Keep Your Us Bank Account Open

You can choose to receive your tax refund either as a bank transfer, check or forward the amount to your 2021 return. However, every year countless nonresidents who file their tax documents from outside the US experience difficulties in accessing their tax refunds.

There are two common reasons for this.

- Firstly, the IRS does not transfer tax refunds into overseas bank accounts.

- Secondly, if you receive your refund as a check, you may find that banks in your home country will not cash them.

The solution?

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With , you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- USPS Tracking® included

- 13 business day delivery

- USPS Tracking® included

- 15 business day delivery

- Extra services available

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

Recommended Reading: When Do My Taxes Have To Be Done

What Do I Need To File Taxes By Mail

Include all necessary tax forms for the IRS if you file by mail: your Form 1040 or 1040-SR, any schedules, and any other additional forms you have to fill out for your particular return. You should also include a check if you owe any taxes, or you can use IRS Direct Pay to make payment online from your checking or savings account.

Where To Send Returns Payments And Extensions

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still file a paper or “snail mail” tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

You May Like: How Does The Federal Solar Tax Credit Work

Why Are There Different Versions Of The 1040 Form

There are now four variations of the 1040 form :

- Form 1040: This is the one the majority of taxpayers will use to report income and determine their tax for the year and any refund or additional tax owed.

- Form 1040-SR: This version is for senior taxpayers . Form 1040-SR is nearly identical to Form 1040, but is printed using a larger font and includes a chart for determining the taxpayer’s standard deduction.

- Form 1040-NR: This form is for non-resident aliens, and it’s several pages longer than the other 1040 form versions.

- Form 1040-X: This form is for taxpayers who need to make amendments to their tax return after previously filing a Form 1040.

Form 1040 Addresses For Taxpayers Who Are Non

If you live in… And you ARE NOT enclosing a paymentuse this address and you ARE enclosing a paymentuse this address A foreign country, U.S. possession or territory, or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien. Department of the Treasury Charlotte, NC 28201-1303 USA – If you live in American Samoa, Puerto Rico, Guam, the U.S. Virgin Islands, or the Northern Mariana Islands, see IRS Publication 570 – Tax Guide for Individuals With Income form U.S. Possessions.

Recommended Reading: Can I Efile 2015 Taxes

Hand Delivering Your Return

You can hand-deliver your return to a local IRS Taxpayer Assistance Center under normal circumstances if you can find one located near where you live. You can ask the IRS agent for a stamped receipt upon submitting it.

Walk-ins are no longer accepted as of January 2022, although you can call ahead and make an appointment. Masks are required to protect against COVID-19 if you’re located in an area with a high or “substantial” transmission rate. The six-feet-apart rule remains in place.

The IRS website provides a search tool based on your zip code, as well as locations, addresses, and phone numbers for each state.

Where To Mail Your Tax Return

If you are a U.S. citizen or resident from the United States, you lived in a foreign country during the Tax Year, you need to mail your return to the following address:

Department of the Treasury

Austin, TX 73301-0215

In case you are expecting a tax refund, you can request to have your refund directly deposited into a U.S. bank account or have the IRS send a check to the mailing address on your tax return.

If you are including an estimated tax payment with your mailed tax return, you should mail your estimated tax payments, along with Form 1040-ES, to the following address:

Internal Revenue Service

Charlotte, NC 28201-1303

Taxpayers with an Adjusted Gross Income within a specified tax period can electronically file their tax return for free using Free File. Taxpayers with an AGI greater than the specified threshold can either use the Free File Fillable Forms or e-file by purchasing commercial software. A limited number of companies provide software that can accommodate foreign addresses. Dont forget that all figures need to be provided in US dollars . Be aware of exchange rates between currencies.

Also Check: How Much Federal Income Tax Should Be Withheld

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2022 federal tax return, or

- 100% of the tax shown on your 2021 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2022. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

This Is How Prepare Your Tax Return For Mailing

Your tax return is complete and ready to be mailed. Before sealing that envelope, take a few minutes to make certain that all information is complete and accurate. Avoid mistakes that may delay your refund or result in correspondence with the IRS. Here are just a few items to complete prior to mailing your tax return:

- Sign your return. Your federal tax return is not considered valid unless it is signed. If you are filing a joint return, your spouse must also sign.

