Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

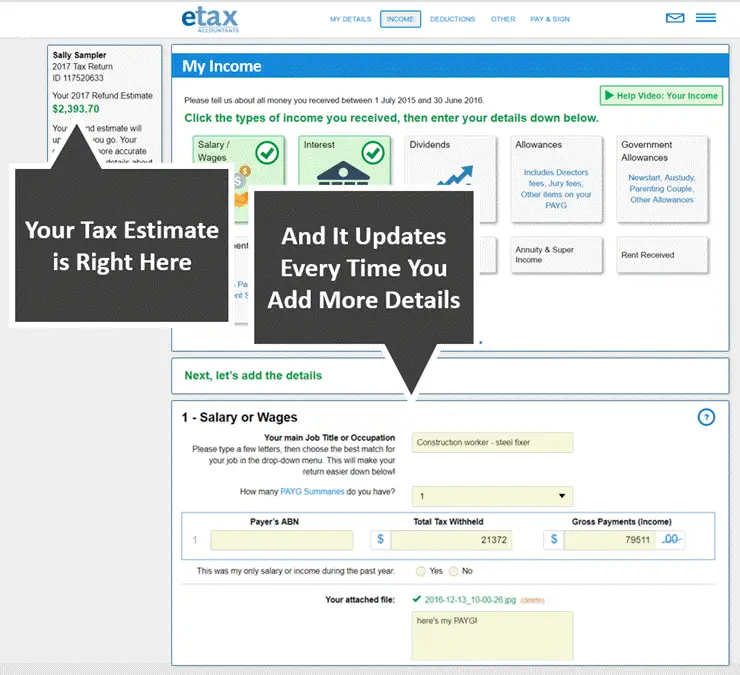

How A Tax Calculator Can Help

Our tax calculator, like others, can only estimate your federal tax liability. To get the exact figure, you need to complete your tax return.

However, using a tax calculator before you sit down to tackle your taxes has several benefits:

- Estimate your refund or tax bill. By entering basic information about your annual income, filing status, and deductions, you can find out whether you underpaid or overpaid taxes throughout the year and prepare your budget accordingly for a bill or refund.

- If your tax bill is larger or your refund is smaller than expected, consider consulting a tax professional to find out how to change the outcome for next year.

- Determine whether you have the correct amount withheld from your paycheck. If you wind up with a big tax bill, you may need to revisit your W-4. Ideally, the amount of money your employer withholds from each of your paychecks for taxes will be as close to what you actually owe as possible. However, if you enjoy getting a big refund, you can instruct your employer to withhold more of your paycheck for income taxes.

- Estimate your effective tax rate. Calculating your tax liability will allow you to figure out what overall percentage of your income is going to federal income taxes.

How Will I Know If I Need To Make An Estimated Payment

If you are required to file a tax return and your Virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income.

Recommended Reading: Do You Pay Sales Tax On Services

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

When Will I Get My Rebate

Direct deposits and physical checks started going out on Nov. 1 to taxpayers who filed the state income taxes by Oct. 17, 2022. Refunds will be sent out on a rolling basis through Dec. 15, a spokesperson for the Executive Office of Administration and Finance told The Boston Herald.

Refunds issued by direct deposit will be labeled MASTTAXRFD in your bank statement. Those sent via check will include information on Chapter 62F and why the recipient is eligible, according to the Department of Revenue website.

If you missed the Oct. 17 deadline but submit your state income tax return by Sept. 15, 2023, you should receive your rebate approximately one month after you file.

