Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didnt save a copy of their prior years tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesnt have this information heres how they can get it:

Recommended Reading: How To Retrieve 1040 Tax Return

Scuba Diving Trips To The Florida Keys Deemed A Business Expense

Tax preparer Jody Padar, CPA, told CNN Money that a firefighter who worked in a cold climate was able to write off scuba diving training trips to the Florida Keys as a business expense on his taxes. He was able to claim the deduction because the scuba diving certification was required for his job with the fire departments dive team.

As with Odoms case, this type of deduction would no longer apply, as unreimbursed business expenses cant be deducted for employees under the new tax law.

If You Think The Amount Youve Been Charged Is Wrong

If you think your statement is wrong, you should and ask them to explain it.

Income tax helplineMonday to Friday, 8am to 8pmSaturdays, 8am to 4pmCalls cost 12p per minute from a landline, and from 3p to 45p from a mobile

HMRC phone lines are often busy. The best time to call is between 8am and 11am on Wednesdays, Thursdays and Fridays – but you might still have to wait in a queue.

There are lots of reasons why the tax youre being asked to pay could be wrong. It could be because:

- you made a mistake on your tax return

- you stopped being self-employed, but didnt tell HMRC

- you missed filing a tax return, so your income tax has been estimated – HMRC call this a determination

- a payment you made previously hasnt been taken into account

- your profits have fallen, so any payments on account included in your bill are too high

Contact the charity TaxAid if you earn less than £20,000 a year and cant sort out your problem with HMRC. The help on their website is available to everyone, whatever you earn.

TaxAid helplineMonday to Friday, 10am to middayCalls cost up to 12p per minute from a landline and 45p from a mobile

You May Like: How Can You Find Out If You Owe State Taxes

What Else Is Required For Us Taxes Living Abroad

When it comes to filing yourUS expat taxes, there are more items youll need to report in addition to your earned income. The IRS also requires that you disclose your foreign accounts and assets that cross a certain value threshold. Even your retirement contributions in foreign retirement accounts, which mayseemtax-deferred, might be taxable!

Make sure to familiarize yourself with these additional tax requirements for US citizens living abroad:

When it comes to filing US taxes while living abroad, its important that youre aware of everything you are required to report in your filing.

How To Claim Tax Savings On Your 1099 Income

If you want to save money with these tax tricks, youâll need to fill out some forms.

Donât want to deal with all that paperwork on your own? File through Keeper. Weâll help you claim all your savings and take care of every form for you, so you can get on with your life.

If youâd rather file your own business taxes, though, read on to make sure you donât miss out on any savings.

Don’t Miss: Where Can I Get Taxes Done For Free

Ways You Might Be Exempt From Paying Social Security Taxes

Itd be nice if you could opt out of receiving Social Security benefits and not pay the taxes.

Unfortunately, thats not how it works for most people.

That said:

There are certain groups of people that may be able to opt out of paying Social Security taxes.

Doing so isnt something to take lightly, though.

You must legitimately fall into one of these groups and carefully consider the ramifications.

- Exemption for qualifying religious groups

- Certain nonresident aliens

How Not To Pay Taxes: Four Legal Ways To Not Pay Us Income Tax

Dateline: Kotor, Montenegro

Today were just going to jump right in. Youve come for my best advice, and thats what youre going to get.

US citizens run in circles to get tax breaks. These include all sorts of tax credits, from the child tax credit to the earned income tax credit to lower the federal income tax and breaks on capital gains tax, amongst others. People contribute to a health savings account, stock money away in retirement accounts to grow tax-free, and hope theyre offered flexible spending accounts by their employers.

This might or might not even apply to your adjusted gross income, and you cant necessarily deduct all your contributions on your federal income taxes.

You can completely avoid paying not just your federal taxes but all sorts of taxes in this tax system, and you can do so legally.

So here it is the four ways you can legally avoid paying taxes on US income tax:

Recommended Reading: How Much Taxes Will Be Taken Out

Allow The Assessor Access To Your Home

You do not have to allow the tax assessor into your home. However, what typically happens if you do not permit access to the interior is that the assessor assumes youâve made certain improvements such as added fixtures or made exorbitant refurbishments. This could result in a bigger tax bill.

Many towns have a policy that if the homeowner does not grant full access to the property, the assessor will automatically assign the highest assessed value possible for that type of propertyfair or not. At this point, itâs up to the individual to dispute the evaluation with the town, which will be nearly impossible unless you grant access to the interior.

