The 2021 Tax Deadline Extension: Everything You Need To Know

OVERVIEW

In response to the Coronavirus pandemic, the Treasury and IRS issued new instructions that call for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Read more to learn about the relevant details and how they impact your situation.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Govt Releases 2023 Social Security Payment Schedule: What You Need To Know

Every year, the Social Security Administration issues a calendar of when the various Social Security benefits are going to be paid for the following year. All Social Security benefits are paid electronically. The Social Security Administration stopped sending paper checks in 2013. You can receive your benefits by instructing Social Security to direct deposit your money to your bank account. The second way you can receive your benefits is to have Social Security issue a Direct Express debit card to you. They load the debit card with your Social Security benefits for the month and you make your purchases using that debit card. Consider working with a financial advisor to make sure your finances are ready for retirement.

Social Security Retirement and Disability Insurance Programs

OASDI stands for Old Age, Survivors and Disability Insurance. You may see it on your pay stub. This program is operated by the Social Security Administration which is a federal agency. The employer collects money from workers wages and that money is put into one of two trusts. The OASI trust is for retirement benefits for workers and the DI trust is for disability benefits. Payroll deduction funnels the money into each trust.

Social security retirement benefits are not, contrary to what some think, an entitlement. Benefits are funded out of the trusts into which you pay your social security taxes. You are paid back the contributions to Social Security you have paid over the lifetime of your career.

The High Income Child Benefit Charge

One reason for some people needing to file a self-assessment tax return is so they can pay the High Income Child Benefit Charge.

The charge is levied against people who earn more than £50,000 a year, and acts as a taper, gradually claiming back the child benefit paid to such high earners.

For every £100 earned between £50,000 and £60,000, 1% of the child benefit you have received must be repaid through the charge. Once you earn £60,000, the charge means you will have to pay back all of the child benefit you have received.

The partner who earns the highest amount is responsible for paying the High Income Child Benefit Charge, even if they are not the one that receives the child benefit payments.

You May Like: How Much Is Capital Gains Tax On Property

Registering To File A Self

You will need to register with HMRC in order to file a self-assessment tax return. This must be done by 5 October for the following tax year.

You can do this online through the Gov.uk website, after which you will be sent a unique taxpayer reference through the post. Activation details for the governments Gateway platform will also be posted to you the Gateway is used for filing an online tax return.

This process can take up to three weeks, so its a good idea to start the registration process as early as possible.

