How Do I Make Payment Arrangements

Do you have outstanding tax debt and are unable to settle the amount in one payment?SARS provides for a deferment of payment arrangement, or instalment payment arrangement for outstanding tax debt. You may request and enter into an instalment payment arrangement with SARS. It allows you to pay your outstanding debt in one sum or in instalments over time until you have paid your entire debt including applicable interest. This agreement however would be subject to certain qualifying criteria.A payment arrangement may be requested through:

- To see the steps on how to make payment arrangements on eFiling, .

- Payment arrangement can be made once the debt is outstanding

Criteria for payment arrangements

SARS may enter into a payment agreement only if:

- The taxpayer suffers from a lack of assets or liquidity which is reasonably certain to be remedied in the future

- The taxpayer anticipates income or other receipts which can be used to satisfy the tax debt

- Prospects of immediate collection activity are poor or uneconomical but are likely to improve in the future

- Collection activity would be harsh in the particular case and the deferral or instalment agreement is unlikely to prejudice tax collection

- The taxpayer provides the security as may be required

- All outstanding returns and/or recons are submitted.

Address Your Tax Situation On Time

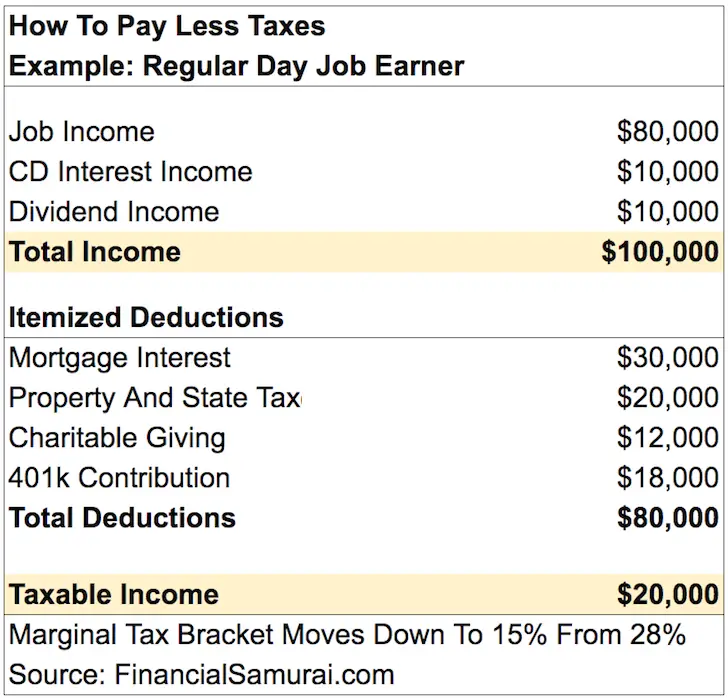

Tax debt can quickly get out of hand if you put off dealing with it. If you fail to pay on time, the IRS will tack on penalties and interest to your outstanding balance. The monthly interest is equal to the federal short-term rate plus 3%. The monthly penalty for not paying on time begins at 0.5% of your tax debt. Other penalties can be added at an even higher rate, especially if you also fail to file your taxes at all.

These amounts can add up quickly, adding a large extra burden onto the taxes you already owe. If you leave your taxes unpaid for too long, the IRS can impose levies and liens on your income and property.

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Also Check: Do You Have To File Taxes By April 15th

Option #: Use Your Credit Card

This option depends on your credit card interest rate and how desperate your situation is. Using credit is a good option if youre paying off tax debt with a low-interest credit card. Its generally not a good idea to use debt to pay off debt, but it could be your only choice if youre facing wage garnishments or asset seizures.

Heres what you need to use credit:

File Your Return With The Right Tax Agency

After you review your sales tax, you can e-file your return on your tax agencys website, or file by mail.

Most states encourage businesses to e-file. But if you cant file online, you can check your tax agencys website for more info on how to mail your return. While you can’t e-file right in QuickBooks, you can manually enter your tax payment in QuickBooks right after you file to keep your sales tax info up to date.

You may choose to prepay your sales tax. A sales tax prepayment is like a deposit paid ahead of time to cover future sales tax liability before the due date. Prepayment requirements, calculations, due dates, and thresholds vary for each state.

To find out how your state handles sales tax prepayments, visit the IRS State Government Websites page.

