How To Get A Tax Id

You must register your address . Around 2 weeks later, you will get a tax ID by post1, 2. It will be a letter from the Bundeszentralamt für Steuern. It looks like this.

If you want your tax ID faster, go to the Finanzamt, and ask for it1, 2. You can do this a few days after you register your address. You dont need an appointment.

If you are homeless, you can get a tax ID at your local Finanzamt.

Finding The Federal Tax Id Number Of A Third Party

Atin Questions And Answers

The following are Questions and Answers regarding the ATIN program.

The Q& A provides information to taxpayers who need a taxpayer identification number for a child who has been placed in their home pending final adoption.

Don’t Miss: How To Get An Extension On Filing Taxes

How Does An Ssn Differ From A Tax Id

A social security number is a tax code used by an individual, while a tax ID is a nine-digit tax code for a business entity. For a business entity, a tax ID is usually called an EIN. Just like an individual uses their social security number to uniquely identify themselves on their tax paperwork, a business entity uses it in the same way. It is a unique way for a business to be identified by the IRS on their tax forms.

To file taxes as a business instead of an individual, a tax ID is required. A tax ID number is necessary for tax forms and when business owners open a business account through a bank. Sometimes, suppliers and customers also need it to create an account with the business.

Small business owner are sometimes unsure if they need a tax ID number. Almost all businesses need a tax ID number. Also, if a small business is associated with certain organizations, it may be required to apply for a tax ID. Here are some examples of those associated organizations:

- Farmers cooperatives

- Certain types of trusts

However, not every business entity needs a tax ID number. An exception is a sole proprietor with no employees and no plans to hire employees. In this case, the sole proprietor can use their own personal social security number as a tax identification number because the person and the business are the same. Sole proprietors who do plan on hiring employees or have already hired employees are required to have a tax ID number, however.

What Is An Itn

An Individual Tax Number is a unique number that Canada Revenue Agency uses to identify you for tax purposes if you aren’t eligible for a Social Insurance Number .

If you are an international student who is not eligible for a SIN, you need to get an ITN if:

- You received a scholarship or award from UBC.You must enter a SIN or ITN into your Student Service Centre by January so UBC can issue your T4A tax forms.

- You want to file a tax return.As an international student now living in Canada, you may need to file a tax return depending on your situation.

