What To Know If Someone Claims You As A Dependent On Their Taxes But You Work Or Go To College

Even if you work or go to college full-time , you still count as a dependent if you meet either the support test or the residency test mentioned above. Basically, if you rely on your parents or guardians for more than half of your financial support, if you made less than $4,200 in 2019 or you’re a full-time student under age 24 who resides with a parent or guardian while not in school, or both, you likely still meet the requirements to count as a dependent.

However, many dependents still have to file tax returns, too. Income for dependents falls into two categories: earned income and unearned income . Those requirements for filing are based on income, so if dependents are receiving either earned or unearned income, they will need to file a tax return or their parents will need to file a tax return for them.

What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms “Letter 6475” on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a “Notice 1444-C” that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Read Also: How Much Is To Do Taxes

The Third Round Of Stimulus Checks Are Based On Your Most Recent Tax Filing With The Irs But Are An Advanced Payment On A Refundable Tax Credit For 2021

Just days after the American Rescue Plan was signed $1,400 direct stimulus payments began to be sent out to eligible recipients. Many Americans are already seeing those payments appearing in their bank accounts, letting families still struggling a year into the economic crisis brought on by the covid-19 pandemic breathe a sigh off relief.

The Internal Revenue Service based eligibility on the information the agency had on file when the payments were made, which could be from your tax filing in 2019 or 2020. However, if you are not eligible for a payment but your income is affected for the worse in 2021, you may be able to claimwhat is due to you through the Recovery Rebate Credit when you file in 2022.

When The Stimulus Checks Will Stop Being Issued

Most of the third stimulus check payments have gone out from the IRS and US Department of the Treasury, based on the information the IRS has on hand to determine payment amounts. The , however, gives these federal agencies until Dec. 31, 2021, to send out all the third checks. That gives the IRS room to process 2020 tax returns and square up payments for those who are owed plus-up amounts, folks who filed for a 2020 tax extension and other groups, like people who moved or dont have a fixed address .

Millions could end up receiving a smaller stimulus check than theyre owed.

Recommended Reading: Do Your Taxes For Free

How Much Is The Third Economic Impact Payment

Those eligible will automatically receive an Economic Impact Payment of up to $1,400 for individuals or $2,800 for married couples, plus $1,400 for each dependent. Unlike EIP1 and EIP2, families will get a payment for all their dependents claimed on a tax return, not just their qualifying children under 17. Normally, a taxpayer will qualify for the full amount if they have an adjusted gross income of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household and up to $150,000 for married couples filing joint returns and surviving spouses. Payment amounts are reduced for filers with incomes above those levels.

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Read Also: How To Get The Most Out Of Taxes

Rhode Island Stimulus Checks

Rhode Island families who qualify for a child tax rebate this year will receive $250 for each child who was 18 years old or younger at the end of 2021 up to a maximum of $750 . The state started sending payments on a rolling basis in October to residents who filed their 2021 Rhode Island tax return August 31, 2022. However, for people who file an extended tax return by October 17, 2022, checks will hit mailboxes in December.

If you’re married and filed a joint Rhode Island return for the 2021 tax year, you qualify for a rebate if your federal adjusted gross income can’t exceed $200,000. For everyone else, your federal AGI must be $100,000 or less.

Check out the Rhode Island Division of Taxation’s online tool if you want to see the status of your rebate.

For Rhode Island taxes in general, see the Rhode Island State Tax Guide.

How To Return A Third Stimulus Check

If you need or want to return a third stimulus check, the method you use depends on how you received your payment and what, if anything, you’ve already done with it.

If you received a paper stimulus check in the mail and still have it, then:

- Write “Void” in the endorsement section on the back of the check

- Mail the voided check immediately to the appropriate IRS location listed below and

- Include a brief explanation stating the reason for returning the check.

If you received a paper check and cashed it, or if your payment was a directly deposited into your bank account, then:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location listed below.