Also Check: Do My Taxes Myself Online

Tax Rates And Allowances

About Us

Which? Limited is registered in England and Wales to 2 Marylebone Road, London NW1 4DF, company number 00677665 and is an Introducer Appointed Representative of the following:Inspop.com Ltd for the introduction of non-investment motor, home, travel and pet insurance products . Inspop.com Ltd is authorised and regulated by the Financial Conduct Authority to provide advice and arrange non-investment motor, home, travel and pet insurance products and is registered in England and Wales to Greyfriars House, Greyfriars Road, Cardiff, South Wales, CF10 3AL, company number 03857130. Confused.com is a trading name of Inspop.com Ltd.LifeSearch Partners Limited , for the introduction of Pure Protection Contracts, who are authorised and regulated by the Financial Conduct Authority to provide advice and arrange Pure Protection Contracts. LifeSearch Partners Ltd is registered in England and Wales to 3000a Parkway, Whiteley, Hampshire, PO15 7FX, company number 03412386.

Pay As Quickly As Possible

If you owe tax that may be subject to penalties and interest, dont wait until the filing deadline to file your return.

Send an estimated tax payment or file early and pay as much tax as you can.

Even if you choose to file an extension, any taxes owed are still due on the filing deadline. Therefore if you dont pay by April 17, you are subject to those extra penalties and fees.

Read Also: How Long Does It Take For Taxes To Come Back

Check On Your Rewards

Before you use a card to earn rewards on your tax payments, double-check to see what you’ll earn back. That’s true whether you want to use an existing card or apply for a new one that offers a robust sign-up bonus. Remember: You want to be able to earn enough rewards to help offset any fees for paying your tax bill with a credit card.

Exceptions To Underpayment Of Tax Penalties

If you underpaid your taxes this year but owed considerably less last year, you typically dont pay a penalty for underpayment of tax if you withheld at least as much as you owed last year. That, of course, is only true if you pay by the due date this year.

TaxAct can help determine if the safe harbor rule reduces your penalties and interest. Simply enter last years tax liability and the software will do the calculations for you.

You may also reduce your penalties and interest using the annualized income method if you received more of your income in the latter part of the year.

Read Also: How Much Is My Check After Taxes

How To Pay Off The Irs Using Your Credit Card

Paying your taxes with a credit card is another way you could avoid interest and penalty fees from the Internal Revenue Service. If you face asset seizures or expect cash payment after the IRS deadline, paying your debt with your credit card is a good option for you.

You can clear your tax debts by using a credit card as a short-term loan and pay the credit card bill later. Before paying off IRS debt with your credit card, ensure your credit limit can account for the tax debt amount in order to avoid interests fees and penalties.

