Some Early Filers Won’t Get Refunds Until Mid

The law provides this additional time to help the IRS stop fraudulent refunds from being issued.

IRS Commissioner Chuck Rettig said in a statement Monday that the pandemic continues to create challenges. But he stressed that taxpayers can take steps to keep returns moving more smoothly.

“Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year,” Rettig said.

Taxpayers also can avoid holdups in getting their tax refunds by not moving too hastily if they received stimulus money and advance payments for the child tax credit in 2021.

“We urge extra attention to those who received an Economic Impact Payment or an advance child tax credit last year. People should make sure they report the correct amount on their tax return to avoid delays, Rettig said.

While you can file early, tax experts warn, it’s best to wait until later in the season if you do not have all the information you need to file an accurate return.

The Daily Money: Get our latest personal finance stories in your inbox

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Estimated 2023 Irs Income Tax Return Chart

| IRS Accepts an E-Filed Return By: | Direct Deposit Sent : |

|---|---|

| IRS may start accepting income tax returns asearly as Jan. 23, 2023. | |

| May 22 |

IMPORTANT: If you file electronically , the IRS will notify you of the actual date they accepted your return. This is often 1-3 days from the time you actually hit the file or submit button, and it is this date that you need to use on the left side of the above chart.

Taxpayers who mail a paper version of their income tax return can expect at least a 3-4 week delay at the front-end of the process, as the return has to be manually entered into the IRS system before it can be processed.

Be Safe Hire a Professional

Taxpayers who use a professional, such as a CPA or EA, can ask that professional for the estimated date of their tax refund, and they can be more confident that their taxes have been properly filed.

There are also apps for Apple, Android and other devices that help track refund status.

Other Notes:

In general, the IRS says that returns with refunds are processed and payments issued within 21 days, and often in as little as 10 days. For paper filers, this can take much longer, however. The IRS and tax professionals strongly encourage electronic filing.

What If You Cant File Your Income Taxes By April 15?

Tax Refund Estimators:

Recommended Reading: How To Track Gas Mileage For Taxes

Get A Larger Tax Refund Next Year

If you want a bigger tax refund next year, then there are a few ways you can increase the amount of money the government will give you as a tax refund. One of the easiest ways is by contributing to a tax-deferred retirement plan such as a 401, the Thrift Savings Plan, or by opening a Traditional IRA, which allows you to deduct up to an additional $5,500 on your taxes each year . You can open an IRA in a variety of locations, including banks, brokerage firms, independent advisors and more.

When To Expect Your Refund If You Claimed The Earned Income Tax Credit Or Additional Child Tax Credit

- You choose to get your refund by direct deposit

- We found no issues with your return

However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Additionally, your financial institution may need time to accept your direct deposit or issue a debit card. Many institutions dont process payments on weekends or holidays. So, if you file early, be aware of federal and local holidays that may affect how soon you get your refund.

Don’t Miss: Can I File My State Taxes Online For Free

Delayed Start To Tax Season Due To Covid

Listen to article

WASHINGTONThe Internal Revenue Service wont start accepting 2020 individual income tax returns until Feb. 12, several weeks later than usual, as the agency implements late tax legislation.

This tax season could be unusually challenging for the IRS and for taxpayers. The IRS said Friday that it needed time to program and test its computer systems after Congress passed a relief law in late December.

Continue reading your article witha WSJ membership

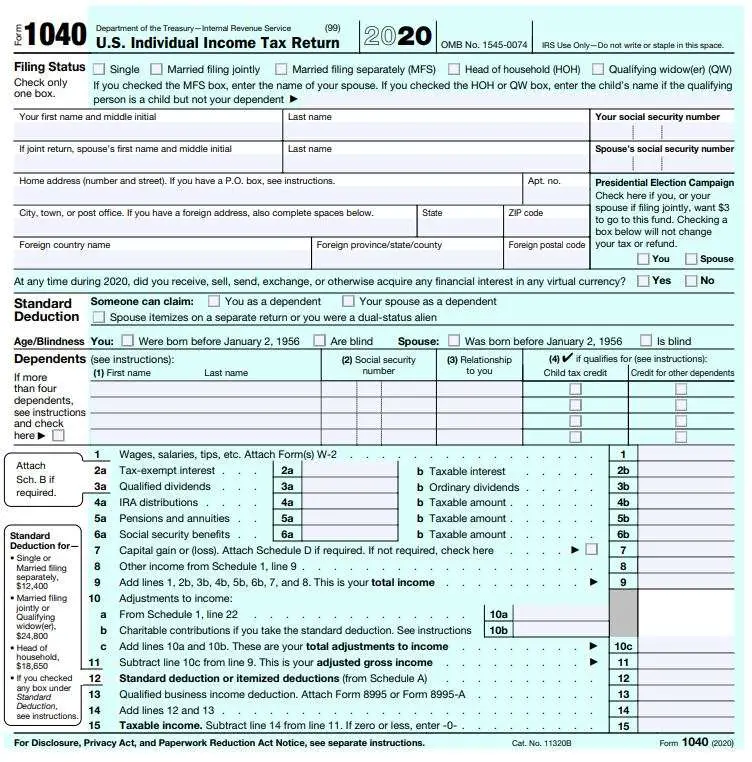

Tax Filing Season Begins January 24

WASHINGTON – The Internal Revenue Service announced today that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers will allow the IRS time over the course of the coming weeks to do additional programming and testing that is critical to ensure that IRS systems will run smoothly this filing season and will help taxpayers claim the remainder of their Child Tax Credit and remaining stimulus funds in a timely manner when filing their 2021 returns.