Get the So Money by CNET newsletter

Don’t Miss: Do I Put Unemployment On My Taxes

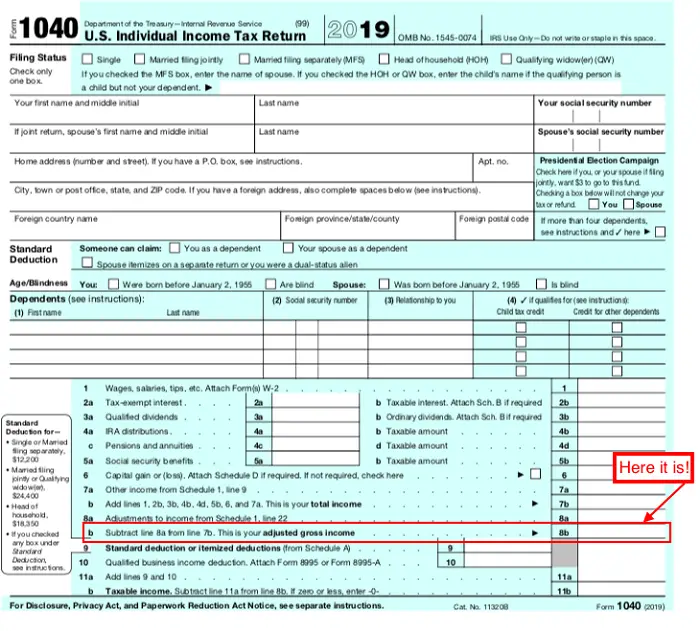

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

More Answers: Income & Household Size

- How do I upload documents to verify my income for the Marketplace?

-

If the Marketplace tells you to provide pay stubs, self-employment records, or other information to verify your income, follow these directions to upload documents.

- What is “MAGI,” and do I need to use it for anything?

-

The Heath Insurance Marketplace uses an income figure called Modified Adjusted Gross Income to determine the programs and savings you qualify for. For most people, its identical or very close to Adjusted Gross Income . MAGI is not a line on your federal tax return.

- The estimate instructions above are based on MAGI, but its not a term you need to know in order to apply or use tools on this site.

- What if I dont know my households recent Adjusted Gross Income?

-

Start with federal taxable wages for each income earner in your household.

- You should find this amount on your pay stub.

- If it’s not on your pay stub, use gross income before taxes. Then subtract any money the employer takes out for health coverage, child care, or retirement savings.

- Multiply federal taxable wages by the number of paychecks you expect in the tax year to estimate your income.

Read Also: Can You Use Pay Stubs To File Taxes

How Do I File Online My 2023 Taxes Before The Tax Filing Deadline

Filing your taxes doesnt have to be a chore. Let PriorTax take care of everything for you. Well tailor the filing process to your specific needs and make sure everything is done before the deadline. Plus, our support team is always here to help you out should you need it. So get started today and make tax season a breeze.

This entry was postedon Monday, November 14th, 2022 at 8:00 amand is filed under Tax Deadlines, Tax for Business, Tax News, Taxes for Prior Years.You can follow any responses to this entry through the RSS 2.0 feed.You can leave a response, or trackback from your own site.

Who Qualifies For The Massachusetts Tax Rebate

Individuals who filed their 2021 state return on or before Oct. 17, 2022, should receive a tax credit this year, even if they didn’t file an extension request. If you have not yet filed your 2021 return, you are still eligible if you file by Sept. 15, 2023. Your refund will come later, however.Individuals with outstanding tax bills, child support payments “or certain other debts” may see their refund reduced or eliminated, according to the department.

Don’t Miss: How To Reduce Taxes On Stock Gains

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

Recommended Reading: How Much Money Will I Get Back In Taxes

How To Make An Estimated Payment

We offer multiple options to pay estimated taxes.

- Individual online services account. If you don’t have an account, enroll here. You’ll need a copy of your most recently filed Virginia tax return to enroll.

- 760ES eForm. No login or password is required. Make sure you choose the correct voucher number.

- ACH credit. Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

See all options to file and pay estimated taxes.

Electronic filing requirement

You must submit all of your income tax payments electronically if:

- Any installment payment of estimated tax exceeds $1,500 or

- Any payment made for an extension of time to file exceeds $1,500 or

- The total income tax liability for the year exceeds $6,000

If any of the thresholds above apply to you, all future income tax payments must be made electronically.This includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed.

