When Are Taxes Due In 2022

The last day to file taxes is typically April 15, unless this date falls on a weekend or holidaywhich this year it does. Therefore this year, the tax deadline is April 18 because of the Emancipation Day holiday in the District of Columbia for everyone except taxpayers who live in Maine or Massachusetts. Taxpayers those states have until April 19 to file their returns due to the Patriots Day holiday.

Taxpayers needing an extension will have until October 17 to file.

More From GOBankingRates

Federal Estimated Tax Due Dates

Estimated payments are usually made quarterly they are due on or about:

The actual due date may be delayed to the next business day if the 15th falls on a weekend. You don’t have to make your payment due on January 15 if you file your income tax return by the end of January and pay the entire balance owing at that time, according to the IRS.

Use Form 1040-ES to calculate your estimated tax payments. Be sure to check the top, left-hand corner of the form before you start to ensure that you have the correct year before you start using the form. You should be using the Form 1040-ES for the current calendar year it will have the correct figures for your standard deductions and the tax rate schedules.

You may be able to annualize your payments to compensate for periods where you are earning unequal income, not distributed evenly by quarters. You’ll have to complete a Form 2210 to calculate payments in this case, but your total estimated payments must equal 90 percent of your liability for the tax year.

How You Can Avoid Or Minimize Penalties

You can skip all IRS late-filing and late-payment penalties completely by filing and paying your tax balance due on time. While thatâs the obvious goal, we all know sometimes life just gets in the way.

If youâre doing your best to catch up, and you just didnât get there before the deadline, consider a few ways to minimize your tax penalties.

-

File an extension. If the April deadline hasnât yet passed, file for a tax extension and use those extra six months to get your finances caught up and organized for filing. Remember that an extension gives you more time for filingânot payment. Payment is still due by April 18. If youâve already missed the deadline, you no longer have the option to file for an extension.

-

File your taxes even if you canât pay them yet. The penalty for missing federal tax filing is larger than the penalty for missing the payment. File your income tax return with the IRS and avoid the larger of the two penalties. There are many ways to sort out how to pay your taxes.

-

Get help to file as quickly as possible. If you missed the deadline, penalties are creeping up every month. File as soon as possible, even if it means paying for help from a tax professional to sort out the numbers and get your tax forms prepared. The cost of bookkeeping and working with a tax agent may be far less than the increasing penalties for leaving your business income taxes unpaid.

Read Also: What Is The Difference Between Estate Tax And Inheritance Tax

How We Calculate The Penalty

We calculate the Failure to File Penalty based on how late you file your tax return and the amount of unpaid tax as of the original payment due date . Unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding, estimated tax payments and allowed refundable credits.

We calculate the Failure to File Penalty in this way:

- The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

- If both a Failure to File and a Failure to Pay Penalty are applied in the same month, the Failure to File Penalty is reduced by the amount of the Failure to Pay Penalty for that month, for a combined penalty of 5% for each month or part of a month that your return was late.

- If after 5 months you still haven’t paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

- If your return was over 60 days late, the minimum Failure to File Penalty is $435 or 100% of the tax required to be shown on the return, whichever is less.

Large Tax Deficiency And Negligence Penalties

When there is an understatement of taxable income equal to 25% or more of gross income, the 25% large individual income tax deficiency or other large tax deficiency penalty will be assessed. When the percentage of understatement of taxable income is less than 25%, the 10% negligence penalty may be applied. The application of the 10% negligence penalty is based on the understatement of tax and will be made on the basis of the facts in each case. When the accuracy penalty has been assessed for federal income tax purposes, the 10% negligence penalty will be assessed for State income tax purposes, unless the 25% large individual income tax deficiency or other large deficiency penalty applies.

A large tax deficiency penalty or a negligence penalty cannot be assessed when the fraud penalty has been assessed with respect to the same deficiency.

You May Like: Can You Change Your Taxes After Filing

Whats The Penalty For Filing Your Taxes Late

Is there a penalty for filing taxes late? The answer: yes. Taxpayers have to pay a separate fine if they fail to file their taxes on time. This is what we call the failure-to-file penalty. Meanwhile, failing to pay your taxes before the due date will result in a failure-to-pay penalty.

Failure-to-File Penalty: If a taxpayer fails to file within 60 days after the deadline, they have to pay $205 or 100% of their unpaid tax, whichever is the lesser amount.

Failure-to-Pay Penalty: The failure-to-pay penalty is 0.5% of every months unpaid taxes. Depending on the amount, it can accumulate up to 25% of the taxes you owe.

