Renewing Your Claim For Tax Credits

State Pension calculator

You can manage and renew your tax credits at GOV.UK

Theres also online help available to support you. This includes webchat to help try and answer queries around renewing.

. But be aware that this line can get very busy in the days leading up to the deadline, so give yourself plenty of time.

Theres also a dedicated team to support the most vulnerable customers who cant go online. People who HMRC know need this support will be contacted by the support team.

Find out more about contacting this team on the HMRC websiteOpens in a new window

Always let HMRC know if your circumstances change at any time during the year. For example, if your income changes, your child leaves home or you move house.

This is because you might have to claim Universal Credit instead.

Tips For Saving On Your Taxes

- A financial advisor can help you optimize your tax strategy for your familys needs. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To make sure you dont miss a credit or deduction that you qualify for, use a good tax software. SmartAsset evaluated common tax filing services to find the best online tax software for your specific situation.

How Do The Monthly Advance Payments Of The Child Tax Credit Affect The Credit On The Tax Return For 2021

The IRS estimated the advance payments based on the number of dependent children reported on a taxpayers prior year return. If taxpayers claim more or fewer eligible children for 2021, the total payment amount may be more or less than their actual credit. If, as will be the case for most taxpayers, the advance payments constitute less than a taxpayers entire annual child tax credit, the taxpayer can claim the remaining undistributed credit balance on their 2021 tax return.

If a taxpayer received advance payments that exceeded their total credit for the year, they may be required to repay the excess when filing their return. However, repayments for low-income taxpayers and repayments of small amounts generally will be waived.

