How Is Gst Calculated On Laptops

GST is a tax that applies to most consumer goods in India. When you purchase a laptop, the GST amount will be shown on the invoice. You need to pay the GST to the vendor before taking possession of your laptop. If youre not registered for GST, youll have to pay an additional 10% customs duty on top of the GST price.

Register for GST as soon as possible to avoid complications or extra costs.

Your Effective Tax Rate

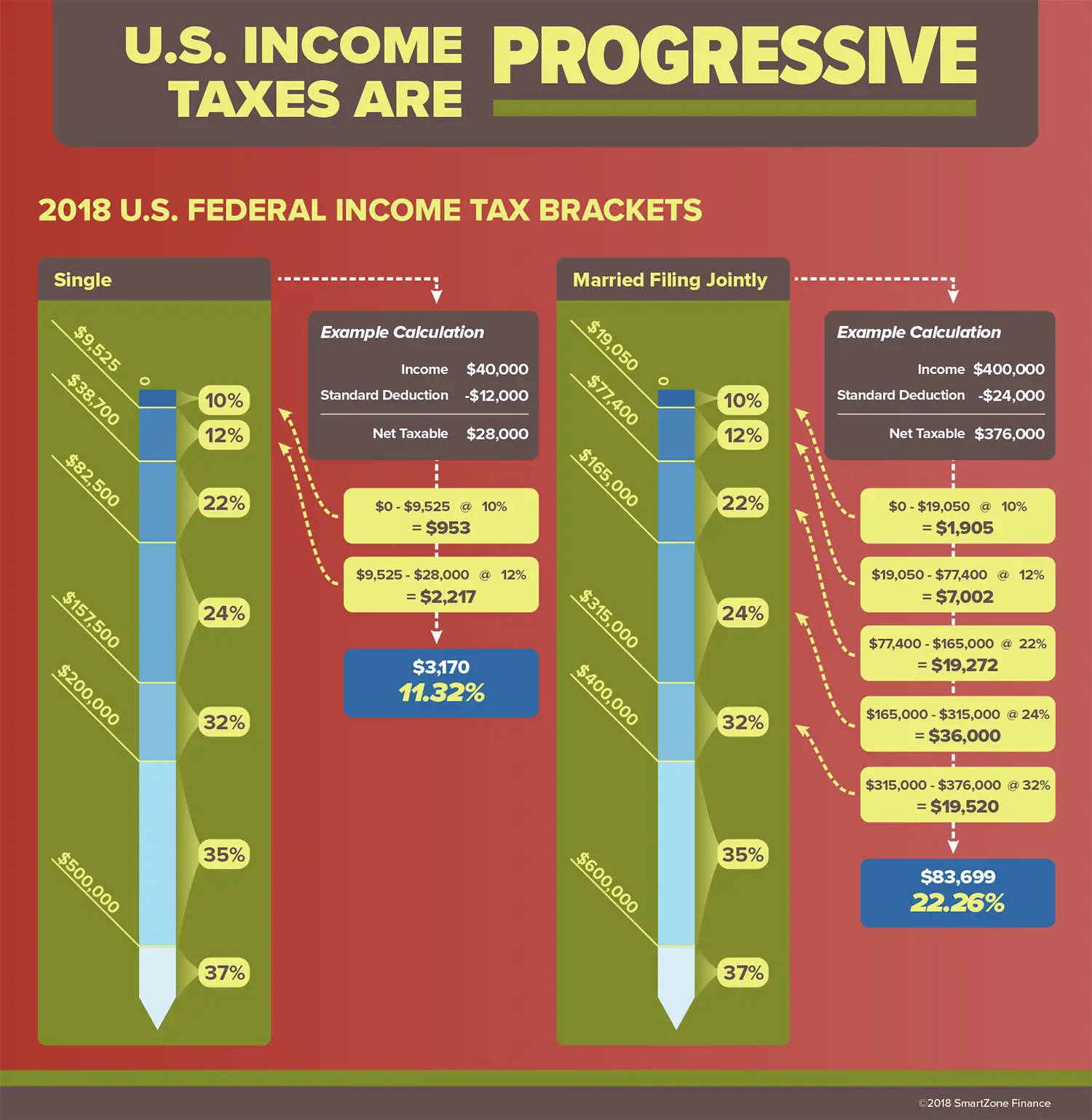

While it’s likely you will pay income tax at various rates or tax brackets throughout the year, the actual percentage of your income that goes to the IRS is often referred to as your effective tax rate. The rate you must pay on the last dollar you earn is usually much higher than your effective tax rate.