Tip: The failure-to-file penalty is about 10 times larger than the IRS failure-to-pay penalty. Thats why, even if you dont have enough cash, you should still file your taxes on time. As much as possible, you want to avoid the failure-to-file penalty.

The IRS can help you find solutions to pay off your taxes. But they cant help you if you dont file your taxes on time.

Big Ten Fines Msu $100k Reprimands Michigan For Tunnel Melee

ANN ARBOR, Mich. The Big Ten has disciplined Michigan State and Michigan for their roles in stadium tunnel altercations that led to seven Spartans being charged with crimes.

The conference announced Monday that it is fining Michigan State $100,000 for its football players hitting, kicking or using of their helmet to hit Michigan players and suspending cornerback Khary Crump, who is facing a felony charge, for the first eight games of next season.

The Big Ten is also reprimanding Michigan for not providing adequate protection for both teams as they left the playing surface.

The Big Ten Conference has a standard of excellence both academically and athletically that has been built over 127 years, said Big Ten Commissioner Kevin Warren, who attended the game a month ago and has a son, Powers Warren, who is a walk-on tight end for the Spartans. Our standards require that our student-athletes, coaches and staff members represent the conference, and their member institutions, with the highest level of decorum and sportsmanship.

We are taking disciplinary action and will continue to work with our member institutions to strengthen their game day procedures and ensure our honored traditions.

The Big Ten said the suspensions that ended the season for seven other Michigan State players was sufficient. The conference also said the schools properly addressed a football staff member who violated the Big Tens sportsmanship policy that was unrelated to the tunnel altercations.

Read Also: How To File My Own Taxes For Free

What Is The Penalty For Not Filing Taxes

The penalty for not filing taxes is also known as the failure-to-file penalty or the late-filing penalty.

-

The penalty is usually 5% of the tax owed for each month or part of a month the return is late.

-

The maximum failure-to-file penalty is 25%.

-

If your return is more than 60 days late, the minimum penalty for not filing taxes is $435 or the amount of tax owed, whichever is smaller.

There is good news, though. You might not owe the penalty if you have a reasonable explanation for filing late.

One important distinction: The late-filing penalty is not the same as the late-payment penalty. The late-filing penalty affects people who dont turn in their Form 1040 and other important tax documents on time. The late-payment penalty affects people who pay their taxes late. It is 0.5% of your unpaid taxes for each month your outstanding taxes are unpaid. Plus interest.

» MORE: How to get rid of your back taxes

Failure To Pay Penalty

If you fail to pay your taxes, the IRS will penalize you based on how long your overdue taxes remain unpaid. The penalty will be a percentage of the taxes you either didnt pay or didnt report on your return. The IRS charges 0.5% of your unpaid taxes for each month or part of a month that your taxes remain unpaid. The failure to pay penalty has a maximum charge of 25% of your unpaid taxes.

Be sure to pay your taxes within 10 days of the failure to pay notice. After 10 days, the penalty charge increases to 1%.

Also Check: When Will Tax Returns Be Accepted 2021

Secretary Of State Statement Of Information Penalty: Businesses

Why you received this penalty

SOS notified us you did not file your entitys annual or biennial Statement of Information on time. We collect this penalty on behalf of SOS. Only the SOS can waive the penalty.

Why you received this fee

We charge a collection cost recovery fee when we must take involuntary action to collect delinquent taxes.

Fee

Fees varies year to year based on legislation.| Whos the fee for? |

|---|

Also Check: Whereâs My Tax Refund Pa

How To File A Late Return

For dates and hours of NetFile and EFile availability, seeour article on Tax Filing Methods. Manylate returns can be filed this way, using your income tax software.

Late returns can always be filed by sending a printed or manually prepared return to CRA. Forms are available from the CRA General Income Tax and Benefit Package web page.

Telefile is no longer available for filing tax returns.

For information on time limits for late returns and circumstances under which the interest and penalties may be waived, see the article on taxpayer relief provisions.

Don’t Miss: Where Do I Pay My Taxes

Irs Late Payment Penalty: Tax Penalties For Paying Late

The Internal Revenue Service adds penalties on taxes owed that have not been paid on time. Filing your taxes late can cost you in the long run, unless you have a refund. If you have a refund owed to you there is typically no penalty fee associated with filing your taxes late because there is no amount due to the IRS, rather they owe you money. The amount owed, interest and penalties associated with late or back taxes can turn out to be a significant sum of money.

Irs Quarterly Interest Rates

Interest compounds daily and is typically added to any unpaid tax from the time the payment was due until the date the tax is paid. The rates are set by the IRS every three months at the federal short-term rate, plus three percentage points.

