How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

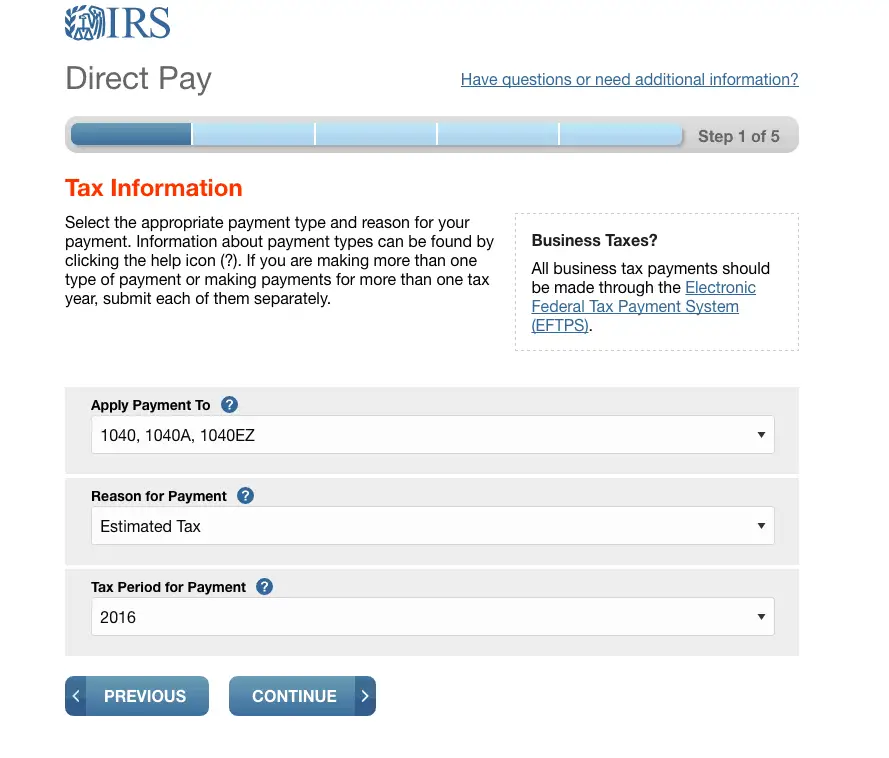

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Payments By Electronic Check Or Credit/debit Card

Several options are available for paying your Ohio and/or school district income tax. For general payment questions call us toll-free at 1-800-282-1780 or adaptive telephone equipment).

If you are remitting for both Ohio and school district income taxes, you must remit each payment as a separate transaction.

Payments made online may not immediately reflect on your Online Services dashboard. Please allow 2-3 business days for the payment made to be applied to your outstanding liability.

The Department is not authorized to set up payment plans. However, you may submit partial payments toward any outstanding liability including interest and penalties. Such payments will not stop the Department’s billing process, or collection attempts by the Ohio Attorney General’s Office.

Note: This page is only for making payments toward individual state and school district income taxes. To make a payment for a business tax, visit our online services for business page.

Whether you file your returns electronically or by paper, you can pay by electronic check or credit/debit card via the Department’s Online Services or Guest Payment Service .

See the FAQs under the “Income – Online Services ” for more information on using Online Services.

Payment can be made by credit or debit card using the department’s Online Services, Guest Payment Service, directly visiting ACI Payments, Inc.or by calling 1-800-272-9829.

Payment Options For Individual Income Tax

To make paying taxes more convenient and hassle-free, the Office of Tax and Revenue allows the use of:

OTR will receive the electronic transaction from the vendor and apply it to the taxpayer’s account. The District’s third-party payment vendor will charge taxpayers a nominal fee for the credit/debit card transaction based on 2.5 percent of the transaction amount.

Also Check: Where Do I File My Illinois Tax Return

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

Also Check: What Does Tax Deferred Mean

Estimated Tax Payment Options

Use the following options to make estimated tax payments. For more information about filing requirements and how to estimate your taxes, see Individual Estimated Tax Payments.

Online, directly from your bank account

- Log in to your online services account to schedule all 4 quarterly payments in advance.

- Dont have an account? Create one now.

Not ready to create an account? Use eForms – make sure to choose the correct voucher number for the payment you’re making.

- Individual estimated payment: 760ES eForm

ACH credit

Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

Pay using a credit or debit card through Paymentus . A service fee is added to each payment you make with your card.

Check or money order

Mail the correct 760ES voucher for the tax period to:

Virginia Department of Taxation

Easy Ways To Pay Taxes

IRS Tax Tip 2018-87, June 6, 2018

The IRS offers several payment options where taxpayers can pay immediately or arrange to pay in installments. Taxpayers should not ignore a bill from the IRS because as more time passes, interest and penalties accumulate.

Here are some ways to make payments:

- Direct Pay. Taxpayers can pay tax bills directly from a checking or savings account free with IRS Direct Pay. Taxpayers receive instant confirmation once theyve made a payment. With Direct Pay, taxpayers can schedule payments up to 30 days in advance. They can change or cancel a payment two business days before the scheduled payment date.

- Taxpayers can also pay their taxes by debit or credit card online, by phone or with a mobile device. The IRS does not charge a fee, but convenience fees apply and vary depending on the card used.

- Installment agreement. Taxpayers who are unable to pay their tax debt immediately may be able to make monthly payments. Before applying for any payment agreement, taxpayers must file all required tax returns. They can apply for an installment agreement with the Online Payment Agreement tool, which also has more information about whos eligible to apply for a monthly installment agreement.

Recommended Reading: How To File Your Taxes For The First Time

Making Tax Payments Simple

We realize that tax administration can be difficult, so we strive to make paying your taxes as simple as possible. We have created a Tax Portal that allows for same-day and future payments for all taxes administered by the Division of Taxation.

We allow for estimated payments, extension payments, payments with a tax filing, license renewal payments, bill payments and payments for various fees.

If you need help getting started, feel free to call us at or email at . If you are not ready to transition to the Tax Portal, we also support various legacy payment options, listed below.

Reporting Of Payment & Receipt

A receipt will be provided through the mail for all completed payments made through the Orangeburg County Online Bill Payment system. The receipt will be mailed to the address on the tax bill. After making your payment, you will be given the option of printing a payment receipt this receipt is generated by Orangeburg Countys payment processing vendor and while it does confirm that your payment has been received it does not denote that Orangeburg Countys tax records have been updated to reflect your payment. Please allow up to 3 business days for our online records to show that your payment has been received and up to 7 days for your receipt from Orangeburg County to be generated/mailed.

Also Check: How To Tax Return Online