Also Check: What Is The Sales Tax In Kansas

Determine How Much You Are Eligible For

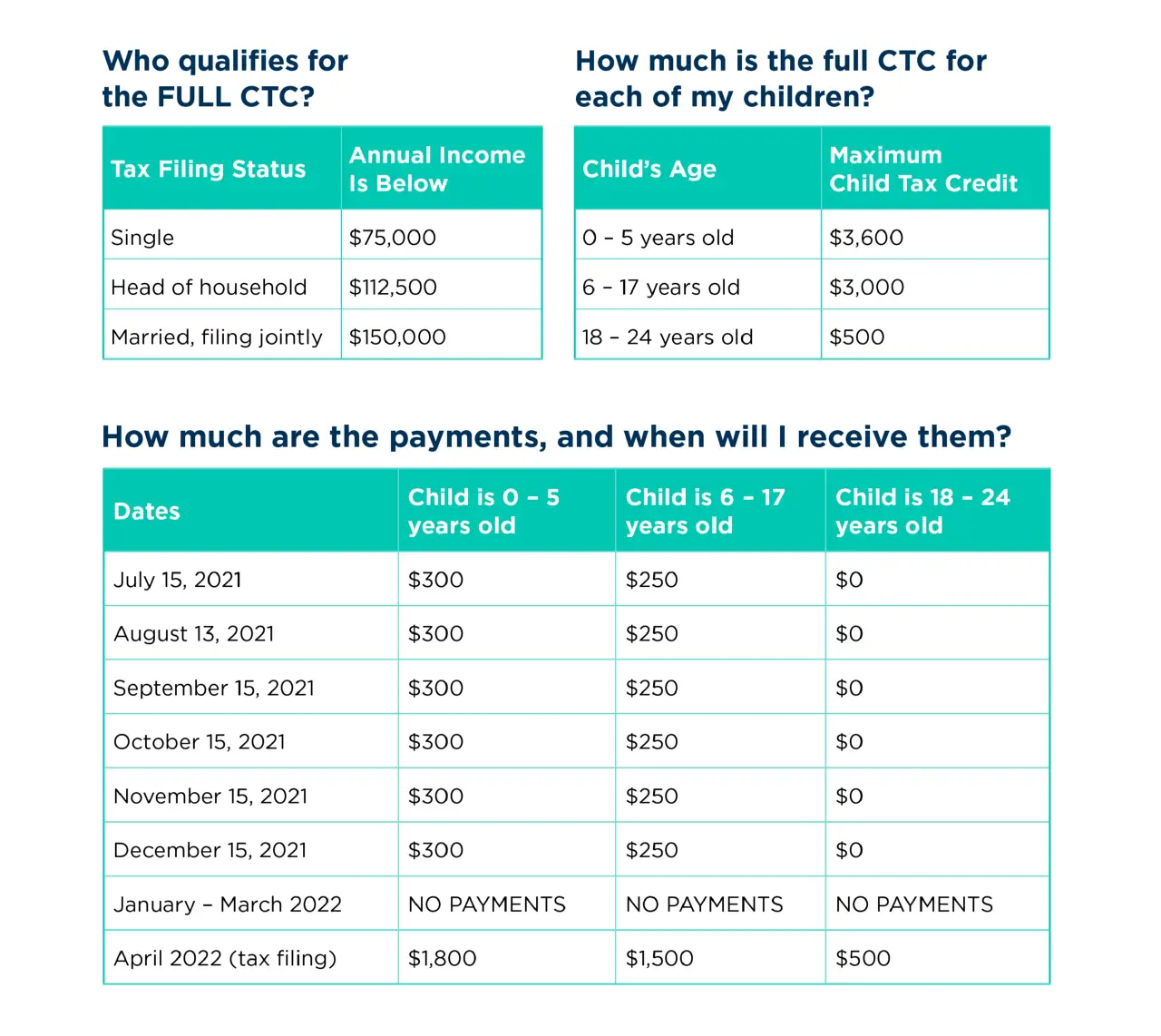

The amount you receive for your 2021 child tax credit is determined by your modified adjusted gross income and the amount, if any, by which it exceeds certain thresholds. The thresholds are:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household

- $75,000 if you are a single filer or are married and filing a separate return

Provided your MAGI does not exceed the relevant threshold above, your 2021 tax year child tax credit for each qualifying child is:

- $3,600 for children ages 5 and under at the end of 2021

- $3,000 for children ages 6 through 17 at the end of 2021

The amounts above will be reduced by $50 for each $1,000 that your MAGI exceeds the qualifying threshold above up to $400,000 if married and filing jointly or $200,000 for all other filing statuses.

The child tax credit wont begin to be reduced below $2,000 per child until your MAGI in 2021 exceeds $400,000 if married and filing a joint return or $200,000 for all other filing statuses.

Above these levels, your child tax credit decreases by $50 for each $1,000 until it phases out entirely.

Can Get I More Of The Child Tax Credit In A Lump Sum When I File My 2021 Taxes Instead Of Getting Half Of It In Advance Monthly Payments

Yes, you can opt out of monthly payments for any reason. To opt-out of the monthly payments, or unenroll, you can go to the IRS Child Tax Credit Update Portal. If you do choose not to receive any more monthly payments, youll get any remaining Child Tax Credit as a lump sum next year when you file your tax return.

Read Also: Where To Get Tax Forms

Keeping Your Tax Credits Up To Date

You need to renew your tax credits claim by 31 July every year if you want to keep getting them.

HMRC will write to you telling you what you need to do to renew your tax credits.

You should get your pack in May or June. The deadline to respond is usually 31 July each year.

If you dont get your renewal pack, youll need to contact the . Do this as soon as you can to make sure you can meet the deadline.

How To Claim The Ctc

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes or submitted your info to the IRS through the 2021 Non-filer portal or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return .

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return , you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit or the first and second stimulus checks.

Read Also: Where Do I Mail My Tax Return

You Can Still Claim $1400 Stimulus Checks And Child Tax Credits For Free

You can still claim $1,400 stimulus checks and child tax credits for free. This is to all United States residents, that means you North Carolina. So, keep reading if you want to find out how you can score this deal before its too late.

How To Get Your Claim

The stimulus payments we received were much needed and appreciated. I know for me, it helped a lot with bills that were piling up. But many people are unaware that money is still out there for them to claim. Nearly 10 million eligible individuals havent yet received Stimulus payments or 2021 child tax credits. This funds are still available and just waiting to be claimed. To determine if you qualify for stimulus payments, child tax credits, or earned income tax credits, you can still file a 2021 tax return.