The Internal Revenue Code requires that the IRS review its interest rate quarterly to keep pace with the economy, but this doesn’t mean that the rate will always change quarterly. It won’t change unless there’s been a somewhat significant swing in the national economy.

You May Like: How To Know If My Taxes Were Filed

Interest On Taxes You Owe

If you have a balance owing for the 2021 tax year and are unable to pay it by the April 30 payment due date, the CRA will start charging you compound daily interest as of May 1, 2022. This includes any balance owing if your return has been reassessed.

The rate of interest the CRA will charge on current or previous balances can change every 3 months based on prescribed interest rates.

Underpayment Penalty For 2017

You could owe a penalty on your 2017 income taxes if your estimated income taxes and any withholdings from employment income are lower than 90 percent of your 2017 tax or the full amount of your 2016 tax.

For more information about estimated tax payments and how to calculate them, consult with an experienced tax professional who can answer your questions and address any concerns you may have.

References

Also Check: Where To Send Federal Taxes

Is There A One Time Tax Forgiveness

What is One-Time Forgiveness? IRS first-time penalty abatement, otherwise known as one-time forgiveness, is a long-standing IRS program. It offers amnesty to taxpayers who, although otherwise textbook taxpayers, have made an error in their tax filing or payment and are now subject to significant penalties or fines.

