Basics Of Estimated Taxes For Individuals

FS-2019-6, April 2019

The U.S. tax system operates on a pay-as-you-go basis. This means that taxpayers need to pay most of their tax during the year, as the income is earned or received. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated or additional tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty when they file.

The IRS has seen an increasing number of taxpayers subject to estimated tax penalties, which apply when someone underpays their taxes. The number of people who paid this penalty jumped from 7.2 million in 2010 to 10 million in 2017, an increase of nearly 40 percent. The penalty amount varies but can be several hundred dollars.

The Tax Cuts and Jobs Act, enacted in December 2017, changed the way tax is calculated for most taxpayers, including those with substantial income not subject to withholding. As a result, many taxpayers may need to adjust the amount of tax they pay each quarter through the estimated tax system.

Divide Your Annual Estimated Taxes Into Quarterly Payments

Now that you know you owe more than $1,000 in taxes from your self-employment income, all you have to do is divide that total amount you owe for the year into four estimated payments youll pay to the IRS every quarter. In this case, thatll be around $1,500.

$6,079/4= $1,519.75

Remember, the taxes above are just an estimate. If you see your income is going to be higher or lower than you thought it would be, adjust your estimated tax payments to match.

Also, you still need to file an annual tax return by Tax Day to show what you actually made during the year. This is also when you can lower your tax bill by claiming credits and deductions you qualify for.

The Takeaway: There Are Ways To Make Freelance Taxes Less Taxing

Freelancing is a great way to help you build up a business with the flexibility and freedom you desire. One drawback? The taxes can be a little complicated. However, there are ways to set yourself up on the right foot and avoid rushing on your taxes. Choosing the right business structure, and organizing your finances in a tax-friendly way can help you avoid stress at tax time.

More guides for freelancers and the self-employed > > >

Recommended Reading: Do I Have To Give My Ex My Tax Returns

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2022 federal tax return, or

- 100% of the tax shown on your 2021 federal tax return .

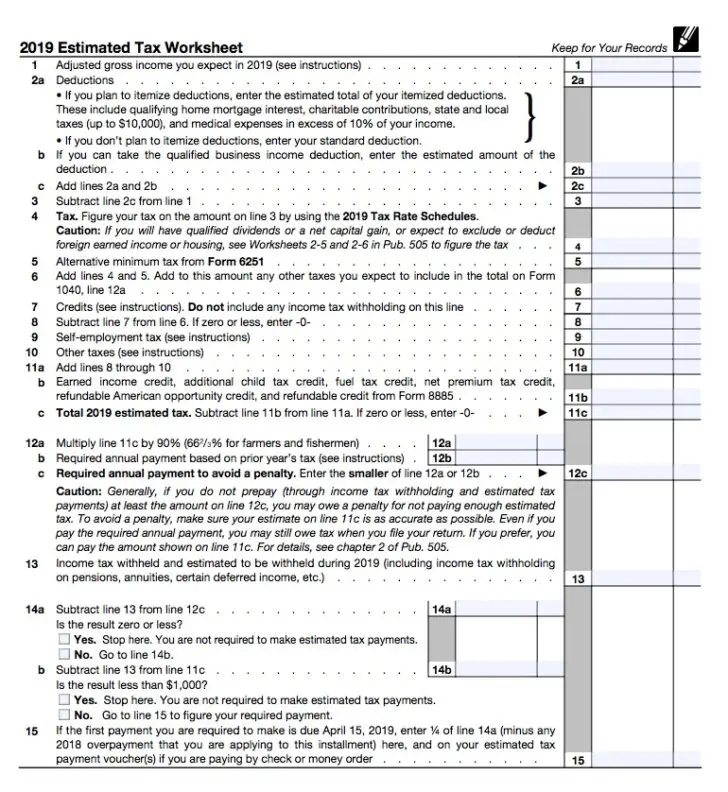

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2022. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

What Happens If My Income Changes During The Year

If your income changes during the year and you realize that your previous estimates may have been inaccurate, you can simply adjust your estimate accordingly in your next quarterly filing. For instance, if you underreported in the first quarter, you can increase your estimate in the second quarter to make up for the initial shortfall. At the end of the day, estimated taxes will always deviate at least somewhat from your actual tax liability, so it is normal for these kinds of adjustments to be made.

You May Like: How Do I Get An Extension On My State Taxes

Tips For Understanding And Calculating Your Estimated Tax Penalty

1. Taxes are due as income is earned. For example, an individual who earns a significant amount of income in a given year must, by both federal and DC law, pay tax on that income as it is earned, rather than waiting until the next year, when the return is filed on April 15. Therefore, if your annual tax liability is not fully covered by withholding, or if you have no withholding, you must make quarterly estimated tax payments. OTR will not charge a penalty if these required estimated payments are made on time and the amount owed at the end of the year is less than $100.

