How Much Do You Have To Owe Before The Irs Garnishes Wages

The following portions of income can be claimed as exempt from wage garnishment: About $12,200 annually for individuals filing as singles without any dependents. About $26,650 annually from a head of household’s income with two dependents. About $32,700 annually from married persons jointly filing with two dependents.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Can A University Take My Entire Federal And State Tax Refund For Money Owed To The Institution

- Posted on Feb 11, 2010

There are a fair number of factors here. I’m not sure how messing up your FAFSA stuck you with a bill. FAFSA gets you aid, unless you mean that your screw up resulted in less aid than you anticipated. Even still, I’m not sure a state university has the right to intercept your state taxes, but that might be a particular provision of Illinois law which I’m not familiar with. If this is a tuition debt being collected by the university as you say, your federal taxes should be safe. The only way your federal taxes can be touched is through the Federal Dept. of Ed. for a default federal loan.I suggest you find a consumer attorney in your state who can verify the facts and the particular state law that seems to be costing you your state taxes.

Read Also: How Much Taxes Will Be Taken Out

Ways The Irs Can Seize Your Tax Refund

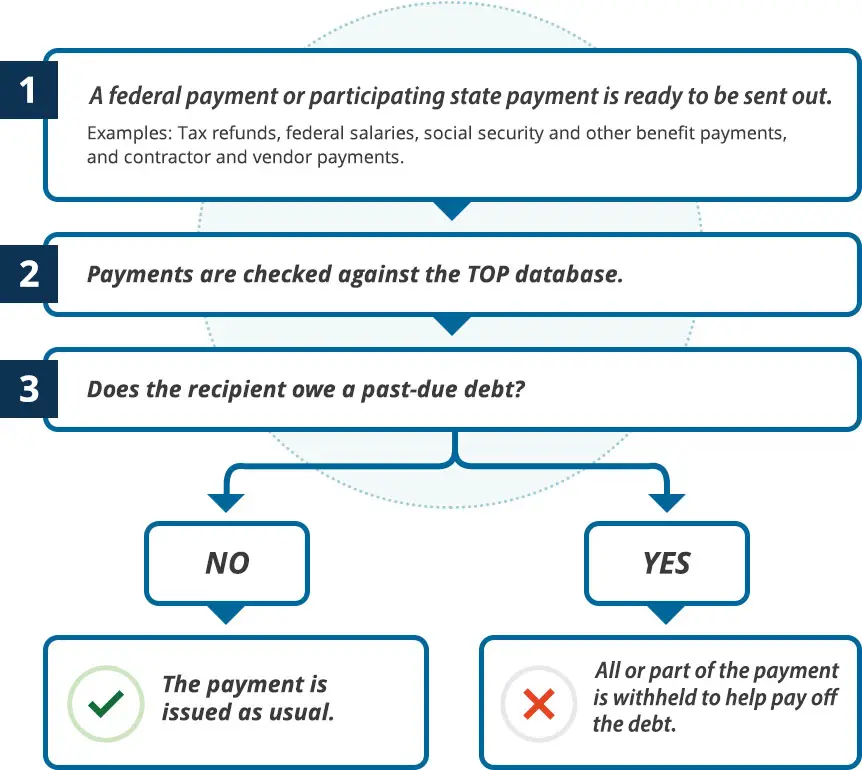

If you’re still waiting for your federal income tax refund this year, here’s one reason it might be delayed: the government might have seized it. The same federal agency that issues tax refunds, the U.S. Department of the Treasury, also has the authority to hold back all or part of your refund to repay debts that you owe. This is done by the department’s Bureau of the Fiscal Service. In bureaucratese, this is known as an “offset.”

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Also Check: Can I File Taxes If I Get Disability

Is There A One Time Tax Forgiveness

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn’t for you if you’re notoriously late on filing taxes or have multiple unresolved penalties.

Be Aware Of Processing Delays

Again, this year some tax returns with errors or items on the return that need an IRS correction due to a tax law change will take longer than the normal timeframes to process, so expect delays. It may take the IRS more than the normal 21 days to issue refunds for some 2021 tax returns that require review, including but not limited to, ones that claim the Recovery Rebate Credit, the Earned Income Tax Credit and Child Tax Credit . Note: For all tax returns that claim EITC and/or CTC, those refunds must be held, by law, until after mid-February and cannot be released before then.

Also Check: How To File 2017 Taxes In 2020

If Your Loans Are In Default Will Next Year’s Tax Return Be Garnished

Normally, if you have federal student loans in default , your tax refunds can be taken to help cover the balance owed. Since federal student loans were on pause during the 2022 tax season, your federal tax refund was not eligible to be garnished by the government.

It’s unclear if this will remain in place for 2023, though with the new payment pause set to expire at the end of 2022, this benefit may expire.