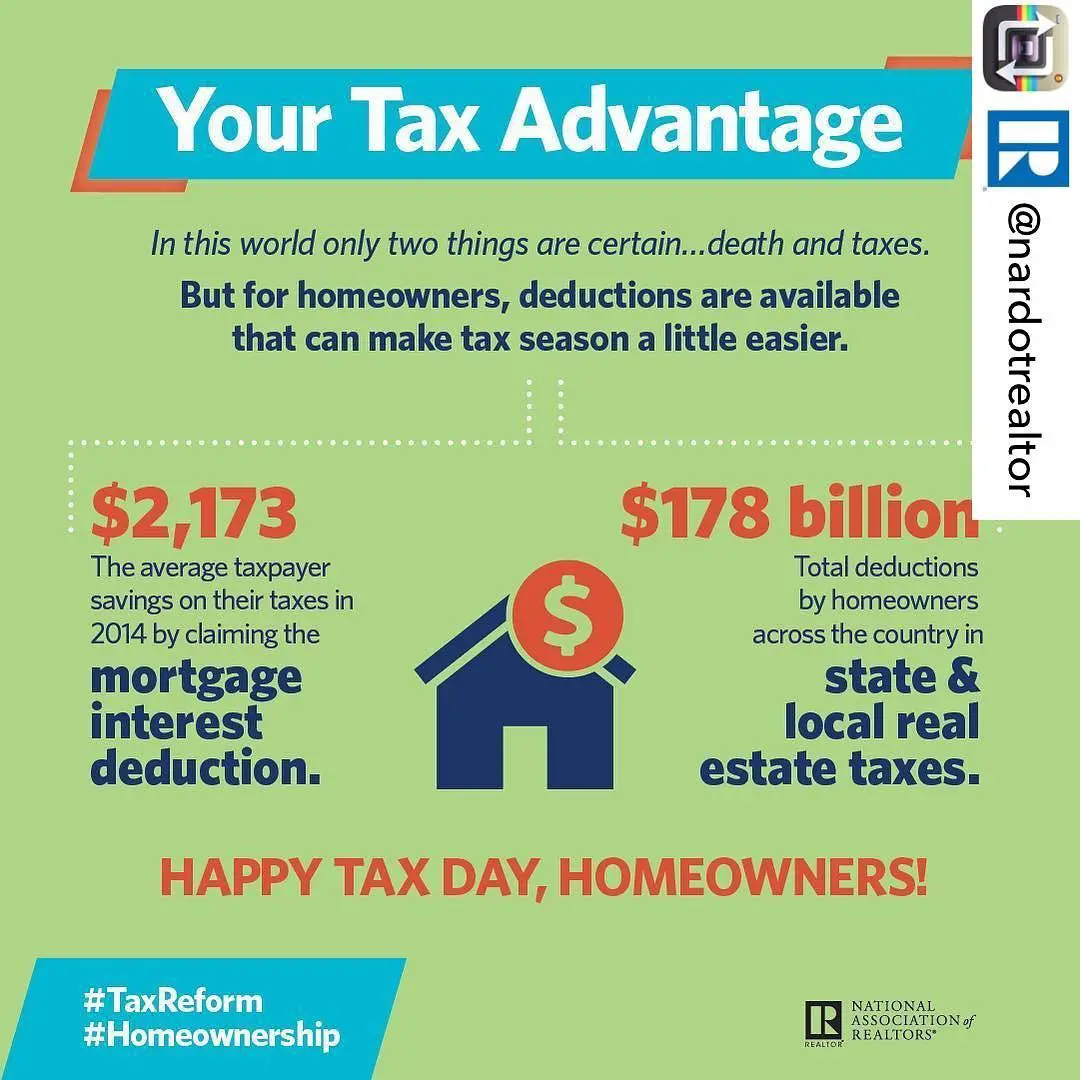

Paying Off Tax Debt By Refinancing Your Home

If you’re a homeowner, paying off your tax debt by refinancing your home is a potential solution to save you from IRS interest and penalty fees. Before refinancing your home, the discount rate, refinancing fee, monthly payment, interest rate, and equity are factors you should consider. The Internal Revenue Service also clearly states that your home must have enough equity to be refinanced.

Many taxpayers ask,can you buy a house if you owe taxes? Yes, you can qualify for home loans even if you owe taxes. Taxpayers should explore this tax settlement option with a certified public account or experienced tax debt attorney. Brotman Law is home to knowledgeable and experienced tax attorneys that can help you clear your IRS debts by refinancing your home.

Recommended Reading: How Can You Track Your Tax Refund

Should You Pay Off Your Debt Or Invest

The rule of thumb is: If you can earn more on your investments than your debts will cost you in interest, maybe it makes more sense to invest. Our suggestion is to pay off that high-interest debt before gambling on risky investments, though. Its also important to consider if high-risk investing and spending is what got you into debt in the first place. If thats the case, debt payoff sounds like the way to go.

Using A Personal Loan To Pay Off Irs Debt

Tax debt is soul-crushing for many taxpayers, and failure to remit quick payment to the Internal Revenue Service often leads to fines and penalties. The Internal Revenue Service charges taxpayers 5% interest on unpaid taxes and from 0.5% to 25% in penalties.

Using personal loans to pay off IRS debt is one way to resolve your issue, and a way to avoid IRS interest or penalty fees. Your debt to income ratio, high-interest rates, and lender fees are a few factors to consider before taking out a personal loan. Taxpayers with good credit scores can qualify for $100,000 in personal loans, leaving them enough to repay their tax debt.

Most lenders offer people with good credit an interest rate as low as 3% for personal loans. Your bank account statements, personal ID, credit report, employment information, and collateral are all needed when applying for a personal loan. The application fee is minimal and generally takes a few days before a bank transfer or money order is approved.

Also Check: How Much Do You Pay In Taxes For Stocks

How To Pay Off Large Tax Debt

If youre facing a large tax debt and know you wont be able to pay it back, making a settlement deal with the IRS might be your best option. Youll need to submit an Offer in Compromise request that cites your financial hardship and inability to pay. If approved, you may be able to knock your large tax debt down into a smaller, more manageable amount.

Start Smart And Maximize Your Down Payment

While its possible to get away with only putting 5% to 10% down on a home purchase, the single biggest cost-cutting measure you can do is to maximize your down payment. Not only will you owe less, reducing the overall interest you pay, but youll also avoid having to pay mortgage loan insurance premiumsa fee buyers pay for the privilege of putting less than 20% down on a home. This insurance doesnt protect you, the buyer, but the bank should you default on your mortgage loan.

One good way to maximize your down payment is to use the federal Home Buyers Plan, which lets you withdraw up to $35,000 in a calendar year from your registered retirement savings plan to put toward a home you will live in or build.

