Figure Out Your Payments

Theres a lot of conflicting information out there about how to pay for your self-employment taxes. Do you file quarterly? Only at the end of the year? If you dont have an accountant handling things for you, its easy just to stop paying.

If youre a contract employee on the side but a full-time employee overall and dont plan to make more than the threshold to file self-employment taxes officially, you can file at the end of the year with your personal income tax form. You may want to ask your employer to withhold a little extra from your full-time checks to help ensure your tax responsibilities are covered just to be safe.

If self-employment is your gig, the IRS requires that you handle your tax responsibility through quarterly payments. These payments are due :

If you expect to owe more than $1000 at the end of the tax year, youll want to make those quarterly payments on time, or the IRS may assess penalties and late fees even if you pay up at the end of the year.

The magic lies in estimating how much money youll make throughout the year and assessing your tax responsibility based on that estimate. If this is your very first year in business, that could seem impossible. Heres a quick tip for making a logical estimation if youve never been in business before.

Setting Aside Money To Pay For Taxes

When someone is self-employed, they must be responsible for setting aside part of their income to pay for taxes when that time of year comes around. Those employed by a business will have part of their wages set aside before receiving their paycheque for this purpose. Contrary, self-employed persons will have to do this themselves.

Therefore, ensure you can pay your taxes by setting aside a portion of your income each month. This will help immensely when it comes time to pay the CRA accordingly. Generally, professional accountants recommend you set aside 15 to 25 % of your gross income for the year to cover tax payments safely.

Filing Your Taxes Can Be Tricky When You’re Self

There’s no avoiding giving Uncle Sam his due, and if you want to avoid an audit, it’s important to do it right the first time. Unlike W-2 employees, self-employed individuals do not have taxes automatically deducted from their paychecks. It’s up to them to keep track of what they owe and pay it on time.

Because taxes aren’t automatically deducted, take-home pay for the self-employed tends to be higher than it is for wage earners. However, unless you want the IRS to come knocking, it’s wise to set aside a chunk of those funds to cover your tax obligations.

“Business owners, whether they are self-employed freelancers or corporation owners, are responsible for complying with tax law with respect to their business,” said Shoshana Deutschkron, vice president of communications and brand at Upwork. “Financial literacy is a critical skill, that literacy includes an understanding of taxation.”

“You need to hold on to some of your money,” added Lise Greene-Lewis, CPA and tax expert for TurboTax. “You should pretend you don’t have that much money because your income varies so often. You have to think about paying your taxes.”

Not only are government forms daunting, but learning the ropes of taxation can be truly complicated. If you’re filing as self-employed with the IRS, here are the basics of filing, paying and saving for taxes.

Recommended Reading: How To Buy Tax Lien Properties In California

Gather Your Receipts And Invoices

If you are self-employed, you should keep supporting documents for all of your business transactions for the year. In addition to all of your 1099-MISC forms, keep sales slips, paid bills, invoices, receipts, deposit slips and canceled checks. Gather documents that show proof of purchases and expenses, including business-related travel, transportation, entertainment and gifts.

Discover: Crucial Tax Tips If Youve Got Any Kind of Side Hustle

Fair Market Value For Your Assets

You might transfer your personal assets to your business.

If you are operating a sole proprietorship, this is a reasonably simple process. The Income Tax Act requires that you transfer these assets to the business at their fair market value . This means that we consider you to have sold the assets at a price equal to their FMV at that time. If this amount is greater than your original purchase price, you must report the difference as a capital gain on your income tax and benefit return.

Your business will show a purchase of these assets, with a cost equal to the FMV at the time of the transfer. This is the value that you will add to the capital cost allowance schedule for income tax purposes.

For income tax purposes, when you transfer the property to a Canadian partnership or a Canadian corporation, you can transfer the property for an elected amount. This amount may be different from the FMV, as long as you meet certain conditions. The elected amount then becomes your proceeds for the property transferred, as well as the cost of the property to the corporation or partnership.

