What Is An Itin Used For

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Finding The Id For Your Business

Can You Look Up An Ein Number Online

If the company is publicly traded and registered with the Securities and Exchange Commission , you can use the SEC’s EDGAR system to look up such a company’s EIN for free. … Try to find the company’s W2, or any local or federal filings that may be online. Hire a service or use a paid database to do the EIN search.

Don’t Miss: How Much Does The Us Collect In Taxes

Q5 I Am Not Sure If I Qualify To Claim The Dependency Exemption Or Child And Dependent Care Credit For The Child I Am Adopting How Can I Find Out

A5. To know whether you qualify to claim the child’s exemption or child care credit for the child, see “Exemptions and Credit for Child” and “Dependent Care Expenses” in the Form 1040 InstructionsPDF. For further information, see Publication 501, Exemptions, Standard Deductions and Filing InformationPDF and Publication 503, Child and Dependent Care ExpensesPDF. You may order copies of these publications by calling .

If you are still not sure, you may call or come to any IRS walk-in office for assistance.

Does My Business Need A Federal Tax Id Number

A business needs a federal tax ID number in order to apply for a business bank account or loan. Here are several other questions to help you figure out whether your business might need a federal tax ID number:

- Do you have employees?

- Do you withhold taxes on any income other than wages paid to a nonresident alien?

- Is your business a partnership or corporation?

- Is your business involved with mortgage investments?

- Is your business involved with real estate conduits?

- Is your business involved with nonprofit organizations?

- Does your business handle estates, trusts or IRAs?

- Do you file a return for tobacco, employment, alcohol, firearms or excise taxes?

If the answer to any of these questions is yes, your business likely needs a tax ID. For more information visit IRS.gov

If your business is tax-exempt, you still have to apply for an EIN. However, you must make sure your business meets the tax exemption requirements before you apply for an EIN.

Upon applying for an EIN, tax-exempt businesses have three years to prove their status. You dont want to spend any of that time trying to jump through legal hoops and requirements to meet the tax-exempt regulations.

Recommended Reading: How Is My Tax Refund Calculated

How You Can Keep Track Of Your Business Tax More Accurately

When starting a business and planning its growth, new entrepreneurs have so many demands on their time, including bookkeeping, planning, marketing and more. While they are each important and critical tasks, they can also often be time-consuming elements of running a business.

Consider using Countingup to automate your bookkeeping and accountancy admin and give you time back to focus on growing your business and meeting important deadlines with less stress.

Built for small business owners, the Countingup app is the two-in-one business current account and accounting software solution. Countingup provides key business features like tax estimates from your trading and handy tools like automated invoicing and real-time profit and loss data. Countingup is also compatible with Making Tax Digital, meaning you can work with your accountant to handle your VAT returns filing all in one app and avoid the last-minute dash to find paperwork from HMRC.

Gain complete confidence in your new business financial records. Find out more about Countingup here and sign up for free today.

Q3 Why Do I Need An Atin

A3. Recent tax law changes require that when you list a person’s name on your federal income tax return, you must provide a valid identifying number for that person. During the adoption process, you may not have been able to obtain an existing or a new Social Security number for the child who may already have been placed in your home. If you are eligible to claim the child as your dependent, and you don’t have the child’s SSN, then you will need to request an ATIN in order to claim the child as a dependent and to claim the child care credit.

Read Also: Where Is Your Agi On Your Tax Return

Can I Cancel A Tin

In terms of a business, an EIN cannot be canceled. Once the IRS assigns a business their business tax ID, it is non-transferable. What a business owner can do is close a business. To close a business, you must simply send a letter to the IRS stating your information and your reason for terminating the business. They will then follow up with your request and confirm when the closure has taken place.

A Social Security Number is also a unique number that stays with you forever. In this case, the IRS does not allow cancellation or transfers.

About Form 1041 Us Income Tax Return For Estates And Trusts

The fiduciary of a domestic decedent’s estate, trust, or bankruptcy estate files Form 1041 to report:

- The income, deductions, gains, losses, etc. of the estate or trust.

- The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

- Any income tax liability of the estate or trust.

- Employment taxes on wages paid to household employees.

Don’t Miss: When Do You Pay Taxes On Stocks

Can I Look Up A Business Ein Number

Unfortunately, no. The only way to obtain your Tax ID number is from your accountant or from/on certain documentation you have for your business such as your tax return, SS4 letter, EIN confirmation letter, or 1099.

If you dont have access to any of that, youll need to contact the IRS directly, who can provide you an EIN number as well as send you a copy of your SS4 letter.

Recommended Reading: How To File 2 Different State Taxes

What Is A Federal Tax Id Number

Discover the steps involved in getting a federal tax ID number for your new business and how this asset helps simplify a range of financial processes, from paying employees to filing taxes. Presented by Chase for Business.

Getting a federal tax identification number is an important first step when you start your business.

