Work From Home Tax Relief

You can claim this tax relief if you work from home. It can cover the expenses for your electricity costs. Your employer can pay you 3.20 tax-free a day to cover your expenses. You should know that your employer is not legally obliged to make this payment. If you dont receive this reimbursement, you can claim tax back on a number of household expenses only for the time you work. This includes:-Electricity / Heating

-Broadband

What Is A Tax Credit For Health Insurance

A health insurance or premium tax credit can reduce the amount you spend on insurance plans purchased through HealthCare.gov or a state marketplace. You must meet income criteria to qualify. Discounts can be applied monthly to reduce your health insurance bill, or you can receive the credits as a refund when filing your federal income taxes.

Advance Child Tax Credit

Because of the COVID-19 pandemic, the CTC was expanded under the American Rescue Plan of 2021. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. When you file your 2021 tax return, you can claim the other half of the total CTC.

Learn more about the Advance Child Tax Credit.

Also Check: What’s The Capital Gains Tax

The Premium Tax Credit

The IRS will soon mail letters on behalf of the Center for Medicare & Medicaid Services, sharing information about obtaining Marketplace healthcare coverage. More information is available in the IRS Statement about Letter 6534.

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. To get this credit, you must meet certain requirements and file a tax return with Form 8962, Premium Tax Credit .

2021 and 2022 PTC Eligibility. For tax years 2021 and 2022, the American Rescue Plan Act of 2021 temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer with household income above 400% of the federal poverty line cannot qualify for a premium tax credit.

2021 Unemployment Compensation. If you, or your spouse , received, or were approved to receive, unemployment compensation for any week beginning during 2021, the amount of your household income is considered to be no greater than 133% of the federal poverty line for your family size and you are considered to have met the household income requirements for eligibility for a premium tax credit. Keep any supporting documentation related to receiving or the approval to receive unemployment compensation with your tax return records.

The Catch To Tax Credits

-

Some tax credits are nonrefundable. That means that if you dont owe a lot in taxes to begin with, you dont get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesnt get you a $400 tax refund check.

-

Some tax credits are refundable. If you qualify to take refundable tax credits things such as the earned income tax credit or the child tax credit the value of the credit goes beyond your tax liability and can result in a refund check.

-

The IRS lays out specific criteria you must meet to qualify for both nonrefundable and refundable credits.

Read Also: When Do We Get Our Taxes

Whats The Difference Between A Tax Deduction And A Tax Credit

Tax deductions are similar to credits, but they dont directly lower your tax bill. Instead, they reduce your taxable income, and if your taxable income is lower, your tax bill will be lower.

How does all that work? Well, if youre in the 22% tax bracket, a $1,000 tax deduction will lower your taxable income by $1,000, which will cut your tax bill by $220. Thats pretty good! But a $1,000 tax will actually save you $1,000 in taxes.

You dont have to be a rocket scientist to see that tax credits are awesome!

Lets look at an example: Say your income is $40,000 per year, putting you in the 12% federal income tax bracket. To figure out what youd owe in taxes without any credits or deductions, multiply your income by 12%. In real life, not all your money is taxed at 12% because of how tax brackets and tax rates work, but for the sake of this example, were keeping it super simple.

$40,000 x .12 = $4,800

That means without any credits or deductions, youll shell out $4,800 for income taxes.

Now, if you get a $1,000 tax deduction, your taxable income drops down to $39,000. So, lets do that same calculation again with your new taxable income to figure out your savings with a deduction.

$39,000 x .12 = $4,680

Voila! With a $1,000 tax deduction, your taxes fell from $4,800 to $4,680, giving you $120 in tax savings! And heres a pro tip: If you ever need to figure out how much a deduction will save you on your tax bill, just multiply your tax rate times the amount of the deduction.

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Don’t Miss: Can I Do My Taxes Myself

How Much Can You Deduct

The amount of money that you can deduct on your taxes may not be equal to the total amount of your donations.

-

If you donate non-cash items, you can claim the fair market value of the items on your taxes.

-

If you donated a vehicle, your deduction depends on if the organization keeps the car or sells it at an auction. A Donors Guide to Vehicle Donation explains how your deduction is determined.

-

If you received a gift or ticket to an event, you can only deduct the amount that exceeds the value of the gift or ticket.

Note: Limits on cash and non-cash charitable donations have increased or been suspended. Learn more about charitable deductions in 2021.

Do I Need To Hold A Certification Or License To Claim The Investment Tax Credit

A certification or license is not required for entities who want to make use of the Investment Tax Credit. However, companies should ensure that they invest in domestically-sourced technologies. The type of technology used in the energy generation project, as well as the period of construction, are factors that are considered in the Investment Tax Credit.

