Deadline For Filing 2021 Taxes

One of the first questions most people want an answer to is: When are taxes due?

For 2021 tax returns those filed in 2022 the deadline to file your return and pay any tax due has been extended a few days from April 15, 2021 to April 18, 2021 because the 15th falls on a weekend. Individual states typically follow the IRS deadline extensions but if you are unsure then check your state governments website for more information.

Filing an extension will postpone your filing deadline until October 17, 2022 which is a couple of days further out than usual since the 15th of October falls on a weekend. Just remember that even if you file an extension to October, any amount of tax that you owe for the year is still due on the earlier April deadline.

If you make estimated quarterly tax payments, the deadline to make your first estimated payment toward 2022 taxes has also been extended to April 18, 2022 due to April 15th falling on a weekend. Even if you wait until the last minute to file your 2021 tax return or file for an extension, you’ll still need to calculate your first 2022 quarterly estimate and make a payment by the April deadline.

Can The Funds On The Eip Card Be Transferred To A Personal Bank Account

Yes. Along with the EIP cards, recipients will receive instructions on how to transfer the balance to their bank account. To transfer the cards balance into a personal bank account, the IRS instructs recipients to activate the card and create a User ID and password on the Money Network portal. Once logged into the portal, users will be asked to identify the bank account where they would like the funds to be sent, and after confirming the transaction, the funds should arrive in 2-3 business days. Recipients who would rather make the transfer over the phone can do so by calling 1240-8100 after the card has been activated.

Does The Irs Ever Negotiate The Amount Owed

Under certain circumstances, the IRS is authorized to resolve a tax liability by accepting less than full payment. An “offer in compromise” is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax debt. There are three circumstances under which the IRS is authorized to compromise:

Form 656: Offer in Compromise Package should be completed to file an Offer in Compromise with the IRS. Included with the Form 656 package are Form 433-A, Collection Information Statement for Wage Earners & Self-Employed Individuals and Form 433-B, Collection Information Statement for Businesses.

- You may need to complete the appropriate Form 433 and should be prepared to provide other documentation and explanations as they are requested.

- Various options are available for accepted Offers in Compromise requests, such as a reduced total payment and scheduled monthly payments.

- Defaulting on an accepted offer in compromise can result in the IRS filing suit against you and reinstatement of the original tax debt, plus interest and penalties.

Also Check: Can You File State Taxes Without Filing Federal

No Matter How You File Block Has Your Back

Earned Income Tax Credit

More people than ever before will qualify for the Earned Income Tax Credit because of the recent expansion. For the first time, adults without kids at home are eligible for a credit worth up to $1,500. This includes people ages 19 24 and over 64 who work and werent eligible before.

In addition, many eligible families with children will get a slightly larger EITC. When you file your taxes in 2022, the credit is worth a maximum of $6,728.

Read What is the Earned Income Tax Credit? to learn about your eligibility, how much the credit is worth, and how to get it.

Also Check: How To Find Out Your Tax Id Number

How Can I Make Sure I Get My Refund As Fast As Possible

Each tax filing is as unique as the individual it represents. To help expedite the tax refund process, consider one or more of the following tips:

- Visit us at any H& R Block office to ensure your return is ready to file when e-file opens.

- Consider e-filing versus traditional paper filing.

- Complete a tax return that is free of any errors or miscalculations. This means carefully reviewing personal information such as your name, social security number, home address and bank information, if applicable.

California Postponed The 2020 Tax Year Filing And Payment Deadline For Individual Taxpayers To May 17 2021 Did California Also Postpone The Time For An Individual Taxpayer To File A Claim For Refund To May 17 2021 If That Period Expires On April 15 2021

Yes, if the statute of limitations to file a timely claim for refund normally expires on April 15, 2021, the FTB considered the claim timely if the individual taxpayer filed the claim on or before May 17, 2021. For purposes of claiming a refund within one year of an overpayment, the look-back period did consider payments made within one year of the actual expiration of the statute of limitations, but if that date expired on April 15, 2021, the FTB considered the claim for refund timely if the individual taxpayer filed the claim on or before May 17, 2021.