So how do you know if you can still get a stimulus check?

At ChildTaxCredit.gov, you can file a simple tax return if you think youre eligible for a COVID stimulus payment or the 2021 child tax credit. Time is of the essence if you think this applies to you. The simplified return deadline for this year is November 15. In the event you missed the April 18 filing deadline, youll need to file a tax return on ChildTaxCredit.gov by October 17, in order to find out if you qualify for a stimulus payment or child tax credit. However, according to the IRS you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. So there is a bit of time there.

How The Child Tax Credit Works

The Child Tax Credit for the 2021 tax year differs from the credit allowed in 2020. The 2021 changes, mandated by the American Rescue Plan, are limited to just that single tax year. For 2022 taxes, the credit will revert to the rules in effect for 2020, with some inflation adjustments. Here’s a look at the credit rules and how they vary across years.

Also Check: How Much Of Your Paycheck Goes To Taxes

Why Have Monthly Child Tax Credit Payments Stopped

The American Rescue Plan increased the Child Tax Credit to $3,600 for qualifying children under 6 and $3,000 for qualifying children 6-17. It also provided monthly payments from July of 2021 to December of 2021. President Biden has proposed extending the enhanced Child Tax Credit. Families can still receive the entire 2021 Child Tax Credit that they are eligible for if they file in 2022. However, continuing enhanced benefits and monthly payments would require new legislation to be passed.

How Much The 2021 Tax Credits Are Worth

The American Rescue Plan Act passed by Congress in 2021 temporarily made enhanced tax credits available to millions of Americans.

That included a Recovery Rebate Credit that provided third stimulus checks of $1,400 per person.

It also made existing tax credits the child tax and earned income tax credits more generous.

The child tax credit included up to $3,600 for children under age 6 and $3,000 per child ages 6 through 17. Up to half of those amounts were paid in advance through monthly child tax credit payments. However, to claim the remaining sums or the total amount if a family did not receive advance payments they need to file a federal 2021 income tax return.

The earned income tax credit, which applies to low- and middle-income workers, was also enhanced for that tax year. Workers with no children may qualify for up to $1,502, which increases to as much as $6,728 for filers with three or more children. Because eligibility was expanded for workers without children and younger and older age thresholds, more workers qualify for the credit in the 2021 tax year.

Don’t Miss: How Much To Set Aside For Taxes

How Much Can I Get With The Ctc

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 . Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you dont owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

This Year More Workers Without Dependent Children Can Claim The Credit And Can Receive Up To Three Times More Money Than In 2020

Before the American Rescue Plan, people with no dependent children were eligible for the Earned Income Tax Credit only if they were age 25 to 64 and they could receive only up to $538. The maximum amount of Earned Income Tax Credit is nearly tripled for these taxpayers up to $1,502.

In addition, the American Rescue Plan made new workers eligible for the Earned Income Tax Credit:

- If you are 19 or older, you could be eligible to claim the Earned Income Tax Credit.

- If you are 18 years old and were formerly in foster care or are experiencing homelessness, you could be eligible for the credit.

- Certain full-time students age 24 and older can qualify.

- There is no upper age limit for claiming the credit if you have earned income.

- Singles and couples who have Social Security numbers can claim the credit, even if their children dont have SSNs.

- More workers and working families who have income from retirement accounts or other investments can still get the credit. The limit on investment income is now $10,000 and will now rise every year with inflation.

Recommended Reading: How To Do Taxes For Shipt

Parents Who Live Outside The United States

If you and your spouse, if you are married and filing a joint return do not have your main home in one of the 50 states or the District of Columbia for more than half the year, you can still qualify for up to $3,000 or $3,600 for each qualifying child, but the refundability of your Child Tax Credit will be limited.

If You’re A Foster Carer

You cant claim child tax credits for a foster child if you get a fostering allowance, or the childs maintenance or accommodation is paid for by someone other than yourself.