The lesson: Allow the assessor to access your home. If you took out permits for all improvements youâve made to the property, you should be fine.

Capital Gains Tax Allowance

Capital gains is the profit you make from selling certain investments, including second homes, art, antiques and shares.

Capital gains of up to £12,300 are tax-free in 2022-23. Married couples and civil partners who own assets jointly can claim a double allowance of £24,600.

Remember, if you don’t use the allowance within the tax year, it’s lost forever. You can’t add your tax-free allowances together for different years.

This chart explains the rate of capital gains tax you will pay as a basic-rate and higher-rate taxpayer. For more details, see our guide on capital gains tax allowances and rates.

Recommended Reading: Can I File Taxes If I Get Ssi

What Happens If Us Citizens Dont File Their Taxes While Living Abroad

US citizens who dont file US taxes while living abroad may face penalties, interest costs, or even criminal charges. The IRS charges penalties for both late filing and late payments. If your lack of filing is willfulmeaning you knowingly avoided your US tax requirements while living abroadthen more serious legal consequences may apply.

- Failure to File Penalty: 5% of the unpaid taxes for each month the tax return is late, up to 25%

- Failure to Pay Penalty: 0.5% of the unpaid taxes for each month the tax payment is late, up to 25%

- Over 60 Days Late: The maximum for this penalty is 25% of your unpaid taxes

Fortunately, the IRS does offer a way for Americans abroad to get caught up penalty-free if they didnt know they needed to file US taxes while living overseas. Regardless of how many years youve missed, the Streamlined Filing Compliance Procedures only require you to file the past three years of federal tax returns and the past six years of FBARs, making it an easier, less expensive way to become compliant.

Maximise Your Personal Savings Allowance

In 2022-23, you can earn £1,000 of interest on savings tax-free if you’re a basic-rate taxpayer. If you’re a higher-rate taxpayer, your tax-free allowance is £500.

You’ll only pay tax on savings income that exceeds this threshold.

This will no longer be deducted automatically by the savings provider. If tax is due, you’ll need to pay it via self-assessment or have it deducted via PAYE.

Keep in mind that you won’t have a savings allowance as an additional-rate taxpayer.

Don’t Miss: How To Estimate Taxes On Paycheck

Brother Can You Spare A Stimulus Check

But the real standouts were the billionaires who reported such low incomes that they qualified for government assistance. At least 18 billionaires received stimulus checks in 2020, because their tax returns placed them below the income cutoff .

How The Wealthy Avoid Paying Tax

Recent weeks have seen a spate of stories about wealthy individuals trying to reduce their tax bills . The latest features a film investment scheme, Eclipse 35, on which HMRC refused to pay tax relief bad news for some famous names, according to reports. But other people have been more successful in their attempts to pay less tax. So how exactly do they do it? Here are few of the common methods used to cut the amount that ends up in the taxman’s coffers.

Read Also: Where To Report Bitcoin On Taxes

Put Your Money In A Super Fund

Super contributions might be one of the best ways to make the most of your tax return. This is especially true for workers who earn less than $52,000 a year. For each 1$ put into your super, the government will contribute 50 cents.

In addition, if youre married and one partner makes less than $40,000, the higher earning partner can contribute up to $3000 to the lower earning partnerys super fund. This results in a tax offset of 18 percent. This is a kind of saving that really pays off in the long run!

How Taxes Will Affect Your Benefits

Whether you’ll owe state income taxes on your benefits depends on where you live. Currently, only 13 states tax benefits — including Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. If you don’t live in one of these states, you’re off the hook for state taxes on Social Security.

When it comes to federal taxes, however, your “combined income” in retirement will determine how much you owe.

Your combined income is half of your annual benefit amount plus your adjusted gross income. So, for example, if you’re receiving $20,000 per year in benefits and are withdrawing $30,000 per year from your 401, your combined income would be $10,000 + $30,000, or $40,000 per year.

How much of your benefit amount that is subject to taxes will depend on your marital status and your combined income.

| Benefit Amount Subject to Taxes | Combined Income for Individuals |

|---|---|

| More than $34,000 per year | More than $44,000 per year |

Data source: Social Security Administration.

The good news is that you’ll never pay taxes on more than 85% of your benefit amount. But if your combined income is higher than $25,000 per year , you’ll owe federal income taxes on at least a portion of your monthly payments.

Don’t Miss: How To Know If Irs Received My Taxes

Claim Your Other Income Tax Savings On Form 1040

On your Form 1040, youâll claim tax savings on your:

- â Health insurance

- â Retirement contributions

Thereâs no âone weird trickâ to dealing with the IRS. But there are definitely plenty of legal methods for avoiding extra taxes on your 1099 income.