The IRS anticipates that most taxpayers will receive their refund within 21 days of when they file electronically, barring any issues with processing their tax return. The IRS urges electronic filing to avoid delays in processing and to utilize information letters provided by the agency when filing their returns to avoid errors that can lead to delays.

Read Also: How Far Can You Go Back To File Taxes

When Are Taxes Due

Last year was another unusual year for taxes, with the IRS automatically extending the tax filing deadline and the date federal income tax payments were due. There has been no such announcement this year.

The tax filing deadline for most individuals and businesses for the 2021 tax year is April 18, 2022.*

* Notes:

- Because Maine and Massachusetts celebrate Patriots Day on April 18, the tax-filing deadline for residents is April 19, 2022.

- The tax-filing deadline was extended to May 16, 2022 for those who live in states that were devastated by the December 2021 tornadoes, namely Illinois, Kentucky and Tennessee. You do not need to file an extension if this applies to you.

You can file a tax extension if you are not ready to file your taxes by the deadline. This year, the tax deadline when you file an extension is Oct. 17 however, any federal income tax payments are due by the original tax-filing deadline. It is recommended to make an estimated tax payment prior to the tax deadline if you believe you will owe federal taxes.

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

Don’t Miss: Do I Pay Taxes When I Sell My Car

If Your Refund Isnt What You Expected

If your refund amount isnt what you expected, it may be due to changes we made to your tax return. These may include:

- Corrections to any Recovery Rebate Credit or Child Tax Credit amounts

- Payments on past-due tax or debts, offset from all or part of the refund amount

For more details, see Tax Season Refunds Frequently Asked Questions.

Gather Documents And Organize Tax Records

The IRS urges all taxpayers to make sure they have all their year-end statements in hand before filing. This includes Forms W-2 from employers and Forms 1099 from banks and other payers. Taxpayers should confirm that each employer, bank or other payer has a current mailing address or email address. Typically, year-end forms start arriving by mail or are available online in January. Review them carefully and, if any of the information shown is inaccurate, contact the payer right away for a correction.

In 2019, taxpayers who engaged in a transaction involving virtual currency will need to file Schedule 1, Additional Income and Adjustments To Income. The Internal Revenue Code and regulations require taxpayers to maintain records that support the information provided on tax returns. Taxpayers should maintain, for example, records documenting receipts, sales, exchanges, or other dispositions of virtual currency and the fair market value of the virtual currency.

To avoid refund delays, be sure to gather all year-end income documents before filing a 2019 tax return. Doing so will help avoid refund delays and the need to file an amended return. Filing too early, before receiving a key document, often means a taxpayer must file an amended return to report additional income or claim a refund. It can take up to 16 weeks to process an amended return and issue any related refund.

Recommended Reading: How To File My Taxes For The First Time

To Speed Refunds And Help With Their Tax Filing The Irs Urges People To Follow These Simple Steps:

- File electronically and use direct deposit for the quickest refunds.

- Check IRS.gov for the latest tax information, including the latest on Economic Impact Payments. There is no need to call.

- For those who may be eligible for stimulus payments, they should carefully review the guidelines for the Recovery Rebate Credit. Most people received Economic Impact Payments automatically, and anyone who received the maximum amount does not need to include any information about their payments when they file. However, those who didn’t receive a payment or only received a partial payment may be eligible to claim the Recovery Rebate Credit when they file their 2020 tax return. Tax preparation software, including IRS Free File, will help taxpayers figure the amount.

- Remember, advance stimulus payments received separately are not taxable, and they do not reduce the taxpayer’s refund when they file in 2021.

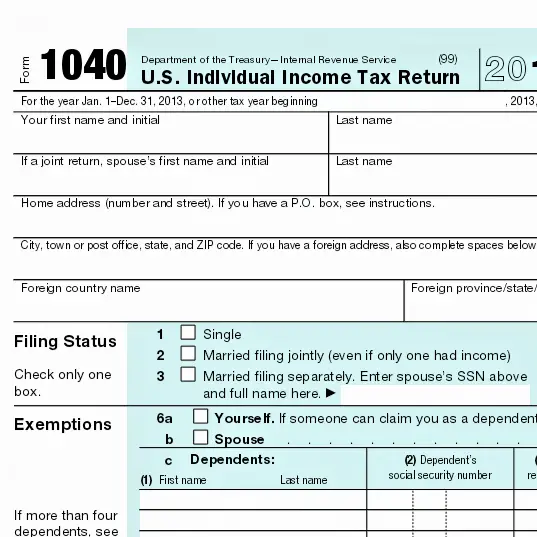

When Does The Irs Start Accepting 2019 Tax Returns

Direct Deposit Sent : IRS will start accepting income tax returns on 31, 2022. * = IRS may delay start of tax season by a week or so. ** = Returns with EITC or CTC may have refunds delayed until March to verify credits.

