Calculating The Medicare Surtax Withholding Amount

Unlike the 6.2 percent Social Security tax and the 1.45 percent Medicare tax, the 0.9 percent surcharge is imposed only on the employee. You withhold the surtax from employee wages, but there is never a matching payment required by the employer.

The employers and employees obligations with respect to the Medicare surtax are different. In some cases, there may be a mismatch between the amounts you are obligated to withhold and the amount of your employees surtax liability.

From the employees perspective, the 0.9 percent Medicare surtax is imposed on wages, compensation and self-employment earnings above a threshold amount that is based on the employees filing status. Once the threshold is reached, the tax applies to all wages that are currently subject to Medicare tax, to the Railroad Retirement Tax Act or to the Self-Employment Compensation Act.

The threshold amounts are as follows:

| Filing Status |

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06% to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets.

The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

Recommended Reading: What Is Federal Tax Due

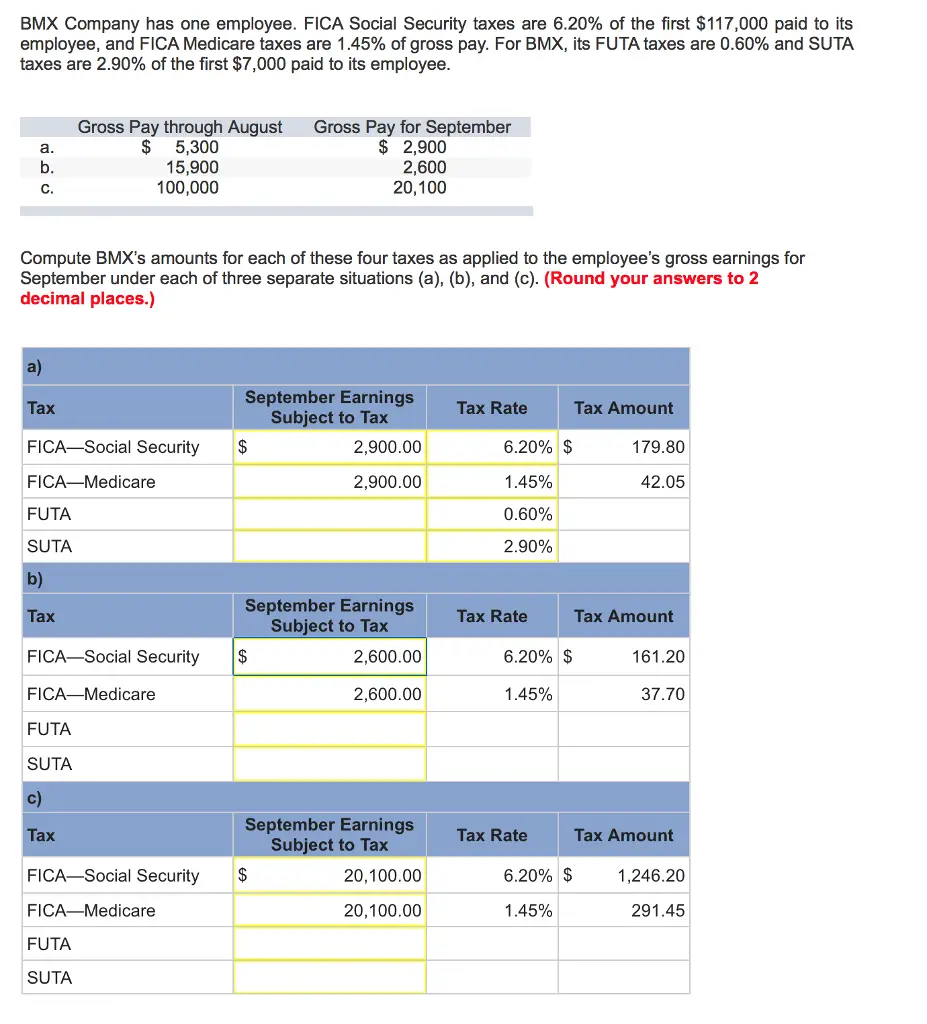

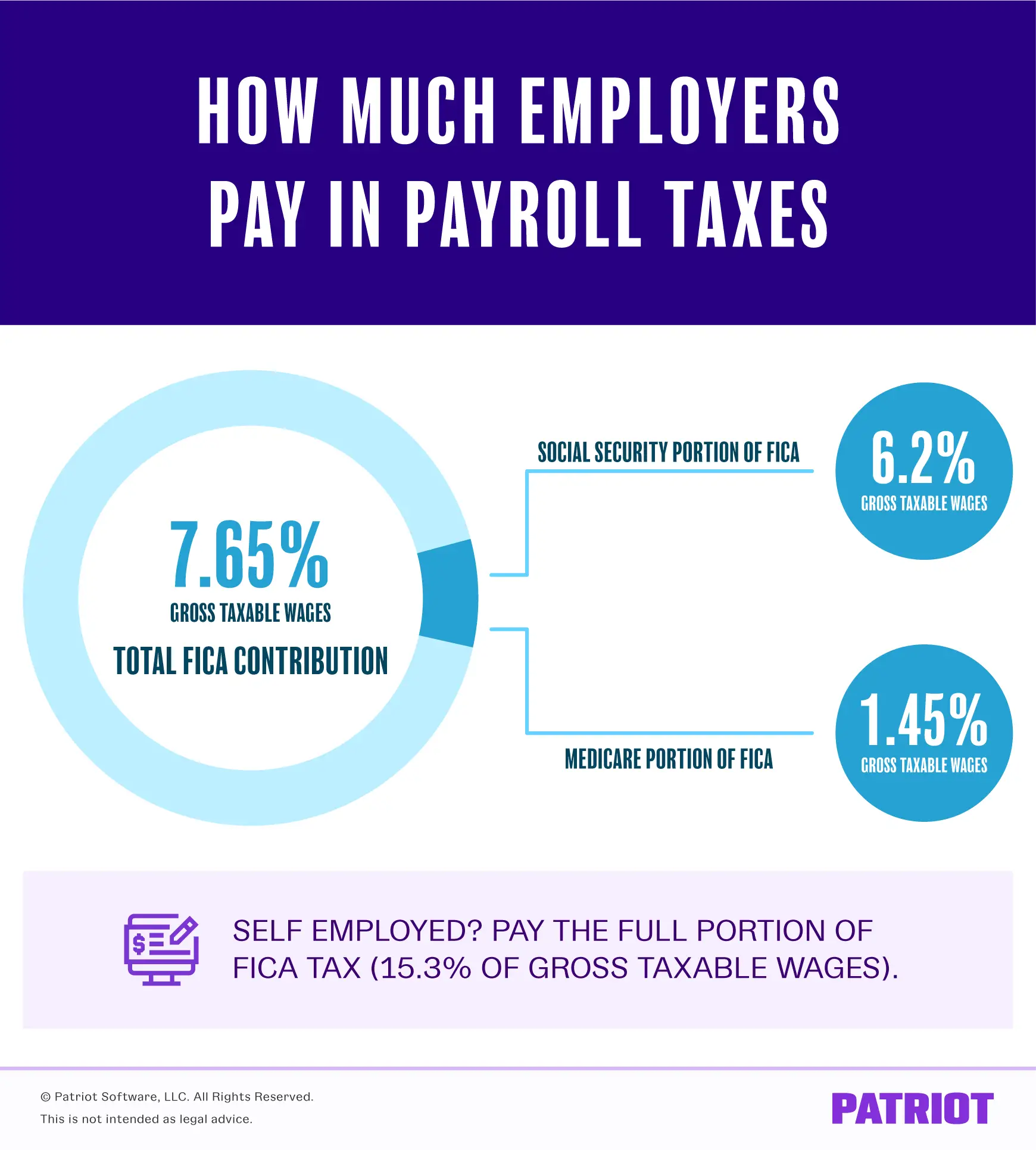

Fica Tax Withholding Rates

There are two different rate components:

- The Social Security withholding rate is gross pay times 6.2% up to that year’s Social Security income cap. This is your portion of the Social Security payment. The employer pays 6.2% with no limit.

- The Medicare withholding rate is gross pay times 1.45%, although high-income individuals will pay an additional 0.9%. The employer also pays 1.45% with no limit, but they don’t pay any additional tax.

The total withheld is 7.65% of your gross pay .

What Is The Medicare Tax Limit

The Medicare tax is not limited to an annual income cap, although the Social Security tax is. For 2022, the Social Security tax is limited to the first $147,000 you earn, and for 2023, it’s $160,200.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Don’t Miss: Does Irs Tax Advocate Help

Only In Certain States Or If Your Income Exceeds The Federal Limits

A Tea Reader: Living Life One Cup at a Time

Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of people who receive Social Security benefits do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for the program have little or no additional income.

Are Social Security Wages The Same As Gross Income

Social Security wages are not the same as gross income. While the amount of Social Security wages and gross income are oftenidentical, they just as easily may not be.