Read Also: How Long Should I Keep Tax Records

Calculating Costs And Benefits

The LIHTC is estimated to cost around $9.5 billion per year. It is by far the largest federal program encouraging the creation of affordable rental housing for low-income households. Supporters see it as an effective program that has substantially increased the affordable housing stock for more than 30 years. LIHTC addresses a major market failurethe lack of quality affordable housing in low-income communities. Efficiencies arise from harnessing private-sector business incentives to develop, manage, and maintain affordable housing for lower-income tenants.

Critics of the LIHTC argue that the federal subsidy per unit of new construction is higher than it needs to be because of the various intermediaries involved in its financingorganizers, syndicators, general partners, managers, and investorseach of whom are compensated for their efforts. As a result, a significant part of the federal tax subsidy does not go directly into the creation of new rental housing stock. Critics also identify the complexity of the statute and regulations as another potential shortcoming. Another downside is that some state housing finance authorities tend to approve LIHTC projects in ways that concentrate low-income communities where they have historically been segregated and where economic opportunities may be limited. Finally, while the LIHTC may help construct new affordable housing, maintaining that affordability is challenging once the required compliance periods are over.

What Are Carbon Credits

Carbon credits, often referred to as carbon allowances, can be thought of as a unit of measurement however, they have a tradeable component. Carbon credits ARE NOT the same as carbon offsets.

Carbon credits only exist in jurisdictions that are governed by whats called a Cap & Trade system .

Carbon credits are created by the governing organization and allocated to individual companies within that jurisdiction. A single credit represents 1 tonne of CO2e that the company is allowed to emit.

Read Also: When Will Child Tax Credit Start

How Do Tax Credits Work In Practice

Suppose a taxpayer, Chris, who has one dependent, comes to the end of the filing process and owes the IRS $1,300 . A tax credit would reduce this amount owed by the amount of the credit the taxpayer is eligible for. In this case, Chris would want to claim the Child Tax Credit, which is valued at a maximum of $2,000 per child . If he took no other credits and met the income thresholds, Chris would receive a $100 refund .

Lets assume that Amy is a taxpayer who cares for her elderly mother . Under current law, Amy may qualify for the Child and Dependent Care Tax Credit , which reaches its maximum at $1,200. Amy has $1,000 in tax liability. If she meets the income thresholds, is eligible for the maximum credit, and takes no other credits, she will not owe the IRS any taxes. Even though the maximum credit is greater than her total tax liability, because the CDCTC is nonrefundable, the credit can only reduce her liability until it reaches zero.

| Refundable Credit | |

|---|---|

|

Chris Refund = $100 |

Amys Liability: $0 |

Because refundable credits often result in refunds, they are more expensive in terms of lost revenue.

What Is The Small Business Health Care Tax Credit

Usually, small business owners are not required to offer health insurance if they have fewer than 50 full-time employees. Therefore, the small business health care tax credit, which was created under the ACA, encouraged small business owners to offer health insurance to their employees.

If a small business or tax-exempt firm meets a number of qualifications, it is eligible to receive the federal tax credit for two consecutive taxable years.

You and your business would be eligible for the credit if you fulfill all of the following requirements:

- You purchased insurance through the Small Business Health Options Program marketplace.

- You have fewer than 25 full-time employees.

- You pay average wages of less than $56,000 per year.

- You pay at least half the cost of your full-time employees’ health insurance premiums.

If you qualify, the federal government gives you a subsidy to help pay for your portion of employee premiums. The size of your workforce determines the amount of credit you can receive. For example, if your business has fewer than 10 full-time employees, you can receive the maximum credit possible. A larger business with 24 employees would qualify for a lower tax credit.

Qualifying small businesses can claim this tax credit by filing Form 8941 with their taxes.

You May Like: How Do You Get Tax Returns

How Do Tax Creditswork

Tax is calculated as a percentage of your income. Your tax credits arededucted from this to give the amount of tax that you have to pay. A tax creditwill reduce your tax by the amount of the credit.

Everyone is entitled to a personal tax credit. There are personal taxcredits for:

- People who are married or in a civil partnership

- People who are widowed or are surviving civil partners

If you are in employment, getting a pension or getting a taxablesocial welfare payment you are alsoentitled to the EmployeeTax Credit of 1,700.

So, for example, if you are single and in employment you are entitled to anannual tax credit of 1,700 and the Employee Tax Credit of 1,700. When thetotal amount of tax you owe is calculated, 3,400 will be deducted from this.

This means that if you earn 17,000 or less you do not pay any income tax. However you may need to pay a Universal SocialCharge and PRSI.

