West Virginia Corporate Income Tax

If your business is incorporated in West Virginia, does business in, or participates in certain other activities in West Virginia, you may have to file an annual West Virginia State Corporation tax return.The Corporation Net Income Tax is a tax on the West Virginia taxable income of every domestic or foreign corporation that enjoys the benefits and protections of the government and laws in the State of West Virginia, or derives income from property, activity or other sources in West Virginia. The current rate of the West Virginia Corporate Income Tax is 6.5 percent.

Other Taxes And Fees Applicable To West Virginia Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees West Virginia car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the West Virginia Department of Motor Vehicles and not the West Virginia State Tax Department.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in West Virginia on a new-car purchase add up to $301, which includes the title, registration, and plate fees shown above.

West Virginia Sales Tax Rates Updated Monthly

Our team of 100+ researchers keeps our database up to date with the latest in rates and taxability rules for each jurisdiction.

Get a quick rate range

West Virginia state sales tax rate

*Due to varying local sales tax rates, we strongly recommend using our calculator below for the most accurate rates.

Get a free download of average rates by ZIP code for each state you select.

If you make sales in multiple states, rate tables can be used to input data into your tax system or maintain as a reference.

Automate calculation

Let Avalara AvaTax calculate rates in real time.

AvaTax gives you street-level precision at the point of sale, without requiring you to look up rates or maintain a database. Because its a cloud-based tool, rate updates are pushed to you automatically, based on the latest jurisdiction rules and regulations.

What do these tax rates mean?

-

The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted.

-

The jurisdiction breakdown shows the different sales tax rates making up the combined rate.

-

While most taxable products are subject to the combined sales tax rate, some items are taxed differently at state and local levels. Be sure to apply the correct sales tax rate to your sale.

The rates presented are current for the date and time you submitted the address, but may change at any time with new tax legislation.

Read Also: Do Doordash Drivers Pay Taxes

Car Sales Tax For Trade

You dont have to pay sales tax on trade-ins in West Virginia. In other words, be sure to subtract the trade-in amount from the car price before calculating sales tax.

As an example, lets say you are purchasing a new SUV for $25,000 and your trade-in is worth $5,000. You will subtract the trade-in value by the purchase price and get $20,000. Therefore, your car sales tax will be based on the $20,000 amount.