- Provide a daytime active phone number. This may help speed the processing of your return if the IRS has questions about items on your return. If you are filing a joint return, you may provide daytime phone numbers for either you or your spouse.

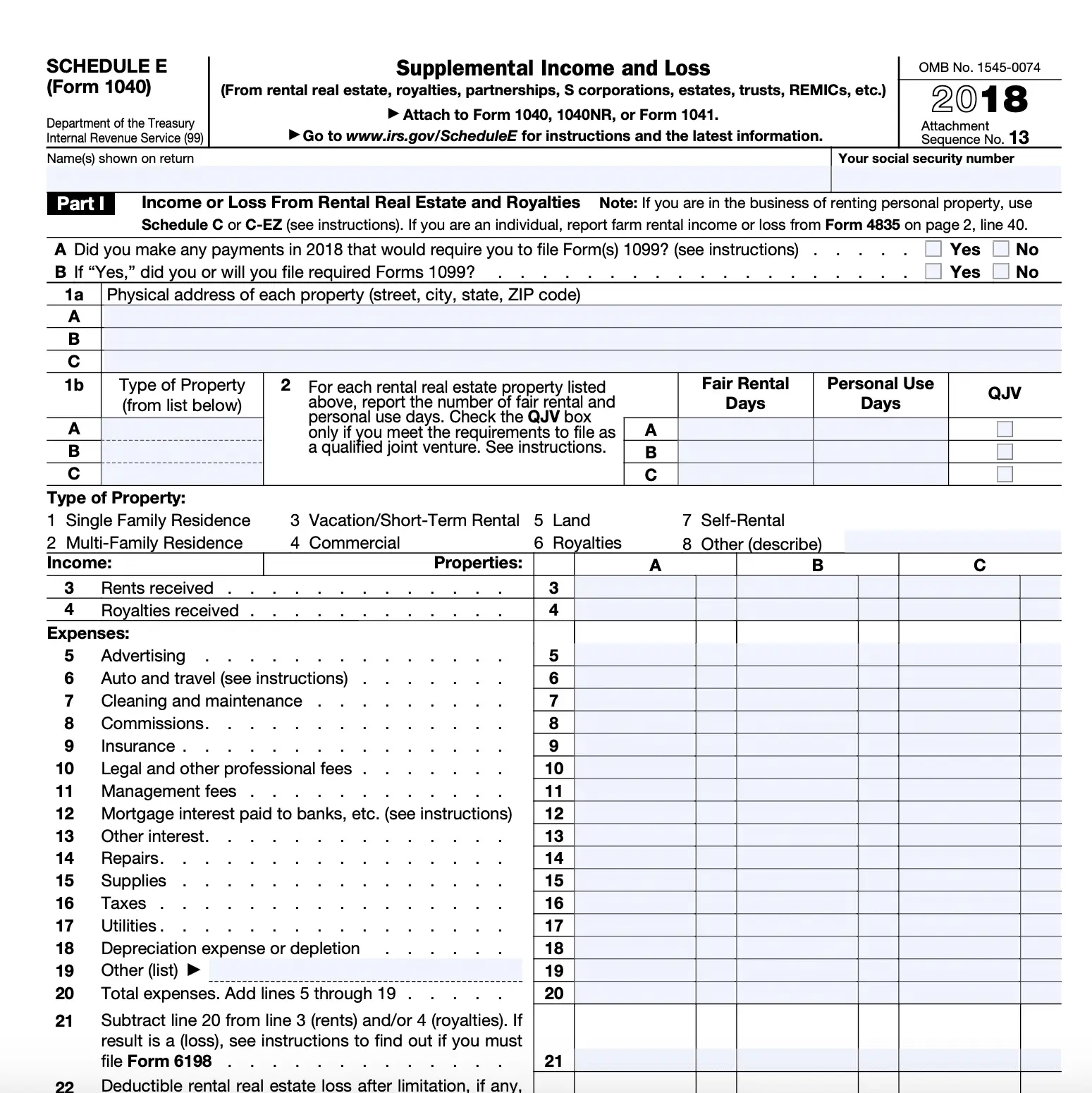

- Assemble any schedules and forms behind your Form 1040/1040A in the order of the Attachment Sequence No. shown in the upper right-hand corner of the schedule or form. For supporting statements, arrange them in the same order as the schedules or forms they support and attach them last.

