How To Check When You Will Receive Your Tax Return

IRS2Go is the official mobile app of the IRS, which you can use to check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips and more. The app is available in Spanish and English, and you can download it from Google Play, the Apple App Store or Amazon.

You can also use the Wheres My Refund tool on the IRS website. To check your refund status, you will need your social security number or ITIN, your filing status and the exact refund amount you are expecting.

The IRS updates the tools refund status on a daily basis, usually overnight, so check back in routinely for the most up-to-date information.

If its been more than 21 days since you e-filed your federal tax return, you should you call the agency directly.

If you havent filed your taxes for the 2021 tax year yet, consider going with a tax prep software that offers expert tax assistance. Speaking with a tax-prep expert may help ensure that your return is accurate, which can help facilitate a timely return.

Here are Selects top picks for best tax filing software:

- Best overall tax software: TurboTax

Recommended Reading: How To Report Tax Fraud To The Irs

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

Here’s Step By Step Guide To Check Itr Refund Status

Step 1- Open the income tax e-filling website – incometaxindiaefiling.gov.in. To receive the OTPs, apart from the registered mobile number assesses will need their PAN and Aadhar Card details.

Step 2- Once the website- incometaxindiaefiling.gov.in- is open, log in to the account using PAN details, OTP and by entering the Captcha code.

Step 3- After logging in, click on the e-file option.

Step 4- Next, select the income tax returns tab and then select the option to view filed returns.

Step 5- From there, the taxpayer can look up the status of the most recent ITR that was submitted.

Step 6- Select View Details to access the options where you may view the status of your income tax refund.

Also Check: How To Lower Your Tax Debt

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Will The Irs Contact You If Your Taxes Are Wrong

Remember that the IRS will catch many errors itself For example, if the mistake you realize youâve made has to do with math, itâs no big deal: The IRS will catch and automatically fix simple addition or subtraction errors. And if you forgot to send in a document, the IRS will usually reach out in writing to request it.

Read Also: What Is Total Tax Liability Mean

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

How Can I Check To See If I Missed A Year Filing Taxes

Contacting the IRS is the only way to know the accurate answer to that question since all returns would go through them no matter how they may have been filed.

You can request transcripts of your prior year returns or call the IRS directly to ask. Use 1-800-829-1040 to call the IRS. Use the following link to get started ordering a transcript of prior year returns: IRS Get Transcript

Be aware that tax return transcripts are only available for the current year return and the previous three years .

You May Like: How Much Does It Cost To File Taxes With Taxslayer

The Tool Displays Progress In Three Phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their financial institution to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Heres How Taxpayers Can Check The Status Of Their Federal Tax Return

IRS Tax Tip 2021-70, May 19, 2021

The most convenient way to check on a tax refund is by using the Where’s My Refund? tool. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Don’t Miss: What Is Income Tax Return

What Is The Phone Number For The Irs

Phone support from the IRS is currently very limited. If you have questions about payments that affect the economy, call 8009199835. Where is my refund? Are you waiting for a refund? The IRS gives more than 9 out of 10 refunds in less than 21 days. 4 weeks after sending the paper declaration. Where is my refund? They invite you to contact us.

Income Tax Refund Latest Updates

- CBDT issues refunds of over Rs 84,781 crore to more than 59.51 lakh taxpayers from 1st April, 2021 to 11th October, 2021. Income tax refunds of Rs. 22,214 crore have been issued in 57,83,032 cases & corporate tax refunds of Rs 62,567 crore have been issued in 1,67,718 cases, Income Tax India tweeted.

- This includes 29.23 lakh refunds of assessment year 2021-22 amounting to Rs 2,241.39 crore, as per details by Income Tax India.