For example, if half of your income is taxed at 10 percent and the other half at 12 percent, then your effective tax rate of 11 percent means that 11 cents of every dollar you earned this year goes to the IRS.

History Of Federal Tax Brackets

Tax brackets have existed in the U.S. tax code since the inception of the very first income tax, when the Union government passed the Revenue Act of 1861 to help fund its war against the Confederacy. A second revenue act in 1862 established the first two tax brackets: 3% for annual incomes from $600 to $10,000, and 5% on incomes above $10,000. The original four filing statuses were single, married filing jointly, married filing separately, and head of household, though rates were the same regardless of tax status.

In 1872, Congress rescinded the income tax. It didnt reappear until the ratification of the 16th Amendment to the U.S. Constitution in 1913 established Congress right to levy a federal income tax. That same year, Congress enacted a 1% income tax for individuals earning more than $3,000 a year and couples earning more than $4,000, with a graduated surtax of 1% to 7% on incomes from $20,000 and up.

Over the years, the number of tax brackets has fluctuated. When the federal income tax began in 1913, there were seven tax brackets. In 1918, the number mushroomed to 56 brackets, ranging from 6% to 77%. In 1944, the top rate hit 91%. But it was brought back down to 70% in 1964 by then-President Lyndon B. Johnson. In 1981, then-President Ronald Reagan initially brought the top rate down to 50%.

Recommended Reading: When Do You Pay Quarterly Taxes

Figure Out What You Owe With Polston Tax

If you need help figuring out what you owe in taxes or need help paying off the taxes you do owe, Polston Tax can help! Our team of tax attorneys and tax accountants can guide you through the tax brackets and let you know how you can save money through tax deductions or credits.

We have a team of more than 100 attorneys, accountants, tax professionals, CPAs, case managers and financial analysts who will fight for you. Founded in 2001, we have been operating with the mission to help our clients escape the challenge of owing back taxes. We are located in five offices across the nation. We offer services to those who owe the IRS or the state back taxes and can help with the following services:

Progressive Tax Rates And Income Brackets

U.S. tax rates are referred to as “progressive,” because the tax rate that applies increases incrementally as an individual’s income increases. For example, someone with $1 million in income would have their income taxed at every tax bracket. Someone with $5,000 in income after deductions would be taxed only at the 10% bracket.

Also Check: Can I Submit Old Tax Returns Online

Corporate Income Tax And Other Business Tax Changes

Four statesArkansas, Nebraska, New Hampshire, and Pennsylvaniahave corporate income tax rate reductions taking effect.

One state, Oklahoma, will offer permanent 100 percent bonus depreciation despite the federal governments phasedown to 80 percent bonus depreciation under Section 168.

One state, Vermont, will repeal its throwback rule.

Two states, Louisiana and North Carolina, will make their capital stock taxes less burdensome.

How Capital Gains Taxes Work

Only assets that have been “realized,” or sold for profit, are subject to capital gains tax. This means that you won’t incur taxes on any unsold, or “unrealized,” investments that are, say, sitting in a brokerage account untouched. This is a good thing for long-term investors, as it allows an asset to grow in value over time without being taxed until the point of sale.

Holding on to an investment for a longer term can also have tax benefits once you cash out. That’s because long-term capital gains tax rates, at 0%, 15% or 20%, are generally more favorable than short-term rates, which follow ordinary tax brackets.

-

Capital gains taxes are also progressive, similar to income taxes.

-

Taxes owed on capital gains are generally due for the tax year of the sale. For example, if you sell stock A for a $10,000 profit in 2022, be prepared to pay when you file in 2023.

-

You can use investment capital losses to offset gains. For example, if you sold a stock for a $10,000 profit this year and sold another at a $4,000 loss, youll be taxed on capital gains of $6,000.

-

The difference between your capital gains and your capital losses for the tax year is called a net capital gain. But if your losses exceed your gains, you have what’s called a “net capital loss,” and you can use it to offset your ordinary income by up to $3,000 . Any additional losses can be carried forward to future years to offset capital gains or up to $3,000 of ordinary income per year.

