Other Options To Pay Your Taxes Over Time

The IRS charges set-up fees for those who need to pay their taxes over time. But there might be more affordable options, such as using a 0% APR credit card to pay your tax bill or even taking out a personal loan.

When comparing costs, calculate how much the interest and fees will cost you over time. But if your is good enough to qualify you for either a 0% interest credit card or personal loan, you should do the math to find out which payment option is cheaper. Then choose the one that costs the least over time and has a monthly payment you can afford.

If a 0% interest credit card is a viable option for you, and once youre approved for the card, the next step is to visit this IRS webpage and pick a payment servicer. Pay1040 charges a fee of 1.87% to use a credit card to pay taxes, and the rewards from some credit cards can even negate this fee.

Read Also: Why Is My Tax Return So Low

Important Electronic Payment Information

All credit card and eCheck payments will take 3 to 5 business days to process and post to your account. However, your payment will be posted as of the date of the online transaction. Before you begin the credit card or eCheck payment process, it is important to make the necessary modifications to your spam blocker to allow the confirmation e-mail to be sent to you. Once you receive the e-mail confirmation, you can go back and enable your spam blocker. You may also include the to your authorized list of senders.

If you should have any questions or concerns, please feel free to contact the Office of the Tax Assessor-Collector during our regular business hours at 210-335-2251.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Also Check: How Much Tax Is Paid On 401k Withdrawal

To Make Your Account More Secure Email Addresses In My Account Are Now Required

As of February 7, 2022, all My Account users will need to have an email address on file with the CRA to help protect their online accounts from fraudulent activity. If you do not currently have an email address on file, you will be prompted to provide one when you sign in.

My Account is a secure portal that lets you view your personal income tax and benefit information and manage your tax affairs online.

Choose from one of three ways to access My Account:

Note:Before you can register using option 1 or 2, you must have filed your income tax and benefit return for the current tax year or the previous one.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

You May Like: How To Find Your Tax Return

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

After Viewing Their Information A Taxpayer Can:

- Select an electronic payment option.

- Set up an online payment agreement.

- Go directly to Get Transcript.

Taxpayers balance will update no more than once every 24 hours, usually overnight. Taxpayers should also allow 1 to 3 weeks for payments to show up in the payment history.

To access their information online, taxpayers must register through Secure Access. This is the agencys two-factor authentication process that protects personal info. Taxpayers can review the Secure Access page process prior to starting registration.

Taxpayers can also visit IRS.gov to use many other self-service tools and helpful resources. These include Wheres My Refund? and the IRS2Go app. These are the best ways for taxpayers to check the status of their tax refund. These tools are updated no more than once a day, so taxpayers dont need to check more often.

Read Also: How Much Money Can You Make Without Paying Taxes

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

Why You Should Consider Filing A Tax Return Even If Youre Not Required To File

Filing a tax return is probably not something most people enjoy doing. So why would anyone want to file a tax return if they dont have to? Well, actually, there are some important reasons you might get a tax refund and you may be eligible for an additional stimulus payment. If youre eligible for future payments or credits, it helps if IRS has your 2020 tax return and direct deposit information on file.

While people with income under a certain amount arent required to file a tax return because they wont owe any tax, if you qualify for certain tax credits or already paid some federal income tax, the IRS might owe you a refund that you can only get by filing a return. Some tax credits are refundable meaning that even if you dont owe income tax, the IRS will issue you a refund if youre eligible. Many people miss out on a tax refund simply because they dont file an IRS tax return.

There is usually no penalty for failure to file if you are due a refund, but why miss out on money thats rightfully yours? If, however, you wait too long to file your return and claim a refund, you risk losing it altogether. Thats because an original return claiming a refund must generally be filed within three years of its due date. If you havent filed a tax return for tax year 2017 and had any money withheld from your paychecks or are eligible for tax credits, you need to file by May 17, 2021. If you dont, the money is forfeited, by law, and becomes property of the U.S. Treasury.