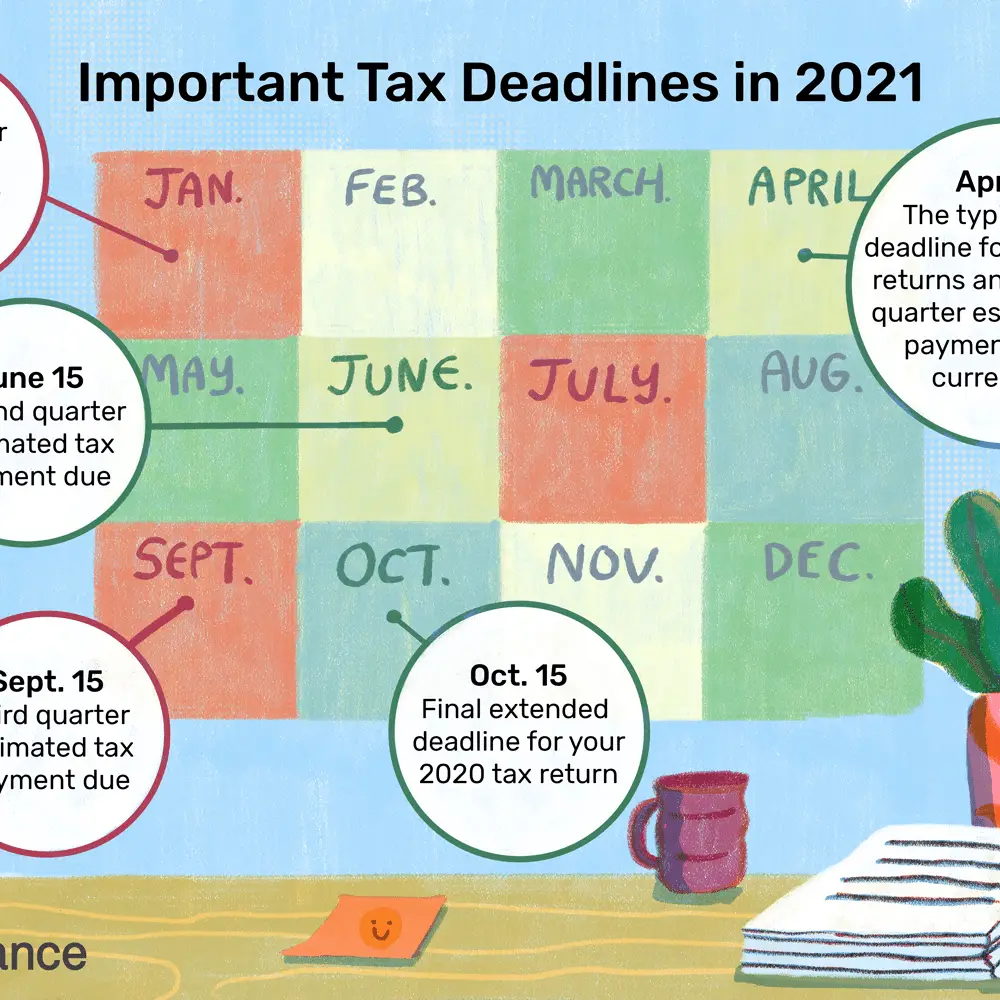

When Are Estimated Taxes Due

Some taxpayers are required to file estimated quarterly tax payments rather than a single annual return. Generally, you will have to file estimated quarterly tax payments if you expect to owe at least $1,000 in US taxes when filing your return. The rules for this are the same for US residents and expats.

The most common categories of taxpayers who have to file estimated quarterly taxes are:

- Taxpayers who are self-employed

- Taxpayers with significant investment or retirement income

- Taxpayers who receive a large windfall, such as from the sale of a major asset

- Taxpayers who receive alimony income

- Taxpayers who receive income distributions from a partnership or S corporation

In addition to this, expats who are employed by a foreign business that does not withhold or pay taxes to the US government on their behalf may also need to file estimated quarterly payments.

So what about the deadlines for these payments? The last estimated payment of 2022 was due on January 18, 2022. Estimated payments for the tax year 2023 will be due on:

Also Check: How To Not Pay Income Tax

When Is Tax Day Its Complicated

The deadline for filing 2021 federal income tax returns for most taxpayers is April 18. Taxpayers havent had to file on the traditional date, April 15, since the 2019 filing season.

2022 IRS Key Tax Dates

IRS Free File service opens to prepare tax year 2021 returns

Final estimated tax payment for 2021 due

IRS begins processing 2021 tax returns

Free MilTax service for military opens to prepare 2021 returns

First estimated tax payment for tax year 2022 due

Filing deadline for tax year 2021

Second estimated tax payment for 2022 due

Third estimated tax payment for 2022 due

Extended deadline to file 2021 tax return

Fourth estimated tax payment for 2022 due

In 2020 and 2021, the April 15 deadline got pushed back by the COVID-19 pandemic. And in some non-pandemic years, the deadline sometimes gets pushed back to the next business day because April 15 falls on a weekend.

The filing deadline this year is Monday, April 18, because Washington, D.C., observes Emancipation Day on Friday, April 15. By law, the IRS is required to treat D.C. holidays as if they were national holidays for tax-filing purposes. Emancipation Day commemorates the day in 1862 when President Abraham Lincoln signed into law a measure to free enslaved people in D.C.

AARP NEWSLETTERS

What If I Cant Pay My Tax Bill

If you cant afford to pay your tax bill in full on the deadline, dont pull out your credit card or ignore the situation.