- If you owe tax, make your check or money order payable to the United States Treasury. Write your name, address, Social Security number, an active telephone number, and 2000 Form 1040 on your payment. Then complete Form 1040-V following the instructions on that form and enclose it in the envelope with your payment. Do not attach the payment to your return.

Recommended Reading: What Is The Mailing Address For Irs Tax Returns

Where Do I Send My 1040ez Form

Whichever version of the 1040 form you use , your 1040 form has to be mailed to the IRS upon completion. However, the answer to this question depends on where you are located. You can check our list below to determine your appropriate IRS mailing address.

Whats your biggest 2022 HR challenge that youd like to resolve

Answer to see the results

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: When Do Taxes Come In 2021

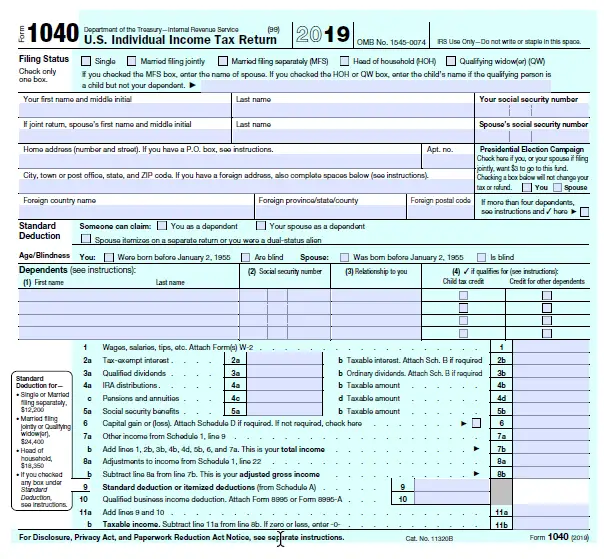

What Is An Irs 1040 Form

OVERVIEW

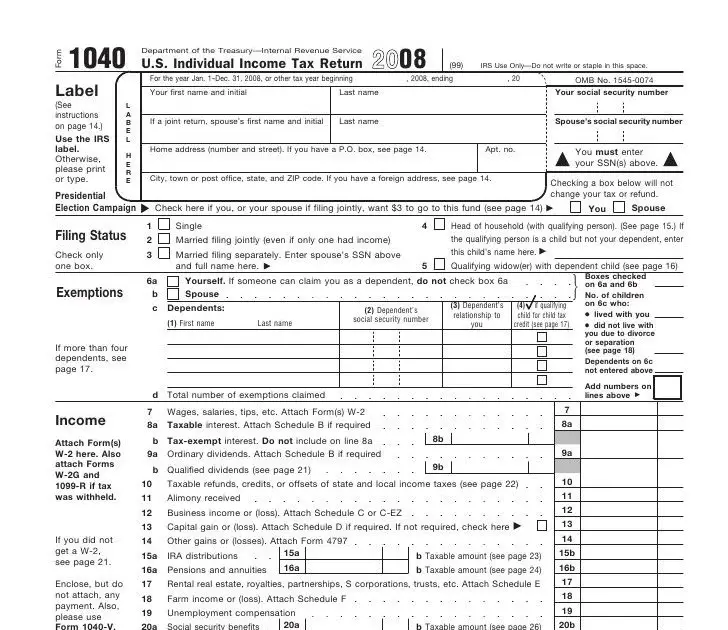

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040. Well review the differences and show you how file 1040 form when it comes to tax time.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Depending on the type of income you need to report, it may be necessary to attach additional forms, also known as schedules.

