax rate. Most U.S. homeowners have to pay these fees, usually on a monthly basis, in combination with their mortgage payments. If you pay off your loan, you receive a bill for the tax from local government occasionally during the year.

The money used for the property tax goes toward the community. It supports infrastructure improvements, public services and local public schooling.

Summary On States With The Highest Tax Burdens

Tax is a complicated issue, with different tax breaks and brackets based on income and household size. However, some states quite simply tax more than others. Between property taxes, sales tax, and personal income there are a variety of ways for states to get revenue and often a low tax in one area means a higher rate in another.

When contemplating an interstate job move, savvy job hunters know that the salary is just one component to investigate, as higher taxes can take a deep chunk of that anticipated pay raise. Which states offer job seekers the least tax obligations?

States With The Lowest Tax Burdens

Don’t Miss: Do You Have To Pay Taxes On Home Sale

How Are Property Taxes Calculated

Property tax is calculated using the value of the property in question. More specifically, the value is assessed based on the type of property, its structure, and the land that it sits on. For example, a vacant plot of land will have a much lower tax than its neighbor with a similar plot of land with a house and guest cottage. If the property has access to public services or has the potential for further development, higher taxes could be assessed.

Each state computes its property tax rate using its own unique formulas. However, they all share two common factors: the propertys assessed value and the percentage tax rate. Because of this, its easiest to look at the tax rate itself when comparing and contrasting property taxes between states.

For example, lets say person A in state A owns a home worth $1 million. They were assessed a property tax of $10,000 last year. Thats a property tax rate of 1 percent. Then, lets say person B in state B owns a condo worth $150,000. However, they were assessed a property tax of $10,000 last year as well, the same amount person A paid. Thats a whopping 7 percent property tax rate. Although person A and person B paid the same dollar amount, you can easily tell that person B has a much heavier tax burden by looking at the property tax rate.

Total Tax Burden: 819%

The Lone Star State loathes personal income taxes so much that it decided to forbid them in the states constitution. Still, because infrastructure and services must be paid for somehow, Texas relies on income from sales and excise taxes to foot the bill.

Sales tax can be as high as 8.25% in some jurisdictions. Property taxes are also higher than in most states, the net result of which is a total tax burden of 8.19% of personal income. Nevertheless, Texans overall tax bite is still one of the lowest in the U.S., with the state ranking 19th. Texas is average for affordability at 22nd in the nation, but it was ranked 31st by U.S. News & World Report on the Best States to Live In list.

Texas spent $9,827 per pupil on education in 2019, ranking it below average among the 17 Southern states, and it received a D grade for its school funding distribution in 2015. In 2021 the ASCE awarded it a grade of C for its infrastructure. Texas spent $6,998 per capita on healthcare in 2014, the seventh-lowest amount in the U.S.

One advantage of living in a no-tax state is that the $10,000 cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act will likely not have as great an impact as it does on residents of high-tax states, such as California and New York.

Also Check: When Are My Taxes Coming

Who Sets Home Value

After looking at the example above, youre probably wondering who exactly determines why person A and person B in the example above paid what they did in property taxes last year. The entities that set home values in each state are tax assessors, and they are typically government agents who value your property every one to five years. They will look at other similar properties in your market and compare recent sales prices to determine your propertys value. Unique formulas are also involved, and as you might imagine, this involves a lot of complicated math.

These tax specialists look at numerous other factors unique to each state and properly calculate tax rates. It might be that Person Bs condo was located a short distance from a popular tourist attraction, or perhaps Person As home is valued at a higher value but local property taxes are considerably low for that area. You can expect your tax bill to go up if you add any value to your home, such as by adding a pool or building a second story. Most states offer an appeal process so that there is some recourse if you feel like your property value assessment is unfair or unreasonable.

Sales Tax Isnt The Only Tax To Consider

While you may think you pay a lot of sales tax because of how often youâre charged it, of the list of taxes you will pay in your lifetime, sales tax actually doesnât amount to as much as you think. Even if you live in a state that has sales taxes, there are legal ways to sometimes avoid paying them, including sales tax holidays. In fact, you will likely pay more in loan interest than sales tax throughout your life.