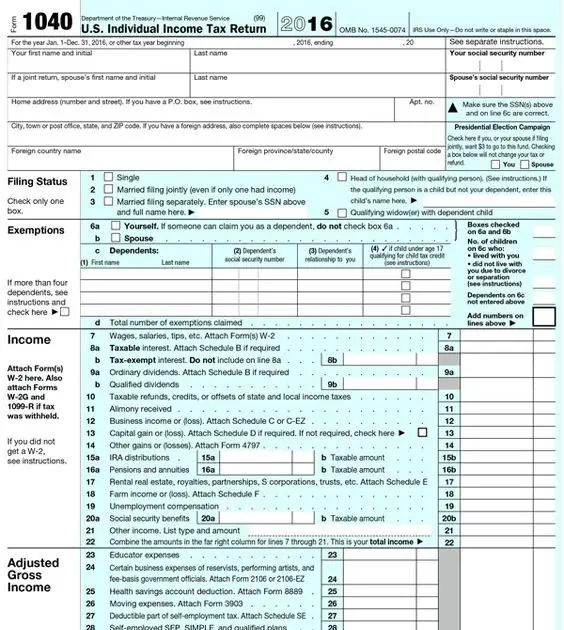

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

You May Like: Is The Tax Assessment The Value Of The Property

When The Irs Takes Or Holds Your Refund Its Important To Research Your Irs Account

There could be many possible causes when your refund doesnt show up as expected. Researching your IRS account will help you get to the bottom of the issue and clear up any confusion with the IRS.

A tax professional can do this for you by dealing directly with the IRS. Your tax pro can interview the IRS and review your tax account transcripts to get your complete tax history. With this information, your tax pro will know exactly whats going on, and how to get back in good standing with the IRS to avoid future refund issues. Get help from a trusted IRS expert.

Related Tax Terms

Related IRS Notices

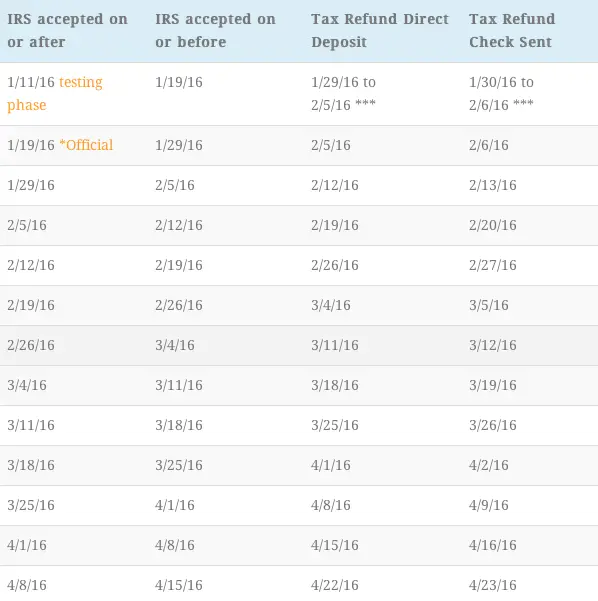

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Also Check: Do Your Taxes Online Free

What Could Cause You Not To Get An Income Tax Refund

Most consumer creditors have no authority to take your tax refund because of unpaid debts. There are, however, exceptions to this rule. The IRS can redirect your federal tax refund to someone else in certain instances, and owing back taxes to your state is one of them. If you owe state taxes, your state can take all of your federal tax refunds until you’re caught up. State tax agencies can take your refund through the Treasury Offset Program .

TL DR

The state can take any taxes you owe from the previous year from your federal refund.

If I Wasnt Working And Didnt Receive Unemployment Benefits Do I Need To File A Tax Return

You only need to file a tax return in years youre required to based on your income or other factors. If you were living off of your savings, you might need to file if you had interest or capital gains that put you over the minimum amount to file.

If you truly had zero income, you generally wont need to file a tax return unless you need to file for other reasons like claiming your stimulus payment.

Also Check: How To Calculate Your Tax Bracket

Who Can Take Your Federal Tax Refund

Federal law allows only state and federal government agencies to take your refund as payment toward a debt.

Will IRS garnish refund?

- However, if you have certain types of unpaid debts, the IRS can seize your federal or state income tax refund even if its already garnishing your wages. Depending on the type of unpaid debt, the IRS can garnish your wages and still take your tax refund.

Why Is My Refund Still Processing After 3 Months

Your refund may be delayed if you made math errors or if you forgot to sign your return or include your Social Security number. It may also be delayed if your dependents’ information doesn’t match IRS records, or if you left out a corresponding schedule or form to support a deduction or credit, says Pickering.

Don’t Miss: Is Social Security Taxed Federally

Can The Irs Take Money From My Bank Account Without Notice

The IRS can no longer simply take your bank account, automobile, or business, or garnish your wages without giving you written notice and an opportunity to challenge its claims. When you challenge an IRS collection action, all collection activity must come to a halt during your administrative appeal.

What Actions Can I Take To Avoid A Federal Offset

To avoid the federal offset, the taxpayer must take one of the actions described below within 60 days from the date of the certified Notice of Intent to Offset.

My spouse and I filed a joint federal tax return and our refund was offset for a debt that my spouse owes. How can I get my portion of the refund back?