The rules regarding these transfers of property are technical. They allow you to change your business type from a sole proprietorship to a corporation or a partnership, or from a partnership to a corporation, on a tax-free basis.

Also Check: How To Report Ppp Loan Forgiveness On Tax Return

When To Pay Self

If you had self-employment income earnings of $400 or more during the year, you are required to pay self-employment taxes and file Schedule SE with your Form 1040, which is generally due by April 15. However, if you expect to owe $1,000 or more in combined income tax and self-employment taxes, youâll need to make estimated quarterly tax payments.

Estimated payments are due on April 15, June 15, September 15, and January 15 of the following year. Those dates shift to the next business day if the 15 falls on a weekend or holiday.

You can estimate the amount you need to pay using the worksheet on page 8 of Form 1040-ES. The form will help you determine the amount youâll owe for the year, divide it by four, and pay in equal installments by the due dates mentioned above. The form also includes vouchers to include when mailing your payment. If you prefer to pay online using IRS Direct Pay, you wonât need a voucher .

You can also use our free estimated tax calculator to figure out how much estimated tax youâll owe.

Social Security Wage Base

Social Security taxes are only charged on a portion of your income. This is called the Social Security wage base. For 2018, the Social Security tax applies to the first $128,400 of your combined income from wages and self-employment.

For example, say you have a full-time job earning $75,000 per year and drive for Uber on the weekends, making an additional $20,000 for the year. Your employer withholds 6.2% Social Security tax on your wages and matches another 6.2%. Your combined earnings from your job and your side gig are less than the Social Security wage base of $128,400, so youll pay another 12.4% on your ride-share driving income of $20,000.

However, if your earnings from your full-time job were $130,000, then you would have the maximum Social Security tax withheld from your wages. In that case, any self-employment income earned with your side gig would not be subject to the Social Security portion of self-employment taxes.

There is no wage base for Medicare, so no matter how much you earn, all wages and self-employment income are subject to Medicare tax.

You May Like: Efstatus.taxact 2014

Earned Income Tax Credit

As a self-employed worker, you may qualify for the earned income tax credit if you have a low to moderate income. The credit increases based on the number of children you claim. For example, if youre single and claim three qualified children, your adjusted gross income has to be $50,949 or lower.

Heres the maximum credit amounts for 2020:

- $6,600 if you claim three qualified children

- $5,290 if you claim two qualified children

- $3,584 if you claim one qualified child

- $538 if you dont claim any child

The IRS has certain rules for a child to qualify.

To qualify for this credit, be sure to see whether you can use one of the optional methods mentioned above. By doing so, you can potentially reduce your adjusted gross income, making it easier to qualify.

When Do I Pay Taxes

The IRS updated the 2021 tax filing deadline from April 15 to May 17 for individual filings . Quarterly taxes for businesses are due April 15th, June 15th, September 15th, and January 15th. Annual tax filings are due April 15th. Use our handy small business tax filing deadline calendar to stay on top of your tax obligations.

You May Like: Where’s My Refund Ga

Withhold More Of Your W

If you increase your tax withholdings on your wages, you can use those dollars to cover the tax liability to generate as a freelancer.

To do this, ask your employer for a new Form W-4. You file Form W-4 when you first start working for your employer, and it helps the employer figure out how much they should withhold in taxes for you. In order to offset your 1099 income, you can ask your full-time employer to withhold more taxes from each paycheck you receive.

The upside to this is the convenience since you dont have to remember to pay quarterly taxes yourself. The downside is that it isnt very accurate, so your employer may over-withhold taxes or under-withhold taxes . Talk to your HR department for more information.

What Are Estimated Taxes

Some people confuse self-employment tax with estimated taxes, which are more properly called estimated tax payments. Whatever you call them, they arent a different or separate tax, but merely how you pay your self-employment and income taxes all year long. Remember, taxes are pay-as-you-go, and estimated tax payments are how you pay as you go. See Estimated Tax Payments for more details about how the payments work.

