Should You Ever File If Youre Not Required To

We know it sounds weird â why would you ever file taxes if you donât have to, right? Well, how about when filing taxes earns you money?

Itâs true: If youâre owed a refund from your W-2 withholding, overpaid your quarterly taxes, or qualify for one of the many refundable tax credits, youâll only be able to collect if you file a return telling the IRS that it owes you money.

How Much Can You Make Without Filing Taxes

You need to claim all the income you earn from any job. If you are an employee for someone during the year, they must issue you a W-2 reporting your wages, and the amounts withheld for Social Security, Medicare, federal and state taxes. If you are working as an independent contractor, have a side gig, or are starting your own business, keep track of your income and expenses.

You Can Claim Refundable Tax Credits

Refundable tax credits are particularly valuable for low-income taxpayers because they can provide a refund beyond what you paid for the year via withholding or estimated tax payments.

In other words, if its worth more than the tax you owe, the IRS will issue you a refund for the difference. Refundable credits include:

Read Also: Can You Turn In Taxes Late

Income Tax Rates And Bands

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

Income tax bands are different if you live in Scotland.

| Band | |

|---|---|

| over £150,000 | 45% |

You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on taxable income over £125,140.

How Much Money Do I Need To Retire At 55

For example, generally accepted retirement planning advice suggests that you save seven times your annual income by the age of 55. So if youre making $ 100,000 a year, youll need $ 700,000 saved by your 55th birthday.

How much money do you need to retire with $ 100,000 a year? Most experts say your retirement income should be about 80% of your final annual income before retirement. 1 This means that if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to have a comfortable lifestyle after leaving the workforce.

You May Like: Will A Roth Ira Reduce My Taxes

Read Also: How To Get Last Year’s Tax Return

How To File Taxes For Side Jobs

When your income increases, taxes could increase, too. Make sure youre withholding the right amount from your paycheck or paying enough estimated taxes to cover the increase, particularly if this is your rst time having a second job or side gig. If you are self-employed, make sure youre keeping receipts of all your expenses as well as a journal of all the miles you are driving for your job. You may be able to use these expenses to offset your income, lowering your tax bill.

