Cancel Your Ein And Close Your Irs Business Account

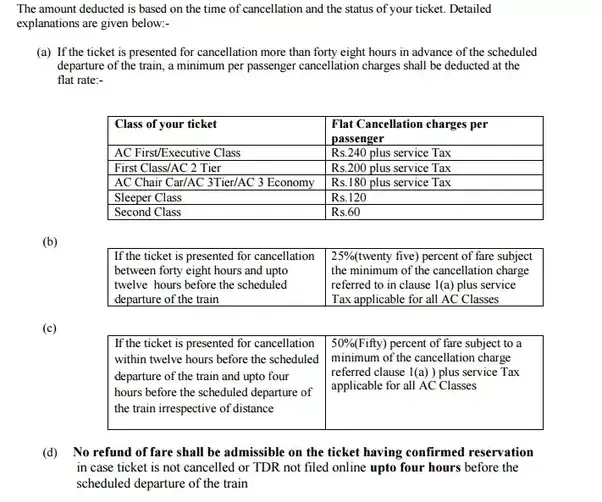

The employer identification number or EIN assigned to your business is the permanent federal taxpayer identification number for that business.To cancel your EIN and close your IRS business account, you need to send us a letter that includes:

- The complete legal name of the business

- The business EIN

- The business address

- The reason you wish to close the account

If you kept the notice, we sent you when we assigned your EIN, you should enclose a copy of it with your EIN cancellation letter. Send both documents to us at:

Internal Revenue ServiceCincinnati, OH 45999

We cannot close your business account until you have filed all necessary returns and paid all taxes owed.

What Is Individual Tax Return

Individual tax return or Form 1040 is an income tax return form that married couples or individuals submit to the Internal Revenue Service to report the taxable income earned during a particular period. The IRS uses it to determine if tax is overpaid or due for that period.

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Individual Tax Return

Besides using this form to report taxable income, one utilizes this form to claim tax credits and deductions. Moreover, they can compute their tax refund for a financial year. Everyone earning money over a specific threshold must file this return, per legal requirements. Individuals can e-file their return or send the form to the federal tax agency via mail.

How Do I Cancel My E

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled “Transmit my returns now“.

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

Once a tax return has been e-filed it cannot be canceled, retrieved or changed. The IRS will not be accepting any 2019 tax return until on and after January 27.

Read Also: Is It Too Late To File Your Taxes

If You Must Amend Your Return

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

However, you dont have to amend a return because of math errors you made the IRS will correct those. You also usually wont have to file an amended return because you forgot to include forms, such as W-2s or schedules, when you filed the IRS will normally request those forms from you.

How To File Irs Individual Tax Return

Individuals can download the standard IRS form from the federal tax agencyâs official website to file individual tax returns. The form may appear confusing to taxpayers. However, it does the following things:

Lastly, this form determines whether the taxpayer has paid a portion or the entire tax bill. It helps individuals determine whether withholding taxes and tax credits cover the bill. If they are not enough, the taxpayer pays the remaining amount while filing Form 1040.

Read Also: How To File Taxes Yourself Online

What If I Accidentally Amend My Taxes

If you changed anything on your just-filed or already accepted return, and then e-filed the changes, those changes went nowhere. When you amend a return you need to be working from the return as it was originally, so restore those changes you made to the way your return was before you tried to fix it.

Close Sales Tax Account

This page explains how to close your sales tax account if your business ceases operations entirely. If you are just closing a location , visit the Close Locations in Your Sales Tax Account page for information and instructions.

When you need to close a business, ensure the business closes in good standing with the Colorado Department of Revenue. Any taxes the business is expected to remit must be paid or returns with “zero” tax due must be filed if your business did not have any retail sales that are subject to tax.

The Department of Revenue must be notified on the final return that the business is closing. Be sure to include the effective date of closure . If you do not file and remit payment for business, the Department will mail a non-filer notice to you. The closure request should be submitted no later than 30 days after closing your business.

You can close your sales tax account using Revenue Online or by filing the Business Account Closure Form . When using a paper form, send the completed form to the address on the form. Please note that the paper DR 1108 takes longer to process. Revenue Online closures are effective the next business day.