According to the IRS, a federal tax ID number is used to identify a business. There are many reasons why a business may need one, including paying employees, claiming benefits and filing and paying taxes.

Heres how to figure out if you need a federal tax ID number, how to apply for one and when your business should use it.

Recommended Reading: What Is The Sales Tax In Georgia

Check Other Places Your Ein May Be Recorded

Aside from confirmation letters from the IRS, you may be able to find a copy of your EIN on other important documents. For example, you might want to take a look at previously filed tax returns. Or you might look over old financing documents, like applications for business loans or lines of credit.

The IRS also suggests that you might be able to get a copy of your EIN by contacting institutions with which you shared that information in the past such as your business bank or local and state business license agencies.

What Is A Taxpayer Identification Number

The reason why some may find the prospect of finding out their taxpayer identification number daunting could be because there are three main types of abbreviations which refer to the taxpayer identification number, and you may not know which one you need. These three abbreviations are: TIN, ITIN, and EIN. The TIN stands for taxpayer identification number which is an umbrella term for what we are talking about. If you are US citizen who pays tax, you will have been issued a TIN which is identical to your social security number . What is your SSN? You can request a replacement SSN card at the SSAs website to find out your social security number.

However, if you are an employer, you may also be wondering what your EIN is. Youll need to file for an Employer Identification Number or EIN. This number is issued to individuals and legal entities, depending on a business legal structure. The IRS issues this number to various business structures, including sole proprietors, partnerships, and corporations . You can get more information on employer identifications numbers in this PDF file from the IRS: IRS Publication 1635, Understanding Your EIN. Note that you will need an EIN in addition to your SSN one functions as your individual number, the other as your number as an employer.

To sum up, there are a few different types of TIN depending on your status:

Hosting with IONOS Fast, Flexible, Secure

Discover fast and secure hosting for any project.

Scalable

Don’t Miss: Is Turbo Tax Fixing The Stimulus Problem

Why Do I Need A Tax Id Number

A Tax ID Number is like a social security number for an entity that either does business or hires employees. With a Tax ID Number, you can file federal taxes, open bank accounts, get business loans, and apply for permits and licenses. Without a Tax ID Number, you will be unable to perform basic business tasks, such as filing payroll taxes. A Federal Tax ID Number should not be confused with a State Tax ID Number: one is used for federal taxes and hiring, while the other is used for state-related taxes and documents.

Even a sole proprietorship will need a Tax ID Number to begin hiring and paying employees. While you can pay contractors without a Tax ID Number , you cannot pay employees without a Tax ID Number. The EIN Number is used on the initial hiring forms, to pay payroll taxes, on end-of-year payroll forms, and on things such as visa applications and worker permits. It is also used to acquire business lines of credit, credit cards, and loans, under the companys name rather than the business owners.

As a Tax ID Number is used for most business tasks, it should be one of the first things that a business acquires. You can get your EIN Number within an hour by filling out an online Tax ID application.

Can You Look Up Another’s Business Ein

If you need to do an EIN number lookup for a different business, you will encounter plenty of roadblocks.

The best way to get it is to ask someone you have a relationship with at the company. If you need the number for a legitimate purpose, you should be able to get it from the other companys accountant.

If the company has applied for a liquor license or building permit, you may be able to find its EIN on the local area chamber of commerce or secretary of state database.

For public companies, you can look up the EIN on the SECs website. Search the companys name, and pull up the most recent 10-Q or 10K.

The EIN is listed with the title I.R.S. Employer Identification Number on Netflixs recent 10-Q. Image source: Author

All non-profit EINs are public information, and you can find them in the IRS database.

If none of these suggestions yield results, you likely wont be able to find the number for free.

You can pay for a business credit report from any of the major providers, do a business search with a legal database like LexisNexis, or use a specific EIN search company that combs through government filings to find the number.

Out of those options, I would recommend purchasing a business credit report as the agencies providing those are generally bigger and more legitimate.

Read Also: Are Traditional Ira Contributions Tax Deductible

Q6 Can I Get An Atin If I Am Adopting A Child From Another Country

A6. You may apply for an ATIN for your prospective adoptive child only if you are in the process of adoption and meet all of the following qualifications:

- The child is legally placed in your home for adoption by an authorized placement agency.

- The adoption is a domestic adoption OR the adoption is a foreign adoption and the child/children have a permanent resident alien card or certification of citizenship.

- You cannot obtain the child’s existing SSN even though you have made a reasonable attempt to obtain it from the birth parents, the placement agency, and other persons.

- You cannot obtain an SSN for the child from the SSA for any reason. .

- You are eligible to claim the child as a dependent on your tax return.

How Do I Perform A Tax Id Lookup

If youre not sure what your TIN is, dont worry. The IRS requires you to include this on all tax documents. So, if you have a 1099 or W2 on hand, you should have the information you need. However, if you cant find these documents, the IRS has resources you can access in case you lose your paperwork. Otherwise, consider these options to secure any of your TINs for a tax ID lookup.

