What Can I Take A Tax Deduction For

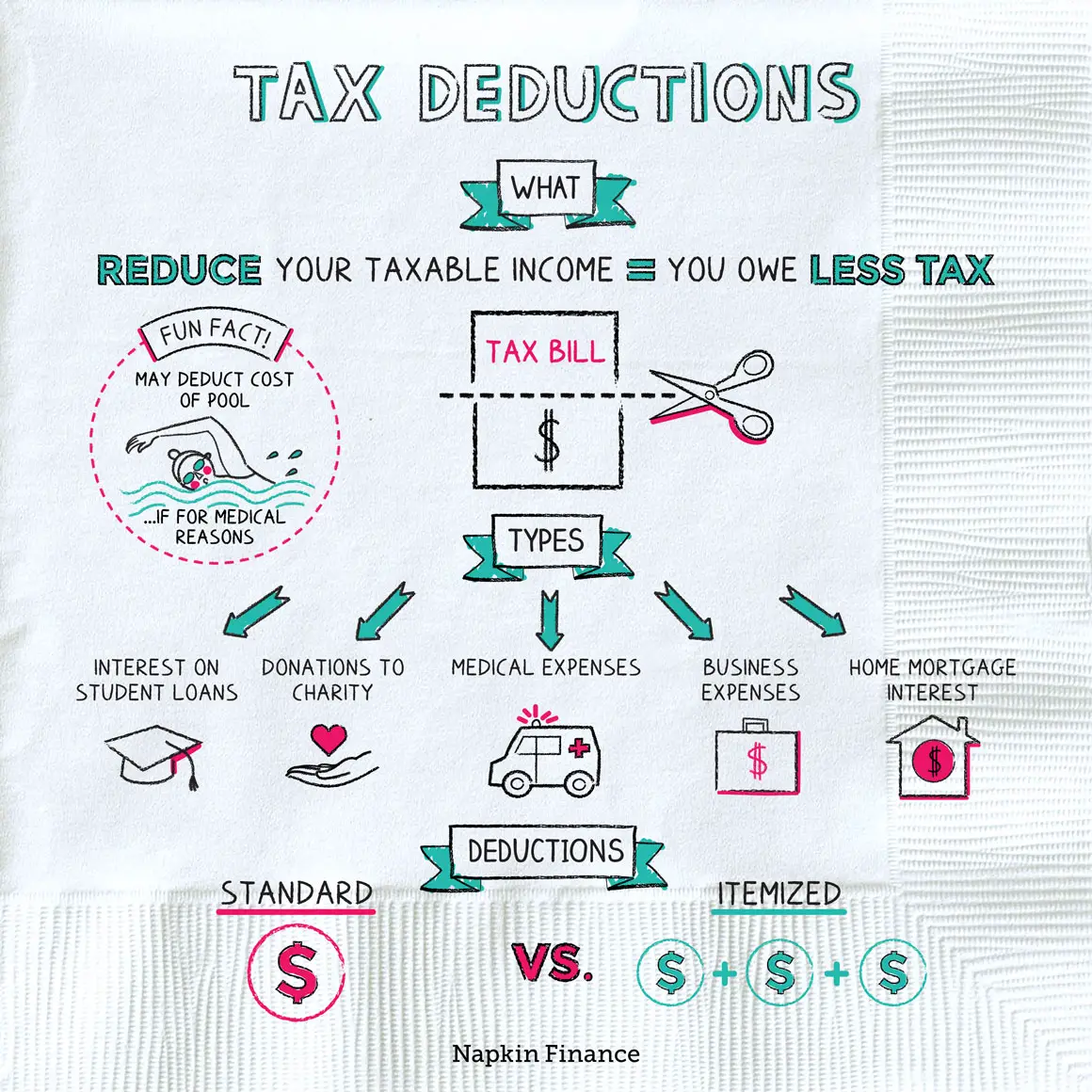

In order to take a tax deduction for a charitable contribution, you’ll need to forgo the standard deduction in favor of itemized deductions. That means you’ll list out all of your deductions, expecting that they’ll add up to more than the standard deduction.

The most common expenses that qualify are:

- Mortgage interest

How Do I Claim Donations To Goodwill On My Taxes

Goodwill donations can only get you a deduction on your Federal income taxes if you itemize them. When you file your taxes, you can choose to either take a standard deduction, which is based on your age, marital status, and income, or an itemized deduction, which takes all of your deductible activity into account.