Recommended Reading: How Much In Taxes Do I Pay Per Paycheck

Is It Possible To Cancel Income Tax Return

Once a tax return has been submitted and you have received an acknowledgement number for it, you will not be able to cancel the tax return. If you have made a mistake while filing the return and need to change it, you can correct it and file a revised return. Do note that return filed after due date cannot be revised.

How To Dispute A Tax Decision

The majority of tax returns, whether business or personal, are typically evaluated as filed by the taxpayer. However, Revenue Canada may occasionally reject the taxpayers return and levy further fees. This can be the result of a calculation or administrative mistake. Or there can be disagreement about how to handle a claimed deduction. This is particularly typical for a company that is being audited. Some processes allow a taxpayer to contest any higher tax assessment when they get a Notice of Assessment or Reassessment informing them that taxes are owed. A professional should be engaged from the beginning, preferably the accountant who prepared the return or one of our knowledgeable tax auditors with years of experience working with CRA tax auditors and understanding how to contest reassessments.

Recommended Reading: Why Are My Taxes Taking So Long

How To Delete Tax Return Germany

You might have created an account on Tax Return Germany | Steuer Go during the course of using the app. Many apps make it so easy to signup but a nightmare to delete your account. We try to make it easier but since we don’t have information for every app, we can only do our best.

Generally, here are some steps you can take if you need your account deleted:

How Is The Refund Amount Determined

The amount of the VLF refund is based on one-twelfth of the annual VLF for each full month that remains until the vehicle registration expires. The registration fee, weight fee and miscellaneous fees are not subject to refund. A total loss vehicle partial VLF refund service fee will be deducted from the refund. If the service fee is more than the amount of VLF subject to refund, no refund will be issued.

Also Check: How Do I Look Up My Car Taxes

File A Final Return And Related Forms

You must file a final return for the year you close your business.

The type of return you file and related forms you need will depend on the type of business you have. A limited liability company is a business organized under state law. An LLC may be classified for federal income tax purposes as a partnership, a corporation or an entity disregarded as separate from its owner.

- A sole proprietor is someone who owns an unincorporated business by themselves.

- A partnership is a relationship between two or more partners to do trade or business.

- A corporation is a separate taxpaying entity with at least one shareholder. This includes S corporations.

You must also provide a Form W-2, Wage and Tax Statement, to each of your employees for the calendar year in which you pay them their final wages. You should provide Forms W-2 to your employees by the due date of your final Form 941 or Form 944. Generally, you furnish copies B, C and 2 to the employees. You file Form W-3, Transmittal of Income and Tax Statements to transmit Copy A to the Social Security Administration.

If your employees receive tips, you must file Form 8027, Employers Annual Information Return of Tip Income and Allocated Tips, to report final tip income and allocated tips.

