Applying For A Firpta Withholding Certificate Without A Tax Id

If the transferor or the transferee does not have a tax identification number, they can request one when they apply for the FIRPTA withholding certificate. To request a tax ID, file Form W-7 with Form 8288-B.

Then, mail the entire package to

ITIN Operation

The IRS typically takes 10 days to process requests for tax identification numbers.

Is Filing Single The Same As Filing As Head Of Household

No, filing single is not the same as filing head of household. The IRS specifies thatthe head of household must be unmarried, cover at least 50% or more of expenses in a household, and have a qualifying dependent. If you meet these criteria, youre better off using head of household as your tax filing status because these individuals get preferential tax treatment.

Single Withholding Vs Married Withholding

The three boxes on the W-4 form , and head of household) correspond to the five filing statuses taxpayers can choose from when they file their annual Form 1040 tax returns.

Single taxpayers generally have two options: File as a single filer or, if they are unmarried and supporting a qualifying person, as a head of household . People who lose their spouse in the tax year, meanwhile, can check the qualifying widow box.

Married taxpayers, on the other hand, have a choice to make. They can opt to file jointly on the same tax return, or on different tax returnswhichever is more advantageous in their situation. In most cases, filing a joint tax return will result in a lower tax bill.

Which box you check on your W-4 will determine your standard deduction and the tax rates that will compute your withholding. All else being equal, married taxpayers who plan to file jointly will have less withheld on a percentage basis than singles or people with other statuses.

If your marital status changes, you’ll want to submit a new W-4 form so your employer can adjust your tax withholding.

Also Check: How To Calculate Income Tax Rate

It’s Easy To Account For Tax Credits And Deductions

The W-4 form makes it easy to adjust your withholding to account for certain tax credits and deductions. There are clear lines on the W-4 form to add these amounts you can’t miss them. Including credits and deductions on the form will decrease the amount of tax withheld, which in turn increases the amount of your paycheck and reduces any refund you may get when you file your tax return.

Workers can factor in the child tax credit and the credit for other dependents in Step 3 of the form. You can also include estimates for other tax credits in Step 3, such as education tax credits or the foreign tax credit.

For deductions, it’s important to note that you should only enter deductions other than the basic standard deduction on Line 4. So, you can include itemized deductions on this line. If you take the standard deduction, you can also include other deductions, such as those for student loan interest and IRAs. However, do not include the standard deduction amount itself. It could be “a source of error if folks just put in their full amount,” warns Isberg.

If you have multiple jobs or a working spouse, complete Step 3 and Line 4 on only one W-4 form. To get the most accurate withholding, it should be the form for the highest paying job.

What Should I Put On My W

If you got a huge tax bill when you filed your tax return last year and dont want another, you can use Form W-4 to increase your withholding. Thatll help you owe less next time you file. If you got a huge refund last year, youre giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.

Here are some steps you might take toward a specific outcome:

Read Also: How Much Tax Will I Pay On 15000 Self Employed

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

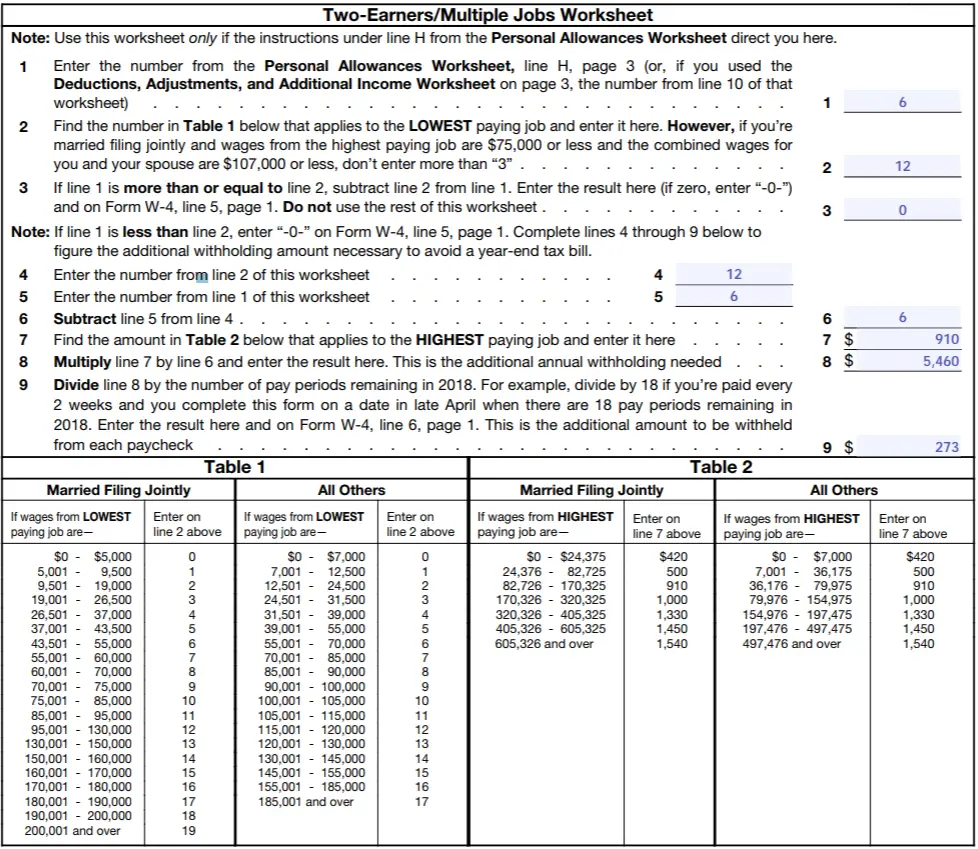

- The Wage Bracket Method:The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

How Do I Affect Withholding Now

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in.

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

Finally, Section 4 of the W-4 is a bit more indefinite. Here youll be able to state other income and list your deductions, which can help reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