But if you are considering what your tax burden may be in a new state, be sure to consider these larger tax bills:

You May Like: What Is An Amended Tax Return

Sales Tax Rate By State

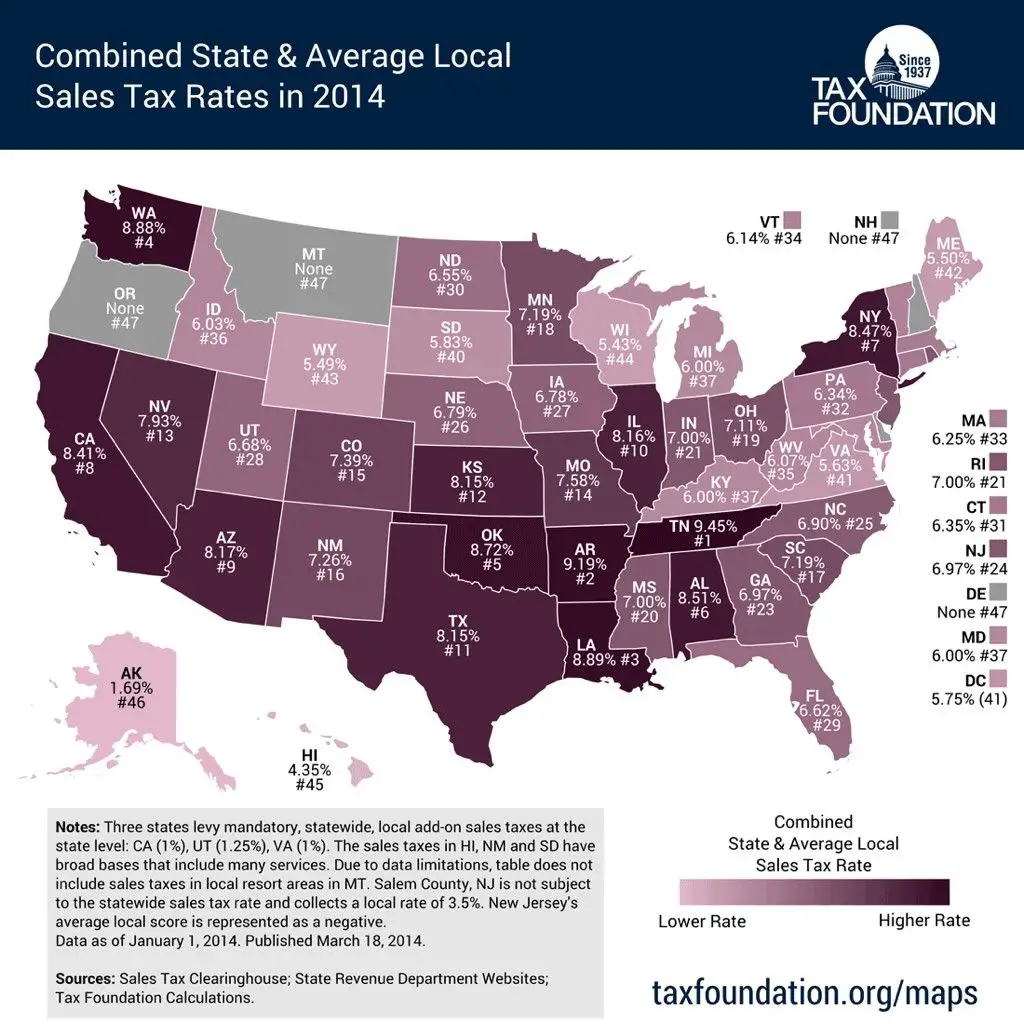

45 US states charge sales tax. According to the 2016 report on sales tax, Oregon, Montana, Alaska, Delaware, and New Hampshire do not have a sales tax. Of the five states, Alaska and Montana allow for the collection of a local tax. However, Alaska’s local authorities have capped local taxes below 2%, meaning the highest tax that can be charged in the state is 2%. The average local tax in Alaska as of 2015 is 1.76%.

The five states with the highest local taxes are Tennessee, Arkansas, Alabama, Louisiana, and Washington. These five states charge sales taxes of 9.45, 9.26, 8.91, 8.91, and 8.89%, respectively. The prices of goods and services in these five states are generally higher compared to the prices of the five states that do not charge sales tax. The high sales tax is attributed to additional local taxes charged by various counties and municipalities within these states.