Dont Miss: How To File Quarterly Taxes For Business

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: What Is Wotc Tax Credit

Is Mileage An Itemized Deduction

The Tax Cuts and Jobs Act of 2017 eliminated itemized deductions for unreimbursed business expenses like mileage. The tax reform law also significantly narrowed the mileage tax deduction for moving expenses. … Under the new tax code, you can claim a mileage deduction for: Business mileage for the self-employed.

Additional Child Tax Credit

The additional child tax credit can be taken in addition to the CTC, and it just allows you to receive a refund if the CTC brings your tax liability the total income tax you owe for the year below $0. The refund for the ACTC in this situation is up to $1,400. However, people who previously took the ACTC likely wont need it for 2021 taxes because the 2021 child tax credit is fully refundable now. If you are claiming the ACTC, complete Schedule 8812.

You May Like: When Do Llc File Taxes

Eliminated Or Changed Deductions

Some deductions that have been eliminated or changed post-TCJA include:

- Entertainment and fringe benefit deduction

- Employees parking, mass transit, or commuting expenses deduction

- Domestic production activities deduction

- Local lobbying expenses deduction

- State and local tax deduction is now limited to $10,000

- Deduction of settlement or legal fees in a sexual harassment case, when the settlement is subject to a nondisclosure

Key provisions that are set to expire in 2025 include:

- Standard deduction will return to pre-TCJA levels

- Income tax rates will return to pre-TCJA levels

It is important to note that tax laws are constantly changing, and these provisions may be modified or extended at any point prior to 2025. A review of the most common self-employed taxes and deductions is necessary to keep you up to date on any necessary changes to your quarterly estimated tax payments.

WATCH: 8 Tax Benefits For The Self-Employed

What Can Be Deducted

There are two categories of deductions that you can take, operating expenses and vehicle expenses. Vehicle expenses are those related to driving your car, including mileage, parking and tolls. Operating expenses are all other expenses, including Uber and Lyft fees and commissions, snacks for passengers, and cost of cell phone plans.

Tax deductions must be expenses made purely for business reasons. If an expense also benefits you personally, only the portion attributed to your business is deductible. For example, you may have a cell phone that you use for driving about 25 percent of the time. In that case, you can deduct 25 percent of the phone bill as a tax deduction.

There are two ways to deduct mileage. That will affect which expenses you can include.

Don’t Miss: When Did I Last File Taxes

How Tax Breaks Work For Homeowners

Most income tax breaks for homeowners are tax deductions, which are reductions in your taxable income. The less of your income that is taxed, the less money you pay in taxes.

When you file your tax return, you must — $12,950 for single tax filers, $25,900 for joint filers or $19,400 for heads of household or married filing separately — or itemize deductions, such as gifts to charity and state taxes.

To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are greater than your standard deduction. All of the best tax software can quickly help you decide whether to itemize or not .

Tax for homeowners don’t require you to itemize. They directly reduce the amount of taxes you owe, and you can usually get those credits whether or not you itemize deductions.

Deduction For Personal Property Rental

If you dont work in a line of business that involves renting out your personal property, such as a car, but you still earn some side income from renting out your property, you can deduct expenses related to that rental income. For example, you may be able to deduct gas from renting out your car. Use Schedule 1 to claim this deduction.

Also Check: How Do I File My Unemployment Taxes

Retirement Plan Contributions Deduction

One deduction that you can take going into business for yourself that is especially worthwhile is the deduction for self-employed retirement plan contributions. Contributions to Simplified Employee Pension-individual retirement accounts , Savings Incentive Match Plan for Employees IRAs, and solo 401s reduce your tax bill now and help you rack up tax-deferred investment gains for later.

For the 2021 tax year, for example, you could feasibly contribute as much as $19,500 in deferred salary . In 2022, that amount goes up to $20,500, with the $6,500 catch-up contribution. Plus, you can contribute another 25% of your net self-employment earnings after deducting one-half of self-employment tax and contributions for yourself.

With a self-employed 401, the total maximum contributions cannot exceed $58,000 for 2021 and $61,000 for 2022 for both employee and employer contribution categories. Contribution limits vary by plan type, and the IRS adjusts the maximums annually. Of course, you cant contribute more than you earn, and this benefit will only help you if you have enough profits to take advantage of it.

Maximize Your Refund With An Expert Tax Consultant

The bottom line? You want to be sure youre getting the most out of all these tax deductions. Just one missed deduction could cost you far more than the fee of a tax professional.

Thats why when youre in doubt, you should turn to a tax advisor. With years of experience behind them, their wealth of knowledge can take the guesswork out of taxesprotecting you and your wallet.

The sooner you connect with a pro, the sooner you can check taxes off your to-do list. Find a tax expert today!

