Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

What Will Income Tax Cost You

Almost every type of income is subject to income tax. This includes things like:

- ð¨â𦳠Pensions

Most self-employed individuals end up in the 10-22% income tax range, with most people having an average tax rate of around 14%.

Why you shouldnât use your effective tax rate to budget

You might be wondering how your effective tax rate squares with the results on our calculator above, which shows a much smaller percentage for federal income taxes.

The short answer: itâs because the calculator only shows the amount of money youâll actually pay at tax time, after accounting for things like your standard deduction. To explain, letâs walk through an example. Imagine you have $48,000 of self-employment income. Your top income tax rate is 22%. The calculator gives you this result:

The percentage shown here isnât meant to reflect your actual tax rate. Rather, it shows what percentage of income youâll have to set aside to account for income taxes at tax time. â

The tax breaks that will lower your income taxesâ

Hereâs why the two rates donât match up: you wonât get taxed on the full $48,000 of income. A few things are subtracted before landing on your âtaxable income.â Namely:

Tax filing for freelancers and side hustlers

Most tax software isn’t built for you. Ours is. We know every form you need and every deduction you can take to pay less this year.

Independent Contractor Taxes: An Example

So, how does calculating your own independent contractor taxes work?

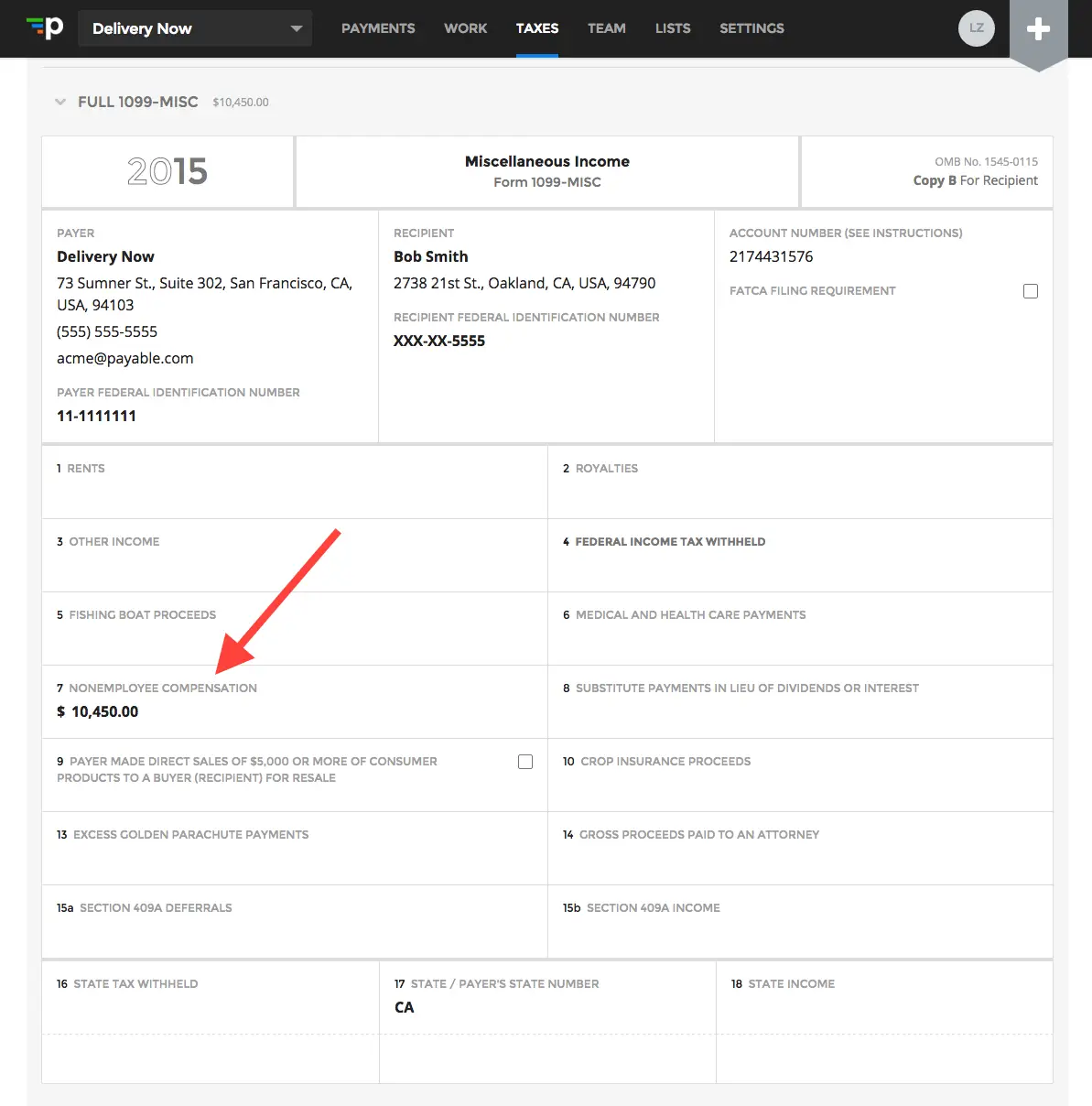

Lets say during the year you earn $40,000 as an independent contractor from working with two companies. These are your only jobs and youre not an employee anywhere else. You should receive a 1099-MISC from each company confirming how much they paid you during the year. Youll include this income on Part 1 of your Schedule C.