How Much Do You Need To Make Before Paying Taxes

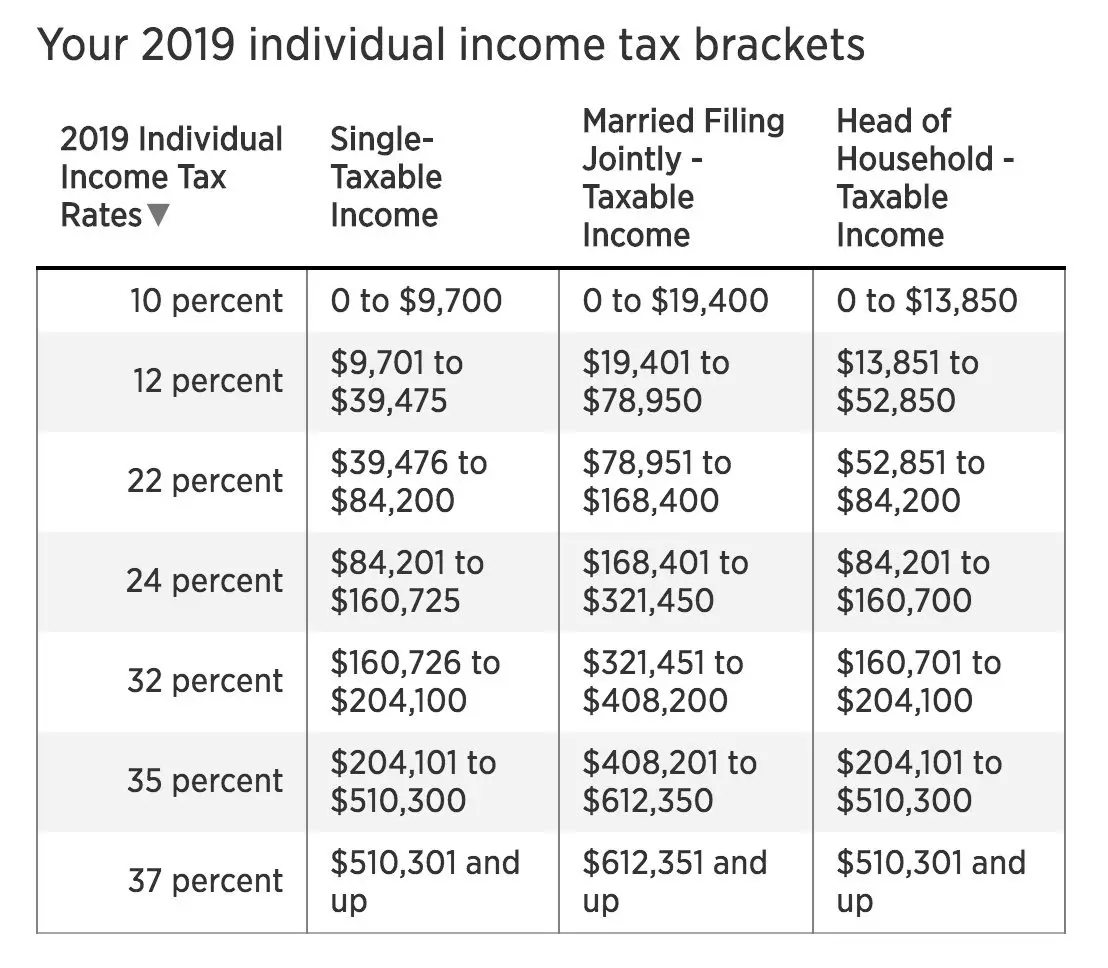

Our jobs bring us different incomes and, therefore, different personal income tax requirements. That being said, the majority of Americans do have to pay taxes on the money they make. If you are a single person or are married and filing separately from your spouse, to be required to file a federal tax return, you will need to have gross income of more than $12,000 in 2018. However, different rules may apply if you are married, file as Head of Household, are self-employed or can be claimed as a dependent of another taxpayer.

Once you understand where your taxable income stands in relation to these minimums, youll want to know the tax protocol that applies when you earn no income, are paid in cash, or are paid under the table.

Also Check: How Much Taxes Does Unemployment Take Out

Farmers Fishermen And Merchant Seamen

Farmers, fishermen and merchant seamen who receive 2/3 of their estimated Virginia gross income from self-employed farming or fishing have special filing requirements, which allow them to make fewer payments. If you meet the qualifications of a farmer, fisherman or merchant seaman, you only need to file an estimated payment by Jan. 15. If you file your income tax return on or before March 1 and pay the entire tax at that time, you are not required to file estimated tax payments for that tax year.

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

You May Like: How To Check Income Tax Refund

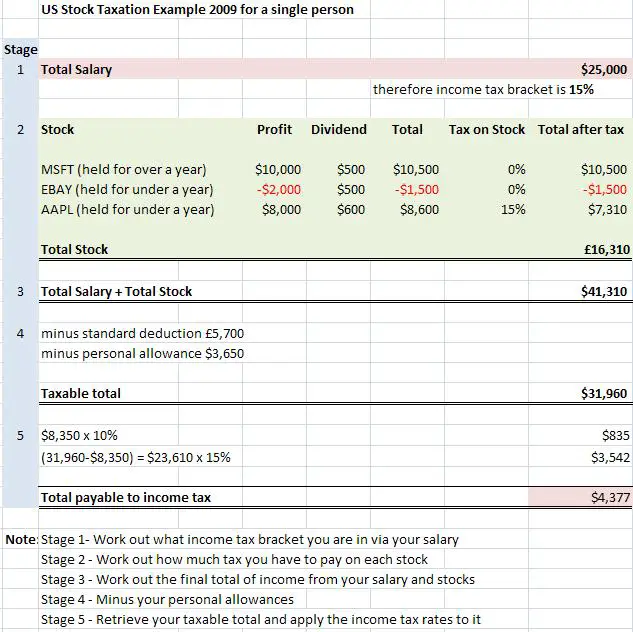

How Do You File Taxes If You Get Paid In Cash

You may get paid in cash for a variety of services. These can be anything from tutoring, gardening, and snow removal, to building websites or babysitting. Regardless of what your cash-based income is, filing taxes is probably easier than you thought.

To file your cash-based income taxes, you follow the same procedure as you normally would for other income types. To file your tax return, you will want to request a Form 1099-MISC from your employer, if you dont already receive a W-2 form from them.

