What Is The Formula For Calculating Total Income

The formula for calculating net income is:

Making Estimated Tax Payments

Many business owners think that the income tax payment deadline is on âtax day,â which falls in mid-April. However, federal income taxes must be paid as they are incurred. This means that most small businesses must make estimated tax payments throughout the year based on an estimate of their total taxable income at the end of the year.

Does My State Have An Estate Or Inheritance Tax

In addition to the federal estate tax of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both.

State inheritance and estate taxes, together with the federal estate tax, reduce investment, discourage business expansion, and can sometimes drive wealthy taxpayers out of state. They also yield estate planning and tax avoidance strategies that are inefficient, not only for affected taxpayers, but for the economy at large.

Due to these issues, most states have been moving away from estate or inheritance taxes or have raised their exemption levels in recent years.

Also Check: When Are Estimated Taxes Due 2021

Double Taxation For C Corporations

With the way the tax system is structured, C corporations are taxed twice: at the corporate level and then again at the shareholder level when profits are distributed to owners as dividends. So if Charlieâs Chocolates Inc. distributed all or part of its $1 million in income to owners, the owners would have to pay taxes on it again when they file their individual tax returns.

One way for corporations to avoid this double taxation is to incorporate as an S corporation instead of a C corporation. S corporations are flow-through entities so income isnât taxed at the corporate level. However, there are certain drawbacks to choosing S corporation status that may outweigh the tax savings. We recommend asking your CPA about this one.

How Can I Check My Tax Deductions And My Payfor The Year

To see what your employer or pension provider paid you and what theydeducted in tax, you can get an Employment Detail Summary through Revenues myAccountservice.

Your Employment Detail Summary shows the pay, income tax, Pay Related SocialInsurance and Universal Social Charge deducted by your employer and paid to Revenue over the year. It also recordsyour LocalProperty Tax deductions if you choose to have LPT deducted from yourpay. Before 2019, this information was provided on a form called a P60.

To view your Employment Detail Summary:

You can also save or print this document and use it in the same way as theForm P60, for example, as proof of income. You can read more about the EmploymentDetail Summary.

You May Like: What Home Expenses Are Tax Deductible

How Do Taxes Impact The Economy

All taxes have some impact on the economy because they have some impact on taxpayer behavior. That said, no two taxes impact the economy the same.

One way to think about this is as a hierarchy: Which taxes are most and least harmful for long-term economic growth? This hierarchy is determined by which factors are most mobile, and thus most sensitive to high tax ratesin other words, what economic activities, if taxed, can easily be moved, reduced, or otherwise changed to avoid that tax?

Taxes on the most mobile factors in the economy, such as capital, cause the most distortions and have the most negative impact. Taxes on factors that cant easily be moved, such as land, are the most stable and least distortive.

Its relatively easy for someone to invest less to avoid a wealth tax, for example. Its much harder for someone to pull up stakes and move their home to avoid a property tax. This difference is how wealth taxes distort peoples decisions, and thus the economy, more than property taxes.

Now that we have a basic understanding of the relative impact that different types of taxes have on the economy, we can use this information to guide lawmakers on crafting tax policies to improve economic growth. Theoretically, reducing the most harmful taxes should have the biggest impact on economic growth.

How To Figure Out Your Tax Rate If Youre A C Corp

The Tax Cuts and Jobs Act greatly simplified tax calculations for C corporations by replacing the graduated corporate tax rate schedule that included eight different tax rate brackets with a flat 21% tax rate.

In other words, if you own a C corporation, no matter how much taxable income your business has, your income tax rate will be 21%.

Read Also: How To Find Tax Refund From Last Year

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000 and starting with tax year 2022, $50,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

What Is Double Taxation

Double taxation is when taxes are paid twice on the same dollar of income.

For example, the United States tax code places a double-tax on corporate income with one layer of tax at the corporate level through the corporate income tax and a second layer of tax at the individual level through the dividend and capital gains taxes paid by shareholders.

Additionally, the estate tax creates a double-tax on an individuals income and the transfer of that income to heirs upon death.

Corporate integration and the removal of the estate tax would address these instances of double taxation.

Businesses and individuals residing in one country but earning income in other countries could also face double taxation if more than one country taxes their earnings. Credits for foreign taxes, territorial taxation, and tax treaties can minimize the likelihood of double taxation of foreign income.

Don’t Miss: Can You Claim Medical Expenses On Taxes

File Your Taxes With Confidence

While tax season may never be your favorite time of year, you dont have to do it all on your own. Reach out to a RamseyTrusted Endorsed Local Provider in your area to help you sort out your tax situationtax liabilities and all! Get ready to walk into the next season feeling like a tax boss. Get a tax pro today!