Gross income is the total of all compensation from which the amount of taxes and other withholdings are calculated. Social Security wages are based on the gross income and have specific inclusions and exclusions .

Don’t Miss: How Much Do Taxes Cost At H& r Block

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

Single Filer Earning $210000

Social security tax is only calculated on the first $147,000 of an employees income, so the employer multiplies that income by 6.2%, for $9,114 in Social Security taxes. For Medicare taxes, a single-filer earning more than $200,000 pays an additional 0.9% on earnings over $200,000. Therefore, $210,000 is multiplied by 1.45%, for $3,045, and the additional $10,000 is taxed at 0.9%, for an additional $90 in Medicare taxes, for Medicare taxes owed of $3,135. The total FICA taxes for this employee is $12,249.

Recommended Reading: Why Would My Taxes Be Rejected

How Does Fica Tax Work

An employer deducts a percentage of an employees gross pay for FICA taxes. When the deduction is made from the employees paycheck, the employer is responsible for remitting it to the IRS . The employer also matches the employee’s portion and submits both. Self-employed individuals withhold a version of FICA taxes from their income, known as self-employment tax, and pay both the employee and employer portions.

FICA tax refers to two types of taxes: Social Security tax and the Medicare tax. Almost all income is subject to FICA taxes, with a few exceptions:

- Some minor children. Children under 18 employed by their parents do not pay FICA taxes.

- Retirement distributions. Income received from qualifying employer retirement plans, such as a 401, is not subject to FICA tax.

- Students.Students employed and earning income from the school, college, or university they attend do not pay FICA taxes.

- Others. Some religious organization employees and state or local government employees may be exempt from paying the FICA tax.

FICA taxes pay the Social Security and Medicare benefits of current beneficiaries. A person earns one credit for each quarter they pay these taxes and needs 40 credits to claim Social Security benefits at their eligible age.

Withholding On Social Security Benefits

You can elect to have federal income tax withheld from your Social Security benefits if you think youâll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2021. Youâre limited to these exact percentagesyou canât opt for another percentage or a flat dollar amount.

If youâd like the government to withhold taxes from your Social Security income, file Form W-4V, the Social Security Withholding Tax Form. This will let the Social Security Administration know exactly how much tax you would like to have withheld.

You May Like: What Is Georgia State Tax

What If I Dont Have Any Employees

Youâll still have to remit Medicare and Social Security taxesâfor yourself. This is called self-employment tax, and itâs effectively Medicare plus Social Security for yourself .

If you had self-employment income earnings of $400 or more during the year, you are required to pay self-employment taxes and file Schedule SE with your federal income tax return , which is generally due by April 15.

Use our free estimated tax calculator to figure out how much estimated tax youâll owe.

How Much Is Social Security Tax

The Social Security tax is part of the FICA taxes withheld from your paychecks. For 2022, the total Social Security tax rate is 12.4% on a workers first $147,000 in wages. The wage base is set by Congress and may change annually.

These are the most recent Social Security wage bases.

| Tax Year | |

|---|---|

| 2017 | $127,200 |

If you work for an employer, youll be on the hook for 6.2% of your pay. Your boss will kick an additional 6.2% and submit the combined 12.4% to the federal government.

If youre self-employed, youre responsible for the entire 12.4%. The IRS offers a self-employment tax deduction that can lessen the sting.

You May Like: Do Retired People File Taxes

Social Security Wage Base

|

|

For the Old Age, Survivors and Disability Insurance tax or Social Security tax in the United States, the Social Security Wage Base is the maximum earned gross income or upper threshold on which a wage earner’s Social Security tax may be imposed. The Social Security tax is one component of the Federal Insurance Contributions Act tax and Self-employment tax, the other component being the Medicare tax. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a worker’s Social Security benefit.

In 2020, the Social Security Wage Base was $137,700 and in 2021 will be $142,800 the Social Security tax rate was 6.20% paid by the employee and 6.20% paid by the employer. A person with $10,000 of gross income had $620.00 withheld as Social Security tax from his check and the employer sent an additional $620.00. A person with $130,000 of gross income in 2017 incurred Social Security tax of $7,886.40 , with $7,886.40 paid by the employer. A person who earned a million dollars in wages paid the same $7,886.40 in Social Security tax , with equivalent employer matching. In the cases of the $130k and $1m earners, each paid the same amount into the social security system, and both will take the same out of the social security system.

