Can You File 2021 If You Didn’t File 2020

Asked by: Boris Hickle IV

Some had wondered early on if they should wait to file 2021 federal income tax return until the 2020 moved through the IRS pipeline. No, the IRS said, you do not have to wait to have your 2020 return processed before you file the 2021 return. But you must take some extra steps if you want to file electronically.

Save Up To 20% On Federal Filing Compared To Turbotax

| TurboTax |

|---|

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 07/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

Do My Stimulus Checks Count As Taxable Income

The government sent out checks of $1,200 and $600 to millions of Americans in 2020 as the pandemic shut down most of the country. The good news is those IRS payments do not count as taxable income. The bad news? They are being treated like a refundable tax credit, so theyre similar to an advance on money you would have received as part of your refund.

Recommended Reading: Where Is Home Office Deduction On Tax Return

How Can I Get Past Tax Returns That Were Filed With Credit Karma Tax

If you filed with Credit Karma Tax before, we can help you get your past tax returns. Starting in January 2022, youll be able to get your previous tax returns that you filed with Credit Karma Tax within Cash App Taxes.

If you need your tax returns before then, visit Cash App Taxes Support for step-by-step instructions.

What Common Tax Mistakes Should I Look Out For

Small errors can have big repercussions. And little things can do everything from delay your refund to put you at higher risk of an audit. Here are the most common errors, according to tax officials.

- Missing or inaccurate Social Security numbers

- Misspelled names

- Errors in figuring tax credits or deductions

- Incorrect bank account numbers

© 2022 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell My Personal Information | Ad Choices FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.S& P Index data is the property of Chicago Mercantile Exchange Inc. and its licensors. All rights reserved. Terms & Conditions. Powered and implemented by Interactive Data Managed Solutions.

Don’t Miss: How To Pay Ny State Income Tax Online

Filing Back Tax Returns

You may be able to fill out past-due tax returns through online software or with an accountant, but youll need to print the forms and mail them to the IRS.

Mail your back tax returns to the IRS in separate envelopes and send them by certified mail so that you have proof that the IRS received each individual tax return. Mailing them in separate envelopes will also help prevent the IRS from making any clerical errors in processing them.

It takes about six weeks for the IRS to process accurately completed back tax returns.

Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years.

Which Tax Returns Are Not Eligible

Penalty relief is not available in all situations, such as where a fraudulent return was filed, where the penalties are part of an accepted offer in compromise or a closing agreement, or where the penalties were finally determined by a court. For complete details, taxpayers should read Notice 2022-36, available on IRS.gov.

Other penalties, such as the failure to pay penalty, are not eligible. However, taxpayers may use existing penalty relief procedures for penalties not eligible under Notice 2022-36. More information about existing procedures is available on the Penalty Relief page of IRS.gov.

This relief doesn’t apply to any 2021 tax returns. Everyone who still needs to file a 2021 tax return should do so as soon as possible.

You May Like: How Much Money To Do Taxes

Filing If You Received Covid

The CRA and Service Canada processed more than 27 million Canada Emergency Response Benefit applications, totaling more than $81 billion in payments to Canadians. The CRA also processed more than 2 million Canada Emergency Student Benefit applications that totaled more than $2 billion in payments.

If you received CERB, CESB, Canada Recovery Benefit , Canada Recovery Sickness Benefit , or Canada Recovery Caregiving Benefit payments, you will have to enter on your return the total of the amounts you received. You will receive a T4A and/or a T4E tax slip in the mail with the information you need for your return. You can view tax slips online as of February 8, 2021 in My Account. Residents of Quebec will receive both a T4A and RL-1 slip from the CRA, however, the RL-1 slip will not be available for viewing in My Account.

The CRA recognizes that receiving these slips might generate questions for Canadians. Individuals who believe they received a T4A or a RL-1 by mistake or believe there may be discrepancy with the information provided on these slips should contact the CRA.

If you received the CERB or CESB, no tax was withheld when payments were issued. If you received the CRB, CRSB, or CRCB, 10% tax was withheld at source. For Quebec residents who received the CRB, CRSB, and CRCB, 5% of the tax withheld will be reported on the T4A slip and the other 5% will be reported on the RL-1 slip.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Read Also: Which State Has The Lowest Tax Rate

Do Not Risk Having Your Benefits And Credits Interrupted

Doing taxes on time is the best way to ensure your entitlement to benefits and credits, like the Canada child benefit , the Old Age Security pension payments, and the goods and services tax/harmonized sales tax credit, are not interrupted. Even if you owe tax, dont risk having your benefits and credits interrupted by not filing. If you cannot pay your balance owing, the CRA can work with you on a payment arrangement.