Recommended Reading: Where Do I File My Illinois Tax Return

What The Future Holds

With this string of recent cases decided in its favor, the IRS now has more tools to attack strategies for reducing LLC members’ self-employment tax liability, and it is likely to become more aggressive in attacking what it perceives as abusive strategies in this area going forward. Indeed, recent Chief Counsel memorandums suggest that the IRS is willing to use management control or participation, or both factors in combination, to stop LLC members who attempt to avoid self-employment tax on their distributive shares.

LLC members wanting to avoid self-employment tax may want to consider a few options. First, they may want to avoid member-manager status perhaps by carving managerial rights out into a separate interest or by avoiding member-managed structures entirely. Second, LLC members providing services should consider opportunities for segregating their involvement into separate interests or separate entities . Interestingly, in doing these things, LLC members would essentially be complying with the proposed regulations issued in 1997. Finally, members may want to instead consider forming an S corporation to better manage self-employment taxes in situations where the S corporation eligibility requirements are satisfied and state law permits the business to be organized in corporate form.

Who Is Required To File Quarterly Taxes

If you work as a self-employed individual or small business owner, you likely need to pay quarterly estimated taxes. You’re considered self-employed if you work as:

- An independent contractor

- A sole proprietor in a trade or field

- A member of a partnership that conducts business, such as an LLC

- A person who runs a business as your own, including part-time

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

How Much Control Do You Want

As we dont know what Social Security benefit payments will look like in the futuremany people expect them to be lower because of how the system is fundedyou may want to go with the sure thing and take the lower tax liability today. After all, one way to lower your tax liability is to take money out of your business and put it in one of the available retirement plans for the self-employed. Thats money youll have a lot more control over than Social Security benefits.

“The great thing about Social Security is you cannot access it until retirement age,” says Kevin Michels, CFP, EA, financial planner and president of Medicus Wealth Planning.

“You cant make early withdrawals, you cant skip payments, and you are guaranteed a benefit,” Michels adds. “However, you have only a small say in the future legislation of Social Security and how it will be affected by the mismanagement of government funds.”

Michels continues to say the following:

If you have trouble saving for retirement already, then paying into Social Security may be the better option. If you are confident you can stick to a savings plan, invest wisely, and not touch your savings until retirement, it may be a better idea to minimize what you pay into Social Security and take more responsibility for your retirement.

Tips For Proving Income When You Are Self

Here are some tips to help self-employed workers keep accurate records of their business transactions.

Many people are generally confused when they differentiate between independent contractors and conventional employees. The reason behind this is that sometimes independent contractors work in situations that appear to be regular jobs. However, there are clear criteria that determine whether one is an independent entrepreneur or not. Yet independent contractors are self-employed. For this reason, independent contractors must use the 1099 forms of all the work they do throughout the year to prove their income. Alternatively, there are many nifty check stub generators that include an option for independent contractors.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Filing As A Partnership

A partnership does not file income tax on its earnings and is not required to pay tax. The income earned from a partnership is divided between the partners, and each respective partner files her own return. The income, deductions and any other credits or losses are divided according to the partnership agreement in place. Each share of income must be reported whether it was received in cash or as a credit. Special rules apply to a partnership concerning capital gains and losses and recapturing cost allowance. If a partnership is dissolved or an interest is sold or disposed, CRA has special guidelines in place.

What Happens When Youre Self

When you’re self-employed, youre considered both the employee and the employer. This means its your responsibility to withhold Social Security from your earnings, contributing the employers matching portion of Social Security and the individuals portion. Instead of withholding Social Security taxes from each paycheckmany self-employed people dont get regular paychecks, after allyou pay all the Social Security taxes on your earnings when you file your annual federal income tax return. This amounts to both your personal contribution and your businesss contribution.