Here’s a guide to all of the 1040 variations you may come across. to begin preparing your tax documents.

How To Mail Tax Return

How to mail a tax return? If youre filing a paper tax return despite the IRS suggesting that you file electronically, a paper Form 1040 must be mailed to IRS.

Before you get to mail your tax return, make sure to go over your tax forms and schedules once again. If there are any missing forms or schedules or information found on these documents, you will need to mail to the IRS again to make corrections. Since you would want to file a tax return only once, these are quite important.

As for how to prepare your tax return before mailing, here are the things you should do:

- Review your documents to see there isnt any missing or false information.

- Look at the forms and schedules you need to file your tax return with and make sure everything is attached to your tax return.

- You can staple forms and schedules in on the upper right or left corner of Form 1040. Sort your forms and schedules orderly so the IRS workers have an easier time processing your tax return.

You shouldnt have a hard time with your tax return later on once everything above is correctly done. Then, you can mail your tax return to the IRS.

The Internal Revenue Service has multiple mailing addresses depending on your state of residence and whether or not youre paying the IRS.

Here is where to mail Form 1040.

If you owe taxes and pay the IRS, mail it to :

| State |

|---|

Recommended Reading: How To Get Tax Transcript

Mail As Early As Possible

Firstly, We recommend that you prepare and mail your tax documents as soon as possible. By preparing your tax documents today you can ensure that you receive your tax refund without delay.

As you will be mailing your documents to the IRS from outside America, delivery times may take longer than what you would expect if you were mailing from within the US. This is why its a good idea to file your documents as soon as possible to ensure they reach the tax office on time. Give yourself plenty of time to locate everything you will need in order to prepare your documents.

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Don’t Miss: How Much Do Charitable Donations Reduce Taxes

What Is The Purpose Of A 1040 Form

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many credits and deduction limitations are affected by it.

On line 11 of the tax year 2021 Form 1040, you will report your AGI. You can reduce it further with either the standard deduction or the total of your itemized deductions reported on Schedule A. Itemized deductions include expenses such as:

If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new other-dependent tax credit.

TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results.

Filing A Paper Income Tax Return

Before starting your Minnesota return , you must complete federal Form 1040 to determine your federal taxable income.

We use scanning equipment to process paper returns. Follow these instructions to ensure we process your return efficiently and accurately:

- Use your legal name, not a nickname.

- Use whole dollar amounts. Round your amounts to the nearest whole dollar.

- Leave lines blank if they do not apply to you or if the amount is zero.

- Do not write extra numbers, symbols, or notes on your return, such as decimal points or dollar signs. Enclose any explanations on a separate sheet unless you are instructed to write them on your return.

- Place a copy of your federal return and schedules behind your Minnesota forms. Do not include your federal Forms W-2 or 1099.

- Sign and date your return. Your spouse must also sign if you are married and filing a joint return.

- Do not use staples or tape on your return. You may use a paper clip.

Note:

Don’t Miss: How To Avoid Federal Taxes

How Do I File My Taxes For Free With The Irs

Use IRS Free File to File Taxes for Free

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

Recommended Reading: How Do I Protest My Property Taxes In Harris County

Can I File My Tax Returns Via Mail

Yes, there are many different ways to file your federal tax return. If you want to post it to the IRS you can.

However, if you want to post your tax return you need to make sure you have the correct address and that you are posting it well in advance of the deadline.

We also recommend that you get proof of postage and pay to have the forms tracked so you know when they arrive.

We also recommend that you photocopy all your forms so that you dont have to start from scratch if they get lost in the mail.

When Do I Need To Post My Tax Return By

You must submit your federal tax returns once a year. The deadline for this submission is known as tax day and it marks the end of the financial year.

The next Tax Day is in April 2023. Currently, Tax Day 2023 is scheduled for April 15th.

Typically, Tax Day is on April 15th, but if it falls on a Sunday or a holiday, it can be pushed back to April 18th.

When you are posting your tax returns, it is recommended that you put them in the mail at least two weeks before the deadline.

Also Check: How Is Inheritance Tax Calculated