If youre confident you can handle your own taxes and just want easy-to-use tax software, check out Ramsey SmartTaxwe make filing your taxes easy and affordable.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Recommended Reading: How To Track Gas Mileage For Taxes

When It Comes To Payroll And Budget These Terms Are Crucial To Understand But Whats The Difference

- Different formulas are used to calculate salaried and hourly employees gross pay.

- Net pay can be significantly different from gross pay, depending on individual deductions.

- Employers are required to pay half of their employees FICA taxes.

- This article is for business owners who want to calculate gross pay and net pay for payroll and tax responsibilities.

No matter your businesss size, handling payroll can be a daunting task. Each employee may receive a different payment amount, require various deductions and follow individual compliance requirements.

Knowing the difference between gross pay and net pay is one of the first steps when determining your businesss budget, accurately processing payroll and calculating taxes.

Well explore the difference between gross and net pay, how to calculate each type, and how best to manage payroll responsibilities.

Dont Miss: Doordash Pay Taxes

Research All Your Potential Tax Deductions

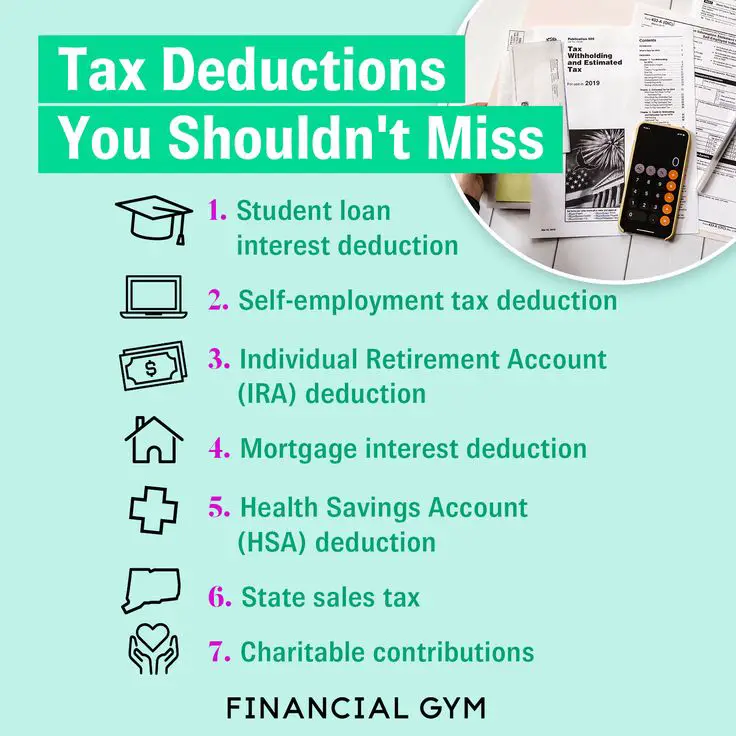

Tax deductions are qualified expenditures that can reduce your taxable income. For example, some losses and expenditures, student loan interest, and up to $3,000 of capital losses are deducted from your gross income when determining your adjusted gross income . Other expenditures, such as state and local taxes and charitable contributions, can be claimed as itemized deductions from AGI in determining taxable income. Most taxpayers tend to focus on the most well-known deductions however, there are a number of lesser-known tax deductions that you may qualify to take.

Also Check: How To Figure Out Tax On An Item

Adoption Credit Or Exclusion

Taxpayers who adopt a child under age 18 or a disabled individual are entitled to tax benefits for qualified reasonable and necessary expenses incurred for the adoption. For 2021, the maximum tax credit for such expenses is $14,440 per child. If a taxpayer receives employer-provided benefits for such expenses, up to $14,440 of benefits per child can be excluded from income. Benefits over that amount are taxable income. For 2022, these amounts increase to $14,890. The adoption tax credit is nonrefundable.

Taxpayers can claim both the credit and exclusion for adoption expenses but cannot claim the same expenses for both benefits. Special rules apply depending on whether or not the adoptee is a U.S. resident. For some adoptions of special-needs children, the tax benefits are allowed even if the taxpayer has no qualified expenses.

For 2021, the credit and exclusion generally phase out for MAGI between $216,661 and $256,659, with no amount of either benefit allowed at higher levels. For 2022, the credit and exclusion generally phase out between MAGI of $223,411 and $263,410, with neither permitted at higher levels.

Tax Deductions For Contractors

If youre self-employed, youll probably end up receiving one or more 1099-NEC tax forms from the companies you worked for. A 1099 lists income you earned as an independent contractor so you can report it on your taxes. Dont just toss those in a desk drawer. Youll need them come tax time!