The IRS offers reasonable payment plans at much lower interest rates than most banks. You may even be able to settle the bill for less than you owe, called an offer in compromise, or request a deferment until you can make a payment. Offers in compromise and requests for deferment require additional paperwork and must be approved by the IRS.

The IRS is predicting significant delays in this years tax season, both because of unfinished past paperwork that has rolled into this year and because of the complexity of tax filing around last years child tax credits and economic impact payments. Taxpayers can expect longer wait times than usual for paper returns and to reach the IRS on the phone.

However, online filing remains the most efficient process, and is recommended by the IRS, which says 90% of people who e-file their tax return should get their federal refund within 21 days. In general, the IRS assures filers that the quickest and safest method for getting a federal refund is filing electronically and opting for direct deposit.

If your tax return was flagged by the IRS for errors, manual processing, or fraud detection, your refund could take longer.

Never return a phone call from someone claiming to be with the IRS. Instead, individuals should call the IRS directly at 1-800-829-1040, and businesses should call 1-800-829-4933.

Read Also: Do I Pay Taxes On Unemployment

Last Quarterly Payment For 2022 Is Due On January 17 2023

Taxpayers may need to consider estimated or additional tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The Tax Withholding Estimator on IRS.gov can help wage earners determine if there is a need to consider an additional tax payment to avoid an unexpected tax bill when they file.