You May Like: What Is The Tax Rate In Missouri

While People With Income Under A Certain Amount Arent Required To File A Tax Return Because They Wont Owe Any Tax If You Qualify For Certain Tax Credits Or Already Paid Some Federal Income Tax The Irs Might Owe You A Refund That You Can Only Get By Filing A Return

Get to know the IRS, its people and the issues that affect taxpayers

As the Deputy Commissioner of Wage & Investment, its important to me that my organization ensures that everyone can claim the tax credits theyre eligible for, whether its a tax refund, a stimulus payment or federal withholding credits.

Before I talk about 2020 tax returns, I do want to mention that IRS employees are hard at work to process some of last years returns that we werent able to get to because of the many office closures during the pandemic. Its important that you file your 2020 tax return even if your 2019 tax return hasnt been processed yet. We will still process your 2019 return even if youve already gotten your 2020 tax refund.

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

Don’t Miss: How To Pay Taxes On Etsy Sales

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

You May Like: How To Calculate Paycheck After Taxes

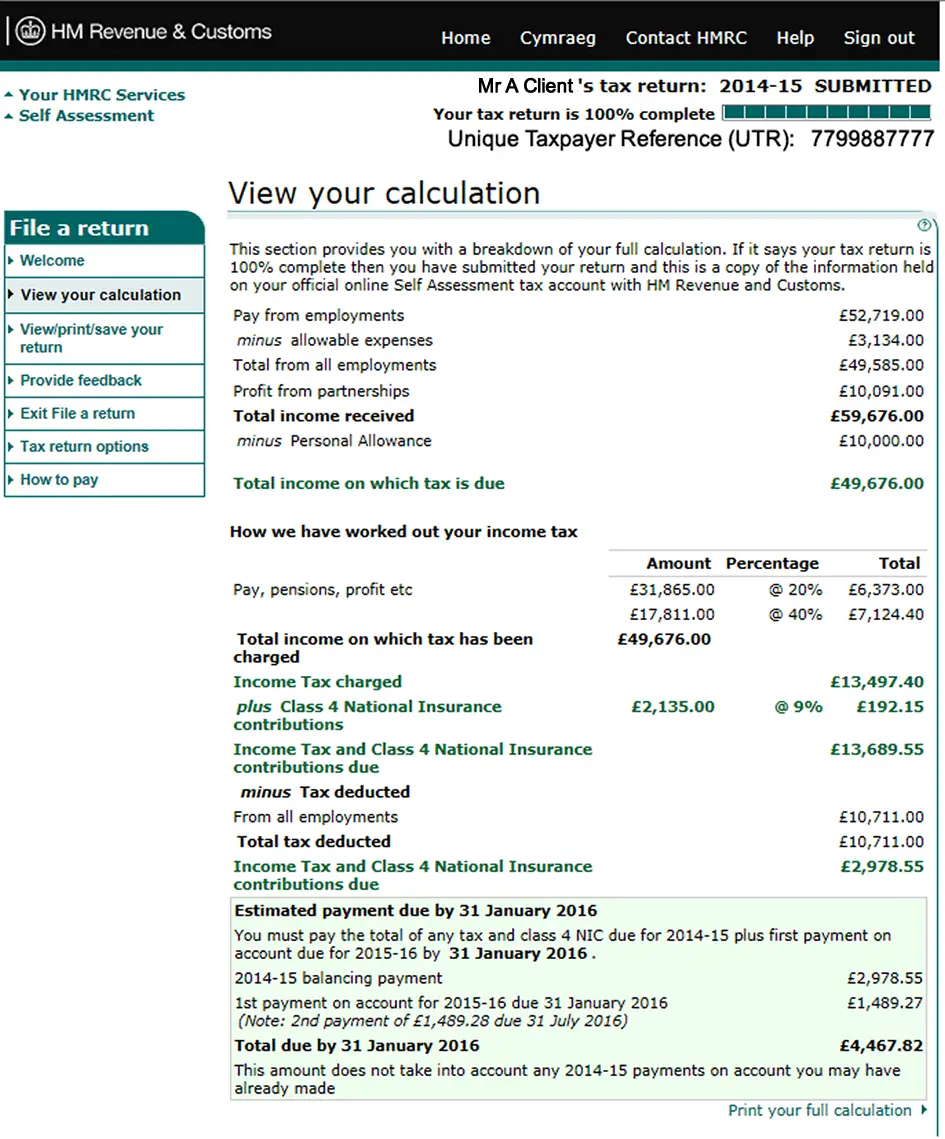

File Your Tax Return Early

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: .

