Is My Social Security Taxable

For purposes of this discussion, we are talking about social security payments that get reported to you and the IRS on a tax form SSA-1099. These are social security retirement income, survivor benefits, and Social Security Disability Insurance payments. The good news is that 15% of your social security payments are never taxable.

But what about the other 85 percent?

Lets start with the federal tax return. If half of your social security income, plus any other taxable income , is below the base amount, none of your social security is taxed. So NO taxes on social security if you are below the base amount listed for your filing status:

- $25,000 if youre single, head of household, or qualifying widow,

- $25,000 if youre married filing separately and lived apart from your spouse for the entire year,

- $32,000 if youre married filing jointly,

- $0 if youre married filing separately and lived with your spouse at any time during the tax year.

If single , etc.) and half your social security payments plus your other income is between $25,000 and $32,000, up to 50% of your social security is taxable. If the total is greater than $32,000, up to 85% of your social security is taxable.

If filing jointly and your total is between $32,000 and $44,000, up to 50% of your social security is taxable. If the total is greater than $44,000, up to 85% of your social security is taxable.

Before You Start Tax Preparation

If you use a program such as Quicken® to keep track of your finances, print a report of your transactions for the tax year . This will make your tax preparation much easier, and helps you clearly see where your money goes each year.

- Having this information in a report is much easier than going through your checks and bank statements for the entire year.

- As you review the report, highlight information you will need to prepare your tax return or make notes to remind yourself of something later.

Tax Documents Required To File Taxes Online

W-2 Form

The W-2 form is one of the most important tax documents required for tax filing. The Federal Wage and Tax Statement form, otherwise known as a W-2, is issued to the taxpayer from their employer. The W-2 will state how much they were paid and how much was withheld during the last year. The information will almost always be required for anyone filing their taxes. If you are filing jointly with a spouse, their W-2s must be used as well.

1099 Form

The next form that is required in the filing of your taxes will be a 1099. This form is used to report any other various types of income which are not considered wages, salaries, or tips. Often, this will include scholarships and grants, contractor services over $600, pensions, annuities, retirement plans, insurance contracts, etc. These forms may be mailed out to the taxpayer by a government agency, contracting company, a health insurance provider, financial institution as well as other entities who may have distributed proceeds to the taxpayer throughout the year.

Types of 1099 Forms

| Acquisition of Secured Property | |

| B | |

| Changes in Corporate Control | |

| DIV | |

| Pension, Annuity or Retirement Plan Payment | |

| S | |

| U.S. Income Earned by A Foreigner | |

| SSA – 1099 | Social Security Payments |

| RRB – 1099 | Railroad Retirement Board Payment |

| W – 2G | Gambling Winnings |

1098 Form

3 Types of 1098 Forms

You May Like: What Is Medicare Tax Used For

Background: The Basics Of Tax Filing

Itâs useful to know what your tax return is for and why you have to file it in the first place. To get you started, here are three important tax terms you should know:

-

Filing is synonymous with sending something to the proper recipient. When the IRS says to file a form, it just means send it to the IRS.

-

When you claim something on your tax return, it means that you qualify to get it and you are taking it. For example, claiming the earned income tax credit just means youâre taking the credit. Claiming a dependent means someone qualifies as your dependent and youâre treating them as such on your taxes.

-

Some tax forms are called schedules. This has nothing to do with the calendar and is just another word for form.

Individuals Required To File A North Carolina Individual Income Tax Return

The following individuals are required to file a 2021 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021 for the individual’s filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2021. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

Also Check: Do You Have To Pay Taxes On Stocks

What If Someone Else Can Claim You As A Dependent

Different income thresholds apply if someone else can claim you as a dependent, as well as the type of incomeearned or unearned. Your total income might be less than the standard deduction for your filing status. However, you will still need to file a tax return if your unearned income was $1,150 or more for the 2022 tax year. You’ll also need to file a tax return if your earned income is more than the standard deduction for an unclaimed single taxpayer, or $12,950 in 2022.

Respond Rapidly For Faster Refund

All income tax returns go through fraud detection reviews and accuracy checks before we issue any refunds. We might send you letters asking for more information.

- Fraud Detection: The Tax Commission uses a variety of methods to validate your identity and tax return to detect and combat tax identity theft. To help protect taxpayer information and keep taxpayer dollars from going to criminals, we might send you:

- An Identity Verification letter that asks you to take a short online quiz, provide copies of documents to verify your identity, or state that you didnt file a return.

- A PIN letter that asks you to verify online whether you or someone you authorized filed the tax return we received.

Also Check: How To Pay Estimated Taxes

Collect These Documents Before You Start Your Tax Return

The Good Brigade / Getty Images

The challenge of gathering everything you need to file your annual tax return can be either minimal and yawn-worthy or aggravating and time-consuming. How you feel about doing your taxes can depend on your financial situation. You can probably yawn if youre single, rent your home, and work one job, but youll have to dedicate some time to the filing process if youre married, are a single parent with at least one of your children living at home, have investments, are self-employed, or work multiple jobs.