You also have some expenses that you can deduct from your income. You work from a qualified home office, which is 200 square feet and using the simplified method, you can deduct $5 per square foot. Your home office deduction is $1,000.

You also drove 600 miles during the year for some required assignments, so you can take a deduction of $348 . In total, you have $1,348 in deductions so the total net profit as an independent contractor that you report on Schedule C is $38,652. That income amount will be included on Form 1040 as your taxable income.

Once you know how much you earned, youll need to figure out how much you must pay in self-employment taxes. Using Schedule SE, you calculate that you owe self-employment taxes of $5,914. Half of this tax that you pay is taken as a deduction on Page 1 of your Form 1040.

Now that youve completed your Schedule C and Schedule SE, you have the income and deduction information you need to finish filing your 1040 personal tax return.

Don’t Miss: Do You Have To File Taxes With Uber

Set Up A System To Track Your Income

The best way to ensure youre always ready come tax season is to have a system for tracking your inflow.

As an independent contractor, you may want to consider using a freelance time tracking system, such as Clockify.

Clockify is great for these purposes, as it allows you to account for all your work hours with minimal effort.

With Clockify, you can:

- Create invoices

Track your work time

Since you dont have an employer to keep track of how much you work, its best to do it yourself and have a record of how many hours you spent on each project and client.

In the Clockify time clock app, you can easily track your time by starting a timer when you begin working on a task.

If you want to take a break, simply pause the timer and resume when you continue working.

If you dont feel like tracking activities in real-time, you can input them manually using Clockifys timesheet view.

Calculate billable hours

Freelancers tend to work less than 30 hours per week, but the truth is not all of that time is spent on billable activities.

Clockify helps you keep track of billable vs. non-billable activities in the following way:

- Create a time entry for a billable task

- Set up hourly rates for the task

- Track time spent on the task by starting the timer whenever you work on the task

- Let Clockify automatically calculate your billable time

Check out how you can easily track billable hours with Clockify in the video below.

Generate reports

Create invoices

Is Working 1099 Worth It

1099 Independent Contractors Its an independent filer form that requires employees to pay their payroll, social security, state, and local taxes without an employers assistance. If they are subject, an employer must send their paychecks directly to the federal or state government to which the money is owed.

Read Also: What States Have The Lowest Income Tax

What Is A Tax Write

A tax write-off â also known as a tax deduction â is an expense you can subtract from your taxable income.

With a lower taxable income, you’ll end up paying less in taxes. That’s why tax deductions are such a powerful financial tool for self-employed people, whose tax bills can be uncomfortably high without them.

Tip #: Consider Switching Your Business Structure

If youve been in the game for a while and earn a solid income , you may look into becoming an S corporation.

An S corporation is a tax designation for a formal business organization that can reduce your tax liability.

As an S corp with one employee , you can assign yourself a salary and pay your FICA taxes only on that salary, instead of the entire business income.

For example, if your business income equals $120,000 and your salary is $90,000, you dont pay taxes for the remaining $30,000.

However, bear in mind that becoming an S corp can be a complicated process . So, its not advisable unless you are an established one-person business with a steady income stream.

NOTE: If youre thinking about transitioning to S corp, paying yourself a $10 salary, and beating the system its not going to work. The IRS has thought of the loophole, and it requires you to pay yourself a reasonable salary for the type of work you do. This means they have a final say as to what that salary can be, and they wont allow you to make it too low.

Read Also: How Much Taxes Will I Have To Pay

When Losses Can Help

Sometimes, losses can help you reduce your tax bill without any negative impact on you.

For people who freelance as a side hustle

People who freelance alongside a W-2 job might find themselves losing money on their side gig initially. You can take this loss and use it to reduce your income from your W-2 job.

For example, let’s say you work a full-time job, where you make $50,000 a year. You also drive for Uber on weekends. But your ridesharing side gig cost you more money than you got paid. After deducting all your expenses, you ended up with a loss of $1,000.

On your tax return, you can take this $1,000 NOL and subtract it from your W-2 salary. Now, your overall income for the year is $49,000.

For people who freelance full-time

What if your only income is from freelancing? In that case, you may not be able to benefit from your loss the year you incur it. But if you include them on your tax return, you can carry it forward to future years.