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2020 to 2021, as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2021.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average.

Of the states with an E grade, two out of three had population declines in 2021. Of the nine states with a D grade, only two New Hampshire and Vermont had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

Recommended Reading: Where Can I Pay My Federal Taxes

Offsets By Other Taxes

Sales taxes are only one of several ways that state governments can reach into your pocket for the cash that keeps them up and running. Some states take, but then they give back again. They pull much of their revenues from a single tax source and spare residents in other areas.

For example, Tennessee’s significant combined state and local sales tax rate is offset by the fact that the state does not impose income tax. Your earned income is tax-free if you live there. Conversely, you’ll pay dearly in property taxes if you live in New Hampshire even though the state is sales-tax-free.

States With The Highest Sales Taxes

At the other end of the spectrum are states with very high state sales tax rates. In some cases, these rates are high enough that shoppers drive across state lines to visit lower-tax or tax-free states when they want to make major purchases. This frequently occurs in areas of Massachusetts that aren’t too far from tax-free New Hampshire.

California has the dubious honor of having the highest statewide sales tax rate at 7.25%. It’s followed by:

- Indiana, Mississippi, Rhode Island, and Tennessee at 7%

- Minnesota at 6.875%

- Washington, Arkansas, and Kansas at 6.5%

Recommended Reading: How To Check If The Irs Received My Tax Return

The Best And Worst States For Sales Taxes

The Balance / Nusha Ashjaee

Adding a sales tax onto a purchase makes everything you buy a little more expensive, and its not just state sales taxes that you have to concern yourself with. Some counties and cities tack on their own taxes in addition to the state’s, making the bill for certain merchandise even higher.

You’ll have to shop in states that either don’t have a sale tax, have a very low tax rate, or shop during a sales tax holiday if you don’t want to shell out a fair bit of extra money every time you approach a cash register. These locations are the bestand worstfor sales taxes as of 2022.

Lowest Property Taxes In The Us

Perhaps surprisingly, Hawaii charges the cheapest property taxes in the US, at least by tax rate. Of course, they also feature some of the highest property values in the country, so a low tax rate still yields a hefty total sum. The ten states with the lowest property taxes in the US are:

If you want to include Washington DC, it would have landed in the #8 slot with property taxes charged at 0.58% of property value.

But the list looks different when you order it by the lowest total property taxes collected for the median property owner:

Many of these states with the lowest property taxes overlap. Alabama, West Virginia, Louisiana, Arkansas, South Carolina, Wyoming, and Mississippi all rank among the states with the lowest property taxes regardless of whether you rank by tax rate or total property taxes collected for the average property.

But some states fall at the opposite end of the spectrum when you look at the total average property taxes collected.

Read Also: File State And Federal Taxes For Free

Don’t Miss: How Much Taxes Deducted From Paycheck Wa

Lowest And Highest Sales Tax States

Four states Delaware, Montana, New Hampshire and Oregon have no statewide sales tax, or local sales taxes, either.

Alaska has no statewide sales tax, but it allows cities and towns to levy sales taxes. The Tax Foundation, an independent think tank, weights local sales taxes by population and adds them to statewide sales taxes. It calculates Alaskas sales tax at 1.76 percent, still well below the national average of 6.57 percent. The lowest state and local sales taxes after Alaskas are in Hawaii , Wyoming , Wisconsin and Maine .

On the other end of the spectrum is Louisiana, whose combined state and local sales tax weighs in at 9.55 percent. Tennessee, whose state sales tax is 9.547 percent, trails Louisiana by a fraction. Following Tennessee on the ranking of states with the highest sales taxes are Arkansas , Washington and Alabama .

States have to get revenue from somewhere, and sometimes states with low income taxes have high sales taxes. Tennessee has a very high sales tax but a very low income tax, says Janelle Fritts, policy analyst at the Tax Foundation. In fact, Tennessee doesnt tax wage income at all it just taxes dividends and capital gains. Washington and Texas, which dont have income taxes, also have above-average sales taxes.

Some states with low sales taxes, such as Alaska and Montana, get significant income from natural resource taxes.

How high are sales taxes in your state?

|

States |

Your email address is now confirmed.