You May Like: How To Find Houses With Unpaid Taxes

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Don’t Miss: How Much Earned Income To File Taxes

Who Is Eligible For The Florida Stimulus Check

Florida plans to issue incentive checks in December to first responders, K-12 teachers, and those financially eligible for a $1,000 lump sum payment. Governor Ron DeSantis says 175,000 teachers and 3,600 principals are eligible for assessment.

When does direct deposit hitWhat time does direct deposit normally get deposited? Instant transfers are credited to your account early in the morning when the bank receives the file from the employer, usually between noon and 2 a.m. .When do you get paid if you have direct deposit?Wire transfers generally come in between 12pm and 6pm on the payday. For example, if you get paid on Friday, Thursday at midnight (which is tech

Also Check: Why Dont I Have My Stimulus Yet

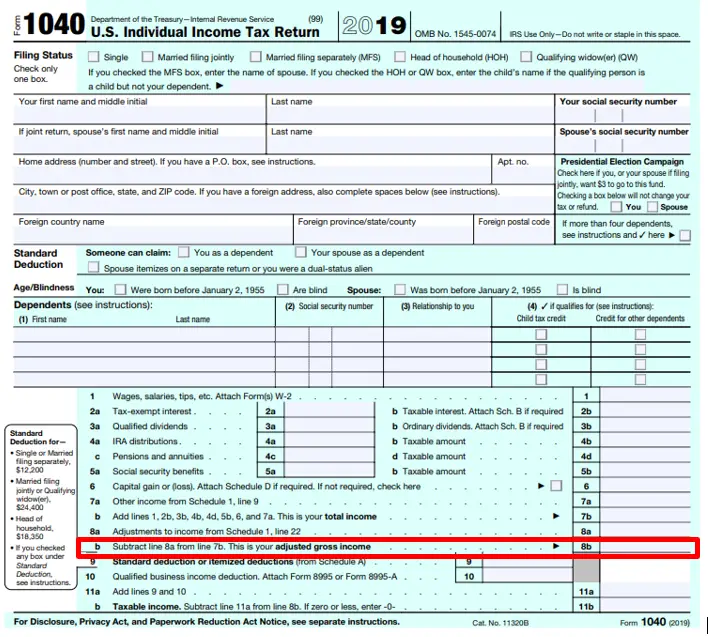

Do Seniors Get A Tax Break In 2019

Increased Standard Deduction When youre over 65, the standard deduction increases. For the 2019 tax year, seniors over 65 may increase their standard deduction by $1,300. If both you and your spouse are over 65 and file jointly, you can increase the amount by $2,600.

Where can I access my tax forms?

Sign in to capitalone.com

Where can you get copies of federal tax forms?

The only way you can obtain copies of your tax returns from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.

Recommended Reading: When Are Estimated Taxes Due 2021

Can I Claim My 25 Year Old Son As A Dependent

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test: To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a “student” younger than 24 years old as of the end of the calendar year.

Do My Stimulus Checks Count As Taxable Income

The government sent out checks of $1,200 and $600 to millions of Americans in 2020 as the pandemic shut down most of the country. The good news is those IRS payments do not count as taxable income. The bad news? They are being treated like a refundable tax credit, so theyre similar to an advance on money you would have received as part of your refund.

Also Check: How Many Years Can I Go Back And File Taxes

Auto Registration For Personal Income Tax

If you are deemed as required to file a tax return, this year SARS will automatically register you for personal income tax based on reliable data from third party sources.

Taxpayers who meet the below criteria will be considered for auto registration:

- South African citizens and permanent residents

- Tax deducted by your employer and/or IT3 data sources indicate that you are liable to submit a tax return

Once the IRP5 and IT3 certificates have been evaluated and you are deemed as required to file a tax return, SARS will automatically register you for Personal Income Tax and issue an ITA150.