Melissa Pedigo, CPA

Melissa Pedigo has been a CPA for over 20 years and she is one of the only CPA copywriters in the world. With a vast knowledge of U.S. tax and accounting, sheâs able to write about tax and finance topics from a unique perspective…as an industry expert. When sheâs not writing or being an accounting nerd, youâll find her watching and playing tennis, reading, tending to her half-grown garden, and studying foreign languages

Find write-offs.

How To Qualify For A Senior Tax Exemption

Property tax rules vary considerably from state to state. Seniors who meet state guidelines can take advantage of an exemption. For example, most states include these two rules to qualify:

- You must meet the minimum age for a senior property tax exemption

- The person claiming the exemption must live in the home as their primary residence

The minimum age requirement for senior property tax exemptions is generally between the ages of 61 to 65.

While many states like New York, Texas and Massachusetts require seniors be 65 or older, there are other states such as Washington where the age is only 61.

In New Hampshire, although youll need to be 65 or older, youll also benefit from an increased exemption as you age.

Many locations set income requirements as well. Earning too much may disqualify you, or the amount of your exemption will be reduced.

Most states have an official government website dedicated to taxes, revenue, or finance that will list the local rules for senior property tax exemptions.

A Google search for senior property tax exemptions should turn up yours.

You May Like: When Are Property Taxes Due

How Do You Know You Need To Adjust Your Withholding On The W

How do you know if youre withholding too much on your taxes every year?

- If youre consistently getting large refunds, like my friend who got an expected $3000 check, youre probably withholding too much.

- If youre ending up with a big tax bill at the end of the year, you might not be withholding enough.

- If your situation has changed, like youve gotten a divorce, you may need to adjust your withholding.

What other situations will necessitate a change in your withholding, either up or down?

- If you recently got married.

- You got divorced.

Recommended Reading: How To Buy Tax Liens In California

Who Must File Taxes

If you earn more than $400 from GrubHub, Postmates, DoorDash, or UberEATS, you must file a tax return and report your delivery earnings to the IRS. Most delivery providers report income as sole proprietors, which allows you to report business income on your personal tax return. If you earned less than $400 from your delivery work, you may still have to file and report your earnings if you have to file for other reasons such as accessing refundable credits like the Earned Income Tax Credit, the Child Tax Credit, and the Recovery Rebate Credit.