Don’t Miss: How Are Brokerage Accounts Taxed

Is Parcel Id The Same As Tax Id

Parcel Number The Parcel Number or Local Number is the same as the Tax ID Number assigned by the Assessors Office. It is shown on your tax bill and used by the Treasurers Office in identifying your tax payment for that particular parcel.

What Are The Benefits Of Having A Ein Number

Even if you’re not required to get an EIN, the benefits of getting an EIN include the following:

- File business taxes and avoid tax penalties. …

- Prevent identity theft. …

- Add credibility as a freelancer or independent contractor. …

- Speed up business loan applications. …

- Open a business bank account. …

- Build trust with vendors.

Also Check: How Much Do Immigrants Pay In Taxes

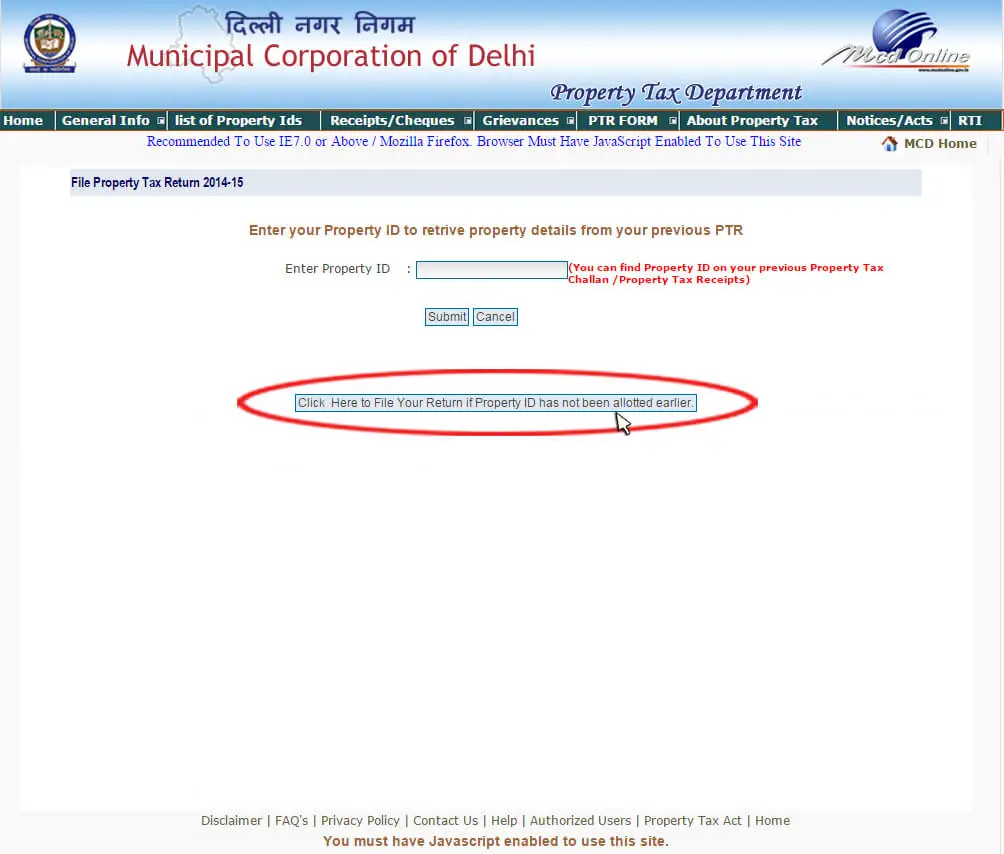

What Is A Property Identifier Number

Property identification number is a number assigned to parcels of real property by the tax assessor of a particular jurisdiction for purposes of identification and record keeping. A PIN may also be referred to by the following terms: Property Tax ID Number. Parcel ID Number. Property Tax Number.

How do I find my Illinois property tax PIN?

The easiest way to find your PIN is to look it up on the Chief County Assessment Offices Property Tax Assessment Information by Address page. Your PIN will be displayed at the top of the search results page and labeled PARID. You can also call the department at 847-377-2050 or contact your township assessors office.

How do I find my property ID number Cook County?

How to find your PIN. The best source for your PIN is your deed or tax bill, or other documents you may have from the purchase of your home. If you are not able to locate any of these documents, the Cook County Assessors website can help you locate a PIN from an address.

What You Need For Apply For An Employer Identification Number

An Employer Identification Number is also known as a Federal Tax Identification Number, and is used to identify a business entity. The only kind of business that does not require getting an EIN is a sole proprietorship with no employees.

You can only receive your EIN through the IRS. If you have questions about getting an EIN, contact the IRS.

Once youve received your EIN from the IRS, you can register your business with MassTaxConnect.

Don’t Miss: How Much To Expect From Tax Return

Finding Your Individual Tax Id