Even if you dont receive a 1099-MISC, you are still required to report the income. If you receive cash payments as part of a business, youll report the amount received on Schedule C attached to your Form 1040. If youre not in a trade or business, report the cash received on Line 21 of Schedule 1 attached to Form 1040.

Rrsp Withdrawal Rules: What You Need To Know

Barry Choi0 **This post may contain affiliate links. I may be compensated if you use them.

If youre saving for your retirement, the odds are that youre using your Registered Retirement Savings Plan . This is an excellent tool to save money, but eventually, youll need to withdraw your funds. Knowing what the RRSP withdrawal rules are is vital since there will be tax consequences depending on when and how you withdraw your funds.

Recommended Reading: When Will We Get Our Tax Return

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

How Much Can A Retired Person Earn Without Paying Taxes

Many retirees plan to earn extra income to supplement their retirement spending. But how much can a retired person earn without paying taxes? The answer to this question varies based on your situation. Understanding the tax rules surrounding retiree income can help avoid an expensive surprise when tax time rolls around. If you need help sorting through the details of your situation, try using SmartAssets free financial advisor matching tool.

Read Also: When’s The Last Day To File Your Taxes

Work Out When Youll Pay

In general, the IRS will only allow you to pay quarterly taxes once each month and no less than two days after that months end.

If your quarterly tax payments dont cover all four periods, youll have to make up the difference with a payment for the annual return. If this is still not enough, it wont be an issue as long as youve paid enough in each quarter.

Youll need to make sure that your bank account is registered for direct debit or set up EFTPS before you can pay your quarterly tax.

Also Check: Are Debt Settlement Fees Tax Deductible

Reporting Unemployment Benefits At The Federal Level

For most states, you will receive Form 1099-G in the mail from your state unemployment office. Find out how you can obtain your 1099-G. On Form 1099-G:

- In Box 1, you will see the total amount of unemployment benefits you received.

- In Box 4, you will see the amount of federal income tax that was withheld.

- In Box 11, you will see the amount of state income tax that was withheld.

You dont need to attach Form 1099-G to your Form 1040 or Form 1040-SR.

In certain states, you will not automatically be mailed a Form 1099-G. You will have to access your Form 1099-G online through your unemployment portal or call your state unemployment office to request that they mail your Form 1099-G. In other states, you will only be mailed a Form 1099-G if you selected that as your delivery preference.

| States that will not mail 1099-Gs at all | Connecticut, Indiana, Missouri, New Jersey, New York, and Wisconsin |

| States that will mail or electronically deliver 1099-Gs depending on which option you opted-into | Florida, Illinois, Michigan, North Carolina, Rhode Island, Tennessee, and Utah |

If you received Form 1099-G, but didnt file for unemployment benefits, this may be a case of identity theft and fraud. Contact your state unemployment office immediately for additional information and how to report the potential fraud.

You May Like: Can I Pay My Federal Taxes Online

Can I Qualify For A Partial Capital Gains Tax Exclusion

Even if you cant exclude all of your home sale profit, there are other scenarios where you may be able to partially lower your taxable profit. If you experienced any of the below life events, you may be able to get a partial exclusion, calculated based on the percent of the two years that you lived in the home.

- Job change/relocation

- Having twins or triplets

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Recommended Reading: What Time Do Taxes Need To Be Filed

How Much Income Can Go Unreported

If you are required to file a tax return, you must report all sources of income. The IRS has a matching process that will find unreported income. Failing to report this income could result in interest, penalties, and even criminal charges, so make sure to report all sources of income when filing your tax return.

What Are Quarterly Estimated Tax Payments

The American tax system works on a pay-as-you-earn system. In other words, as you earn money throughout the year, you need to receive income for it. This way, the government will also receive a steady income.

For this reason, taxes are paid in two ways. W-2 employees will pay their taxes through withholding, whereas taxpayers that get their money through freelancing will pay through quarterly taxes.

If you are self-employed, theres no way to have your tax payments withheld from your paycheck. For this reason, the IRS requires that the individuals make these payments themselves, by their due date.

Quarterly tax payments are usually a better alternative to paying the taxes all in one lump sum. The IRS allows you to do that as well, but this might cause you to be overwhelmed by the larger sum. By paying quarterly, you pay in smaller increments, and the penalty will not be as big.