If you arent sure, call the tax credits helpline to check.

HM Revenue and Customs tax credits helpline

Telephone: 0345 300 3900

Relay UK – if you can’t hear or speak on the phone, you can type what you want to say: 18001 then 0345 300 3900

You can use Relay UK with an app or a textphone. Theres no extra charge to use it. Find out how to use Relay UK on the Relay UK website.

If you’re calling outside of the UK: +44 2890 538 192

Monday to Friday, 8am to 6pm

Telephone : 0300 200 1900

Monday to Friday, 8.30am to 5pm

Your call is likely to be free of charge if you have a phone deal that includes free calls to landlines – find out more about calling 0345 numbers.

Recommended Reading: How To Get An Advance On Your Taxes

What To Do If You Are Missing Payments

If you were late applying or for some other reason did not get a July, August, September, October, or November payment, your December payment should have been the full advance amount . This means that instead of up to 6 payments, you received just one in December.

Alternatively, you can claim your full 2021 Child Tax Credit when you file your income tax return in 2022. You will be filing for half of your credit anyway and, if you didn’t receive your full advance payment, you can claim whatever is due to you in April.

Support For American Families

The Child Tax Credit is a tax benefit to help families raising children. Under the American Rescue Plan Act of 2021 that President Biden signed into law on March 11, 2021, advance payments of up to half the 2021 CTC were sent to eligible taxpayers, meaning that most families started receiving monthly payments of $250 or $300 per child without having to take any action. Those who filed tax returns for 2019 or 2020 or signed up to receive the IRS stimulus check started receiving this tax relief automatically.

- Whether they received monthly advance payments or not, eligible families can claim their remaining Child Tax Credit benefits by filing a tax return this year.

- Low-income families with children, including those who have not made enough to be required to file taxes, should file taxes to receive their full benefit.Free tax helpis available to file tax returns.

- For families eligible for the CTC, filing taxes to claim this credit also means many families may also receive thousands of dollars in additional tax relief through the Earned Income Tax Credit , which provides a tax break for low-income workers and families based on their wages, salaries, tips, and other pay, as well as earnings from self-employment. Under ARPA, the EITC is more generous and open to more workers than ever.

- The CTC does not count as income in determining WIC eligibility .

Recommended Reading: Is It Hard To Do Your Own Taxes

Who Is Eligible For The Child Tax Credit

There are eligibility requirements for the taxpayer and the dependent. The taxpayer must meet certain relationship requirements with the dependent, and the taxpayer’s income may limit their ability to claim the Child Tax Credit. The taxpayer must have a social security number, and only one taxpayer may claim the Child Tax Credit for any single dependent .

It’s often more difficult to meet the requirements for the qualifying child. The individual must be under the age of 18 at the end of the year, provide no more than half of their own financial support, and have lived with the taxpayer for at least half of the year. The qualifying child must be the taxpayer’s son, daughter, stepchild, brother, sister, stepsibling, half-sibling, or a descendant of any of these.

Additional Child Tax Credit

The additional child tax credit, which offered up to $2,000 for every qualifying child, was eliminated under the Tax Cuts and Jobs Act in 2018. This credit effectively gave you a refund if the CTC reduced your tax bill to less than zero. You should note that if you need to file a return for a tax year before 2018, you can find information for the ACTC on the Form 1040.

Starting with the 2018 tax year, there is an additional $500 Credit for Other Dependents . This allows you to claim non-child dependents, such as a parent, and dependents who are college students . The eligibility requirements are very similar but you cannot claim the ODC for a dependent who qualifies for the CTC.

Don’t Miss: When To File Quarterly Taxes

The Earned Income Tax Credit Puts Thousands Of Dollars In Workers Pockets

The Earned Income Tax Credit is a tax credit that provides a tax break for low-income workers and families based on their wages, salaries, tips, and other pay, as well as earnings from self-employment.

The EITC has existed for decades but the IRS estimates that 1 out of 5 eligible Americans do not claim the credit. This year, thanks to President Bidens American Rescue plan, the credit is more generous and open to more workers than ever.