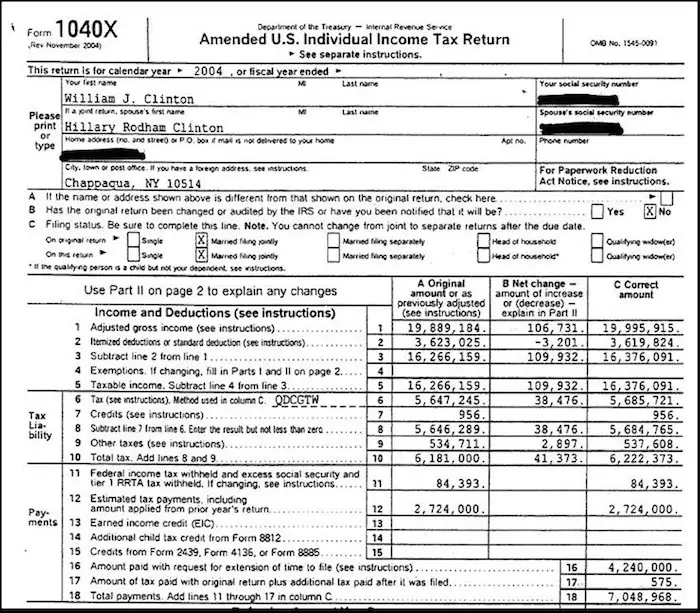

When Do I Have To File An Amended Tax Return For The 2022 Tax Year

Its important to know the deadline for filing an amended return, three years from the original due date. For example, the deadline for a return filed in 2023 would be April 18, 2026. After that, you would only need to file an amended tax return only if changes needed to be made, and you cant amend a return until the IRS has accepted it.

Don’t Miss: When Is The Income Tax Due

What If You Cant Pay Your Tax Bill

If you cant pay taxes, dont panicbut dont ignore the situation either. Not filing your tax return at all comes with a steep tax penalty thats 5% of your unpaid tax balance per month.

Instead of not filing, the IRS has payment options you could sign up for to pay over time, or you could borrow money to pay what you owe.

Here are a few options to consider.

Recommended Reading: How Does Taxes Work With Doordash

Estimate Your Income Tax For The Current Year

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year .

This tells you your take-home pay if you do not have any other deductions, such as pension contributions or student loans.

If youre self-employed, the self-employed ready reckoner tool can help you budget for your tax bill.

You may be able to claim a refund if youve paid too much tax.

Recommended Reading: What Is The Corporate Tax Rate

Why The Irs Issues Refunds

Your employer determines the rate of your withholding tax by calculating your income, personal allowances, and other taxes you want to be withheld, as listed on your W-4 form.

Sometimes, however, your rate of withholding tax is greater than your actual tax liability, or the amount of tax you have to pay. This is why the IRS issues tax refunds to taxpayers, who qualify at the end of each tax season.

How Do State And Federal Taxes Affect Your Refund

In addition to federal income tax, you may also pay state income taxes depending on where you live. You wont pay state income tax if you live in one of these eight states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

New Hampshire doesnt tax wages, but does tax dividends and interest, though recent legislation has been passed to phase out this tax beginning in 2024.

If you live in one of the other 41 states, youll need to file a state tax return in addition to your federal tax return. The IRS website contains a directory to help you find information on your states tax requirements.

Key Differences Between State and Federal Taxes

- State tax rates are typically lower than federal tax rates.

- States can have different types of tax credits and deductions.

- The amount of tax withholdings will vary for state and federal taxes.

Also Check: How Much Taxes Do The Top 10 Percent Pay

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Underpayment Of Estimated Income Tax

An addition to tax is imposed by law if at least 90% of your total tax liability is not paid throughout the year by timely withholding and/or installments of estimated tax except in certain situations. The addition to tax does not apply if each required installment is paid on time and meets one of the following exceptions:

- Is at least 90% of amount due based on annualized income

- Is at least 90% of amount due based on the actual taxable income

- Is based on a tax computed by using your income for the preceding taxable year and the current year’s tax rates and exemptions

- Is equal to or exceeds the prior year’s tax liability for each installment period and the prior year return was for a full year and reflected an income tax liability or

- The sum of all installment underpayments for the taxable year is $150 or less

If you do not qualify for an exception, your underpayment computation will be based on 90% of the current year’s income tax liability or 100% of your liability for the preceding year, whichever is less. The addition to tax is computed on Form 760C .

You May Like: How To Calculate Taxes From Your Paycheck

How Ameriprise Compares

When it comes to financial services companies, we offer a unique approach. Check out how Ameriprise compares to other financial advisor companies.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Also Check: What Documents Do You Need For Tax Return

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.