Cashing The Check Using Online Us Tax Service

Recently we understood that the $1800 check can also be paid out via . After deduction of a fee and transaction costs, the result was approximately 1600 on the persons own account. This route takes about 2 months. Please note: this is very new information that we have not yet been able to confirm from other clients.

Read Also: How To Get 1400 Stimulus Check

Also Check: When Can You File Your Taxes 2021

Are My Stimulus Payments Taxable

No. The money is tax-free.

But some people who are eligible for the money didnt receive it primarily those whose 2019 income was higher than their 2020 income or people who did not file tax returns for 2019 or 2018. They will be able to receive the money owed them via their federal tax return so long as they claim the refundable Recovery Rebate Credit.

That credit will reduce your income tax liability dollar-for-dollar. And to the extent the credit exceeds your tax liability, youll get the remainder as a refund.

Here’s How Free File Works:

Most companies provide a special offer for active duty military personnel who earned $69,000 or less. Those taxpayers can choose from any participating Free File provider regardless of the company’s other eligibility standards. Free File also can be a valuable tool for younger taxpayers or first-time filers with modest incomes as well as retirees and working families seeking to save money.

Free File providers also offer state tax return preparation, some for free and some for a fee. Again, use the “look up” tool to find the right product. There are two products in Spanish. With Free File, you can even use any digital device, personal computer, tablet or smart phone. Free File products are mobile enabled so you can do your taxes on your smart phone or tablet and e-File with your hand-held device.

Recommended Reading: How Much Can You Get Back In Taxes

Members Of The Military

If youre stationed outside the United States or Puerto Rico on May 1, you have until to file your return and pay any taxes you owe.Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Combat ZoneIf youre serving in a combat zone, you receive the same filing and payment extensions allowed by the IRS, plus an additional 15 days, or a 1-year extension from the original due date. If you claim this extension, write Combat Zone on the top of your return and on the envelope. For more information, see Tax Bulletin 05-5. Extensions also apply to the spouses of military members who are serving in combat zones.Military Deployment Outside the United States Combat or NoncombatIf youre deployed to military service outside the U.S., youre allowed a 90-day filing extension following the completion of deployment. If youre using this extension, write Overseas Noncombat on the top of your return and the envelope.Note: If youre deployed in combat service, you can use whichever extension is more beneficial for you .

I Have Adhd Am I Eligible

The Canada Revenue Agency recognizes several types of disabilities. In order to be determined eligible, it will depend on the way in which the disability affects your daily life. Two main criteria need to be met. First, the disability must be prolonged for a period of at least 12 consecutive months and second, the disability must restrict at least one or more of the aspects of your day-to-day life.

Recommended Reading: Is Gym Membership Tax Deductible

How Will Taxpayers Receive Penalty Relief Refunds

Most taxpayers will receive their penalty refund via a paper check sent through the mail. The IRS says it will mail the check to the taxpayers last known address.

If your mailing address has changed since you last filed, you must update your mailing address with the IRS.

To track the status of your penalty refund payment, you need to create a free online account with the IRS. With an online account, you can bypass long telephone hold times at the agency and obtain information about your refund quickly.