You May Like: How To File Taxes If Self Employed And Employed

Calculating Your Withholding Tax

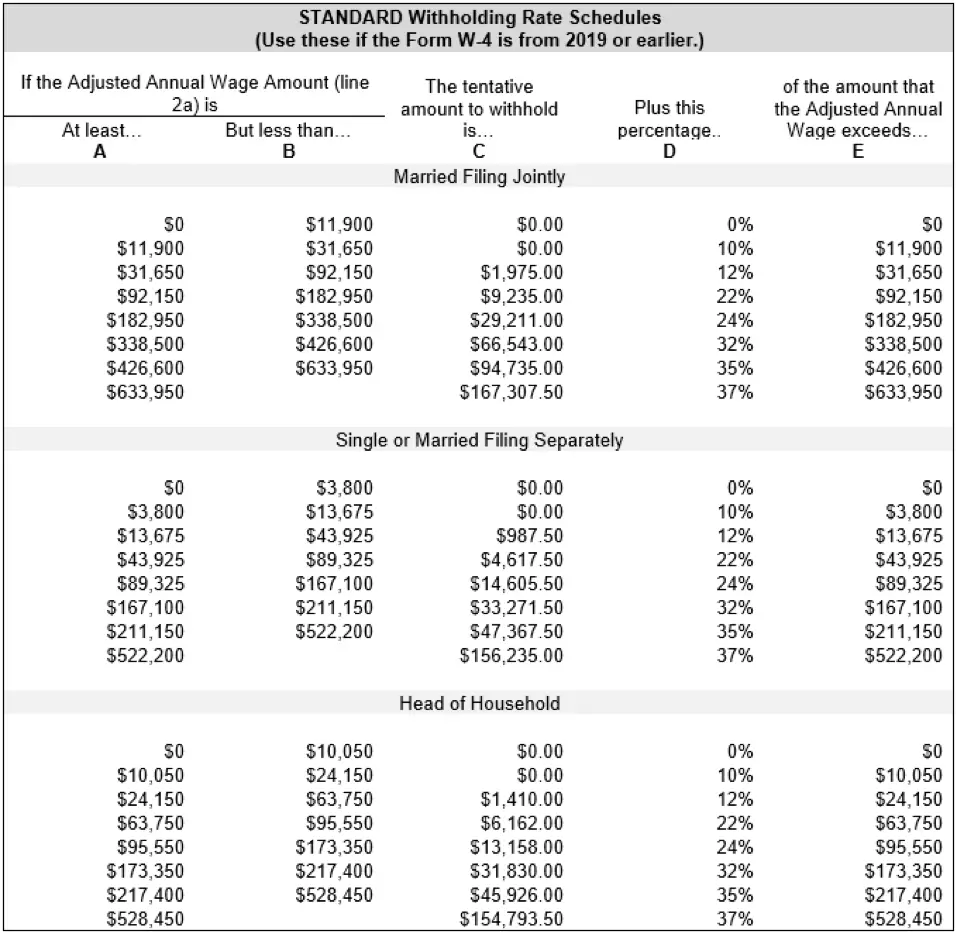

The IRS publishes and updates marginal tax rates annually. The rates for the 2022 tax year are highlighted in the table below:

| Tax Rate |

- The end date of your most recent pay period

- Your wages per period and the year-to-date totals

- The amount of federal income tax per pay period and the total paid year-to-date

- Whether you take the standardize or itemize your deductions

- The amount of any tax credits you take

The estimator tells you how much of a refund or tax bill you can expect. You can also choose an estimated withholding amount that’s suitable for you.

Withholding Rates For Lump

Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use.

Use the following lump-sum withholding rates to deduct income tax:

- 10% on amounts up to and including $5,000

- 20% on amounts over $5,000 up to and including $15,000

- 30% on amounts over $15,000

Read Also: Is Aaa Membership Tax Deductible

How To Apply For Firpta Without Form 8288

To apply based on reasons four, five, or, six, you do not file Form 8288-B. Instead, you need to provide a written application, and the information needs to be labeled with the following letters and numbers.

How To Apply For A Firpta Withholding Certificate

When you apply for a FIRPTA withholding certificate, you need to choose from one of six categories to explain why you’re applying, and the application process varies based on which category you select. Here are the six options:

If you’re applying for a FIRPTA withholding certificate for reasons one, two, or three, you should file Form 8288-B .

Also Check: Can I Use Bank Statements As Receipts For Taxes

Changing Your Withholding Allowances

Since your circumstances might change from time to time, its important to review your tax withholding allowances on a regular basis.

Life changes that might determine your withholding allowances include:

- Birth or adoption of a child

- Purchase of a new home

- New job or second job

- Increase in interest, dividend, or self-employment income

- Increase in your itemized deductions

In 2021, each withholding allowance you claim reduces your taxable income by $4,300. If you claim more allowances than you have a reasonable basis for, the IRS can penalize you.

To help determine how many tax withholding allowances you should claim, it might help to look at your returns or payments from previous years. If you received a large refund, consider increasing the number of allowances you claim so less tax is withheld. If you paid the IRS a large sum when you filed your return, decrease the number of allowances you claim. An H& R Block professional can help answer any further tax withholding questions you might have.

How Much In Taxes Should I Withhold From My Pension

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

When you start a pension, you can choose to have federal and state taxes withheld from your monthly checks. The goal is to withhold enough taxes that you won’t owe much money when you file your tax return. You don’t want to get a large refund, either, unless you like lending money to Uncle Sam.

If you choose not to have any taxes withheld and you underpay your taxes, you could end up owing taxes plus an underpayment penalty. To avoid those fates, you’ll want to estimate your income for the year and set your tax withholding appropriately.