Don’t Miss: What Age Can I Stop Filing Taxes

Option #: Apply For A Personal Loan

The IRS charges 5% interest on unpaid taxes. They also add between 0.5% and 25% in additional penalties. Depending on your credit score, personal loans to pay off tax debt could have an interest rate higher than 5%. Eliminating the penalties more than makes up for that.

Heres what you need:

- Employment information

Borrow From Family And Friends

If you have friends or family who are willing to help, you may want to ask them for a loan to pay your taxes. A personal loan can be especially useful when you need short-term help. For instance, if youre expecting a payment from a client, but your taxes are due before that, you may want to borrow from friends and family.

You May Like: Can I File Taxes If I Have No Income

Record Your Tax Payment In Quickbooks

Once you’re done filing, it’s time to keep your sales tax info in QuickBooks up to date. Here’s how to manually record your tax payment to zero out your sales tax payable.

Interest Rate For Corporate Income Tax

You pay tax interest for corporate income tax if the Tax Administration is unable to issue an assessment on time. For example, because you filed your tax return for your business too late or for an incorrect amount. This interest rate was temporarily reduced to 4%, but this has been reinstated at 8%.

Also Check: How Do I Find Out My Property Taxes Paid

Get On An Installment Plan

The IRS understands that many people with unpaid taxes dont have the ability to make one-off payments. This is why theyre willing to offer installment plans to make settling tax debt easier.

In a nutshell, youll have up to 72 months to pay off what you owe. Youre free to choose a timeframe thats suitable for you. The longer the duration, the lower your monthly payments.

Although your failure-to-pay penalty will reduce by half when you enter into an installment agreement, the interest will keep accruing until you fully pay off the debt

What Happens If You Dont Pay Taxes

If you filed your tax return but arent able to pay your bill, you have a couple of other options besides setting up a payment plan.

The failure-to-pay penalty is 0.5% per month up to 25% of your unpaid taxes.7 Its much lower than the failure-to-file penalty, so the lesson here is to always file your taxes on time. If youre proactive and set up a monthly payment plan, the IRS will lower your failure-to-pay penalty to 0.25% per month until your bill is paid in full.8

Recommended Reading: What Taxes Do Retirees Pay In Pennsylvania

Tax Debt: 3 Steps To Resolve Your Debt With The Irs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

You can avoid many things in life dishes in the sink, getting an oil change, yard work but one thing thats unavoidable is tax debt.

Over 18 million Americans owed taxes in September 2014, according to the most recent data from the IRS. Meanwhile, an estimated 10 million face tax penalties each year, the IRS found.

Here are three tips to help you handle your tax debt to lessen penalties and properly resolve your obligation.

Recommended Reading: Look Up Employer Ein

Untaxed Income And Late Fees

There are specific deadlines for filing your tax return, paying your taxes and, in some circumstances, informing HMRC of new income.

If you file your return or pay your taxes late , you may have to pay a penalty. Interest is also charged where tax is paid late.

If you receive untaxed income that is liable for tax, you have to declare this to HMRC your tax office will tell you how to do this. You pay the extra tax either through a tax return or via an adjustment to your tax code if you’re a PAYE taxpayer.

You must tell your tax office about new untaxed income by 5 October following the end of the tax year in which you received the income. So if you received untaxed income during the 2021-22 tax year, you’ll have to tell your tax office about this by 5 October 2022.

Read Also: How Do Donations Help With Taxes

What Happens To My Property Taxes When I Pay Off My Mortgage

What happens to my property taxes when I pay off my mortgage? I am finally done paying off my mortgage, but Iâm wondering if my property taxes will change. Will my real estate taxes change or will my property be reassessed after making my last mortgage payment?

Q: Iâm just about to pay off my mortgage. Iâve been waiting for this day for a long time. But now Iâm wondering if my property taxes will change or my property be reassessed after I pay off the mortgage?

A: Congratulations on reaching this major milestone. Few mortgages get paid off because the owner has made regular payments over a long period of time. Most mortgages get paid off because the owner has refinanced or has sold the property.

Your real estate taxes should not change in any way due to paying off your loan â or taking on a new loan for that matter. Local governmental taxing bodies base real estate taxes on the value of a property. The way they come up with that value can be confusing, complicated, convoluted, unfair and in some cases strange and illogical, but in the end, the value they come up with for your property shouldnât take into account whether you have a mortgage on the home.

On the plus side, now that your mortgage is paid off, you wonât have to make those monthly mortgage payments, you will own your home free of any mortgage and will have that much more money in the bank going forward. Thanks for your question.