Feel like your taxes are simple enough to do yourself with tax software? Ramsey SmartTax makes it easy to take control of your taxes and file your tax return in a matter of minutes. You wont be surprised by hidden fees, and you wont have to make sense of confusing tax jargonwhat you see is what you get!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

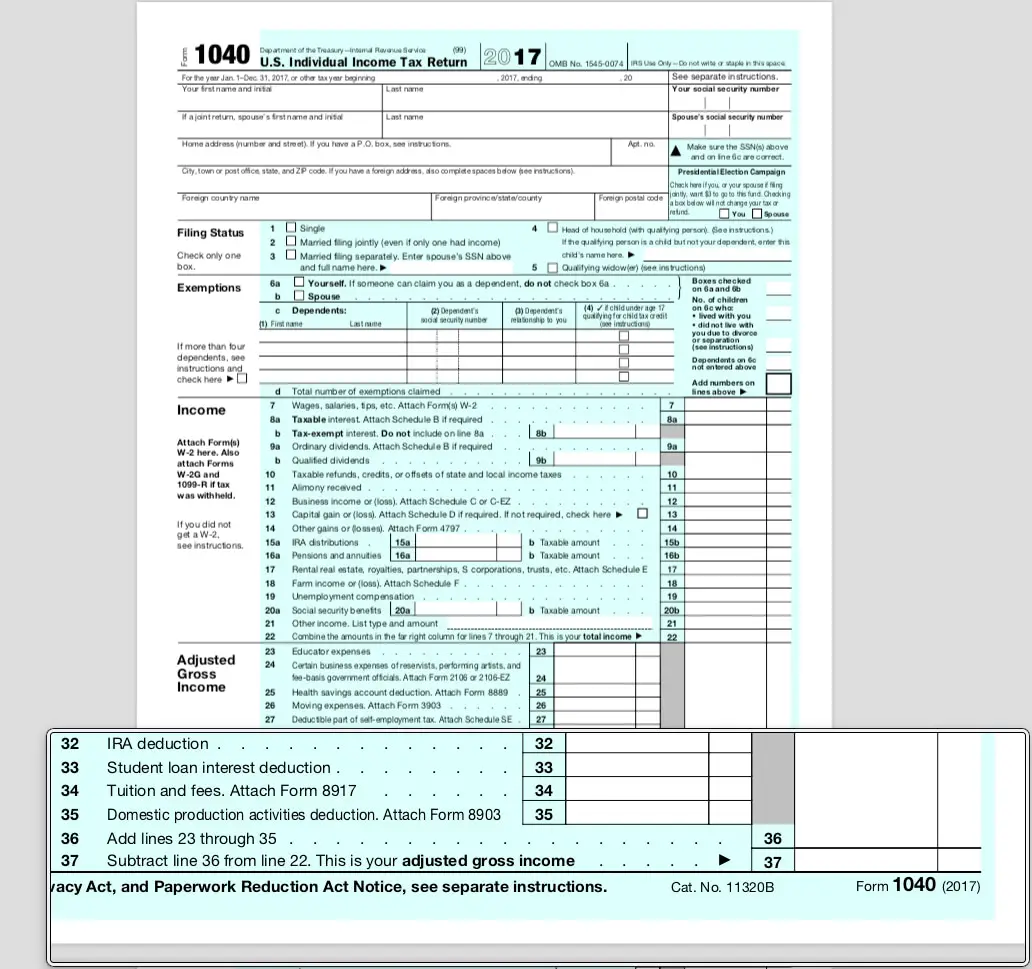

How Did The Tax Cuts And Jobs Act Of 2017 Impact My Taxes

As with any major tax reform, the Tax Cuts and Jobs Act of 2017 affected taxpayers in different ways depending on a number of factors, including income level, marital status, whether they had children, whether they owned a business, and more.

That said, chances are the TCJA lowered your taxes. On net, about 80 percent of taxpayers saw their taxes go down, 15 percent saw no material change in their taxes, and 5 percent saw their taxes go up.

To get a better sense of how the TCJA impacted you, we encourage you to explore our Tax Plan Calculator to model a scenario similar to your own and our interactive map to see the average tax change by income group and income range across the country. Both are linked below.

Also Check: How Do I File Previous Years Taxes

Check The Basic Accounting Formula

In double-entry bookkeeping, there is an accounting formula used to check if your books are correct. The formula is:

Liabilities + Equity = Assets

Equity is the value of a companys assets minus any debts owing. An asset is an item of financial value, like cash or real estate.

In a nutshell, your total liabilities plus total equity must be the same number as total assets. If both sides of the equation are the same, then your bookâs âbalanceâ is correct.

A small business can use this formula to check whether they accurately calculated their liabilities.

That said, if the equation doesnât work, youâll need to double-check your equity and assets as well to figure out what account is wrong.

If you already know your total equity and assets, you can also use this information to calculate liabilities:

Assets â Equity = Liabilities

A balance sheet generated by accounting software makes it easy to see if everything balances.

In the below example, the assets equal $18,724.26. Assets plus liabilities also equal $18,724.26. Total liabilities must be correct because the equation balances.

If youre using Excel, plug in your assets and equity and make sure the equation works.