You May Like: How Much Is Property Tax

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Also Check: How Much Tax Is Deducted

Don’t Miss: How To File Llc Taxes On Turbotax

When Can I File Taxes In 2021

Immediately. The Internal Revenue Service began accepting and processing tax returns for the 2020 tax year on Feb 12. That was a lot later than last yearnearly two and a half weeks later, in factas the IRS needed time to program and test its systems after the tax law changes passed in December as part of the second round of stimulus checks. Without that testing, there could have been a delay in the turnaround time on refunds.

The start of tax season is one of two peak times for the IRS, as people with relatively simple tax filings and those expecting big refunds often file as soon as possible. All totaled, over 150 million individual tax returns are expected to be filed this year.

When Will I Get My Refund From The Irs

Ah, the critical question! The IRS estimates people who file as soon as tax season opens will get their refunds by the first week of March. The organization is hoping to issue them as quickly as possible in the pandemic to help people whose jobs were impacted last year.

The IRS says more than nine out of every 10 refunds are issued within three weeks of the day the return is filed. The best place to track where things stand is with the Wheres My Refund? tool, which updates the status of tax refunds daily.

You May Like: How To Pay My Taxes

Whats The Fastest Way To Receive My Refund

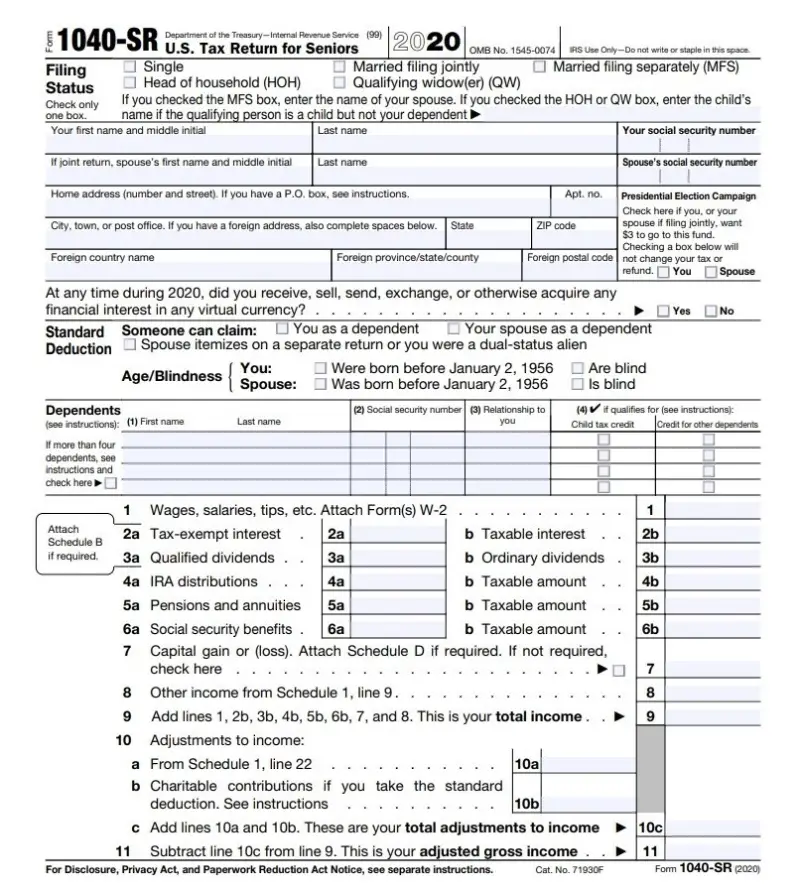

Step 1: E-file your taxes. That gets the information into the IRS system a lot faster than paper filings. Also, if you were eligible for an economic impact payment but didnt receive it youll have to file a tax return to claim the recovery rebate credit, even if you arent normally required to file.

Step 2: Make sure youve signed up for direct deposit, as the IRS says that can significantly speed up your refund. It also adds more flexibility. Your refund can be split into up to three separate accounts, including individual retirement accounts.