About The West Virginia Sales Tax

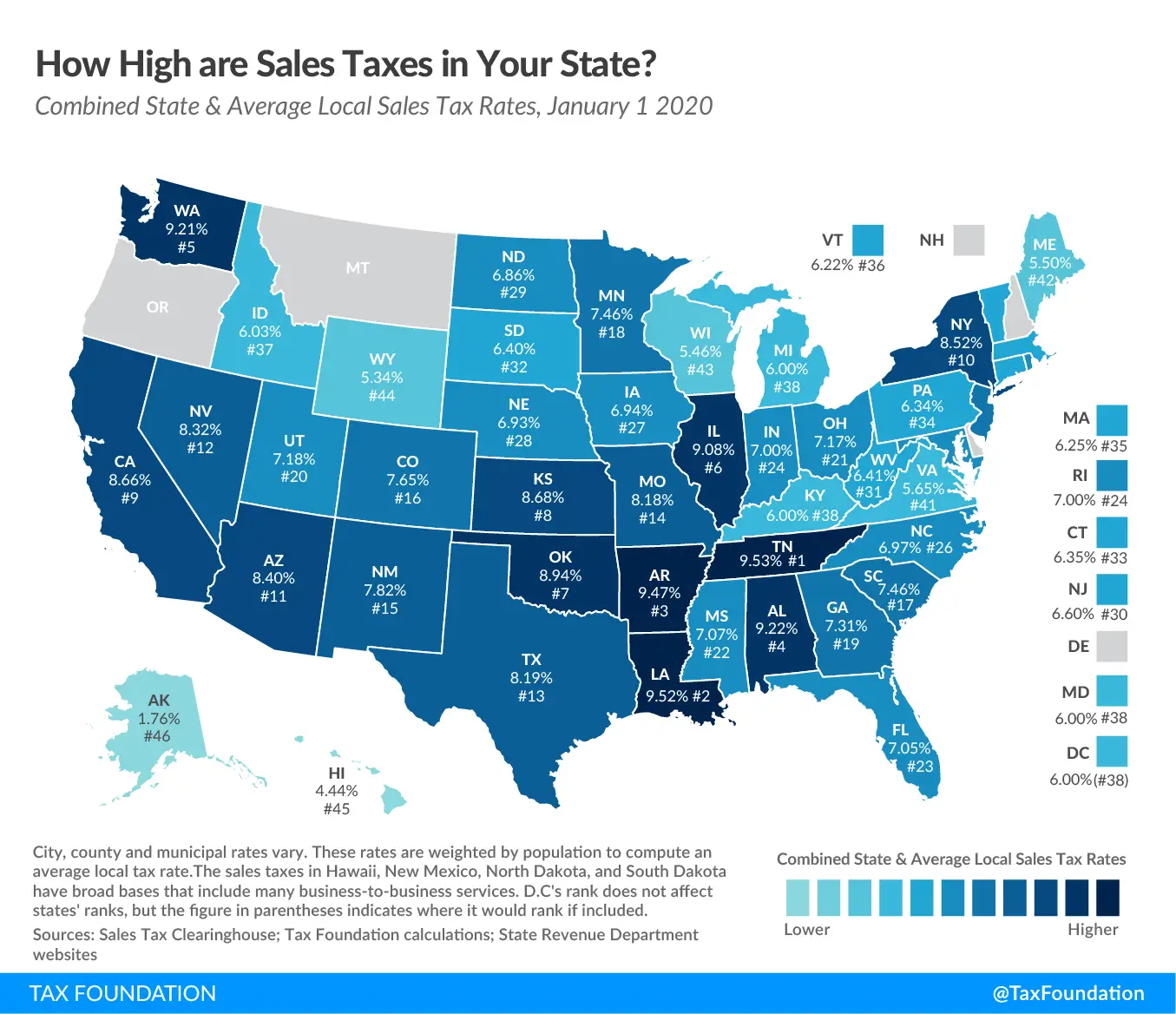

In the state of West Virginia, the state has a very simple sales tax rate. The state incurs a base state sales tax, in addition to county taxes or local city taxes, which will vary significantly depending on which jurisdiction you are in. These local tax rates would be in addition to the state rate.

Don’t Miss: How To Figure Out Payroll Taxes

Taxable And Exempt Shipping Charges

West Virginia sales tax may apply to charges for shipping, handling, delivery, freight, and postage.

There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in West Virginia and sales tax should be taken directly to a tax professional familiar with West Virginia tax laws.