- Make the check/money order payable to “U.S. Treasury “

- Write “Third EIP” and your taxpayer identification number on the check and

- Include a brief explanation of the reason for returning the payment.

Use the following table to identify the property IRS location to send your stimulus check, personal check/money order, and explanation.

Recommended Reading: How To Calculate Sales Tax In Texas

Timing Of Third Stimulus Checks

Question: When will I get my third stimulus check?

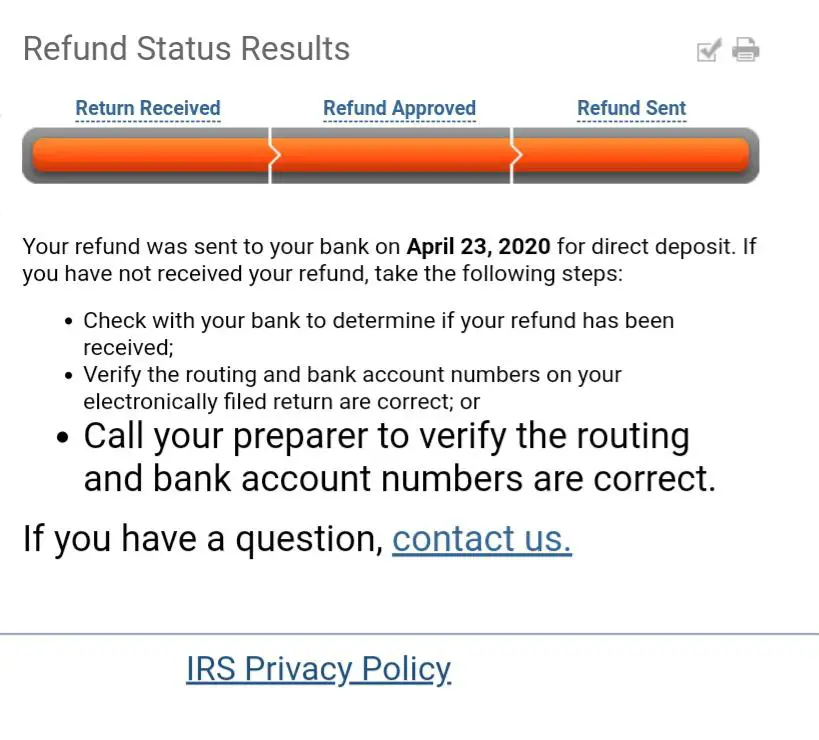

Answer: Millions of Americans have already received their third stimulus check. And the IRS will be sending out more over the next several weeks. So, if you haven’t received your payment yet , it should arrive relatively soon.

How long it will take to send all payments is not known yet. The IRS has a lot on its plate right now. We’re in the middle of tax return filing season, so the IRS is already busy processing tax returns. The tax agency also has to send refunds for people who reported unemployment compensation on their 2020 return and come up with a way to send periodic child tax credit payments later this year. All of this could very well slow down the processing and delivery of third-round stimulus checks.

If the IRS already has your bank account information either from a recent tax payment that you made, a tax refund it sent you, or some other source then expect to get your third stimulus check faster. That’s because the IRS will be able to directly deposit the payment into your bank account. The IRS can also make a third stimulus payment to a Direct Express debit card account, a U.S. Debit Card account, or other Treasury-sponsored account. Otherwise, you’ll get a paper check in the mail.

If you already have a prepaid debit card from the IRS , you’ll get a new card if the IRS decides to send your third stimulus payment to you in that form.

Could Filing Early Disqualify Me For The Next Stimulus Payment

Thats a fair questionuntil we see what the package has for sure, its hard to say, but there may be some situations where youd be disqualified for a third stimulus payment.

For example, if your 2019 income ends up being in the EIP3-eligible income range, but you made more than the eligible threshold in 2020, then filing early would prevent you from getting that payment. Thats not a bad problem to haveafter all, being above the threshold means you dont need the assistance .

Another situation could be if you claimed a child in 2019 but that dependent is now on his own. You wouldnt get any additional payment for the dependentbut your child would receive the EIP3 if they have filed their return in 2020, which hopefully means less money out of your pockets in the long run.