Recommended Reading: How To Pay Taxes With Doordash

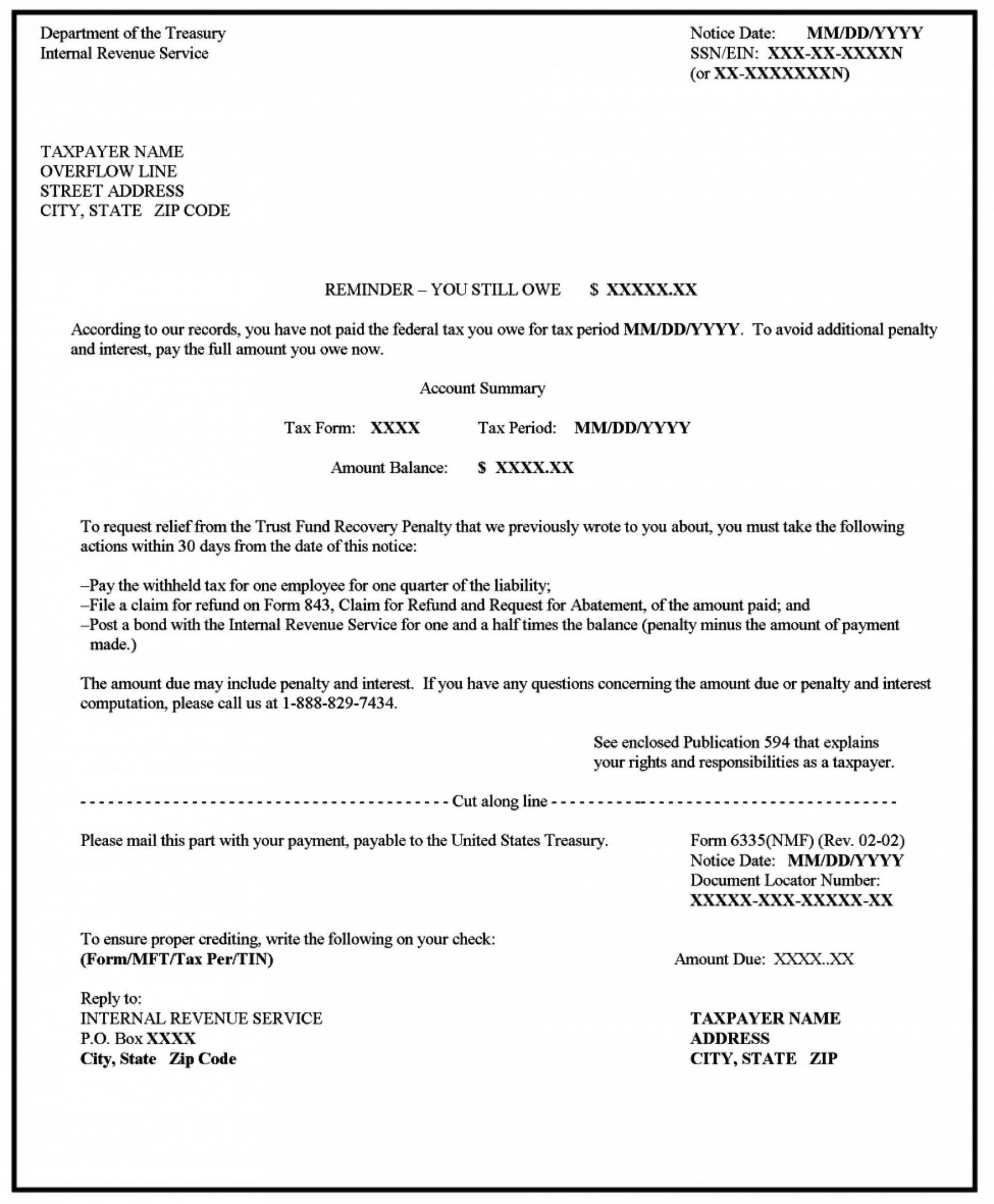

How You Know You Owe A Penalty

When we charge you a penalty, we send you a notice or letter by mail. The notice or letter will tell you about the penalty, the reason for the charge and what to do next. These notices and letters include an identification number.

Verify the information in your notice or letter is correct. If you can resolve the issue in your notice or letter, a penalty may not apply.

For more information, see Understanding Your Notice or Letter.

Also Check: How To Pay Tax Uber Driver

Does The Department Grant Penalty Waivers

Yes, DOR has the authority to waive delinquent or late return penalties under limited circumstances:

- The first circumstance is when the underpayment of tax, or the failure to pay any tax by the due date, happened because of circumstances beyond the taxpayers control. For more information, see WAC 458-20-228. Lack of funds, being unaware that taxes are due, or not receiving the return in the mail are generally not considered circumstances beyond the taxpayers control, and would not qualify for this type of penalty waiver.

- When a taxpayer has filed and paid all tax returns required for 24 months prior to the period in question, the department has the authority to waive a penalty even when the late filing was not the result of a circumstance beyond the taxpayers control. This type of penalty is only available for one return within a 24-month period.

Filing Enforcement Fee: Individuals And Businesses

Why you received this fee

We charge a filing enforcement cost recovery fee for any individual or business who fails to file a required tax return in response to a legal demand to file.

Fee

Fees varies year to year. Current fees:

- Corporations and LLCs treated as corporations: $83

- Individuals and all other businesses: $97

You May Like: Where To Mail New York State Tax Return

What Are The Fatca/fbar Penalties

The Foreign Bank Account Reporting is introduced so as to prevent taxpayers from avoiding taxes by hiding their financial assets abroad. You need to file FinCEN 114 if you have one or more foreign financial accounts with an aggregate total value that exceeds $10,000 at any time during the tax year. It also applies to accounts that you have control over, such as a signature authority, for example.

The tax penalties and fines for US expats for not filing FBARs are much stricter and tougher than the failure-to-file or failure-to-pay ones. Expat willful violation means that you knew you had to file but decided not to. Non-willful, on the other hand, means that you werent aware of the requirement to file FBAR and, therefore, unintentionally failed it. The minimum penalty you may face for non-willful violation is $10,000 for each year that you fail to file FBAR. If the IRS considers the failure to file as willful, then the penalty will be $100,000 or 50% of the account balance at the time of the violation, whichever is larger.

How To Avoid A Failure

If youre going to miss the tax-filing deadline, help yourself avoid the penalty for not filing taxes by getting an extension to file your tax return. A tax extension can get you an extra six months to get your tax return to the IRS.

Remember, however, that a tax extension only gets you more time to file your tax return. It does not get you more time to pay your taxes. Some people, such as natural disaster victims, certain members of the military or Americans living overseas, may automatically get more time to file.

If you miss the tax extension deadline, though, that failure-to-file penalty could come back to haunt you.

» MORE:How to set up a payment plan with the IRS

You May Like: Do I Have To Pay Federal Taxes

How Much Youll Owe For Filing Or Paying Your Taxes Late

The penalty for not filing on time depends on how late your return is. The fine for filing up to 60 days late can be as much as 5% of your unpaid taxes each month or part of a month that you are late, up to 25%. After 60 days, the IRS imposes a minimum penalty of $435 or 100% of the unpaid tax, whichever is less. Taxpayers owed a refund wont be charged a fee for filing late.

The failure-to-pay penalty is 0.50% each month your IRS payment is late, up to 25%, according to the IRS. But the failure-to-file penalty can be reduced to 0.25% if the taxpayer files a return and requests an installment IRS payment plan to repay their debt in full.

If both the failure-to-file penalty and failure-to-pay penalty apply in the same month, the maximum amount charged for both penalties is 5% per month. Taxpayers can avoid these late filing penalties by filing on time or filling out the appropriate paperwork for a tax extension. But keep in mind, you must request the extension by the tax due date and you must have paid 90% of your tax bill to avoid a failure-to-pay penalty.