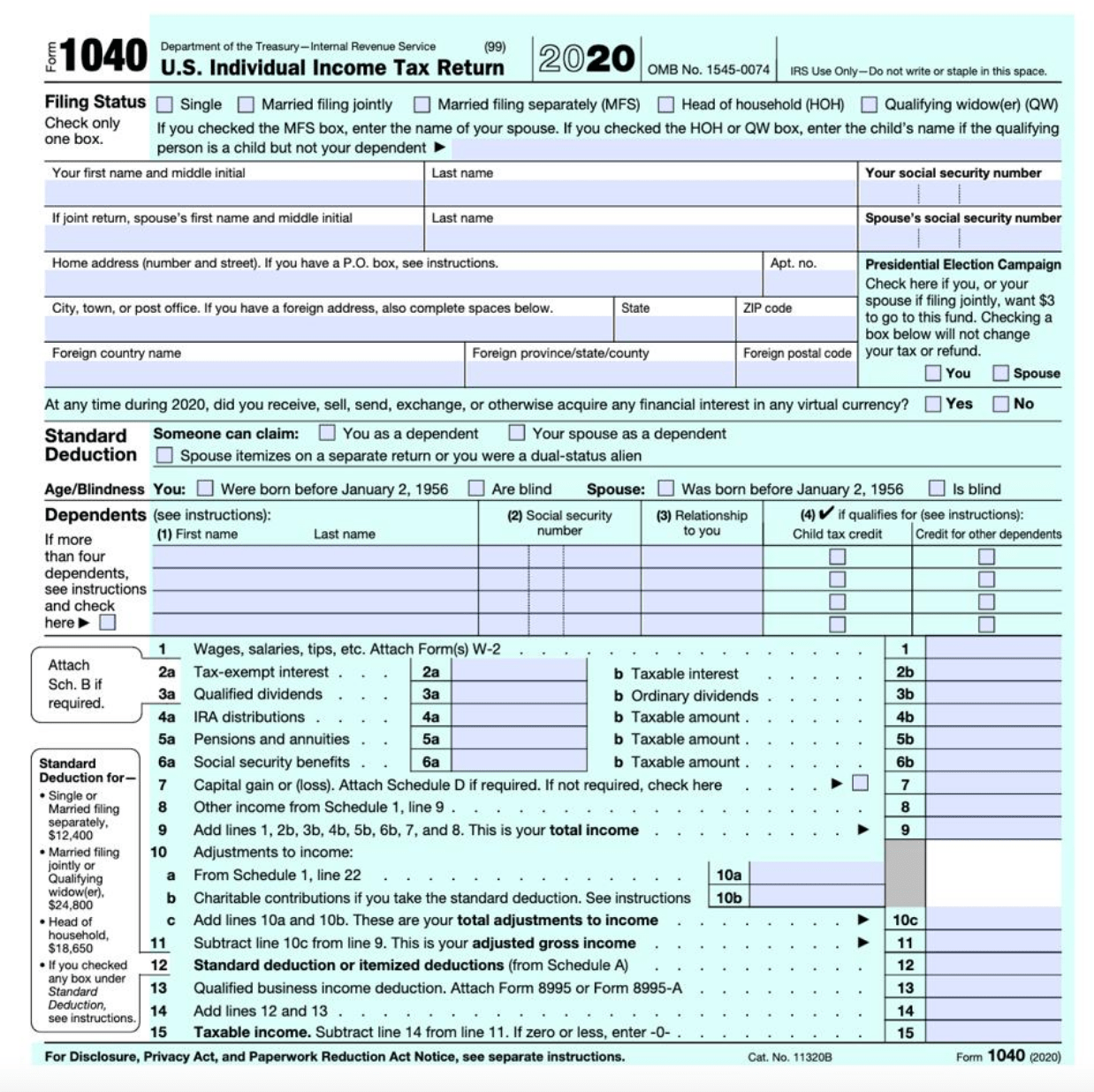

Can I Still File My 2021 Taxes Electronically In 2021

More In NewsIRS Free File, available only through IRS.gov, is now accepting 2021 tax returns. IRS Free File is available to any person or family with adjusted gross income of $73,000 or less in 2021. The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit.