Here’s how that works. Say you had a NOL of $1,000 the first year you went freelance. The year after, you start to hit your stride: your income, after expenses, is $10,000.

You can carry your loss from the previous year forward, reducing your income to $9,000 for the year.

How To File W

- Web Upload – file-based system, multiple file types accepted, files often created using payroll software

- eForms – fillable electronic forms, no files or signup required, best for companies with a small number of employees or payees

- Combined VA6H/ W-2

Note: Your Annual or Final Withholding Summary is separate from W-2 and 1099 data. You are required to send both by Jan. 31. You can file your VA-6 using your regular filing method .

Each method requires authentication as described in the guides below:

If you need help with Web Upload, email us at . If you need help with eForms or have questions about your filing requirements, please call Customer Services.

If your business is required to file Form 1099-K with the IRS, youll also need to file a copy of each 1099-K related to a Virginia taxpayer or an individual with a Virginia mailing address with Virginia Tax.

If your business is a third-party settlement organization and paid $600 or more to a Virginia payee, or to a payee at a Virginia mailing address, you will also need to file a Form 1099-K for that payee with Virginia Tax. This may mean youll need to file 1099-K forms with Virginia Tax that you would not need to otherwise submit to the IRS. You should also send a copy of this form to the payee by February 28, 2022..

These new requirements are in effect for tax year 2020 and later.

Recommended Reading: Do State And Federal Taxes For Free

Tax Trick #: Use Your Self

Again, when youâre a full-time W-2 employee, the company that employs you pays a portion of your health insurance plan. But that costs them money, so your employer gets to write off that expense.

Since youâre technically a small business owner, you can take the cost of health insurance off on your taxes, too â for the most part.

Be aware that self-employed health insurance deductions work a little differently than most business expenses. To start, you do not list it on your Schedule C with the rest of your write-offs. Thatâs because it lowers your income tax tax, not your self-employment tax.

Most 1099 workers have to foot a much larger bill to get good health insurance than people with 9-to-5 jobs. Being able to take such a hefty amount off your taxes â regardless of which tax â might help you sleep better!

How To Avoid Paying Taxes As An Independent Contractor

Nothing is certain but death and taxes, so you cant really avoid paying them that would be tax evasion that could earn you a hefty fine and even land you in jail.

However, there are ways to significantly reduce your tax liability, mostly through one of the following methods:

Don’t Miss: Where Is My Tax Return Check

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

How Much Should I Put Back For Taxes 1099

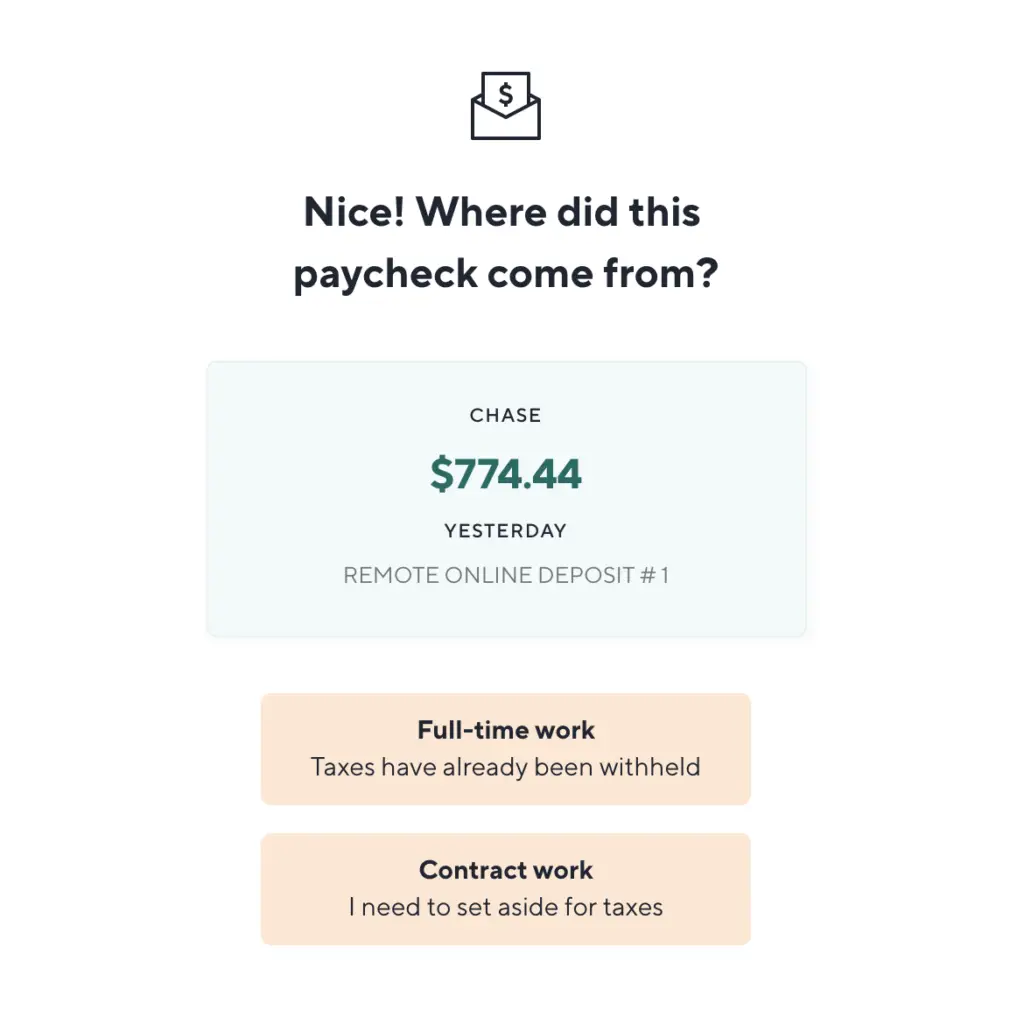

Earned income is generally recorded in two ways for federal tax purposes. There is W-2 income and 1099-MISC income. The former is for employees, either full- or part-time the latt

Earned income is generally recorded in two ways for federal tax purposes. There is W-2 income and 1099-MISC income. The former is for employees, either full- or part-time the latter is for contract workers, sometimes known as a freelancers. Heres what you need to know to minimize your tax liability if you file a 1099-MISC. If youre unsure about filing taxes, engage the services of a financial advisor.

Contract work is by far the most common form of self-employment. It allows workers to strike out on their own without necessarily having to launch a formal business.However, taxes for freelancers arent fun. For a W-2 employee, the employer and the employee each pays half of the individuals payroll taxes. This comes to about 7.65% for the employer and the employee each. However, a 1099-MISC employee must pay both halves of this tax, amounting to a flat-tax increase of 7.65% across the board for the self-employed. This is known, appropriately enough, as the self-employment tax.

Since taxes tend to start out pretty high for contractors they try hard to cut that bill. If this is how you earn a living or just some money on the side, here are some tips.

Read Also: Are Taxes Extended This Year

Determine If Youre Required To File

For taxpayers who only have W-2 income, if their earnings for the year were less than the standard deduction , they donât have to file a tax return at all. Self-employed individuals, on the other hand, get the short end of the stick. If you have net earnings of $400 or more, youâre required to file a tax return. The IRS does this in order to collect your self-employment tax. You wonât owe income tax if your earnings are that low, but you might still owe self-employment tax.

How Do I Avoid Paying Taxes On A 1099

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

Also Check: How Do You Calculate Your Tax Bracket

Frequently Asked Questions About Form 1099

Note: These questions are intended to help you prepare your individual income tax return if you received a Form 1099-G because a state or local tax refund was reported to the Internal Revenue Service or a Form 1099-INT was reported to the IRS for interest paid on a state or local tax refund.

Form 1099-G

Myth : Your Taxes Are The Same Whether Youre Employed By Someone Else Or Self

As an employee, your employer typically pays half of the employment taxes on income you earn during the year. This means they pay half of your Social Security and Medicare taxes while you pay the other through tax withholding from each paycheck.

If you are self-employed, you must account for both halves of the self-employment tax because you are both the employee and employer. The good news is that you can deduct half of the amount you pay in self-employment tax from your income on your Form 1040. For example, $3,000 in self-employment tax reduces your taxable income by $1,500. In the 22% tax bracket, that would mean an income tax savings of $330.

Recommended Reading: How To File Federal Taxes For Free

Don’t Miss: How To Pay Retail Sales Tax Online

Who Pays For Payroll Taxes For 1099 Workers

As a client of a 1099 worker, you dont pay your freelancer a salary. You pay fees based on the scope of work agreed to, according to terms agreed upon by both parties in your Master Service Agreement / consulting agreement / independent contractor agreement.

Since you dont pay salaries to your freelancers, independent contractors, and other 1099 workers and vendors, you dont pay their payroll taxes. How those taxes get paid depends on the tax and legal structure of your 1099 worker.

Generally, since 1099 workers dont receive wages, they must pay their own payroll taxes. Those who are self-employed or sole proprietorships must pay the entire payroll tax on their own. This self-employment tax totals 15.3% plus another 0.9% surtax for Medicare for those whose self-employment earnings exceed $200,000 and independent contractors must pay for this on their own as part of their quarterly estimated taxes.

1099 workers who have incorporated an S Corp are still responsible for paying their own payroll taxes but do so at a slightly higher rate on the portion paid to themselves as their employee wage. They are able to split their profits between their own employee wage and their distribution of profits, minimizing their payroll tax expenditures.

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Don’t Miss: How To File Taxes For Personal Business