Each of the latter scenarios will require gathering multiple documents.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How To Find Tax Delinquent Properties In Your Area

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

Your Security Is A Top Priority Now And Always

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 10/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

You May Like: How Do I File Unemployment On My Taxes

Benefits Of Using Infreefile Are:

- Faster refunds: A paper-filed return can take up to 8 weeks versus up to 2-3 weeks for an electronically filed return.

- Confirmation: Youll receive confirmation that your return was received and accepted.

- 24/7 access: You can access INfreefile at any time, day or night.

- Easy to use: All INfreefile options are user-friendly and include step-by-step instructions.

- Fewer errors: Electronically filed returns have a 2% error rate, compared to a 20% error rate for paper-filed returns.

- More efficient: You can prepare and file your federal and state tax returns at the same time.

- Convenient:INfreefile provides the added convenience of direct deposit for refunds and direct debit for payment of taxes owed.

Free File partners are online tax preparation companies that offer what is called the IRS Free File program, which provides free electronic tax preparation and filing of federal tax returns at no cost to qualifying taxpayers . Not all companies that participate in the IRS Free File program offer free state filings. Those vendors who participate in INfreefile must meet Indianas software certification requirements to ensure an accurate product.

The IRS and DOR do not endorse any individual partner company. The links below will take the user to sites provided by the vendor and are not maintained or controlled by DOR. Any other links used to access vendor websites may result in fees or charges. Please review each vendors offerings, including limitations and exclusions, carefully.

What Is A W

Use Form W-4, also called Employees Withholding Certificate, to tell your employer how much in taxes to withhold from your paycheck. Any time you start a new job, your employer will ask you to fill this out. The W-4 will help you determine the correct amount to have your employer withhold if you ask your employer to withhold less, you will still owe the remaining tax, plus, in some instances, a penalty. The IRS online Tax Withholding Estimator can help you fill out this form correctly.

Best for:People with new jobs, a change in income or other significant financial or family changes.

Don’t Miss: What Percent Does Taxes Take Out

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

What Are The 1095

If you or a member of your family enrolled in health insurance coverage through a government-run marketplace in 2020, the marketplace should send you a 1095-A form. The form shows the months of coverage purchased through the marketplace and any Premium Tax Credit the insurance company received from the government to help cover your premiums. If you are eligible for the Premium Tax Credit, received your insurance through a qualified marketplace and did not have the credit paid out throughout the year directly to your health insurance provider, you should file an 8962 form to receive reimbursements.

Best for:People who bought private health insurance on government-run marketplaces.

Read Also: When Will I Receive My Taxes

When In Doubt File

You can’t be blamed for preferring not to file your income tax if you don’t have to, but there are benefits to filing.

Various tax credits can be earned by filing an income tax return, including earned income credit, child and dependent care credit, educational tax credit, and the savers credit.

These credits might offset the amount of income taxes owed for people with small amounts of income and could in some cases even yield them more money than if they had not paid taxes on that small amount of income. It is important to always consult a tax professional prior to making a decision on whether to file a yearly income tax return.

Information About Your Income

- Income from jobs: forms W-2 for you and your spouse

- Investment incomevarious forms 1099 , K-1s, stock option information

- Income from state and local income tax refunds and/or unemployment: forms 1099-G