Don’t Miss: Where Can You Get Tax Forms And Instructions

Types Of Gst Applicable To Laptops Computers And Accessories

For starters, the GST is a federal indirect tax that applies to laptops, computers, and accessories. This means that the tax rate, value of the goods, and other specifications are all listed on the GST website. Additionally, if youre buying a laptop or computer in India and its not explicitly mentioned on the invoice/bill/receipt then its likely subject to GST. Keep this in mind when shopping, and be prepared to pay the tax on your purchase.

How The Tax System Works With Multiple Income Streams

If you have multiple streams of income, you need to realize, it is taxed altogether, not separately. The IRS looks at how much total income you have received in the tax year and that is how they determine your tax bracket.

So if you earn $75,000 from your salary job, but earn $25,000 a year in pension or other income, then you will move up a tax bracket. You will then earn a total of $100,000 for the year. You can use the same process to figure out how much taxes you will owe total for all your income.

The income tax brackets work as a tiered system, not a flat tax percentage on all your income. So when you hear youve moved up a tax bracket, dont be scared. Moving up a tax bracket doesnt necessarily mean youre going to lose more money it just means the portion of money youve earned over your previous tax bracket will be taxed at a higher rate.

If you are unsure how your multiple streams of income may affect your taxes, reach out to a tax attorney at Polston Tax who can advise you on what you can expect at tax time.

Recommended Reading: When Do I Get My Tax Refund 2021

South Dakota Tax Changes Effective January 1 2023

South Dakota has a property tax assessment limit that freezes property assessments for qualifying South Dakota residents who are 65 or older or are disabled as defined by the Social Security Act. Beginning January 1, the property valuation limit will be adjusted for inflation in determining eligibility for the program.

Effective Income Tax Rates

Effective tax rates are typically lower than marginal rates due to various deductions, with some people actually having a negative liability. The individual income tax rates in the following chart include capital gains taxes, which have different marginal rates than regular income. Only the first $118,500 of someone’s income is subject to social insurance taxes in 2016. The table below also does not reflect changes, effective with 2013 law, which increased the average tax paid by the top 1% to the highest levels since 1979, at an effective rate of 33%, while most other taxpayers have remained near the lowest levels since 1979.

| Effective federal tax rates and average incomes for 2010 |

|---|

| Quintile |

Read Also: Who Do I Call About My Tax Return

Retirement Contribution Limits Increased

For 2022, the individual 401 contribution limit increased to $20,500, a $1,000 increase from 2021. If you’re over 50, you can contribute an additional $6,500. The total contribution limit, which includes your employer’s contributions, is $61,000 for 2022 . IRA contributions remained unchanged at $6,000 for the year, with a $1,000 additional catch-up contribution for those 50 or older.

Contributions to SIMPLE IRAs were also increased in 2022, rising from $13,500 to $14,000. Those over 50 can contribute an additional $3,000.

With the end of the year fast approaching, maximize your retirement contributions before the end of December. However, if you have an IRA, you can continue contributing for tax year 2022 until April 18, 2023, next year’s tax filing deadline.

More Americans may qualify for the Saver’s credit this year, since the IRS increased the income thresholds for 2022. It’s worth up to $1,000 for single filers , as long as you contribute to a retirement account and meet AGI requirements. For this tax year, your AGI must not be over $34,000 for single filers and those married filing separately, $68,000 for married, joint filers and $51,000 for head-of-household filers.

Iowa Tax Changes Effective January 1 2023

Iowa enacted comprehensive tax reforms in 2018, 2021, and 2022, and many of these reforms will continue phasing in with the new year. Most notably, effective January 1, Iowas nine individual income tax rates will be consolidated into four, and the top rate will decrease from 8.53 to 6 percent. The individual alternative minimum tax rate will be set at 6 percent for 2023 and will phase down over time. In addition, starting in 2023, the standard deduction and state deduction for federal taxes paid will be repealed, broadening the base to help pay for reductions to the rate. Iowa will also exempt retirement income and certain farm rental income from taxation beginning January 1, and phase out its inheritance tax by 2025, with a further reduction in rates taking effect on January 1.

Separately, under S.F. 2367, enacted in June 2022, Iowa will exempt diapers and menstrual products from its sales tax beginning January 1.

You May Like: Does California Have An Inheritance Tax

Optimizing Your Tax Bracket

At the most basic level, a person who makes more money falls into a higher tax bracket, and a person who makes less money falls into a lower one.