Also Check: Which Tax Software Gives The Most Refund

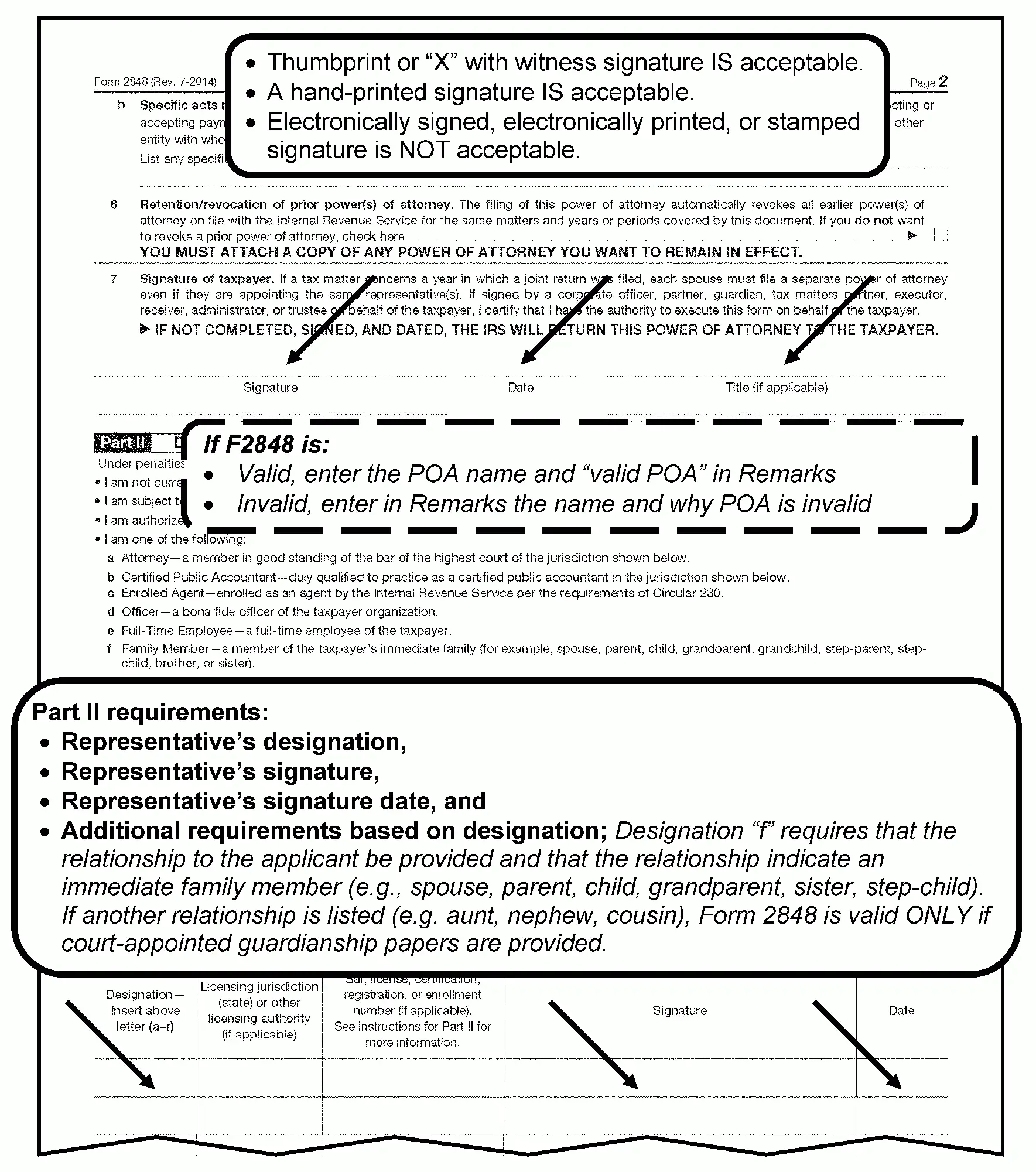

What Is An Itin Used For

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

What Is A Tax Id Number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. It’s required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too: the ITIN, EIN, ATIN and PTIN.

Read Also: What Documents Do I Need For My Taxes

What Is Tax Identification Number

Tax Identification Number is a unique number given to an individual, a registered business or incorporated companies for the purpose of tax payment. TIN as fondly called is generated by the Tax Authority for proper identification, order and ensuring that more people are brought to the tax net.

Usually, the number is issued by the Tax Authority, through Joint Tax Board portal online or via an application letter to the office of Federal Inland Revenue Services nearest to your location.s

How To Apply For Tax Identification Number

In line with Section 10, subsection 2 of CIT Acts, as amended in 2019 Finance Acts. Banks in Nigeria has been mandated to obtain Tax Identification Number from both Individual and Corporate Organisations, before an account can be open for them. The section equally requires Banks to ensure, all accounts opened prior to this Acts, provide such Tax Identification Number information as a precondition for the continued usage of their bank accounts

This is done to synchronize taxpayer banking and tax database with a view to improving tax compliance and ease of tax administration. This will also expand the tax net to capture more individuals and the informal sector

Tax Identification Information In Other Eu Member States

The use of a common identifier for tax purposes is already widespread in the EU member states and also complies with OECD recommendations for the Taxpayer Identification Number . For example, according to a recent study by the OECD, Germany is one of the few states that has not yet used a number to identify taxpayers in the area of tax administration.

As a result, by introducing the IdNo, Germany is narrowing the gap to the standard used by the other industrial nations. The tax IdNo is a significant improvement in performing administrative duties in the international exchange of information in tax matters.

Without the use of a TIN, identification of people is in principle possible, but it is associated with considerable additional expense because name, address, date and place of birth must also be transmitted.

Germany may refrain in the future from providing this information, which until now has always had to be agreed on in international conventions.

Also Check: How Do I Pay My Taxes Turbotax

Electronic Data Gathering Analysis And Retrieval System

Using the Electronic Data Gathering, Analysis, and Retrieval System is the easiest way to search for a federal tax ID number.

Maintained by the SEC, the EDGAR system is a database that includes information about for-profit companies. This online service is completely free.

The EDGAR database includes several forms that may contain a businesss EIN, including the 8-K, 10-K, and 10-Q forms.

Before you start your EDGAR search, you should keep in mind that searching just the first few letters of a businesss name will provide you better results, as many businesses are not listed under their full names.

Dont Miss: How Much Do I Get Back In Taxes

How Do I Know If I Need A Tin

You need a TIN if you are authorized to work in the United States or if you plan to file taxes with the IRS. Youll also need a TIN if you want to take advantage of benefits or services offered by the government. If you run a business or other organization, youll also need a TIN to run your day-to-day operations and to report your taxes.

Also Check: Tax Deductions Doordash

Read Also: Do You Pay Transfer Tax On Refinance In Florida

Finding A Tax Id Number For A Public Company

You can find a publicly-traded companys tax ID number by reviewing the SEC filings. In addition to its quarterly and annual reports, the Securities and Exchange Commission requires public entities to publish certain public disclosures.

The SEC will provide financial information about the entity and its EIN in SEC filings, which are available on the SEC website. Simply searching the companys business name will yield its financial information.

Where Is My Tax Id Number Located

The U.S. Taxpayer Identification Number may be found on a number of documents, including tax returns and forms filed with the IRS, and in the case of an SSN, on a social security card issued by the Social Security Administration.

What is tax ID number in Netherlands?

Section II TIN Structure The Dutch TIN has 9 digits: 999999999. Validation rule and check digid: 1. The TIN always has 9 digits: N1, N2, N3, N4, N5, N6, N7, N8, N9 N9 is a check digit.

Is tax ID the same as VAT ID?