When youre self-employed you often end up wearing lots of hatsaccountant, HR rep, janitor. And since you dont have an employer withholding taxes from your paycheck, its up to you to manage them yourself. That includes the self-employment tax, which is the full 15.3% of Social Security and Medicare taxes .

The best way to lower your tax bill is by claiming tax deductions. Here are 16 self-employment tax deductions to help you save money!

One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction. To take this deduction, youll need to figure out the percentage of your home used for business. Say your home office occupies 10% of your house. That mean you can deduct 10% of your utility bills , mortgage payment or rent, property taxes, mortgage interest, homeowners insurance, repairs, and maintenance.

Also Check: How Much Tax Do You Pay On Lottery Winnings

Books And Legal And Professional Fees

Business books, including those that help you do without legal and tax professionals, are fully deductible as a cost of doing business.

Fees you pay to lawyers, tax professionals, or consultants generally can be deducted in the year incurred. But if the work clearly relates to future years, they must be deducted over the life of the benefit you get from the lawyer or other professional.

Add The Employees Pay Information

You should see fields that say pay type, pay rate, hours worked, pay date,and pay period. Start with pay type and select hourly or salary from the dropdown menu.

If the employee is hourly, input their hourly wage under pay rate, and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for additional pay.

If the employee is salaried, both the pay rate and hours worked fields will disappear. Instead, youll need to know how much the employee makes each pay period. Youll put that into the field labeled amount.

Then select the pay date and the employees pay frequencyor, rather, if you pay them weekly or every two weeks.

Also Check: Where’s My Unemployment Tax Refund

How Do Tax Deductions Work

When youre filling out your tax return, there are two ways to claim tax deductions: Take the standard deduction or itemize your deductions. You have to pick one!

The standard deduction is an amount set by the IRS each year, and it is the easy optionits like an automatic tax freebie. If you choose to take the standard deduction, your taxable income is automatically reduced by a set amount based on how you file . That lowers the amount of taxes you have to pay. No need to dig through receipts or bank statements to find your deductions.

Itemizing your deductions takes more workyoull need to list all the deductions you want to claim one by one. And youll have to fill out a Schedule A form with your tax return and save your records to back up your claims.1

Yes, itemizing is a bit of a hassle, but its worth the effort if you can claim enough deductions to lower your taxable income more than the standard deduction.

How do you know which option is best for you? There are a few things you need to know before you make your decision this year.

All The Homeowner Tax Breaks For 202: How To Maximize Your Tax Refund

Learn how your home can save you big money on your income taxes.

Peter Butler

Writer

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Owning a home might be the American dream, but it can have drawbacks — such as major maintenance costs — as well as bonuses. On the plus side, being a homeowner gives you access to a number of tax breaks, which can add up to big money in your tax refund.

For homeowners, learning about your tax benefits now can help you review and adjust your tax situation for when you file your income tax returns in early 2023.

While most homeowners with mortgages know they can deduct payments toward their loan interest, many tax deductions and tax credits involved in owning a house are less obvious. Learn about all the possible tax breaks for homeowners to get the biggest refund possible on your 2022 taxes.

For more on taxes, learn about the new income brackets and standard deduction for 2023, or review our end-of-year checklist for optimizing your taxes.

Also Check: How To Do Back Taxes

How To Calculate Gross Pay For Salaried Employees

Employees who receive a fixed amount each year are salaried employees. The Fair Labor Standards Act considers salaried employees exempt under U.S. federal law.

Whether a salaried employees pay schedule is weekly, biweekly or monthly, the formula to calculate their gross income remains the same. Use this formula to calculate gross pay for a salaried worker:

Annual gross salary ÷ number of pay periods = gross pay for salaried employees

For example, if a salaried employees gross pay is $40,000 and you want to calculate their monthly or weekly pay, divide $40,000 by 12 or 52, respectively. Thus, a $40,000 salary results in gross pay of $3,333 monthly or $769 weekly.

Credit For Other Dependents

This credit allows you to deduct up to $500 for each dependent who you cant claim with either the CTC or ACTC. Paying for the care of a parent will usually qualify. You can only take the ODC if you are within the income limits. The credit starts to phase out once your AGI reaches $400,000 if youre married filing jointly, or $200,000 if you use any other filing status. Claim the credit for other dependents on your 1040 its combined with the child tax credit.

Want more tax & money advice? Sign up for our weekly Easy Money newsletter.

Don’t Miss: How To File Quarterly Taxes For Business