Also Check: What Age Do You Have To File Taxes

Where Can I Find Filing Requirements Each Tax Year

While these filing requirements are accurate for the 2021 tax year, they will likely change in the future. Before you file your taxes, make sure to check the IRS website for the most updated numbers. These tables are published by the IRS in Publication 17 and Publication 501 and are updated each year.

Other Situations That Require Filing A Tax Return

In addition to requirements based on age, your filing status and income, and the rules regarding the Affordable Care Act and self-employment income, there are several other situations that require you to file a tax return.

For example, if you owe any special taxes, such as the alternative minimum tax extra taxes on qualified plans like an IRA household employment taxes for employees like nannies, housekeepers or gardeners or tips you didnt report to your employer, then you need to file a federal return. You must also file if you had write-in taxes that might include taxes on group term life insurance or health savings accounts. In addition, you have to file if you have recapture taxes on the profitable sale of an asset.

Another instance which requires you to file a return is if you or your spouse received distributions from a health savings account, Archer MSA or Medicare Advantage MSA.

If you worked for a church or a church-controlled organization that is exempt from paying Social Security and Medicare taxes and you had wages of $108.28 or more, youre required to file a return.

Finally, if you have a tax liability and are making payments under an installment agreement, you must file a return.

Read Also: How Does Contributing To Ira Reduce Taxes

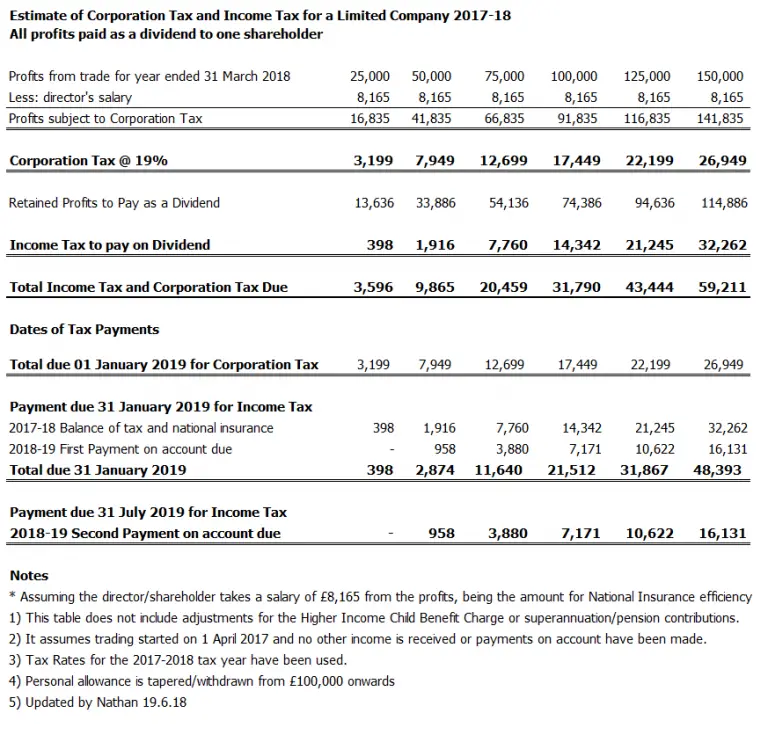

Tax Rules Are Based On Your Business Structure

Because tax rules differ based on business structure, its important that small businesses consult with an attorney and accountant to determine how their businesses should be classified.

Your business will likely fall into one of four structures:

- Sole proprietorship: A sole proprietor is someone who owns an unincorporated business by him or herself.

- Partnership: In a partnership, individuals are taxed on their share of business net income.

- Limited liability corporation: LLCs are taxed on their share of business net income. Multiple-member LLCs are taxed as partnerships.

Read Also: Car Sales Tax In North Carolina

How Do I Make My Quarterly Payments

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for IndividualsPDF, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior years annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

Read Also: Where Can I Get 2020 Tax Forms

How Much Child Tax Credit Can I Get

When it comes to how much child tax credit you can get, theres no single fixed amount as payments are made up from different elements. How much you get depends on your income, the number of children youre responsible for, along with whether any of your children have a disability.

Child tax credit rates for the 2022-23 tax year

| Element |

|---|

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 $18,200 | $0 |

Recommended Reading: License To Do Taxes

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Also Check: How Do I Fill Out My Tax Return