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

Don’t Miss: How Much Taxes To Take Out For 1099

Can I Efile My 2020 Taxes Now

Asked by:Daija Harris

Most of the 2021 tax forms and schedules have not been released by the IRS we will update this page as soon as they become available. These forms are for 2021 Tax Returns due by April 15, 2022 and they can be e-filed via eFile.com between early January 2022 and October 15, 2022.

How Do I File For An Income Tax Extension

Its actually not too hard to file for an extension. The easiest way is electronically requesting one via Free File, which will extend your filing date until Oct. 15. There are a couple things to know, though.

First, youll need to estimate your tax liability, even if you havent calculated it precisely. And youll have to pay any owed taxes by the regular deadline.

If that doesnt work, you can get an automatic six-month extension by using IRS Form 4868, which will also require you to estimate your tax liability based on the data available to you. The difference is, you wont have to make a payment immediately. You will, however, owe interest on your tax bill if you end up owing money.

If youre planning to file for an extension, dont drag your feet. In 2018, the online service went offline owing, in part, to a flood of people who had waited until the last moment.

Recommended Reading: What States Have The Lowest Property Taxes

How Long Can The Irs Come After You For Unfiled Taxes

Generally, under IRC § 6502, the IRS will have 10 years to collect a liability from the date of assessment. After this 10-year period or statute of limitations has expired, the IRS can no longer try and collect on an IRS balance due. However, there are several things to note about this 10-year rule.

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

Also Check: Where Is My Income Tax Refund

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

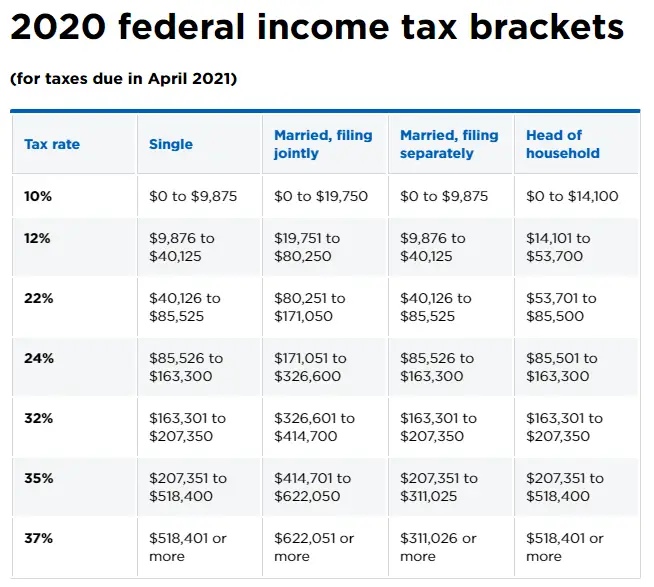

When Are My 2020 Taxes Due

Youve now got until May 17 to file your taxes, a roughly one month extension from the usual deadline.

Not ready when the deadline comes around? You can file for an extension before that date. Special rules apply to people serving in the Armed Forces who are in a combat zone or contingency operation, or have been hospitalized owing to an injury sustained in such an area. Those individuals have 180 days after they leave the area to file and pay taxes.

Read Also: How Do I File Colorado State Taxes

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Also Check: Can Energy Efficient Windows Be Claimed On Taxes

Don’t Miss: How To Calculate Tax Expense

Be Aware Of Deadlines That Differ From May 17

To be sure, some taxpayers do need to adhere to the original April 15 deadline. The first estimated quarterly payment made by those who have income from self-employment, interest, dividends, rent and alimony is still due on April 15.

In addition, some states have state tax-filing deadlines that differ from the due date for federal returns. Taxpayers in Hawaii must file their state returns by April 20, while those in Oklahoma and Maryland have until June 15 and July 15 respectively.

And, those affected by winter storms in Texas, Oklahoma and Louisiana have until June 15 to file their taxes, following disaster declarations issued by the Federal Emergency Management Agency.

For most states, however, the state deadline is also May 17 to match the federal government and make it easier for taxpayers to complete everything at once.

Filing late can lead to penalties and interest for those who owe taxes which start to accrue after the deadline, said Wilson. But, if you’re owed a refund, like most Americans, you won’t see any penalty deducted from the amount you receive, and you have up to three years to claim the money.