Do I Need To File My Taxes To Get A Stimulus Payment

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

Here’s The Rule On Tax Filing And Stimulus Checks

When stimulus checks were authorized, the requirements for eligibility did not include filing or paying taxes. In other words, if your income is so low that you don’t have to file a tax return, you were still eligible for the payment.

However, the IRS did use information from your past returns both to determine eligibility and to find your financial information to deliver your check. In other words, if you didn’t file a return in 2018 or in 2019, you were still eligible for a check, but the IRS wouldn’t have known where to find you to pay you your money.

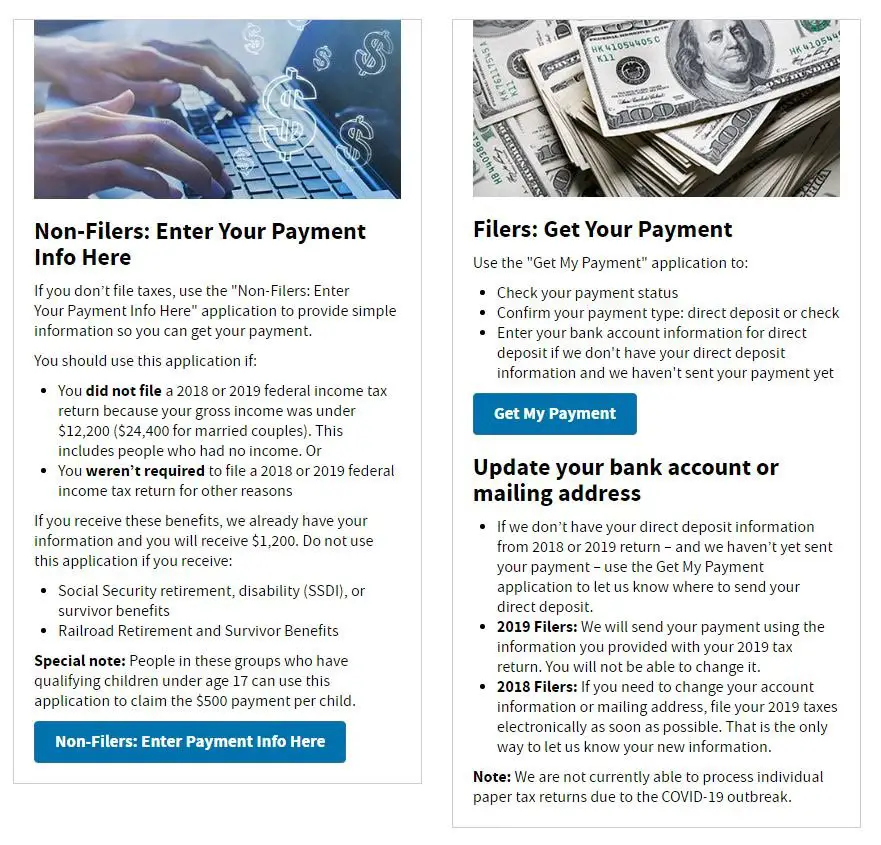

To get around this problem, the IRS collected information from the Social Security Administration and the VA so it could send out checks to individuals who receive these benefits but don’t file returns. The agency also set up an online form for non-filers that people could use to provide the necessary details for the IRS to send their stimulus payments. Those who don’t get SSA or VA benefits and who don’t file returns were able to use this form. And individuals who do get benefits could also use the non-filers form to alert the IRS to their dependents and claim the stimulus money for them .

You’ll now have to file a return because the stimulus payments that were made were an advance on a tax credit. It’s late to get the advance but not too late to claim the credit, which is being referred to as a Recovery Rebate Credit.

Are Stimulus Checks Taxable

- 8:35 ET, Aug 8 2022

TAX season is in the rearview mirror, but many Americans took an extension that will allow them to file a 2021 tax return by October 17.

And many are wondering if stimulus checks received last year are subject to being taxed.

In 2021, millions of Americans received a stimulus check worth up to $1,400.

That was the third round of stimulus issued amidst the ongoing Covid pandemic.

The payment was in addition to the child tax credit payments that began in July 2021, offering up to $300 per month per child to qualified parents.

Some individual states also issued aid to residents and more states rolled out relief refund programs this year to help compensate for surging inflation.

You May Like: How To Not Pay Income Tax

Don’t Miss: How Much Is Sales Tax In Florida

What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms “Letter 6475” on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a “Notice 1444-C” that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Don’t Miss: Can I File Taxes On Unemployment

Has The Irs Sent My Stimulus Check

The IRS has issued all first, second and third Economic Impact Payments. ⦠Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

You May Like: Can You Estimate Your Tax Return

Did You Get All Your Stimulus Money Check This Irs Letter To Make Sure

The IRS has finished sending out all the third-round stimulus checks. Learn how to make sure that you got all your money.

Every American who got a third stimulus check should receive IRS Letter 6475 in the mail.

On Wednesday, the IRS announced that it had disbursed all of the third-round stimulus checks from the American Rescue Plan, but you still could receive more stimulus money. One critical IRS notice youâll need to get any additional money is Letter 6475, Your Third Economic ImpactPayment. Itâs the official record of your âEconomic Impact Payment,â or stimulus money, for 2021.

Most Americans received their full stimulus check payments in 2021. However, if youâre not sure, Letter 6475 will âhelp Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022,âaccording to the IRS.

In that third round of Economic Impact Payments, the IRS sent Americans more than 160 million checks of up to $1,400 per adult, plus additional amounts of $1,400 for each dependent. If you had a new baby or added a qualified child to your family in 2021, youâre eligible for an additional $1,400 for each new child.