- IRS confirms tax filing season to begin IR-2019-01, January 7, 2019. WASHINGTON Despite the government shutdown, the Internal Revenue Service today confirmed that it will process tax returns beginning January 28, 2019 and provide refunds to taxpayers as scheduled. We are committed to ensuring that taxpayers receive their refunds notwithstanding the government shutdown.

Don’t Miss: Why Am I Owing Taxes This Year

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2022. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refunds. Refunds should be processed normally after this date.

Note: There may be delays for the 2021 tax year. The IRS continues to work through a backlog of tax returns , including those with errors and amended returns.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

You May Like: What Do I Need To Complete My Taxes

When Does The Irs Start Accepting Tax Returns

The IRS has announced that the 2020 tax season will begin on January 27th. The beginning of tax season marks the first day that the IRS will accept individual electronic returns and start processing traditional paper returns.

Soon, you and more than 150 million of your fellow Americans will be sifting through tax information and preparing returns or have them prepared for you. In 2018, tax preparers filed nearly 79.5 million electronic returns. In 2019, the industry employed 314,413 tax practitioners in 134,475 businesses and created $11 billion in revenue. Expect tax preparers to be even busier in 2020 due to the tax laws in effect.

You may have an alternative to paying for tax services. About 70% of American taxpayers are eligible to save money by using IRS Free File. The IRS and their commercial partners supply free software to families or individuals making less than $69,000. This software can help you file your taxes without the need of outside assistance.

Regardless of who prepares your taxes, you have until April 15 to file a return or an extension.

Tax Brackets and Tax Rates for 2019 Returns

For your 2019 tax return, which you’ll file this season, the seven tax brackets set by the Tax Cuts and Jobs Act are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. For the lower thresholds for each tax bracket are $19,401 , $78,951 , $168,401 , $321,451 , $408,201 , and $612,351 . Individual taxpayer thresholds are $9,701 , $39,476 , $84,201 , $160,726 , $204,101 , and $510,301 .

When Will The Irs Start Accepting 2023 Tax Returns And Issuing Refunds

The IRS usually starts accepting tax returns during the last week of January. If major new tax legislation is passed at the end of the year, however, this could push the start of tax season back by a week or two. So, early tax filers who are a due a refund can often see them as early as mid- or late February. However, taxpayers with the Earned Income Tax Credit or Child Tax Credit generally have their refunds delayed by about one month while the IRS confirms eligibility for these credits.

Although the last two tax filing seasons were significantly impacted by the Covid-19 pandemic, and the IRS extended both deadlines, the IRS is not expected to extend the tax filing deadline for 2023.

The below chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years- and depending on when a person files their return. If your IRS income tax refund is delayed after youve filed, ask your tax professional, or simply use the Wheres My Refund? tool on the IRS website. Or download the IRS2Go app to check your refund status.

Most Americans who are expecting an income tax refund receive it by direct deposit in as little as 2 weeks, although it can take longer during the peak of the filing season, which starts in late March. So its a good idea to e-file your tax return as soon as you have all of your tax documents .

Don’t Miss: How Do Property Taxes Work In Texas

When Will My Refund Be Available

Keep in mind that it may take a few days for your financial institution to make your deposit available to you, or it may take several days for the check to arrive in the mail. Keep this in mind when planning to use your tax refund. The IRS states to allow for five additional days for the funds to become available to you. In almost all cases, a direct deposit will get you your tax refund more quickly than in five days, and in some cases, it will be available immediately.

What You Can Expect

Look on the following list for the action you took whether that’s sending us your individual or business tax return or answering a letter from us. Then, open the action to see how long you may have to wait and what to do next.

Filed a Tax Return

We are opening mail within normal time frames, and weve processed all paper and electronic individual returns in the order received if they were received prior to April 2022 and the return had no errors or did not require further review.

As of November 25, 2022, we had 3.2 million unprocessed individual returns received this year. These include tax year 2021 returns and late filed prior year returns. Of these, 1.7 million returns require error correction or other special handling, and 1.5 million are paper returns waiting to be reviewed and processed. This work does not typically require us to correspond with taxpayers, but it does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund.

How long you may have to wait: We continue to process tax returns that need to be manually reviewed due to errors. For returns received in the current year, we process individual tax returns for which refunds are due first. Tax returns reflecting tax owed are processed last, but if a payment is mailed with the tax return, the payment is separated upon receipt and deposited to ensure the taxpayer account is credited for the payment.

Answered a Letter or Notice

You May Like: When Are Individual Tax Returns Due