If you are married or in a civil partnership, you have the option of sharingtax credits and tax bands between you and your spouse or civil partner. If onespouse or civil partner works in the home, caring for one or more dependentpeople, you may be able to claim a Home Carer Tax credit. You can readmore about taxationof married people and civil partners.

Will I Lose Out If I Didnt Sign Up In Time To Get A Payment On July 15

No. Everyone can receive the full Child Tax Credit benefits they are owed. If you signed up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign-up in time for monthly payments in 2021, you will receive the full benefit when you file your tax return in 2022.

Recommended Reading: How Do Tax Write Offs Work For Llc

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

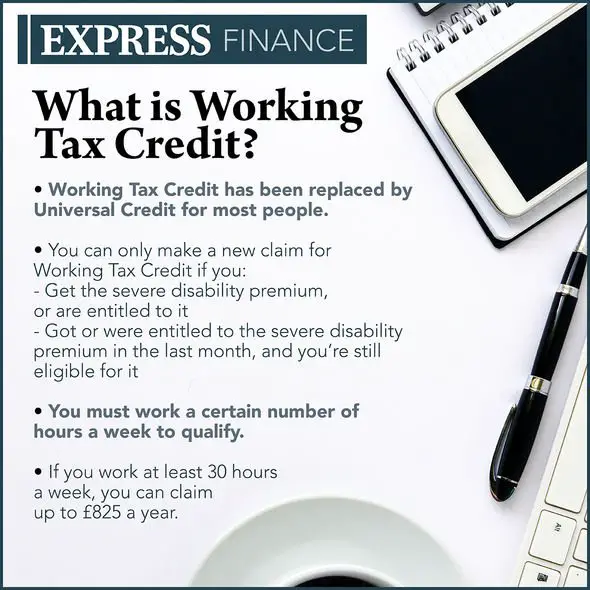

If Your Hours Change Regularly

If the number of hours you work from week to week are predictable, HMRC call this a ‘normal working pattern’, even if your hours are different each week. You can give HMRC your average weekly hours over whatever period your normal working pattern is. For example, if it’s common for you to work 20 hours and 40 hours on alternate weeks, you could put your normal working hours as 30 hours per week.

If your working hours are unreliable and irregular, you might not be able to say what hours are normal for you. If this is your situation, contact HMRC to get advice on how to describe your weekly hours. Or you can contact your nearest Citizens Advice.

Don’t Miss: Do You Have To Pay Taxes On Life Insurance Payout

What Types Of Credits Are There

Tax credits can be divided into two types: Refundable and nonrefundable. A refundable tax credit allows a taxpayer to receive a refund if the credit they are owed is greater than their tax liability. A nonrefundable credit allows a taxpayer to only receive a reduction in their tax liability until it reaches zero.

What Is An Education Tax Credit

Education tax credits incentivize students to pursue higher education by reducing their tax obligation. The amount of this reduction is based on the money the taxpayer has put toward their education it is matched dollar for dollar up to a specified amount.

There are two federal education tax credits: the AOTC and the LLC.

Don’t Miss: Do I Owe Federal Taxes

Tax Credits: How Do Tax Credits Work

In this section you will find information about how the tax credits system works.

Tax credits and coronavirus: HMRC made several changes to tax credits as a result of the coronavirus pandemic. This page explains all of those changes.

The annual cycle: Unlike other benefits, tax credits are based on a tax year. This section explains the yearly cycle and critical dates during the tax year including claims starting , changing , renewals and finalisation.

Forms, notices and checklists: In this section you will find links to the most common current forms and notices used by HMRC to communicate information to claimants. You will also find archived versions of forms, notices and checklists used in previous years.

Calculating tax credits: Calculating tax credit awards can be complicated. This section explains how awards should be calculated under the legislation as well as quicker ways for advisers to do calculations that are still accurate.

Who can claim: In this section you will find information about the basic conditions for claiming including single/joint claims, residence and immigration requirements.

Making a claim: In this section you will find information about the different ways of making a claim for tax credits including protective claims . It also explains how claims are processed once received by HMRC and what steps need to be taken to request backdating.

Understanding the disregards: This section explains in detail how the disregards work and includes several examples.

How Do Carbon Credits Work

The number of credits issued to a particular company or organization represents its emissions limit .

If a management team is able to limit company emissions below its cap, then the organization has a surplus of carbon credits they may wish to retain these for future use alternatively, they may sell them immediately into the compliance carbon market, which is overseen by the regulatory body.

If a management team cannot keep company emissions under its limit, then they are non-compliant and must make up that difference. Over-emitters turn to the carbon market to purchase carbon credits from an under-emitter within their Cap & Trade network.

Recommended Reading: How Can I Keep My Tax Return From Being Garnished