What is a VAT number? The value added tax registration number (abbreviated VAT number, or VAT reg no. This means that VAT numbers are similar to normal tax IDs, which most citizens are familiar with from their personal tax returns. However, the VAT number and tax number are by no means identical.

Is BSN a tax number?

BSN since November 2007 it is a tax identification number in the Netherlands . Everyone who works in the Netherlands must have a BSN, it is necessary to settle all the formalities in various Dutch institutions. BSN seems to Dutch Tax Office .

Recommended Reading: How To Mail Taxes To Irs

Q4 How Do I Know If I Should Apply For An Atin

A4. You should apply for an ATIN only if you are in the process of adopting a child and you meet all of the following qualifications:

- The child is legally placed in your home for legal adoption by an authorized placement agency.

- The adoption is a domestic adoption OR the adoption is a foreign adoption and the child/children have a Permanent Resident Alien Card or Certificate of Citizenship.

- You cannot obtain the child’s existing SSN even though you have made a reasonable attempt to obtain it from the birth parents, the placement agency, and other persons.

- You cannot obtain an SSN for the child from the SSA for any reason. .

- You are eligible to claim the child as a dependent on your tax return.

Finding The Id For Your Employer

You May Like: What Is Tax Deadline 2021

Q9 What Is Placement Documentation

A9. Placement documentation is the signed documentation placing the child in your care for legal adoption. In general, one of the following documents will satisfy this requirement:

- A placement agreement entered into between you and a public or private adoption agency.

- A document signed by a hospital official authorizing the release of a newborn child to you for legal adoption.

- A court order or other court document ordering or approving the placement of a child with you for legal adoption.

- An affidavit signed by an attorney, a government official, etc., placing the child with you pursuant to the states’ legal adoption laws.

The placement documentation is sometimes referred to as “Placement Agreement” “Surrender Papers” “Temporary Placement Paperwork” “Placement Order” etc. This documentation termed differently from state to state must clearly establish that the child was placed in your home for purposes of adoption by an authorized adoption agency , and must include the following information:

- Adoptive Parent full name

Who Is Eligible For A Refund

The owner of the salvage vehicle may request a refund of the prorated VLF. The owner of the salvage vehicle can usually be determined as follows:

- The insurance company is the owner if you received a settlement for your loss and possession of the salvaged vehicle is retained by an insurance provider or their agent.

- You are the owner if you retained the salvaged vehicle following a determination by your insurance provider that your vehicle is uneconomical to repair and:

- No repairs are initiated by you or in your behalf, and

- You applied for a Salvage Certificate or Non-repairable Certificate.

If you are not sure that the VLF refund was included as part of your settlement you should contact your insurance provider for verification. DMV does not have this information. Persons who were cited for violations of CVC §§23152, 23153, or 23103 as specified in §23103.5 , incidental to the loss, are not eligible for this refund.

Read Also: Who Do I Call About My Taxes

How To Find An Ein For A Business

The nature of your business may require that you regularly look up EINs of other companies, or you may want to look up another businesss EIN to validate their information.

If the company is publicly traded and registered with the Securities and Exchange Commission , you can use the SECs EDGAR system to look up such a companys EIN for free. You can do an EIN lookup for nonprofit organizations on Guidestar.

If a company is not registered with the SEC, it will be more difficult since theres no central EIN database for these companies. Here are a few strategies you can use:

- Contact the companys accountant or financing office and ask for the EIN, though they dont have to provide it.

- Search for the company on the secretary of states website or seek out other local or federal filings that may be online.

- Hire a service or use a paid database to do the EIN search.

Also Check: Travel Trailer Tax Deduction 2021

Use Melissa Database For Nonprofits

The Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Only share the number with a limited subset of peoplelenders, prospective suppliers, bankers, etc. You should guard your businesss EIN just like you would guard your social security number.

Also Check: How To Pay Your State Taxes

Importance Of Tin Number

-

Tax Identification Number is important as it is a way to integrate and make essential tax-related details available under one single platform.

-

It also helps in the identification process of assets under the Income Tax Act.

-

The TIN is required for business enterprises specialising in trade, manufacture and export and dealing with goods and services for both purchase and sale of goods and services.

-

All the information of any business enterprise can be easily accessed by the governments where the business entity is present thus streamlining intra and interstate transactions.

How Do I Find My Business Tax Id Number

Do you know whether your UTR is relevant when making a VAT return? With so many tax ID systems, it can be easy to feel overwhelmed. Make sure you know how to find your business tax ID number and use it correctly when making payments to HMRC.

Well cover various identification numbers that HRMC uses, when theyre relevant, and where to find them in this article. Discover:

- What system does HMRC use to identify different payments?

- Where can you find each number?

- Which numbers are for sole traders versus limited companies?

- How you can keep track of your business tax more accurately

At Countingup, we want to empower new entrepreneurs to meet the challenges of business and save them time to make it a success. Learn more about the various tax ID numbers available and how you can streamline your tax payments below.

You May Like: Who Can Claim Education Tax Credit