Heres how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Heres an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: Is Aarp Doing Taxes In 2021

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Recommended Reading: Are Donations To St Jude Tax Deductible

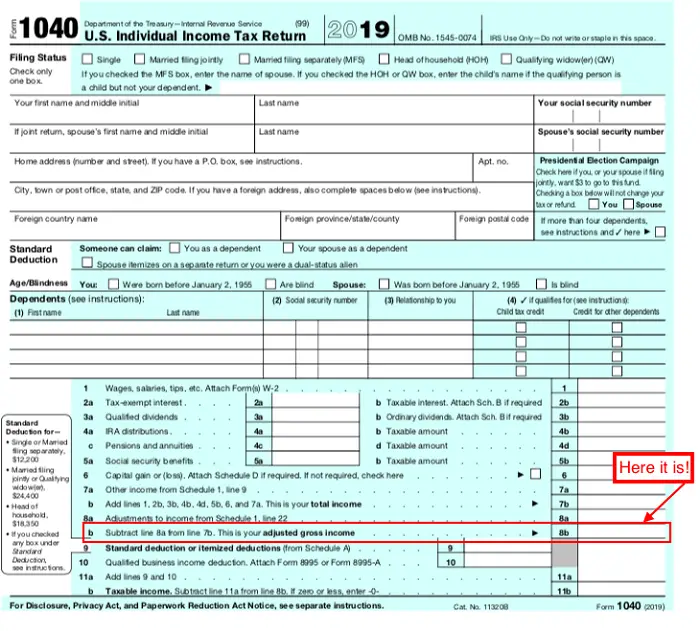

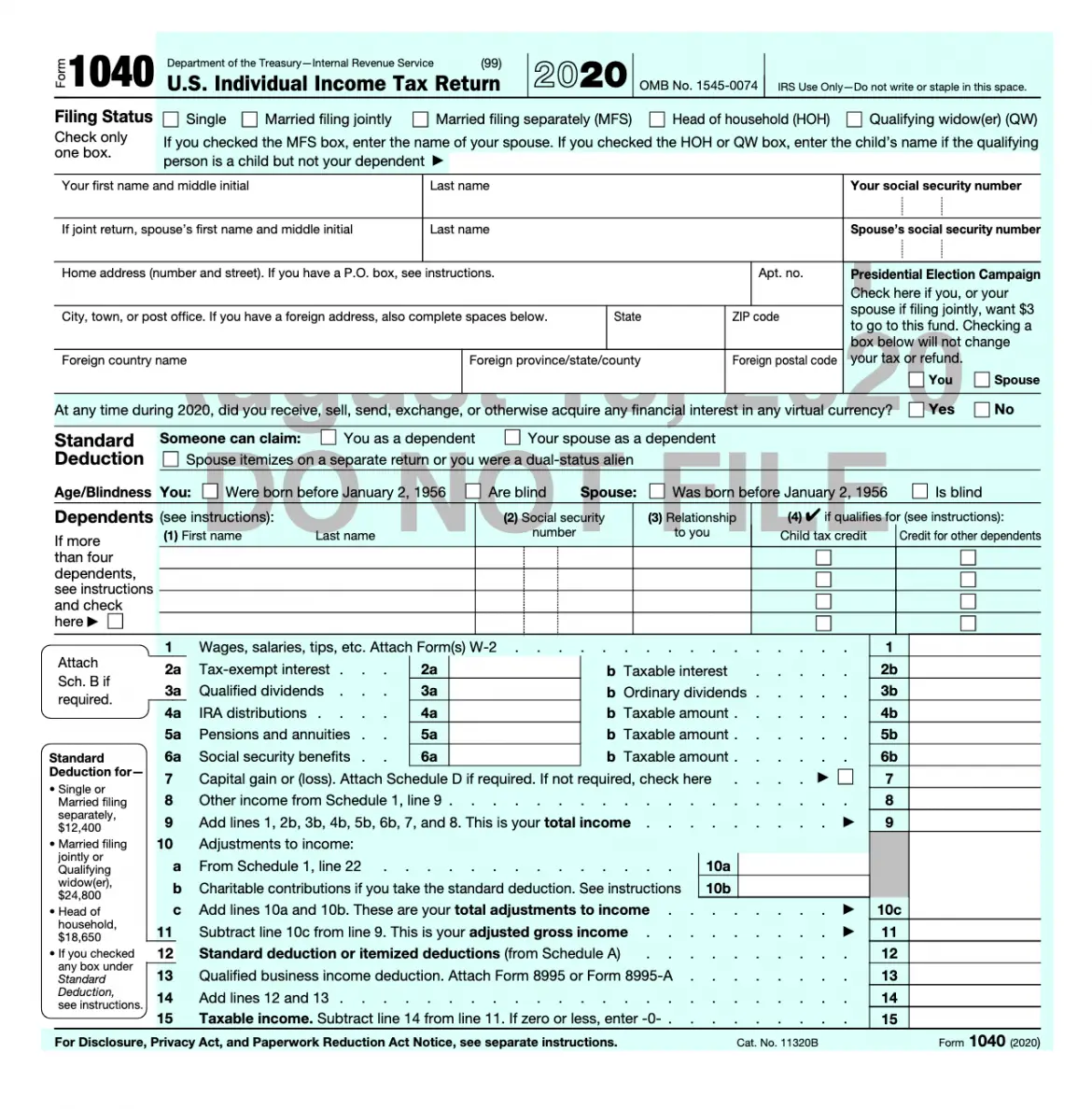

Estimate Your Federal Tax Refund With The Last Pay Stub Of The Year

When workers receive their last pay stub of the tax year, they are likely wondering if they will receive a tax refund for the year and, if so, by how much. Most taxpayers know completing their income tax return is complex and challenging even with all the information they need, such as W-2 forms and receipts for other income and eligible deductions. However, even without this information, a taxpayer can make an educated guess as to whether they will receive a tax refund or not, including the amount, by using the information on their last pay stub.

Recommended Reading: Why Would My Taxes Be Rejected

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

Those Who Have Filed Their Itr For Ay 2022

IMAGE: PTI

Now that the due date to file Income Tax Return is over and the tax payers have filed their returns, the other part of the process will begin, where the Income Tax Department will issue refunds that have been claimed by the taxpayers in their filings.

Those who have filed their ITR for Assessment year of 2022-23 on time will now wait for their income tax refunds, which is issued to taxpayers only when they pay higher taxes than the actual liabilities.

Income Tax assesses can check the status of their refund online.

You May Like: How Do I Check My Taxes

How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

Recommended Reading: Is Roth 401k Pre Tax

Also Check: Does Tennessee Have State Tax

How To Check The Tds Refund Status

Visiting the online e-filing portal helps in knowing the refund status.

1. Log in to your account.

2. Check out the section labelled My Account and select Refund/Demand Status.