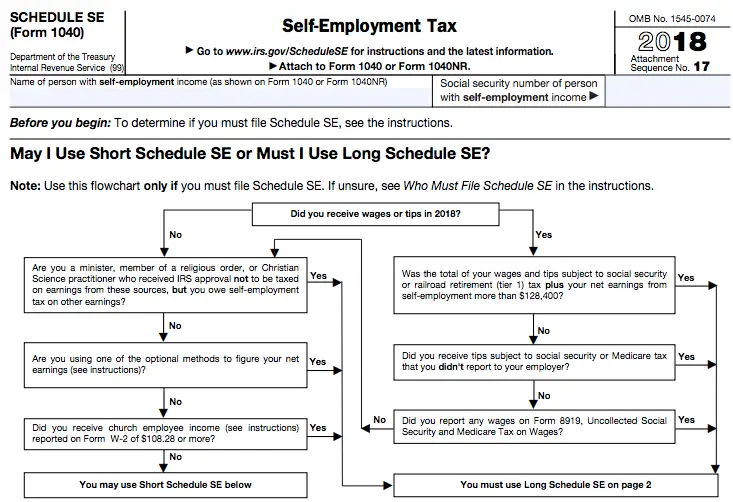

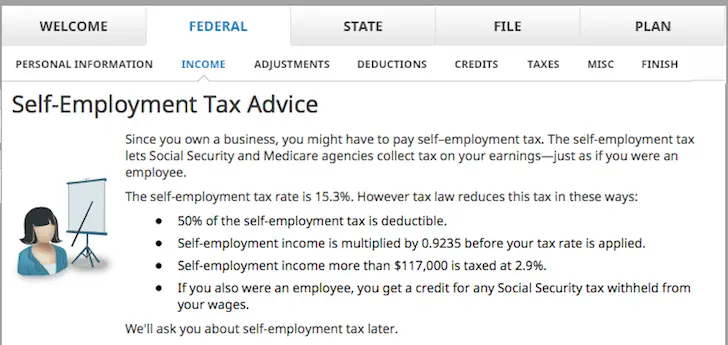

IRS Schedule SE: Self-Employment Tax is where you report your businesss net profit or loss as calculated on Schedule C. The federal government uses this information to calculate the Social Security benefits youll be entitled to later on down the road. Self-employment tax consists of both the employee and employer portion of Social Security and the employee and employer portion of Medicare , which makes the total self-employment tax rate 15.3%.

It may seem like youre getting the short end of the stick because you have to pay both the employee and the employer portion of the tax, but that isn’t necessarily true.

If you are self-employed and earned $400 or less, you wont owe Social Security taxes.

Don’t Miss: Efstatus.taxact

Filing Your Annual Business Tax Return

As a self-employed individual you will still need to file an annual return. Yes, this means another round of forms, but look at the bright side: if youve filed quarterly, this time you wont owe them anything, and you might even get a little something back!

Let us know your thoughts on how to deal with business taxes today find another freelance persons question in The Self-Employed Forum, and answer it!

- 22shares

How Do I File Taxes As A Freelancer In Canada

As freelancers work for themselves, ultimately they are self-employed. As such, they would file their taxes as self-employed individuals do. Self-employment taxes are filed with your personal income tax return. The businesss income, net of deductions, must be reported on the T2125 form for professional or business income. The form helps with the calculation of gross income needed to complete the personal tax return.

Recent Posts

Don’t Miss: How To Appeal Property Taxes Cook County

How To Calculate Your Taxes

As a self-employed person, your business earnings and your personal income are one and the same. Thereâs no separate income tax rate for money you make from your business.

However, you do need to pay Canadian Pension Plan contributions, and you have the option of making Employment Insurance contributions as well.

So the total of your tax obligations would be income tax + CPP + EI .

A Guide To Paying Quarterly Taxes

OVERVIEW

Self-employed taxpayers likely need to pay quarterly tax payments and meet key IRS deadlines. Heres a closer look at how quarterly taxes work and what you need to know when filing your tax returns.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Working for yourself presents a host of benefits, such as never having to report to a boss and setting your own hours. It also carries a few added tax requirements, such as paying your taxes quarterly instead of with each paycheck as a W-2 employee would.

Keep reading to learn answers to questions like, “Who has to pay quarterly taxes?” “When are quarterly taxes due?” and “How do I pay quarterly taxes?”

Read Also: Do You Have To Pay Taxes On Plasma Donations