2. If your income is regular throughout the year, and you are not covered by withholding, then you would make four equal quarterly payments of estimated tax. However, if you tend to receive the bulk of your income late in the tax year, you are better off using the annualized income method and filing a completed Form D-2210 with your annual return. The annualized income method allows you to make estimated payments based on the actual percentage of annual income received in a given quarter.

3. Form D-2210 helps you calculate your required quarterly estimated tax payments, plus any penalties resulting from underpayment of these required quarterly payments. There are two keys to understanding the D-2210:

5. Send the completed Form D-2210, along with your notice of tax due and any payment due with your return. If you are mailing it after receiving a Notice of Penalty Assessment, send it to:

Can You Pay Estimated Taxes Anytime

Estimated taxes are due as income is earned, and the IRS sets quarterly deadlines for their collection. You can opt to send four payments per year following the IRS schedule, pay in smaller increments more frequently or cover your estimated yearly liability in your first quarterly payment just make sure youre covering your tax liability for each quarter to avoid penalties.

Read Also: How Much Is Capital Gains Tax On Stocks

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

What About State Taxes

States that assess annual income tax also require their taxpayers to make quarterly estimated payments. Generally, these estimated payments align with federal due dates, but not always. For example, in 2020, some states did not extend first- or second-quarter estimated tax payments when the IRS extended both to July 15, 2020, in response to the coronavirus pandemic. Look to your state to determine when your estimated taxes are due.

Estimated taxes are just that estimates. You may not get it perfect every time, and thats OK. But if you have proper tax planning software, you can ensure your estimated taxes are as accurate as possible. If you want to learn more about Corvees Tax Planning software, reach out to us today to request a demo.

Read Also: What States Have The Lowest Sales Tax

How Do You Pay Estimated Taxes

You pay estimated taxes directly to the IRS every quarter by mail, phone, on the IRS2Go app, or on your online account. You will need to submit Form 1040-ES when submitting a payment. To get a full breakdown of your quarterly tax payment options, go to .

The IRS highly recommends paying via the Electronic Federal Tax Payment System to easily track all your estimated tax payments.

If you do not want to make quarterly lumpsum payments, you can choose to pay your estimated tax payment weekly, bi-weekly, or even monthly. However, it is your responsibility to ensure you have paid enough by the end of the quarter.