The taxpayer must complete IRS Form 8379 from the IRS website, call the IRS at 1-800-829-3676 or visit their local IRS office.

The taxpayer may call 1-877-252-3252 to verify the amount owed to the Department of Revenue.

You May Like: How Much Medicare Tax Is Withheld

Why Do I Owe This Debt

Any person who has received unemployment compensation benefits to which he is not entitled is liable to repay those benefits. IDES is authorized to intercept state income tax refunds, lottery winnings, other funds held by the State Treasurer, and federal income tax refunds to offset unemployment compensation debts.

State Refund Offset: Common Questions

I received a notice that my State refund was forwarded to another agency. Who should I address my questions to?

Any questions or issues must be resolved with the agency receiving the refund offset. That agencys contact information should be listed on the notice.

If I have filed bankruptcy, will my state refund be offset?

Also Check: Which Hybrid Cars Are Eligible For Tax Credits

Who Do I Call If I Have Questions About The Notice Of Intent To Offset Your Federal Income Tax Refund And/or The Amount Of The Overpayment I Owe

Call the Benefit Overpayment Collection Section at 1-800-676-5737, Monday through Friday, 8 a.m. to 5 p.m., Pacific time, except on state holidays.

You must pay your benefit overpayment in full within 60 days of the date on the Notice of Intent to Offset Your Federal Income Tax Return to avoid having your refund offset .

Visit Benefit Overpayment Services to log in or make a payment. Options for payment are:

- Online with Benefit Overpayment Services or Make a Payment:

- Benefit Overpayment Services: Log in to view your balance, make a payment, or set up an installment agreement.

- Make a Payment: Pay with Automated Clearing House debit or by credit card . No enrollment necessary.

Opt To Withhold Taxes From Your Benefits

Its tempting to opt out of withholding tax on your unemployment benefits. But foregoing that option is an expensive choice. The tax bill racks up quick. Even if you havent done it yet, you can still elect to withhold your tax liability directly from your unemployment income.

Federal law allows you to have a flat 10% withheld from your benefits to cover your tax liability. Simply fill out Form W-4V, Voluntary Withholding Request, and send it to the agency paying your benefits. Before completing the form, however, check with the payor to see if they have their own withholding request form. Following their procedure will help expedite the request.

Also Check: Can I Apply For Unemployment Online

You May Like: When Do Taxes Have To Be Filed By

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years’ processing time, according to trade publication CPA Advisor.

It’s important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is “deeply concerned about the upcoming filing season” given the backlog, among other issues.

“The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal,” said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. “It just snowballs into a terrible situation.”

Delays in processing tax returns count as one of the agency’s most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.

How Do I Dispute A Debt Being Sent To The Treasury Offset Program

If you have evidence to show that the debt is not past due, not legally enforceable. or not the result of unreported earnings when claiming benefits, you may submit a written objection to the referral of your debt for offset. The objection must state the grounds upon which you are objecting your debt’s referral and may include any available evidence, which may include sworn affidavits, to support the grounds.

Recommended Reading: How To Subtract Tax From Total

How Taxpayers Can Check The Status Of Their Federal Tax Refund

IRS Tax Tip 2022-60, April 19, 2022

Once a taxpayer files their tax return, they want to know when they’ll receive their refund. The most convenient way to check on a tax refund is by using the Where’s My Refund? tool on IRS.gov. Taxpayers can start checking their refund status within 24 hours after the IRS acknowledges receipt of the taxpayer’s e-filed return. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Taxpayers can access the Where’s My Refund? tool two ways:

- Visiting IRS.gov

To use the tool, taxpayers will need:

- Their Social Security number or Individual Taxpayer Identification number

- Tax filing status

- The exact amount of the refund claimed on their tax return

The tool shows progress in three phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their bank of credit union to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Standard Deduction Vs Itemized Deductions

Now that we know what tax deductions are, lets look at the two deduction options you have when filing your income tax return.

First up: the standard deduction.

The U.S. tax system allows every taxpayer to receive a standard deduction. This is a flat dollar amount that everyone can automatically subtract from their taxable income.

Your standard deduction amount depends on the tax filing status we mentioned earlier. For tax year 2022, the standard deduction is $12,950 for single taxpayers. Standard deduction amounts typically increase every year to account for inflation.

Standard deduction by filing status for tax year 2022:

-

Single or married filing separately: $12.950

-

Head of household: $19,400

But you dont have to take the standard deduction theres also another option called itemized deductions.

When you itemize, instead of taking the standard flat-rate deduction, youd list all your deductions separately. Some examples of itemized deductions are personal property taxes, some medical expenses, disaster losses, and any state sales tax or state income tax you paid.

It typically only makes sense to itemize if the total of your itemized deductions exceeds the standard deduction. This generally means youll owe less federal income tax, which can increase your tax refund.

If youre still unsure which option is better for you, TaxAct adds up all your entered itemized deductions and recommends the method that will save you the most money.

Also Check: Do I Have To File Taxes If I M Self Employed