3. This reflects the assessment year, the status, and the mode of payment. In case of rejection, the corresponding reason is mentioned here as well.

Know Your Itr Status User Manual

1. Overview

The ITR Status service is available to the following registered users:

- All taxpayers for ITRs filed against their PAN

This service allows the above users to view the details of ITRs filed:

- View and download the ITR-V Acknowledgement, uploaded JSON , complete ITR form in PDF, and intimation order

- View the return pending for verification

2. Prerequisites for availing this service

Pre-Login:

- At least one ITR filed on the e-Filing portal with valid acknowledgement number

- Valid mobile number for OTP

Post-Login:

- Registered user on the e-Filing portal with valid user ID and password

- At least one ITR filed on the e-Filing portal

3. Process/Step-by-Step Guide

Step 1: Go to the e-Filing portal homepage.

Step 2: Click Income Tax Return Status.

Step 3: On the Income Tax Return Status page, enter your acknowledgement number and a valid mobile number and click Continue.

Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

On successful validation, you will be able to view the ITR status.

Step 1: Log in to the e-Filing portal using your valid user ID and password.

Step 2: Click e-File> Income Tax Returns> View Filed Returns.

Note:

Recommended Reading: How To Report Self Employment Income On Taxes

What You Need For Check The Status Of Your Ma Income Tax Refund

To check the status of your personal income tax refund, youll need the following information:

- Tax year of the refund

- Your Social Security number or Individual Taxpayer Identification Number

|

|

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

You May Like: Can You Pay Taxes Online

Can I Call The Irs If Im Waiting On My Refund

Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Heres the best number to call: 1-800-829-1040.

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Also Check: How Much Is Excise Tax In Maine