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/publications/file-your-self-assessment-tax-return-early/file-your-tax-return-early

You dont have to wait until January to file your Self Assessment tax return here are some quick facts about beating the rush:

- you can do your tax return early as soon as the tax year ends, you can submit your tax return at a time that suits you

- filing early has a few benefits:

- some people do so for their peace of mind

- it might help you manage your tax bills or your financial planning for the year by finding out how much you owe, so you can plan your payments

- if youre owed a refund youll get it sooner

Theres more information below, including:

Loudoun County Homeowners Could See Lowered Property Tax Rates In The Coming Fiscal Year

Loudoun County homeowners and businesses could see a lower real estate tax rate in fiscal year 2024, owing to higher than estimated valuations of commercial and residential properties, according to a budget update by county staff Tuesday night.

But that may not necessarily translate into a lowered tax bill.

At the Dec. 13 meeting of the Board’s Finance/Government Services Committee, County Administrator Tim Hemstreet said Loudoun County would be able to meet its base budget operations and maintenance needs, employee compensations and opening of new facilities in fiscal year 2024 with a real estate tax rate of 88 cents per $100 of assessed property value, which is a penny lower than what was paid in the current fiscal year. This tax rate, however, would not be sufficient to meet the funding needs of the Loudoun County Public Schools , the county’s critical needs, or any of the Board’s priorities, which range from collective bargaining to meeting unmet housing needs and implementing the energy work plan to regulating short-term rental units.

Hemstreet and his staff craft the county’s fiscal year 2024 budget based on guidance they receive from the finance committee. The budget is proposed in January each year to the board, which then approves it in April following a series of work sessions and public hearings.

You May Like: Can You Still File Taxes After Deadline

Did You Receive A 1099

What Happens If You File Taxes Late

If you are getting a refund, there is no penalty, according to H& R Block. Then again, not getting your money from the IRS might be punishment enough.

If you owe the IRS, the penalties kick in. TurboTax says penalties can reach 5% of the amount owed for each month you are late. The maximum amount taxpayers can be penalized is 25% of the amount due, according to TurboTax.

Read Also: How To Figure Capital Gains Tax

When Did Irs Accept Returns 2020

IRS opens 2020 filing season for individual filers on Jan. IR-2020-02, January 6, 2020 The Internal Revenue Service confirmed that the nations tax season will start for individual tax return filers on Monday, January 27, 2020, when the tax agency will begin accepting and processing 2019 tax year returns.

Check Your Income Tax For The Current Year

This service covers the current tax year . Use the service to:

- check your tax code and Personal Allowance

- see if your tax code has changed

- tell HM Revenue and Customs about changes that affect your tax code

- update your employer or pension provider details

- see an estimate of how much tax youll pay over the whole tax year

- check and change the estimates of how much income youll get from your jobs and pensions

You cannot check your Income Tax for the current year if Self Assessment is the only way you pay Income Tax.

Don’t Miss: How Many Years Do You Have To File Taxes

Your Unique Taxpayer Reference

Before you start to fill in your Self Assessment return, you will need your ten-digit unique taxpayer reference .

This allows HMRC to identify you on their systems.

This will be contained on any Self Assessment statements you have received.

If you have your National Insurance number to hand this will help HMRC identify your UTR. You can also find it on your Personal Tax Account or the HMRC app.

Read how to find a lost UTR number.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Don’t Miss: Am I Paying Too Much Tax