For more information on balance sheets and how to read and use them, read this article.

People also ask:

- Pension expenses

Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address: Louisiana Department of Revenue

- Mail all others to the following address: Louisiana Department of Revenue

Read Also: Why Are My Taxes Still Processing

If I Owe Tax How Do I Pay It

If your Statement of Liability shows that you owe tax of less than 6,000,you have the option to:

- Pay all or part of it through myAccount

- Pay all or the remaining part of it by having your tax credits reduced for up to 4 years.

If the amount you owe is over 6,000, you can pay the amount throughmyAccount or contact Revenue to discuss repayment options.

Of Ct Payable Calculation

The Public Consultation Document issued in April 2022 by the MOF has outlined a method for calculating the CT payable for a financial year. Businesses can seek additional information and advice from a reputed Dubai based professional tax consultant, IMC Group to accurately evaluate the CT liability as specified in the consultation document.

The 9 % CT will be imposed on businesses only if the taxable value exceeds AED 375,000. CT in UAE is calculated at a flat 9% rate of the net profit shown in the companys financial statements after deducting all applicable deductions and excluding the exempted income. Any taxes paid in overseas jurisdictions will also be allowed for reduction from the profit shown in the financial statement. The net profit derived after all deductions will be considered as taxable income.

UAE CT will apply to UAE resident companies on their global income including overseas income which may be subject to a similar tax like UAE CT in another jurisdiction outside of UAE. The proposed UAE CT regime, for avoiding double taxation, will allow a credit for the tax paid in an overseas jurisdiction on the foreign sourced income against the UAE CT liability as a foreign tax credit.

The maximum Foreign Tax Credit that can be availed will be determined by the amount of tax that is paid in the foreign jurisdiction or the UAE CT payable on the foreign sourced income and whichever is lower.

Also Check: Are Taxes Extended This Year

Recommended Reading: How Is An Inherited Ira Taxed

How Do I Get A Final Statement Ofliability

The Statement of Liability is a final review of your tax liability for a taxyear. It was previously known as the P21End of Year Statement.

You must complete an income tax return to request your Statement ofLiability.

- Change existing tax credits or declared income

- Claim additional credits or reliefs, for example medical expenses

You can use your Statement of Liability in the same way as the P21, forexample, as proof of income.

How do I get a Statement of Liability?

You must completean income tax return to get a Statement of Liability. This applies even ifthere are no changes needed to your record and you have no additional taxcredits to claim or additional income to declare.

Your Statement of Liability will normally be available within 5 working daysfrom the date you make a request. It will be available under My Documentsin your myAccount. To view it:

Is there a time limit for when I can request my Statement of Liability fora particular tax year?

You can get your Statement of Liability for the last 4 years . In 2023, you can requesta Statement of Liability for the years 2019, 2020, 2021.

What Are Tax Liabilities

Tax liability is the amount of money a company or individual owes to the government in taxes on the local, state and federal level. Anytime an individual earns income, or a business makes a sale, they need to pay taxes on that amount. Individuals have different tax liabilities based on their income level, while businesses pay different amounts of taxes based on their type.

Employees fill out W-4s with their employers, who then withhold the requested amount of money for taxes and send it to the IRS. Employers send their employees W-2s once a year, which employees then use to file their taxes and ensure they donât owe more or are due for a tax refund.

Businesses, however, make tax payments to the government throughout the year. Different businesses have varying tax liabilities based on several factors, like their type, amount of sales or income and tax bracket. Accountants calculate all of these factors and make estimated payments based on their figures.

Related:

Also Check: Can You Get The Stimulus Check Without Filing Taxes

Tax Liability For Capital Gains

If you sell any asset, including real estate or other investments, for a gain then youll owe taxes on that gain. For example, if you buy a house for $500,000 and sell it 10 years later for $1,000,000 then your capital gains tax liability basis will be the $500,000 you sold the house for that is above the $500,000 you paid for it.

When an asset is held for more than a year, the transaction becomes a long-term capital gain. Long-term capital gains are taxed at a lower rate than short-term capital gains would be. However, both short-term and long-term capital losses are treated the same way when it comes to tax liability. Losses can be applied against long-term gains that were incurred during the same tax period. They can also be carried forward, in some cases, to future years.

Read Also: How Do I Get Child Tax Credit

Do You Know What Your Tax Liability Is

Part of being a responsible business owner is paying your bills on time, which includes taxes. Estimating, recording, and paying your taxes may not be fun, but it is necessary. Dont let yourself be surprised by a huge tax bill at yearâs end. Know what your tax liabilities are and make sure theyre paid when theyâre due.

Also Check: How To Check State Tax Refund

Tax Liability Formula And Calculation

The calculation of liability for a business or an individual involves the following steps:

The following formula is used to compute net taxable income:

Net Taxable Income = Gross Income Deductions Exemptions

The formula for calculating tax liability is given below:

For Individuals:

Tax Liability = Employee Taxes Tax Credit