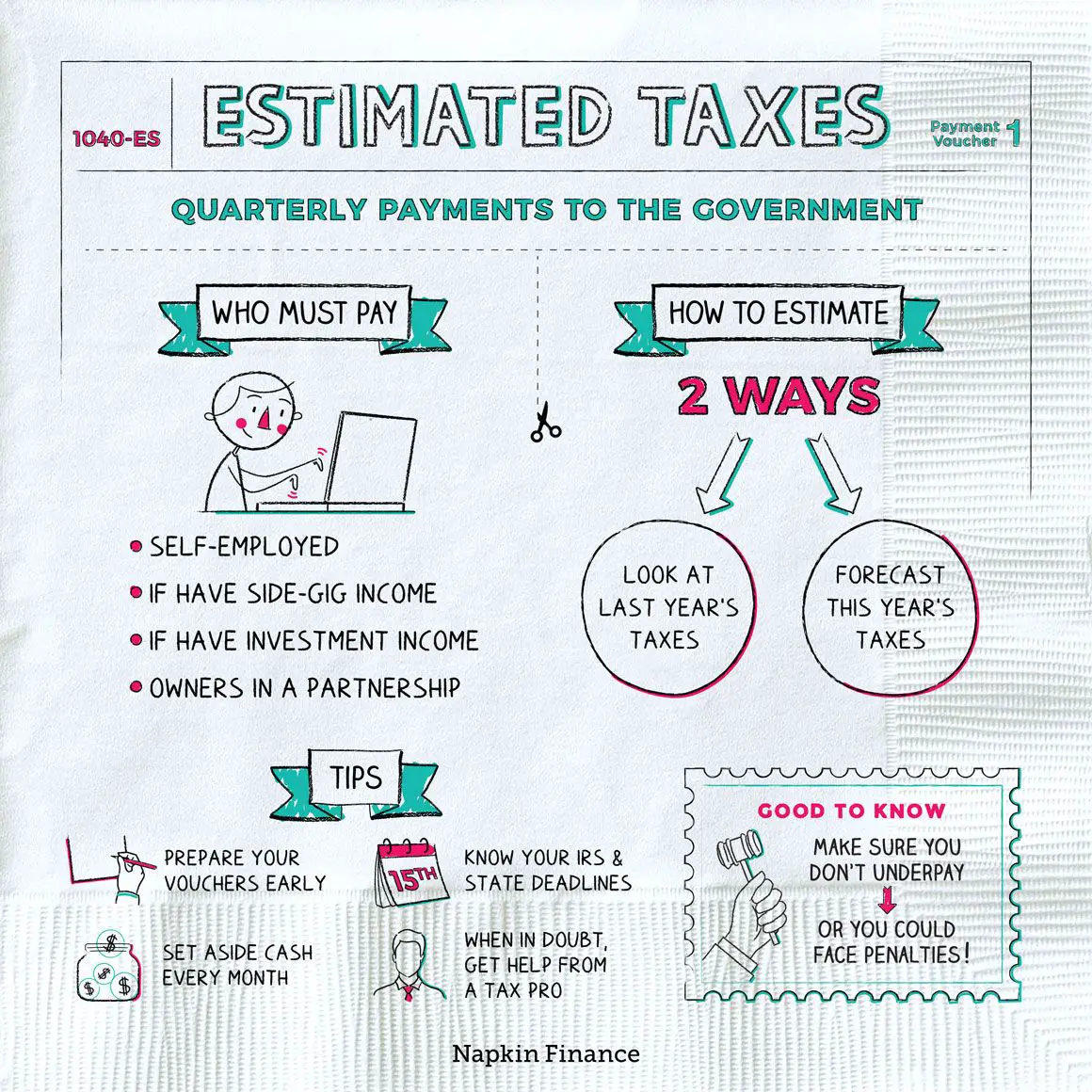

Who Is Required To Pay Estimated Taxes

Individuals should pay federal estimated taxes if they expect to owe $1K or more of tax when they file their return. This applies to all individuals, regardless of employment status, which means that all of the following people may be expected to make estimated tax payments:

- Sole proprietors

Over- or underpayments will be trued up when taxpayers calculate and file their returns.

You May Like: What Is Advanced Premium Tax Credit

What Are Estimated Taxes

If you are newly self-employed, you may have no idea what estimated taxes are.

In the United States, we have a pay as you go tax system. That means the government expects most of your taxes throughout the year. On the other hand, if you are self-employed as a freelancer, contractor, or home-based entrepreneur, you most likely dont have taxes withheld from your pay throughout the year like employees do, and are subject to quarterly estimated taxes. In general, you are expected to pay estimated taxes if you owe $1,000 or more annually.

Make Estimated Tax Payments Online With Masstaxconnect

Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. It’s fast, easy, and secure. In addition, extension, return, and bill payments can also be made.

Visit the MassTaxConnect video tutorial, How to Make an Estimated Payment.

Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 887-6367 or 392-6089 .

Individuals can also calculate their underpayment penalty with MassTaxConnect’s Estimated tax penalty calculator .

Please note:

Read Also: How Long Do You Have To Pay Back Taxes

Pay From Account With A Bank Or Banking Services Provider

- save your bank account information ,

- receive instant confirmation from the New York State Tax Department, and

- schedule payments in advance. Note: To schedule additional payments, return to your Account Summary homepage and select Make a payment again.

Your bank statement will indicate our receipt of your payment with an NYS Tax Payment line item for the authorized amount.

For Fishermen And Farmers

You have special criteria to meet, but you may end up paying less in estimated taxes. You’re considered a qualified farmer or fisherman if you earn more than two thirds of your taxable gross income from farming or commercial fishing.

If you’re not sure you qualify, or how this all works, TurboTax can help you figure your taxable gross income and what fishing and farming income you can include as qualified income.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

Also Check: Where Do You Pay Taxes

How Do I Know The Correct Estimated Taxes Payment

If your business is growing, the simplest way is to take your tax obligation from last year, and make four equal payments that total slightly more than that amount. If you are a high-income taxpayer, make that four equal payments that total slightly more than 110%.

Otherwise, keep track of your income and expenses meticulously, so you can calculate actual taxes due each quarter. QuickBooks Self-Employed easily calculates your quarterly estimated taxes through your business income, expenses, and tax-deductible mileage year-round. At the end of the year, QuickBooks Self-Employed gives you the ability to export your Schedule C information, mileage, and receipts from QuickBooks Self-Employed to TurboTax Self-Employed to make your annual tax filing even easier.

Make An Estimated Income Tax Payment Through Our Website

You can pay directly from your preferred account or by credit card through your Online Services account.

Note: There is no online option at this time for Forms IT-2658, Report of Estimated Tax for Nonresident Individual Partners and Shareholders, or CT-2658, Report of Estimated Tax for Corporate Partners. See Pay estimated tax by check or money order for instructions.

Also Check: How To Determine Fair Market Value Of House For Taxes

Farmers Fishermen And Merchant Seamen

Farmers, fishermen and merchant seamen who receive 2/3 of their estimated Virginia gross income from self-employed farming or fishing have special filing requirements, which allow them to make fewer payments. If you meet the qualifications of a farmer, fisherman or merchant seaman, you only need to file an estimated payment by Jan. 15. If you file your income tax return on or before March 1 and pay the entire tax at that time, you are not required to file estimated tax payments for that tax year.