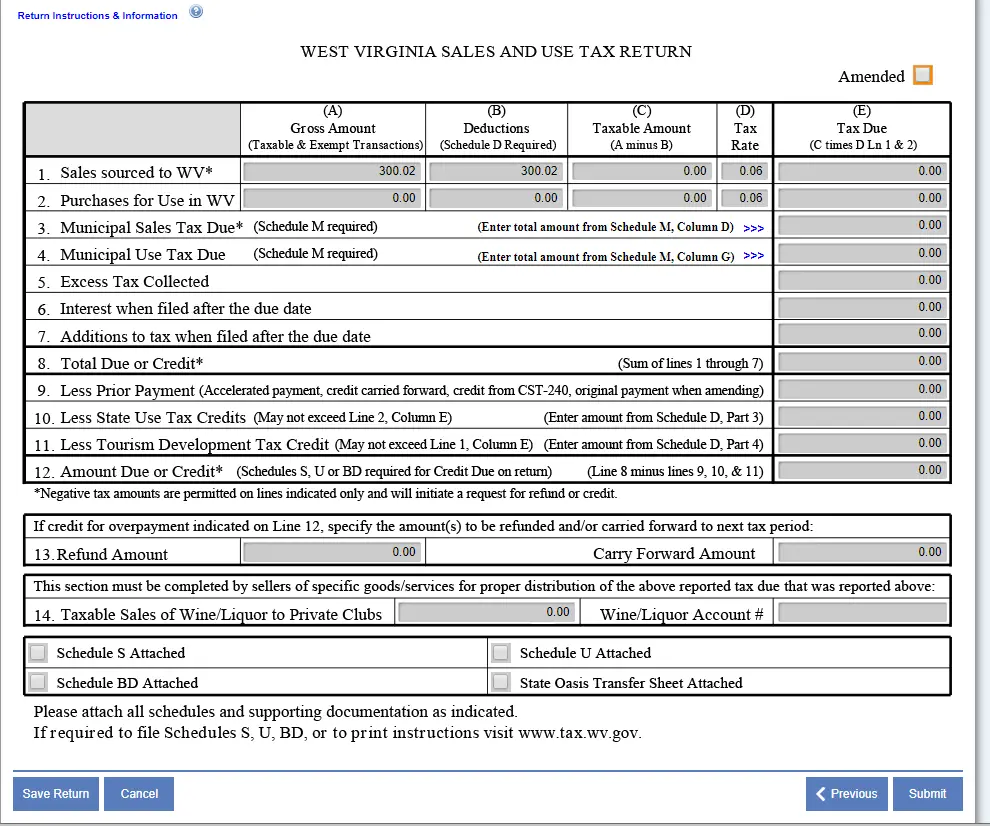

Sales And Use Tax For Sales Of Goods And Services

The sales tax has a complementary use tax. Consumers and businesses do not pay both. If a business purchases tangible taxable personal property without paying taxes and does not resell the items, it must pay use tax on them. If a consumer purchases tangible personal property and does not pay tax, the consumer must pay the use tax. Some online businesses do not charge West Virginias sales tax because they do not meet the physical or financial nexus.

Also Check: How To Get Stimulus Check On Tax Return

Filing When There Are No Sales

Once you have a West Virginia seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Local Wine And Liquor Distribution Tax

Retailers selling wine and liquor must collect and remit:

- The state sales and use tax of 6 percent.

- Municipality sales and use tax for the business location.

- Local wine and liquor tax of 5 percent.

The state requires a retailer to complete two forms: The CST-200CU Combined Sales and Use Tax Return and the CST-270 Wine/Liquor Return.

To determine the total tax due for a municipality that charges a 1-percent sales and use tax:

- Multiply gross sales by 7 percent combined state and municipality tax. If a sale is $100, the tax is $7, for a total of $107.

- Multiply gross sales by 5 percent. If a sale is $100, the tax is $5. Add the $5 to $107 for a total due from the consumer of $112.

Retailers can also file both taxes online.

Recommended Reading: How Do I Do My Taxes Online

Special District Excise Tax

If a municipality has a Special District Excise Tax for economic opportunity development, the business pays only this tax. It does not have to pay the states sales tax. As of this writing, Monongalia County, Harrison County and Ohio company are the only three counties with a Special District Excise Tax:

- Monongalia County: University Town Center. The tax rate is 6 percent.

- Harrison County: Charles Pointe. The tax rate is 6 percent.

- Ohio County: The Highlands. The tax rate is 6 percent.

- South Charleston: Park Place. The tax rate is 6 percent.

The local sales tax of 1 percent still applies to Park Place, so the total tax rate for that local jurisdiction is 7 percent.

If the business taxpayer has sales only in Park Place, it can file the local tax on the District forms. However, if the business has sales from other physical business locations or sales made by delivery to locations not in the District, it must file those sales on the regular sales tax return .

Do You Have Nexus In West Virginia

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in West Virginia.

You probably have nexus in West Virginia if any of the following points describe your business:

- A physical presence in West Virginia: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- A significant amount of sales in West Virginia within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in West Virginia is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

Also Check: Can The Government Tax Cryptocurrency

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

West Virginia taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.

What Transactions Are Generally Subject To Sales Tax In West Virginia

In the state of West Virginia, legally sales tax is required to be collected from all tangible, physical products being sold to a consumer, in addition to the vast majority of services performed. Several exceptions to this tax are certain types of prescription medicines, and items purchased for resale. This means that the owner of a office supplies store would have to charge sales tax on his products, while the owner of a pharmacy would not have to charge sales tax on the majority of the medications he sells.

Read Also: When Us The Last Day To File Taxes

Are Services Subject To Sales Tax In West Virginia

The state of West Virginia often does collect sales taxes on services performed. In fact, most of the services in West Virginia are indeed considered taxable. The only notable exemptions would be the furnishing of personal services and professional services.

You can find a table describing the taxability of common types of services later on this page.

Who Is Obliged To Register Sales Tax:

All remote sellers must be registered to collect and remit sales tax or West Virginia and municipality sales tax beginning January 1, 2019.

Small remote sellers are an exception if they do not have a physical presence in West Virginia and their annual sales of products and services in the state are less than $ 100,000 and have fewer than 200 separate transactions for goods and services supplied in West Virginia.

You May Like: How To File Taxes As Student

How To Register For Sales Tax In West Virginia

Okay, so you have nexus! Now what?