You May Like: How To Figure Out Payroll Taxes

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

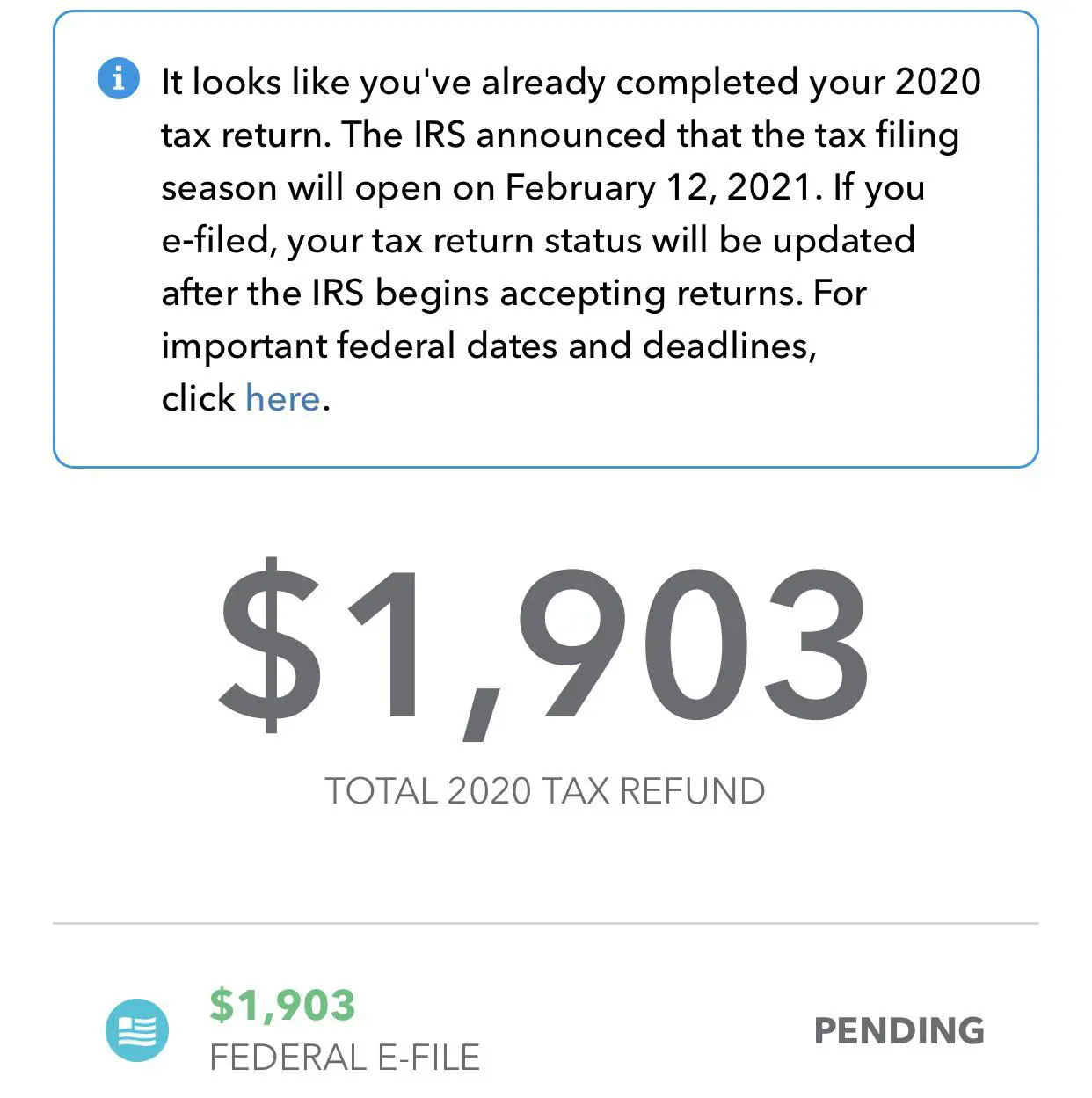

When Is The Earliest I Can File

Because so many of our clients are excited to get their refunds, we get asked all the time, When is the earliest I can file my federal tax return?

You cannot technically file your federal taxes until the IRS starts accepting returns. However, you can begin to prepare your return with a pay stub, and complete it when you have your W-2 form or other necessary tax documents. Tax-preparation services can also help with this.

You can prepare and submit your return as soon as you receive your W-2s from your employers and have all the relevant information and documents. Most W-2s arrive in mid-January, but employers have until January 31, 2020 to send W-2s and Forms 1099, so you could receive yours as late as early February.

Don’t Miss: How To File Estate Taxes