Additionally, the third stimulus payment was based on 2020 taxes. If you earned less money in 2021, youâll need Letter 6475 to claim any additional money from an adjusted recovery rebate tax credit on this yearâs tax return.

How Do I Know If Im Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, youre due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

Dont Miss: Can You Go To Jail For Not Paying Taxes

Read Also: How To Estimate Payroll Taxes For Small Business

Most People Who Qualify Under The Cares Act Should Receive Their Payment Automatically But Some May Need To Submit Their Information To The Irs To Receive Their Economic Impact Payment

As a result of the hardships presented by the coronavirus, Economic Impact Payments are being issued by the Internal Revenue Service. While most people will receive their payment automatically, there are some cases where non-filers will need to take action and submit their information to the IRS.

The best way to submit your info to receive the payment is through the IRS Non Filers Enter Payment Info portal. There, youll choose how you want to receive your payment. The fastest way to receive payment is through direct deposit, either to your bank or credit union account, or to an eligible prepaid card.

What If I Dont Have A Permanent Address

You can receive monthly Child Tax Credit payments even if you dont have a permanent address. You can list a trusted address where you would like to temporarily receive your monthly checks, such as the address of a friend, relative, or trusted service provider like a shelter, drop-in day center, or transitional housing program.

Read Also: Can Closing Costs Be Deducted From Taxes

Will I Get A Stimulus Check If I Haven’t Filed 2020 Taxes Yet

Even if you had no income last year, or too little to file a return, you should file a basic 2020 tax return this year, the IRS says. … For eligible individuals, the IRS will still issue the payment even if they haven’t filed a tax return in years. The quickest way to receive a stimulus payment is via direct deposit.

What Can I Do If The Amount Of My Stimulus Payment Is Wrong

If you didnt get the additional $500 for your children or didnt get the full payment amount that you expected based on your eligibility, you can get the additional amount by filing a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, and didnt get the first stimulus check or the full amount you are eligible for, you will also have to file a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Don’t Miss: How To Find Property Tax Records

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Also Check: Will Social Security Get Stimulus Check

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

You May Like: Are Refinance Fees Tax Deductible

Enter $1 For Your Income If You Didnt Earn Anything

If you earned money for the year youre filing for, report that amount. Since your earnings were low enough that you werent required to file a tax return for the year, you shouldnt worry about owing income tax.

And if you didnt earn income? Youd put $1, Allec said. Dont worry. Youre not going to owe taxes on that dollar.

Q How Much Was The Second Stimulus Check For

A. Your second stimulus check depended on your 2019 income. The full amount was $600 per individual, $1,200 per couple, and $600 per qualifying child under the age of 17. For expats to qualify for the full second stimulus check, you must have had $75,000 or less in income if you filed as single, $112,500 or less if you filed as head of household, or $150,000 or less if you filed jointly with your spouse or as a qualifying widow. Youd also then qualify for a $600 payment per qualifying child.

For those above this income level, your stimulus check amount would lower $5 for each $100 your AGI exceeded the above thresholds.

Q. Did I have to pay back the amount I get?

A. No.

Q. Will this affect my 2020 tax return?

A. It could only help your 2020 return. If you are eligible for more stimulus than you were awarded, you may be able to claim it as a credit on your return that either decreases your tax liability or increases your refund. If youre eligible for less or received the full amount, you dont have to pay it back and it wont affect your return.

Q. Will I owe tax on this second stimulus check in 2021 or have to pay it back?

A. No, this is considered a tax credit, not income, so you will not need to pay taxes on it in 2021 or pay it back.

Q. Im retired overseas and dont file a tax return did I qualify for the second stimulus check?

Q. What if I didnt have an SSN but filed a U.S. return. Did I get to take advantage of the second stimulus check?

Also Check: Does Grubhub Take Out Taxes

H& r Blocks Expat Tax Advisors Are Here To Help You With Your Stimulus Taxes No Matter Where You Are

We understand this is a stressful, confusing time, and thats why our Expat Tax Advisors will be standing by ready to help. No matter where in the world you are, weve got a tax solution for you whether you want to be in the drivers seat with our DIY online expat tax service designed for U.S. citizens abroad or want to let one of our experienced Tax Advisors take the wheel. Head on over to our Ways to File page to choose your journey and get started.

At H& R Block, were committed to providing information you can trust and use to help navigate the changing tax landscape for Americans abroad. Visit our Expat Coronavirus Tax Impact page for the latest information on how the Coronavirus has affected expat taxes in 2020 and 2021.

Was this article helpful?

When Will I Receive The Money

Press briefings have indicated 3 weeks if the IRS is able to do direct deposit. Paper checks will inevitably take longer, especially for those residing abroad.

After the payment is paid, the IRS will mail a letter to the taxpayers last known address within 15 days. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If unsure if it is legitimate, please visit IRS.gov first.

The IRS just released a tool to check payment status . Importantly if the IRS has your information on file, you cannot update the direct deposit info. Update: the direct deposit information can only be updated via filing the 2020 tax return. Get My Payment tool no longer offers the option to update bank details.

- Check payment status

- Confirm payment type: direct deposit or check

- Enter bank account information for direct deposit if direct deposit information is not on file and payment has not yet been mailed.

Read Also: Do You Get A 1099 From Doordash

Also Check: Do Beneficiaries Pay Taxes On Life Insurance Policies

So What’s The Bottom Line With All These Rules

While this may seem complicated, here are the basics of what you need to know:

The good news is, if you didn’t file a return in the past but you submit one this year to claim your stimulus check, the IRS will have your information on file going forward. If the Biden Administration is successful in passing legislation providing a third stimulus payment, the IRS will have your updated information, and you should get the third payment without further action on your part.

The Motley Fool has a disclosure policy.