The next crucial step in complying with West Virginia sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in West Virginia on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Tax On Rebates & Dealer Incentives

You do have to pay tax on dealer rebates and incentives in West Virginia. In other words, do not subtract the incentive/rebate amount from the car price before calculating sales tax.

As an example, if you are purchasing a new car for $30,000 with a $5,000 rebate, you will pay sales tax on the full $30,000 final cost of the car.

Also Check: How Much Money Is Taken Out Of Paycheck For Taxes

West Virginia Income Tax

As a business owner, youll need to pay West Virginia income tax on any money you pay to yourself. These earnings flow through to your personal tax return. Youll be taxed at West Virginia’s standard rates, and youll also be able to apply regular allowances and deductions.Any employees will also need to pay state income tax.The West Virginia income tax rate varies between 3 and 6.5 percent, depending on how much you earn.

Charleston West Virginia Sales Tax Rate

charleston Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Charleston, West Virginia?

The minimum combined 2022 sales tax rate for Charleston, West Virginia is . This is the total of state, county and city sales tax rates. The West Virginia sales tax rate is currently %. The County sales tax rate is %. The Charleston sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect West Virginia?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in West Virginia, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Charleston?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Charleston. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Read Also: Can I Still File My Taxes 2021

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects.

- Annual filing: If your business collects less than $600.00 in sales tax per year then your business should file returns on an annual basis.

- Quarterly filing: If your business collects no more than $250.00 in sales tax per month, then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $250.00 in sales tax per month,then your business should file returns on a monthly basis.

Note: West Virginia requires you to file a sales tax return even if you have no sales tax to report.

Do You Need To Register To Collect Sales Tax

If you sell, lease, distribute, or rent tangible personal property to customers in Virginia, or otherwise meet the definition of a dealer, and have sufficient activity in Virginia, you have nexus as defined in Va. Code § 58.1-612, and must register to collect and pay sales tax in Virginia.

- In-state dealers: generally individuals and businesses making sales with, or at, one or more physical locations in Virginia must register to collect sales tax as an in-state dealer.

- Out-of-state dealers: generally individuals and businesses located outside of Virginia, but with sufficient physical or economic presence to establish nexus in Virginia, must register to collect sales tax as an out-of-state dealer. Starting July 1, 2019, this includes remote sellers or online retailers that make more than $100,000 in annual Virginia gross sales or 200 or more transactions to Virginia customers. Learn more about economic nexus requirements for remote sellers.

- that have economic nexus in Virginia must register to collect and pay sales tax starting July 1, 2019. Generally, businesses without a physical location in Virginia that meet the economic nexus threshold should register as an out-of-state dealer, and businesses with a physical location should register as an in-state dealer. Marketplace facilitators must indicate that they are a marketplace facilitator when registering. Learn more.

How to register

You can register online or by mail. Use our checklist to make sure you have what you need.

You May Like: Who Does Not Have To File Taxes

Consumer’s Use Tax For Businesses

The consumer’s use tax applies to tangible items used, consumed, or stored in Virginia when the Virginia sales or use tax was not paid at the time of purchase. The use tax is computed on the cost price of the property, which is the total amount for which the property was purchased, including any services that are a part of the purchase, valued in money or otherwise, and includes any amount for which credit is given the purchaser or lessee by the seller.

Returns are due on the 20th day of the month after the filing period. You dont have to file for any periods that you dont owe tax. File by including the taxable items on your regular sales tax return, or you can file using the eForm ST-7.

How To Register For A West Virginia Seller’s Permit

You can register for a West Virginia sellers permit online through the Tax Department. To apply, youll need to provide the Tax Department with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

- Products to be sold

Also Check: How Much Is The Penalty For Filing Taxes Late

Are Clothes Taxed In Wv

During the holiday, certain back-to-school items are exempt from sales tax, such as clothing, school supplies, school instructional materials, laptops and tablets, and sports equipment.

Which state has highest property taxes?

New Jersey1. New Jersey. New Jersey holds the unenviable distinction of having the highest property taxes in America yet againits a title that the Garden State has gotten used to defending. The tax rate there is an astronomical 2.21%, the highest in the country, and its average home value is painfully high, as well.

What state has the lowest property tax?

HawaiiHawaii. Hawaii has the lowest effective property tax rate in the country, but it does cost to live in paradise.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about West Virginia sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Also Check: What Day Are Income Taxes Due