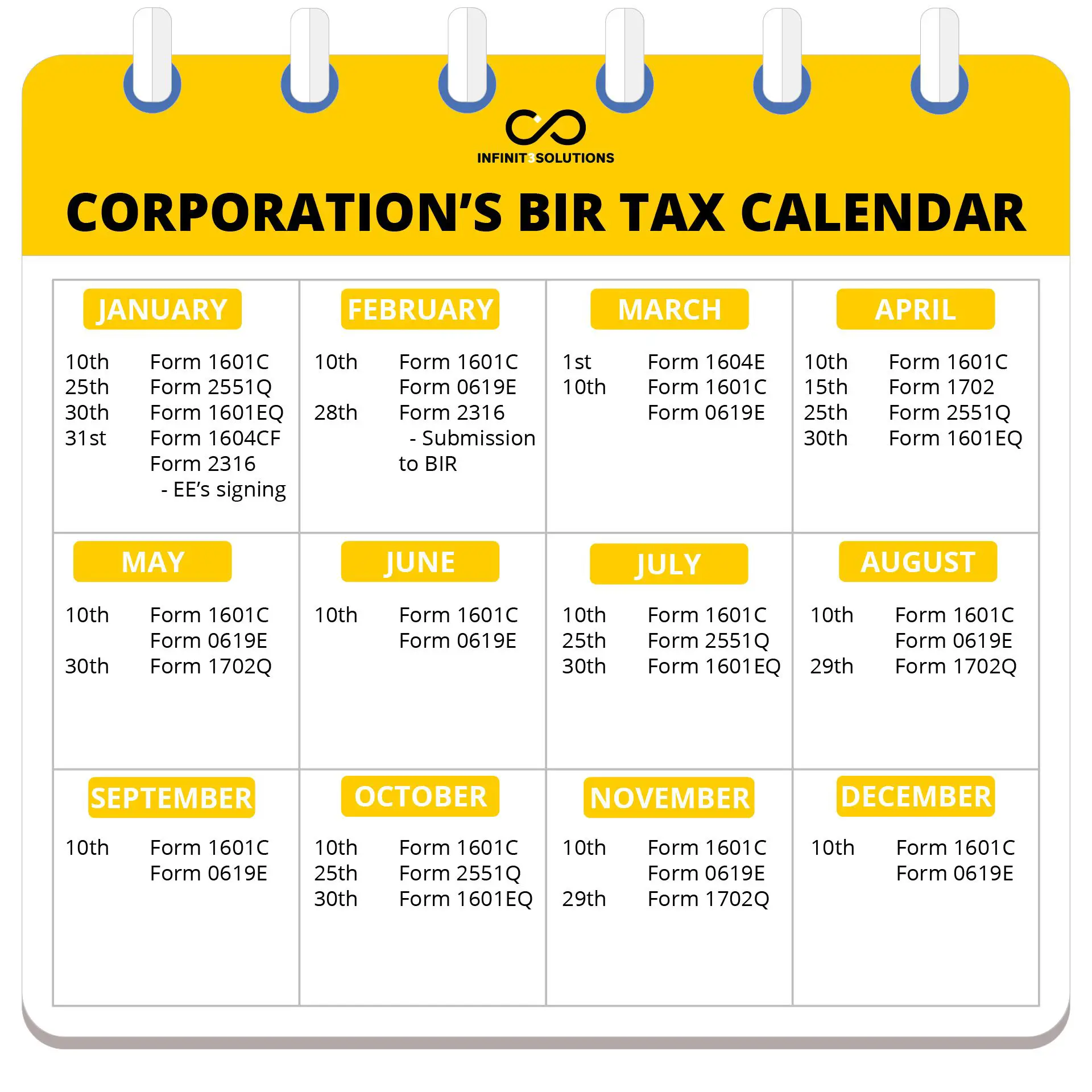

Tax Calendar: Important Tax Due Dates And Deadlines

Know the tax deadlines that apply to you, so you don’t get hit with IRS penalties or miss out on a valuable tax break.

If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break.

It’s easy to avoid these headaches, though just don’t miss the deadline! But we realize that it’s not always easy keeping track of all the various IRS due dates. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2022 federal income tax due dates for individuals. There’s at least one deadline in every month of the year, so play close attentionwe don’t want you to get in trouble with the IRS.

Don’t Miss: How To Get Tax Return From Turbotax

Does An S Corp Have To File Quarterly Taxes

If your S corporation has employees, it must withhold employment taxes on their wages. ⦠As part of the payroll tax process, your corporation must periodically pay money to the federal government using electronic funds transfer. In addition, your corporation needs to file quarterly employer tax returns .

Recommended Reading: How To Pay Your Federal Taxes Online

When Does Tax Season Start

The IRS takes a few weeks to get ready to process the millions of returns it receives during tax season. Last year, taxpayers sent more than 168 million individual returns to the IRS. However, IRS and Treasury officials say some returns have yet to be processed due to delays stemming from the pandemic.

The IRS will begin accepting and processing new returns on Jan. 24. The IRS says most taxpayers will get their refunds within 21 days of when they file electronically, barring any issues with processing their tax returns. Electronic filing, when linked with direct deposit, is the fastest way to get a refund. Last years average tax refund was more than $2,800.

Read Also: When Can You Do Taxes

Tax Deadlines For Expats

At a glance

Find out what the Expat tax filing deadline is this year. The tax experts at H& R Block breakdown other deadlines and extensions for U.S. Expats.

Just like most taxpayers in the United States are required to file U.S. tax returns and pay any taxes due by April 18 , expats living and working in another country as a U.S. citizen are also required to file.

However, if youre living abroad, the rules for expat tax filing and deadlines are a little different.

Make Sure To Pay Your Estimated Taxes On Time To Avoid Penalties

A Tea Reader: Living Life One Cup at a Time

People who work for companies have estimated taxes withheld from their paychecks, but the self-employed, business owners, and those who live on investment income are required to proactively pay estimated taxes on a quarterly basis.

In the United States, income taxes are pay-as-you-go. If you don’t keep up with payments, you could potentially end up with a large tax bill, in addition to penalties for late payment, when it comes time to file your return.

Recommended Reading: How To Calculate Your Tax Bracket

What Is The Penalty For Missing A Tax Deadline

Generally, if you miss the filing due date or fail to file by the tax extension deadline, the IRS may charge a failure-to-file penalty. The penalty is based on your unpaid taxes, and the IRS charges 5% of your taxes due for every month or partial month your tax return is not filed. However, the maximum amount the IRS can charge you is capped at 25% of any taxes owed.

Letâs say you owe $10,000 in taxes. The IRS will charge you $500 for every month you donât file your taxes. But the most the agency may charge you is $2,500.