But your financial situation isnt only determined by income: its also affected by your lifestyle, spending, and factors like student loans. The tax system accounts for these additional factors through tax deductions and tax credits. By taking advantage of these, you may be able to fit into a lower tax bracket and reduce your tax bill. You may also be able to defer taxes, resulting in a higher tax return down the line. Some investors can also offset taxes on crypto and other investments that experience losses.

Deductions lower your taxable income. Many taxpayers choose to take the standard deduction, which is a set amount by which your taxes are reduced. This applies to most taxpayers who meet filing status criteria. However, other taxpayers, particularly those with complex assets, instead choose to calculate itemized deductions. Itemized deductions allow you to write off various specific expenses. These include charitable donations, property taxes, medical bills, and mortgage interests. Claiming these deductions is more labor-intensive than taking the standard deduction, but depending on which ones apply to you, the itemized deductions might be more effective at moving you into a lower tax bracket or maximizing your income tax return.

All About Gst On Laptops In India

Laptop users must be aware of laptop taxes. Since the tax was first levied on laptops, there have been inquiries on the applicability of GST on laptops and computer devices. We will discuss the various aspects of GST on laptops and computer accessories in India. From the brief history of laptop tax to the present day, we will cover everything you need to know about the taxation of laptops in India.

Don’t Miss: Can You Get The Child Tax Credit With No Income

The Standard Deduction For 2022 Is Higher

It’s typical for the standard deduction to increase a little each year, along with the rate of inflation. For your 2022 tax return, the standard deduction for single tax filers has been increased to $12,950 , and has been bumped to $25,900 for those married filing jointly .

The standard deduction is what most taxpayers with simple tax returns claim to reduce their taxable income. If you receive a traditional paycheck through an employer and aren’t eligible for many special deductions or credits, the standard deduction likely makes sense for you. If you have expenses or individual deductions you’d rather claim, like self-employment tax breaks, you would not claim the standard deduction.