Read Also: When Is Taxes Due This Year

When To Check Your Withholding:

- Early in the year

- When the tax law changes

- When you have life changes:

- Lifestyle – Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income – You or your spouse start or stop working or start or stop a second job

- Taxable income not subject to withholding – Interest income, dividends, capital gains, self employment income, IRA distributions

- Adjustments to income – IRA deduction, student loan interest deduction, alimony expense

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, child tax credit, earned income credit

Everyone Should Check Withholding

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, its also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

Read Also: How Much To Do Taxes At H& r Block

Personal Tax Credits Returns

You may have to ask your employees or your pensioners to complete a federal and a territorial personal tax credits return using a federal Form TD1 and a territorial Form TD1.

For more information, go to Chapter 5, “Deducting income tax” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

Estimate Your Tax Liability

Now that you know your projected withholding, the next step is to estimate how much youll owe in taxes for this year.

The IRS provides worksheets to walk you through the process, which is basically like completing a pretend tax return.

If youre married and filing jointly, for example, and your taxable income is around $107,000 for the 2022 tax year, that puts you in the 12% tax bracket. But you actually wont pay 12% on your entire income because the United States has a progressive tax system. After deductions, your tax liability, or what you owe in taxes, will be about $9,300.

Remember, federal taxes arent automatically deducted from self-employment income. If you have a side business or do freelance work, its especially important to factor that income into your tax equation to make sure you dont end up with a big tax bill at the end of the year.

Also Check: How To Get Maximum Tax Deductions

When To Change How Much Tax Is Withheld From Your Pension

When you are working, you can change the amount of tax withheld from your paycheck each year. In retirement, you can do that, too. When your tax situation changes, you will want to adjust your tax withholding.

For example, in your first year of retirement, you may have a salary for part of the year, and you may have a spouse who is still working, so you may need to withhold a larger amount in taxes from your pension for that year. In subsequent years, your income may change, which means you should adjust your tax withholding.

The following events may trigger a need to change your tax withholding in retirement:

- Your spouse stops working.

Choosing How Many Allowances To Claim

Knowing how many allowances to claim on a W-4 can be a little tricky. You do not want to pay too much or too little. TaxShark makes the following recommendations:

- Claiming zero allowancesThis is good if you are a dependent on someone elses tax forms.

- Claiming one allowanceIt will work well if you are single and have just one job. Also, claim one allowance if you are married and filing jointly, or if filing as head of household.

- Claiming two allowancesThis is for singles with more than one job, or if you are married and want to split the allowances between spouses.

- Claiming three allowancesClaim three if you are married and have one child, or more than one child.

- Single with childrenIf you have one child, you should claim two allowances.

You May Like: How Much Of Social Security Income Is Taxed

How Withholding Is Determined

The amount withheld depends on:

- The amount of income earned and

- Three types of information an employee gives to their employer on Form W4, Employee’s Withholding Allowance Certificate:

- Filing status: Either the single rate or the lower married rate.

- Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

- Additional withholding: An employee can request an additional amount to be withheld from each paycheck.

Note: Employees must specify a filing status and their number of withholding allowances on Form W4. They cannot specify only a dollar amount of withholding.

Federal Income Tax Table Changes: Rate And Bracket Updates

The federal income tax table brackets change annually. And due to the 2020 changes surrounding the repeal of withholding allowances and the redesign of Form W-4, you might still have questions about which table to reference.

Like last year, the federal withholding tax table you use depends on which version of Form W-4 an employee filled out and whether you automate payroll or do it manually.

Heres a rundown of all of the federal income tax withholding methods available for determining an employees federal income tax withholding :

There are also two additional methods the IRS offers:

You can view all of the income tax withholding table methods in IRS Publication 15-T.

If youre using the IRS withholding tables for forms from 2020 and later, there is a Standard withholding and a Form W-4, Step 2, Checkbox withholding amount in place of the withholding allowances.

Tax brackets 2022

| Tax Rate | |

|---|---|

| $539,901+ | $162,718 plus 37% ofthe excess over $539,900 |

Also Check: What Forms Are Needed To File Taxes