Pension or Benefit Plans

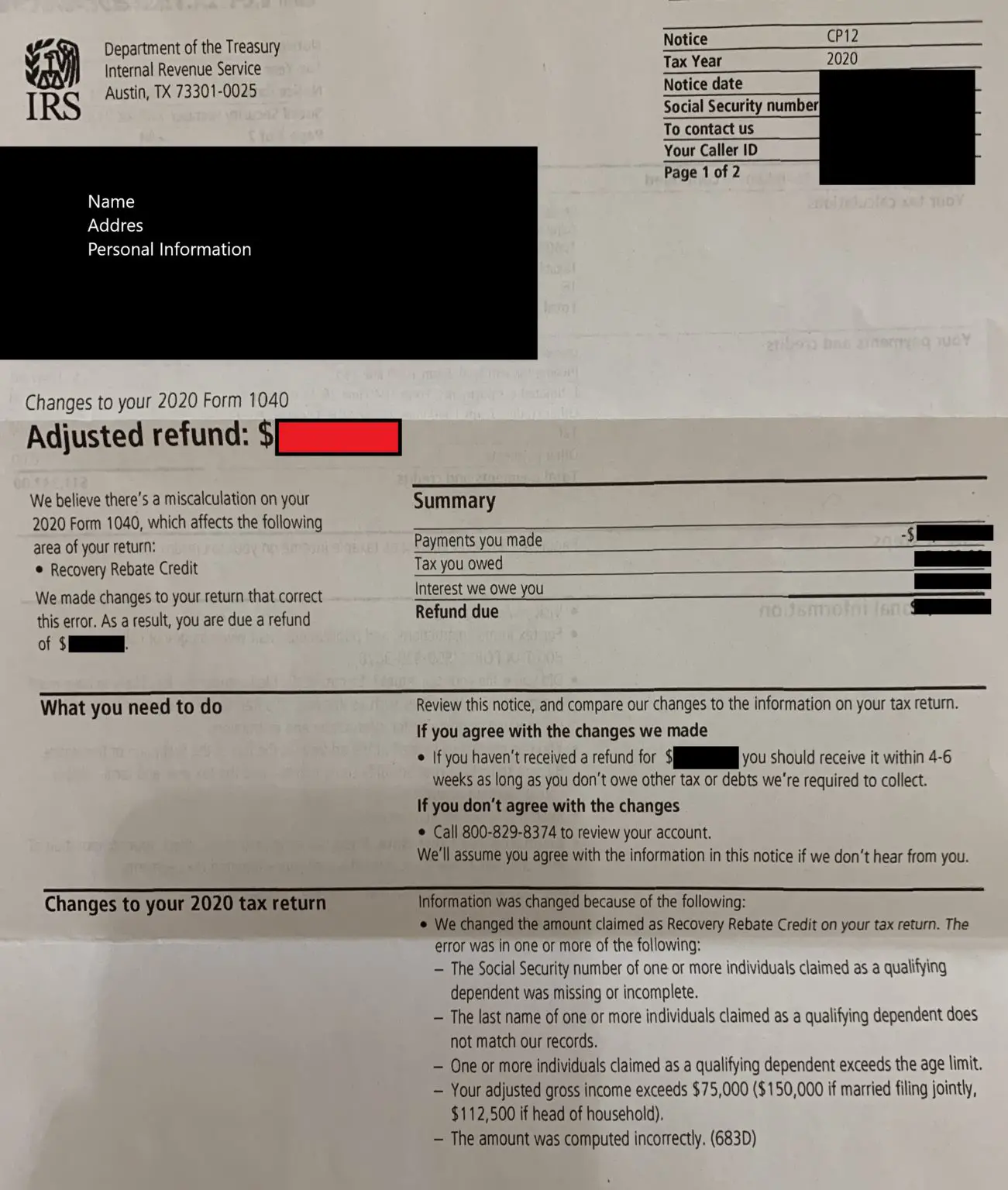

Will The Irs Let Me Know If I Made A Mistake

IRS NotificationYou’ll likely receive a letter in the mail notifying you of the error, and the IRS will automatically adjust it. If, however, your mistake is more serious — such as underreporting income — you could be headed for an audit. Many audits start with a letter requesting more information or verification.

Recommended Reading: When Do You File Taxes This Year

Refund Of Vehicle License Fee On Total Loss Vehicles

California law provides for a prorated refund of the VLF portion of the registration fees paid when your vehicle becomes:

- An Unrecovered Total Loss- A vehicle subject to registration which was stolen and not recovered within 60 days after the police report date. The vehicle must be transferred to the individual or company who paid you for the loss of your vehicle §10902).

- A Constructive Total Loss- A vehicle which was wrecked, destroyed, or damaged to such extent that the owner, or the insurance company, considers it uneconomical to repair the vehicle and because of this, the vehicle is not repaired by or for the person who owned the vehicle per California Vehicle Code §544. A Salvage Certificate must be issued for this vehicle before a refund request will be processed .

- A Nonrepairable- A vehicle with no value except as a source of parts or scrap metal, or was found completely stripped after theft, or was completely burned . A Nonrepairable Certificate must be issued for this vehicle before a refund will be processed.

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

Also Check: Who Gets The Child Tax Credit 2021

Individual Tax Return Explained

Individual tax return meaning refers to a standard Internal Revenue Service form that individual taxpayers use to report information, including wages and taxable income. By filing this return, taxpayers can determine whether they overpaid or underpaid their taxes. Individual taxpayers may include:

- The head of a household.