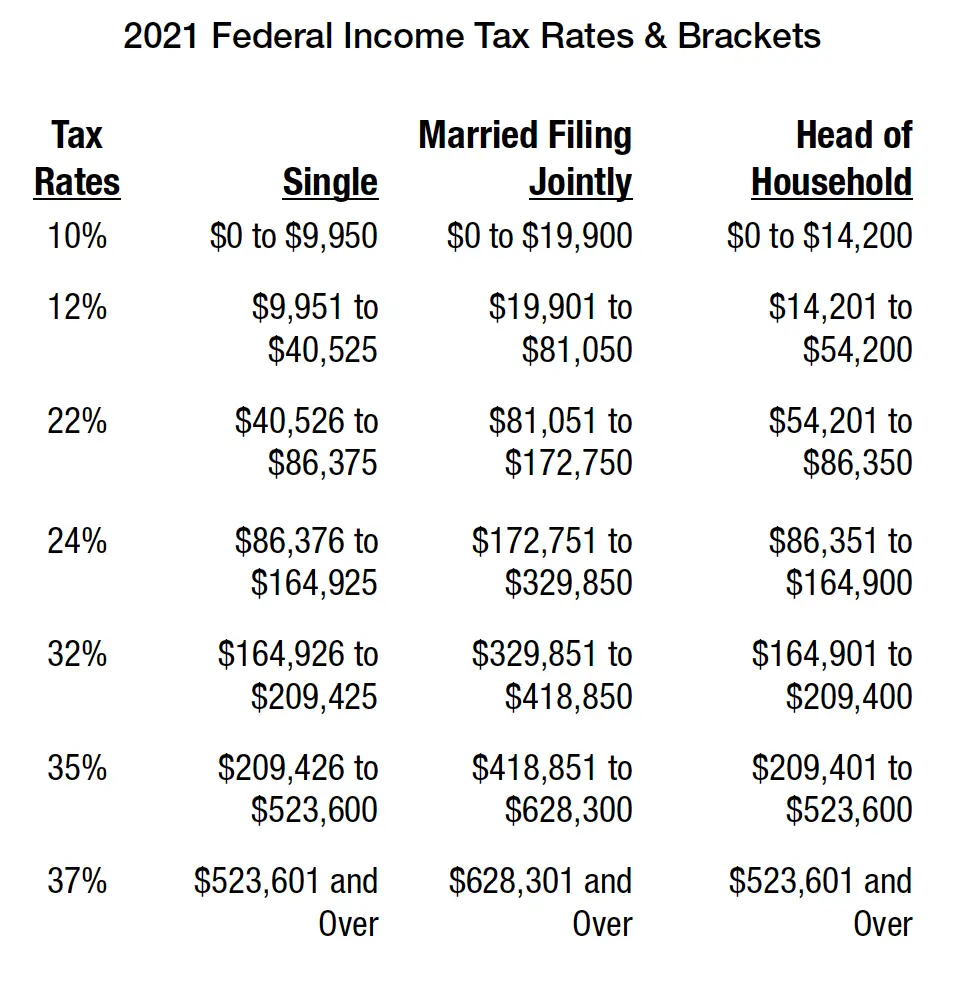

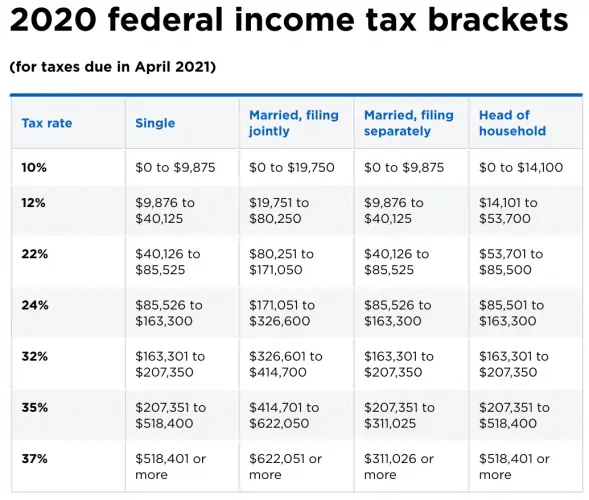

Types Of Federal Tax Brackets

There are four complete sets of tax brackets for different filing types, each with different bracket widths. These bracket types allow taxpayers filing as Married Filing Jointly or Head of Household to pay less in taxes by widening each tax bracket’s width.

Some individuals may have to follow a special tax structure not listed here, such as the Alternative Minimum Tax for certain high-income taxpayers.

Recommended Reading: How To Pay My State Taxes Online

Effects On Income Inequality

According to the CBO, U.S. federal tax policies substantially reduce income inequality measured after taxes. Taxes became less progressive measured from 1979 to 2011. The tax policies of the mid-1980s were the least progressive period since 1979. Government transfer payments contributed more to reducing inequality than taxes.

Gst Rates On Computer And Laptop With Accessories

The Goods and Services Tax is a new tax that was implemented in India on July 1, 2017. With GST, there are different rates for different types of items. For computer hardware and accessories, the tax rate is 10%. The tax rate for items below Rs 2,000 but above Rs 250 is 5%. The final rate applies to all other items, including laptop computers. So, now that you know the basics, its time to head to the store and start stocking up on tax-free items.

You May Like: Do You Have To Pay Federal Taxes On Social Security

Example Of Tax Brackets

Below is an example of marginal tax rates for a single filer based on 2022 tax rates.

- Single filers with less than $10,275 in taxable income are subject to a 10% income tax rate .

- Single filers who earn more than $10,275 will have the first $10,275 taxed at 10%, but earnings beyond the first bracket and up to $41,775 will be taxed at a 12% rate .

- Earnings from $41,776 to $89,075 are taxed at 22%, the third bracket.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2022:

- The first $10,275 is taxed at 10%: $10,275 × 0.10 = $1,027.50

- Then $10,276 to $41,775, or $31,499, is taxed at 12%: $31,499 × 0.12 = $3,779.88

- Finally, the remaining $8,225 is taxed at 22%: $8,225 × 0.22 = $1,809.50

Add the taxes owed in each of the brackets:

- Total taxes: $1,027.50 + $3,779.88 + $1,809.50 = $6,616.88

The individuals effective tax rate is approximately 13% of income:

- Divide total taxes by annual earnings: $6,616.88 ÷ $50,000 = 0.13

- Multiply 0.13 by 100 to convert to a percentage, which is 13%.

Taxes that you pay on 401 withdrawals are also based on tax brackets.

Pennsylvania Tax Changes Effective January 1 2023

The enactment in July 2022 of H.B. 1342, part of the states FY 2022-23 budget, will reduce the corporate net income tax rate from 9.99 percent to 8.99 percent on January 1, 2023. Each year thereafter, the rate will decrease by 0.5 percentage points until it reaches 4.99 percent at the beginning of 2031. Further analysis of the CNIT rate cut can be found here.

Read Also: Do You Pay Taxes On Cash Out Refinance