Social Security Benefits In 2023 Will Rise The Most In 40 Years How Much Will I Get

Social Security recipients will get a hefty raise in 2023, with benefits rising 8.7%, the most in four decades.

The inflation-related bump may coax some retirees into tapping their benefits early, before they reach full retirement age. It also may spark a few questions.

-

How do you apply for Social Security?

-

How are benefits calculated?

-

Are they taxable?

The cost-of-living adjustment, or COLA, will boost the average retirees monthly payment by $146 to $1,827 next year, according to the Social Security Administration . Yet for 70 million retirees, disabled people and others, the increase will simply help them catch up to inflation that hit a 40-year high of 9.1% earlier this year, outpacing the 5.9% COLA they received in 2022, says Mary Johnson, a policy analyst for the Senior Citizen League, an advocacy group.

Heres what you need to know:

IRS Tax Tip 2022-22, February 9, 2022

A new tax season has arrived. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits.

Social Security benefits include monthly retirement, survivor and disability benefits. They donât include supplemental security income payments, which arenât taxable.

The portion of benefits that are taxable depends on the taxpayerâs income and filing status.

Also Check: How To File Only State Taxes On Turbotax

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: How Much Is The Maximum Social Security Benefit

What Is The Purpose Of The Fica Tax

The FICA tax provides for the Social Security and Medicare programs that benefit children, retirees, and disabled people in the US. The Federal Insurance Contributions Act was passed in 1935 in response to the Great Depression and began by funding Social Security. It later expanded to include Medicare.

You May Like: What Is Federal Payroll Tax

Other Key Social Security Increases In 2022

Along with the wage base, the retirement earnings test exempt amount rises every year. The exempt amount applies to people who are receiving benefits but have not reached full retirement age . If you earn more than this amount, the Social Security Administration will withhold $1 in benefits for every $2 you earn above the limit. The amount is higher the year you reach FRA, and the SSA will withhold $1 in benefits for every $3 you earn above the limit.

For workers who have yet to reach their FRA, the 2022 earning limit is $19,560, up from the 2021 earning limit of $18,960. If 2022 is the year you will reach your FRA, the limit is $51,960, up from $50,520 in 2021.

Another number that generally increases every year is the benefit amount, which gets a cost-of-living adjustment . For 2022, the COLA jumped 5.9%, the highest in decades. However in 2023 the COLA climbs 8.7%.

Social Security Tax Limits

The government bases the annual Social Security tax limits on changes in the National Wage Index , which tends to increase every year. The changes are intended to keep Social Security benefits on track with current inflation.

Any income you earn beyond the wage cap amount is not subject to a 6.2% Social Security payroll tax. For example, an employee who earns $165,000 in 2023 will pay $9,932 in Social Security taxes .

Keep in mind, however, that there is no wage base limit for Medicare tax. While the employee is only subject to Social Security tax on the first $160,200, they will have to pay 1.45% Medicare tax on the entire $165,000. Individuals who earn more than $200,000 are also subject to a 0.9% additional Medicare tax.

The combination of the increase in the Social Security tax limit and the additional Medicare tax for high-earners could result in lower take-home pay. Unfortunately, that means workers who earned over $200,000 in 2022 are at risk of owing more taxes in 2023.

Here is an example of how the Social Security limit works:

| Social Security Tax Limit Example |

|---|

| 2022 Income |

You May Like: Should I Itemize My Taxes

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employee’s death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a “Statement Concerning Your Employment in a Job Not Covered by Social Security”. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

Social Security Wage Base Increases To $160200

The Social Security Administration has announced that the maximum earnings subject to Social Security tax will increase from $147,000 to $160,200 in 2023 . The maximum Social Security employer contribution will increase $818.40 in 2023.

For 2023, the FICA tax rate for both employers and employees is 7.65% .

For 2023, an employer must withhold:

Social Security and Supplemental Security Income benefits will increase by 8.7% in 2023. The average monthly Social Security benefit will increase from $1,681 to $1,827, and the maximum federal SSI monthly payment to an individual will increase from $841 to $914. The maximum federal SSI monthly payment to a couple will increase from $1,261 to $1,371 in 2023. The amount of earnings that is required in order to be credited with a quarter of Social Security coverage will increase from $1,510 to $1,640.

The SSA has a 2023 Fact Sheet on the changes.

For more information on the Social Security wage base, see Checkpoints Federal Tax Coordinator ¶A-6035.

Get all the latest tax, accounting, audit, and corporate finance news with Checkpoint Edge. Sign up for a free 7-day trial today.

Recommended Reading: When Is The Deadline To File Your Income Tax