- Qualifying widowers or widows.

Married couples and single filers must fill out the other required tax forms, for example, any relevant Schedule. For instance, if taxpayers itemize deductions, they must use Schedule A in conjunction with Form 1040. This Schedule would mention tax deductions, like home mortgage interest and charitable contributions.

One must note that every individual taxpayer files their return on a version of Form 1040-SR or 1040. Married people can decide to file their annual returns as an individual or a couple. After filling out the form, they must submit it to the taxing agency within the individual tax return due date to avoid penalties.

Some taxpayers earning business income must include the earnings in their individual income tax returns. Such individuals may include freelancers running a sole proprietorship business and small business owners with limited liability corporations or LLCs treated as pass-through entities.

As a result, different states may require different information from taxpayers. Most state tax returns evaluate and compute taxes based on the line items copied from IRS tax returns.

What Happens After Youve Told Dvla

Your vehicle tax will be cancelled by DVLA. If you pay by Direct Debit, the Direct Debit will be cancelled automatically.

Youll automatically get a refund cheque for any full months left on your vehicle tax. The refund is calculated from the date DVLA gets your information. The cheque is sent to the name and address on the vehicle log book.

You will not get a refund for:

- any credit card fees

- the 5% surcharge on some direct debit payments

- the 10% surcharge on a single 6 month payment

Also Check: How To Know Which Tax Bracket You Are In

What If I Made A Mistake On Turbotax

If you used TurboTax Online, simply log in to your account and select Amend a return that was filed and accepted. If you used our CD/download product, sign back into your return and select Amend a filed return. You must file a separate Form 1040X for each tax return you are amending.

Are You Opting For 115bac

The Budget 2020 introduced a new regime under section 115BAC giving an option to individuals and HUFs to pay income tax at lower rates. From FY 2020-21, the assessee can choose to pay income tax under an optional new tax regime. Now the time for filing ITRs for Assessment Year 2021-22 is approaching.

Also Check: How To Correct Taxes After Filing

The Deadline For Submitting A Tax Notice Of Objection

The typical deadline for submitting a Notice of Objection to a Notice of Assessment or Reassessment is April 30th of the following year. There is a 90-day window from the date the Notice of Reassessment was mailed for prior tax years. However, because this date is subject to change, it should be confirmed with an experienced Ontario tax lawyer. A formal Notice of Objection must be submitted by a corporate taxpayer within 90 days of the date the Notice of Assessment or Reassessment was mailed. The first step in the appeals procedure is to submit this Notice of Objection. It protects the rights of a taxpayer under the Income Tax Act and is a requirement before any legal action may be brought.

You can ask the Tax Court of Canada for an extension of time to appeal if you miss the deadline for submitting an appeal. You have one year and 90 days from the date of confirmation, reassessment, or redetermination to file an appeal for income tax and GST/HST. According to the official Canadian government website, you must prove this in order to receive an extension.

Procedural Changes Regarding Failure To Appear Violations Faqs

A recent appellate court decision, Hernandez v Department of Motor Vehicles , held that DMVs practice of suspending a persons driving privilege based on certain FTA notifications reported is contrary to VC §13365.

DMV will impose an FTA suspension based only upon a finding of the court that the driver willfully failed to appear in court.

FTA violations will be listed near the bottom of your drivers record under the CONVICTIONS section. If the conviction is in FTA status, the message *FAILURE TO APPEAR will be displayed.

Your drivers record printout will indicate a status of VALID or SUSPENDED or REVOKED under the LICENSE STATUS section.

Yes. You may legally drive provided you have a valid DL and there are no other open actions against your driving privilege.

If your DL has expired, you must clear any outstanding FTAs before visiting your local DMV field office and applying for a DL renewal.

If your DL has expired, or is no longer in your possession, DMV will charge an application fee for either a duplicate or renewal of your DL.

You May Like: When Are Tax Returns Due This Year

What Happens If I Already Filed My Taxes

If you want to make changes after the original tax return has been filed, you must file an amended tax return using a special form called the 1040X, entering the corrected information and explaining why you are changing what was reported on your original return. You dont have to redo your entire return, either.