Itâs important to know that if you expect a tax refund and have yet to file your tax return, the IRS wonât charge you a penalty for late filing. But if you expect you may owe penalties for filing your tax return late, you should consider speaking with a tax professional before filing. You may be responsible for penalties plus interest.

When Are Taxes Due In Your State

Be sure to find out when your local tax day is. Most taxpayers face state income taxes, and most of the states that have an income tax follow the federal tax deadline. Ask your state’s tax department: When are taxes due?

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

-

However, getting a tax extension only gives you more time to file the paperwork it does not give you more time to pay.

-

If you can’t pay your tax bill when it’s due, the IRS offers installment plans that will let you pay over time. You can apply for one on the IRS website.

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

Also Check: What Is The Sales Tax In Washington Dc

When Is The Us Tax Deadline For 2022

The standard deadline for US residents to file a Federal Tax Return for tax year 2021 is April 18, 2022.

However, for US citizens living overseas, this deadline is automatically extended to June 15, 2022. You can then apply for a further deadline extension to October 17, 2022. In extreme cases, you can even request an extension to December 15.

Pro Tip: If you need more time to file your expat tax return, you can request an additional filing extension to October 17. In extreme cases, you can even request an extension to December 15.

I Am Having Issues Downloading The Income Tax Forms Online What Is The Issue

The most compatible browsers for this form are Internet Explorer or Mozilla Firefox. If you are using Google Chrome or Safari and see a blank/warning/error message, please view the form within your computer’s Download folder instead of online.

Please ensure you download and open the form from your computer folder using Acrobat, as you will encounter issues when viewing and filling it out within your internet browser.

Fillable forms are in PDF format and contain JavaScript coding, which does not operate properly in internet browsers.

For more forms technical help, see .

You May Like: How To Pay Sales Tax For Small Business

Get Your Expat Taxes Done On Time With H& r Blocks Expat Tax Services

No matter if youre early, on-time, or behind, weve got a tax solution for you whether you want to be in the drivers seat with our DIY online expat tax service designed for U.S. citizens abroad or prefer to let one of our experienced tax advisors take the wheel.

Ready to get the tax season over with? Start the process with virtual Expat Tax Preparation from H& R Block today!

Was this article helpful?

I Need Help Filing My Taxes Where Can I Get Income Tax Preparation Assistance

Arizona Department of Revenue does not offer tax preparation assistance. offer free assistance to the elderly and other individual taxpayers that need to file their income tax electronically.

To expedite the processing of your income tax return, we strongly encourage you to use the bar-coded fillable Arizona tax forms or electronically file. Electronic filing information is available on our .

You May Like: What Are Itemized Tax Deductions

May 2022 Tax Due Dates

| Tips for April 2022 Reported to Employer | |

| May 16 | Arkansas, Illinois, Kentucky and Tennessee Storm, Tornado and Flooding Victims’ Extended Deadline for Filing and Payment Obligations from January 1 to May 15 |

| May 16 | Colorado Wildfire Victims’ Extended Deadline for Filing and Payment Obligations from January 1 to May 15 |

After a busy April, things slow down considerable in May for most people. There’s the typical deadline for employees to report tips received in April to their boss. That’s due by May 10.

In addition, victims of certain natural disasters also have extended due dates on May 16. First, victims of the severe storms, tornadoes and flooding in Arkansas, Illinois, Kentucky and Tennessee that began on December 10, 2021, can wait until May 16 to file federal returns or pay federal taxes that were supposed to be due between December 10 and May 15. People impacted by the Colorado wildfires that started on December 30, 2021, also have until May 16 to file returns and pay taxes originally due from December 30 to May 15.

What Is The Due Date For Calendar Corporate Income Tax Returns For Businesses That Received An Extension

The filing extension provides a 7-month extension to file the 2021 Arizona corporate returns . The extension due date for calendar year corporate Arizona returns is due November 15, 2022.

The federal calendar year corporate returns are due October 17, 2022.

Corporate income tax payments can also be made on AZTaxes.gov, but registration is required.

Recommended Reading: What Income Do You Have To File Taxes

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can put this on your tax return and make the actual contribution by the new deadline.