How Do I Estimate My Quarterly Tax Payment Amounts

To calculate your estimated quarterly tax payments, you need to calculate your estimated tax liability for the year and divide it by four. This is the amount that you need to pay quarterly. This involves estimating income, expenses, deductions, credits, and withholding, often using last year’s numbers as a guide.

The IRS provides detailed worksheets that you can use, such as Estimated Tax for Individuals and Estimated Tax for Corporations . If you don’t earn your income evenly throughout the year or misestimated in either direction, simply fill out a new 1040-ES and re-work the numbers for the next quarter. Any overage paid can be applied to future payments.

Your estimated payments need to equal the lesser of 90% of your current year’s tax liability or 100% of your previous year’s tax liability to avoid a penalty.

Remember that although estimated quarterly tax payments sound threatening, they save you from being faced with a whopping tax bill when you file your annual return that’s one surprise that you can definitely do without.

About the Author

Naomi Levenspil

A CPA by trade, but a writer at heart, Naomi Levenspil jumps at the chance to exercise the right side of her brain. WhenRead more

Read Also: Can You Claim Child Support On Taxes

Preparing For Next Years Taxes

As a freelancer, its important to keep records of your income and expenses, including notes on your travel, business meals, and mileage. That means filing away your receipts in a semi-orderly manner. Expense tracking apps can help you keep your records organized throughout the year, making it easier come tax time.

Lastly, remember to set aside money regularly for taxes. Its easy to get caught up in business activities and forget to pay the IRS, but this can come back to bite you in a big way. Open a taxes bank account, separate from your business account, and transfer funds there on a monthly basis.

If you can find a quality, licensed accountant to help you set up your business and prepare your returns, youll save yourself a lot of headaches, and possibly save you thousands along the way.

Penalties Related To Estimated Taxes

If a taxpayer underpaid their taxes they may have to pay a penalty. This applies whether they paid through withholding or through estimated tax payments. A penalty may also apply for late estimated tax payments even if someone is due a refund when they file their tax return.

In general, taxpayers dont have to pay a penalty if they meet any of these conditions:

- They owe less than $1,000 in tax with their tax return.

- Throughout the year, they paid the smaller of these two amounts:

- at least 90 percent of the tax for the current year

- 100 percent of the tax shown on their tax return for the prior year this can increase to 110 percent based on adjusted gross income

To see if they owe a penalty, taxpayers should use Form 2210.

The IRS may waive the penalty if someone underpaid because of unusual circumstances and not willful neglect. Examples include:

- casualty, disaster or another unusual situation.

- an individual retired after reaching age 62 during a tax year when estimated tax payments applied.

- an individual became disabled during a tax year when estimated tax payments applied.

There are special rules for underpayment for farmers and fishermen. Publication 505 has more information.

You May Like: What Is The Sales Tax Rate In Washington State

What You Should Know About Estimated Tax Payments

If you are an independent contractor or business owner, you are responsible for making sure that you get the correct tax payments to the government unlike people who work as employees of a company which withdraws payments from each paycheck. Estimated taxes are what you expect to pay on any salary you earn that isnt subject to withholding, along with other income like interest, dividends and capital gains. For help figuring out your estimated taxes and make sure you dont make any costly mistakes, consider working with a financial advisor.

What Are The Penalties If I Don’t Pay My Estimated Taxes

It’s a good idea to post a calendar reminder as the quarterly deadline approaches to avoid paying a late penalty. You may be charged a penalty if:

- If you owe more than $1,000 in taxes after subtracting withholdings and credits.

- If you paid less than 90% of the tax for the current year through estimated taxes.

The penalty could be waived in some situations. If you want to delve further into estimated tax penalties and conditions of a waiver, see the instructions in IRS form 2210.

Read Also: When Do You File Taxes This Year

Penalty For Underpayment Of Estimated Taxes

If you dont pay enough to cover what you owe in estimated taxes every quarter, brace yourself . . . because youre about to get hit with penalties courtesy of the IRS.5

How much, exactly? Well, theres no specific dollar amount or percentage you can use to figure out what you owe. Instead, the IRS will calculate your penalty based on the following factors:

- The total underpayment amount

- The period when the estimated taxes were due

- The interest rate for underpayments 6

And if youre late on a tax payment, the late payment penalty is generally 0.5% of how much you owed after the due dateand that goes on every month the tax remains unpaid, up to 25%.7

Listen, the last thing you want is to have the IRS hounding you about underpaid or late taxes, so do everything you can to make sure you pay that balance off in full as soon as you can. If you need help, work with your tax advisor to figure out how much you owe and how you can get current.