Also Check: Who Can Take Your Federal Tax Refund

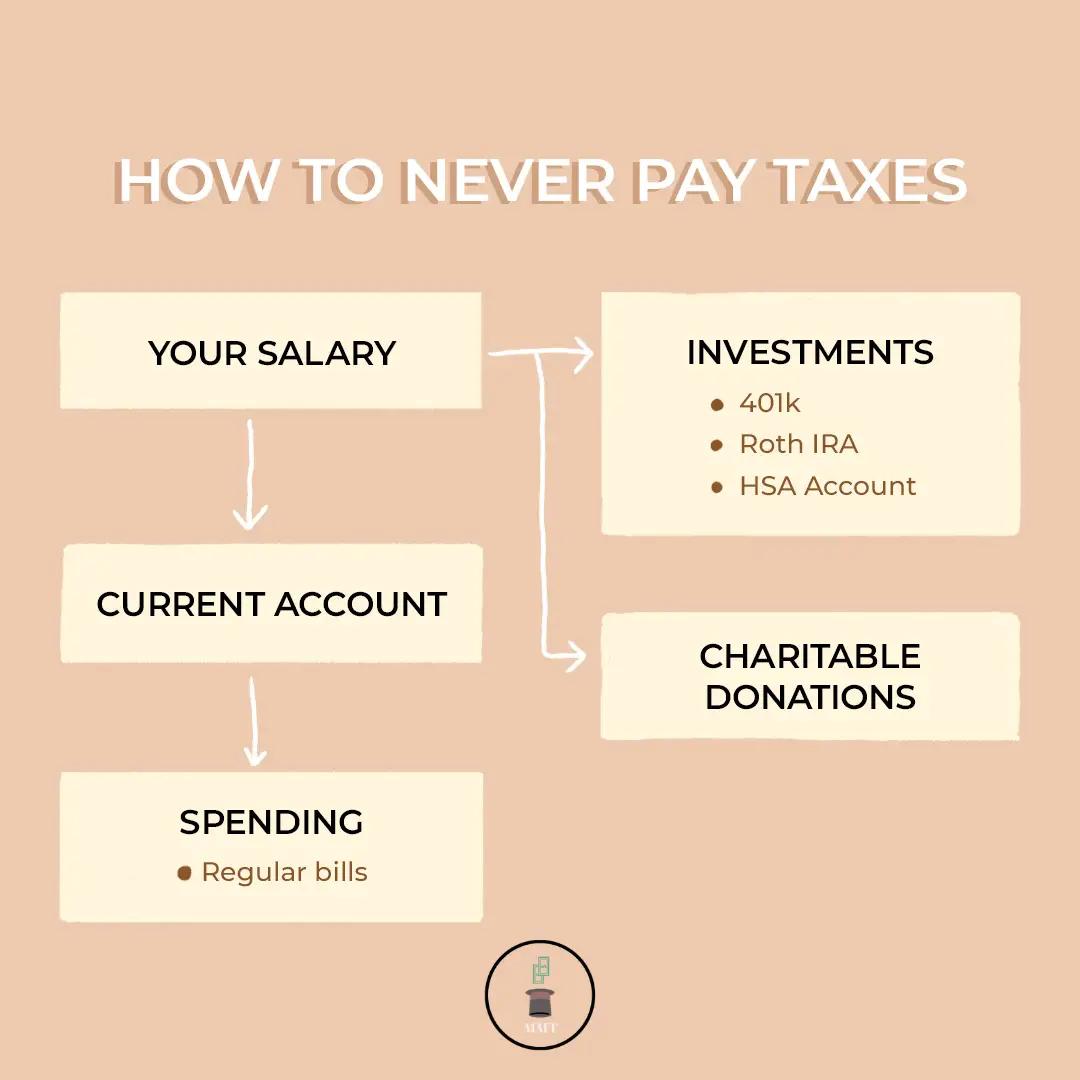

Path : Get Your Income Out Of The Taxable Income Category

When you fill out a 1040 form, your income cascades through several levels, changing a little each time: from income to total income, then to adjusted gross income, and finally to taxable income. Each stage gives you the opportunity to prevent some of your income from being taxed.

From income to total income

Income is just whatever money you brought in during the year. But income according to the IRS is not so simple.

Some income is invisible to the tax collector. For example, if you had money deducted from your paycheck to go into a 401k retirement account or a Health Savings Account, the IRS doesnt include that money in your income.

There are other ways to shield your money from taxes. For example, at one job, I had money withheld from my paycheck to buy my transit passes, and that money also did not register as part of my total income.

Keep your eye out for opportunities like this. Ask your employer what pre-tax contributions you can make. Consider switching to a variety of health insurance that qualifies for Health Savings Accounts, and then shelter some of your income by saving it to pay health costs.

Your total income also includes any capital gains you made during the yearfor instance if you sold stock or property at a profit. You can also subtract some capital losses when you calculate your total income.

Among the other things that are part of your total income are interest, dividends, and unemployment compensation.

Estate And Gift Exemptions

Gift and estate deductions help bring down taxable income, but there is even more reason to take advantage of them now.

Thanks to the new tax law, the deductions have been temporarily doubled. Individuals can now claim up to $11.18 million, compared to the $5.29 million limit per person in 2017. The exemption expires after the end of 2025, so the wealthy are taking advantage, said Featherngill.

Many of them are setting up long-term trusts, such as a Delaware Dynasty Trust, which allows wealth to be passed down from generation to generation, she said. While it is subject to income taxes along the way, it will not be taxed as a gift if it meets the limit and will not be subject to estate tax when money comes out.

However, given the costs involved in setting up and running a multi-generation trust, it only makes sense when you have $5 million or more to commit, said Featherngill.

Don’t Miss: When Is The Tax Deadline For 2021

Determining Collection Financial Standards

Your leftover income after paying necessary living expenses is how much the IRS will expect you to pay every month. You can complete IRS Form 433-A or Form 433-F to make these calculations, but the IRS might not allow all your expenses. It can disregard an expense that is unnecessary or higher than average.

The IRS will compare your actual spending to averages that vary by region to take into account that some areas have higher costs of living than others. These expense averages are called âcollection financial standards.â

The IRS will assume that you need to spend only up to the amount specified by the collection financial standards. Anything over and above that amount is considered to be discretionary rather than necessary.

For example, your mortgage might be $3,000 a month. But if the standard in your area is only $1,500, the IRS will most likely add $1,500 back to its calculation of your monthly disposable income.

Donât Miss: 1040paytax Customer Service