- Taxable alimony received

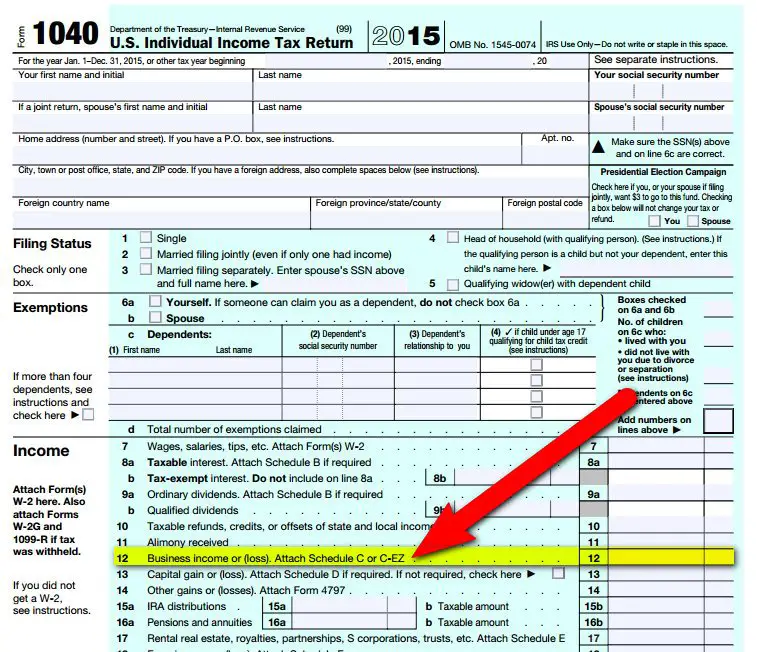

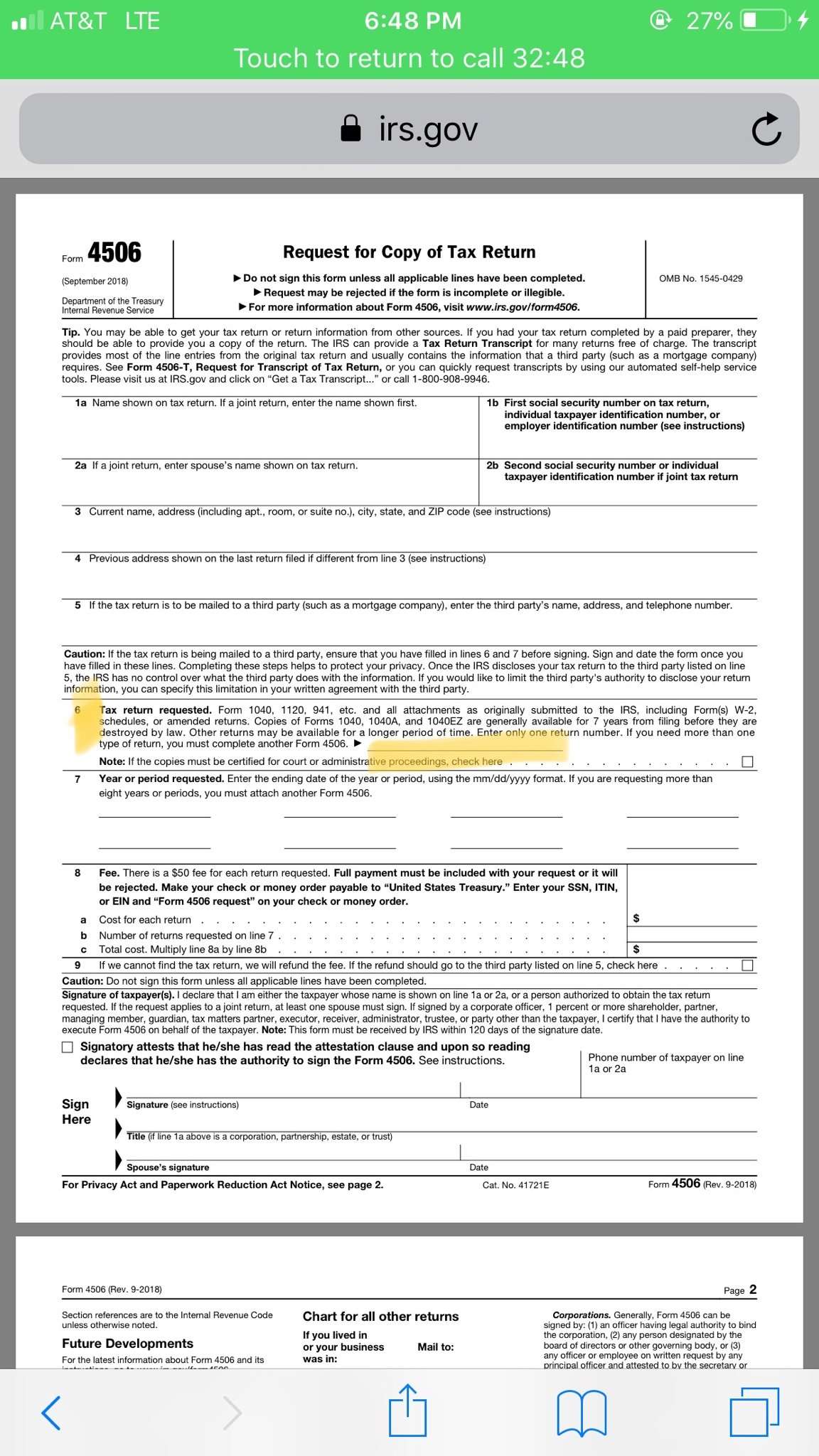

- Business or farming incomeprofit/loss statement, capital equipment information

- If you use your home for businesshome size, office size, home expenses, office expenses.

- IRA/pension distributionsforms 1099-R

- Rental property income/expenseprofit/loss statement, rental property suspended loss information

- Social Security benefitsforms SSA-1099

- Income from sales of propertyoriginal cost and cost of improvements, escrow closing statement, cancelled debt information

- Prior year installment sale informationforms 6252, principal and Interest collected during the year, SSN and address of payer

- Other miscellaneous incomejury duty, gambling winnings, Medical Savings Account , scholarships, etc.

Also Check: How To Know If You Filed Taxes Last Year

Deadlines For Annual Taxes

Most small-business ownersincluding members of partnerships, S corporations, and C corporationswill file annual taxes. The exact due date depends on the type of business you own:

- is the tax-filing deadline for partnerships, multi-member LLCs, and S corporations

- is the tax-filing deadline for sole proprietors, single-member LLCs, and C corporations .

If you want extra guidance on when your taxes are due, we recommend consulting with an accountant.

If your C corporation ends its fiscal year on a date other than December 31, business taxes are due four months after the end of your fiscal year.

Bank And Credit Card Statements

Every small business owner should have a separate bank account and credit card for their business. At the end of each calendar year, your financial institution will generate a year-end report that shows you exactly what youve spent throughout the year. You can use this report to double-check your own financial records and ensure youre filing the right amount in taxes.

Recommended Reading: How Much Can You Donate For Taxes