Don’t Miss: Can I File Taxes Separately From My Husband

Enlisted In The Us Armed Forces You Likely Can Get Your Own Payment

If you’re age 17 or older and have enlisted in the US armed forces, you’re considered emancipated from your parents or guardians and would file taxes independently. Therefore, you would be eligible for your own stimulus check if you met the requirements.

Would you get your own stimulus check, contribute to the family share or none of the above?

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Also Check: Do I Need To File An Extension For 2020 Taxes

States Sending Stimulus Checks In December 2022

Almost half of the states have sent “stimulus checks” in 2022. While these state payments generally aren’t as big as the stimulus checks paid by the federal government last year, they can still be an important source of additional support for families dealing with higher inflation and other economic hardships.

As the year winds down, most state stimulus payments have already been paid to eligible residents. But there are a few states where payments will continue in December. This is particularly helpful for qualified recipients who have extra expenses at the end of the year or during the holidays. Here’s a look at the states sending stimulus checks in December and answers to some of the who, what, and when questions about those payments.

Why Else Should I File My 2020 Tax Return Early

If you don’t have direct deposit information filed with the IRS, filing your taxes can allow you to get that set up. You’re likely to get your stimulus payment faster through direct deposit than waiting for a physical check in the mail.

Beyond the stimulus, getting your 2020 return in early means you’ll get your refund back faster if you are due one. The IRS says those who file their returns online and are signed up for direct deposit generally get their refunds back within 21 days.

Another reason to get your taxes in sooner rather than later is security. Hackers and scammers — if they are able to get a hold of your personal information including your social security number — may be able to claim your refund before you do.

Read Also: How To Calculate Annual Income After Taxes

Nine Million Households Could Still Be Due Significant Stimulus Money And For Expanded Child Tax Credit And Earned

With rent, food prices and utility bills up, many families could use some extra cash. Inflation is stressing peoples budgets big time.

If youre struggling and didnt file a tax return this year, check your mail.

Last week, the IRS started sending letters to the 9 million households who may still be eligible for several lucrative tax benefits, including the third round of stimulus payments, worth as much as$1,400 for an individual and $2,800 for couples.

If you didnt get the full amount of the pandemic-related Economic Impact Payment under the $1.9 trillion American Rescue Plan, you may be able to claim the 2021 credit. But you must submit a 2021 tax return even if you dont usually file taxes.

The payments were the largest of those sent to Americans under federalcoronavirus relief packages starting in 2020.

You dont have to have income for 2021 to qualify for the stimulus money. But there are income caps.

The IRS faced a daunting task amid the pandemic to reach millions of people who dont typically file tax returns. Technically, the stimulus payments were an advance of a credit referred to on Forms 1040 and 1040-SR as the Recovery Rebate Credit.

For the third round of payments, eligible individuals with an adjusted gross income of $75,000 or less were entitled to the full $1,400. The ceiling was $112,500 for individuals filing as head of household and $150,000 for couples filing jointly. Your AGI is your gross income minus certain adjustments.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

Also Check: When Can You Start Filing Taxes 2021

Democrats Celebrate Stimulus Checks With Times Square Billboards

President Biden is looking to press home the success in passing the $1.9 trillion American Rescue Plan and is doing so with a series of public billboards. Here MSNBC presenter Rachel Maddows runs through some of the self-publicising being done by the Democrats at the moment, having fought to get the stimulus bill passed without any Republican support.

Republicans in the Florida state Senate have proposed a new bill that would provide a considerable increase to the current unemployment support. Some states have opted to provide their own stimulus checks for residents, but Florida currently has some of the stingiest jobless benefits in the country so lawmakers are prioritising that.

The Democrats have tabled some amendments which would widen eligibility, but Republican senators have so far blocked these attempts. Heres everything you need to know about the new unemployment benefits in Florida.

Dont Miss: Has The House Approved The Stimulus Package